lindsay_imagery

Investment Thesis

In my previous article on the American States Water Company (NYSE:AWR), I came to the conclusion that the company was expensive based on its growth prospects. You can read about it here. Since then, AWR lost ~6% vs a loss of ~14% for the S&P 500 and has outperformed the market. AWR recently reported Q1 FY22 results and the business missed both non-GAAP EPS and revenue estimates. The company is still trading at more than 20x LTM EV/EBITDA, which is a very high multiple for a business that is likely to grow at less than 10% annually. Based on historical multiples, I continue to believe the current valuation offers an unattractive risk-reward scenario for potential investors.

Recent Developments

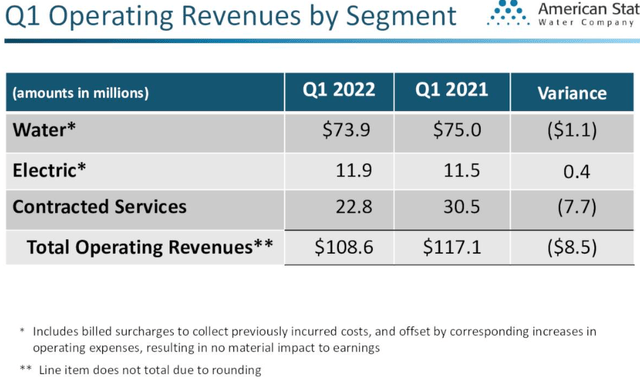

On May 2nd, 2022, the company reported Q1 FY22 results. Both non-GAAP EPS and revenue missed estimates. Sales reached ~$108.6 million in the last quarter, which represents a ~7.3% YoY decrease. The Water and Contracted Services registered negative growth versus last year, while the Electric segment was slightly up (+3.4%). AWR generated $24.4 million in operating profit in Q1 FY22 compared to ~$30.3 million in the same quarter last year. The operating margin slightly decreased from ~26% in March 2021 to ~22.5% in the most recent quarter.

AWR earned about $38 million in cash from operating activities in Q1 FY22, a 54% increase compared to last year on the back of positive changes in working capital (~$8.2 million). Capital expenditures (“CapEx”) remained stable at nearly $35 million, and management now forecasts a minimum infrastructure investment of $140 million for FY22 at the company’s regulated utilities. Given the above-mentioned CapEx forecast, I expect free cash flow to remain modest this year (<$20 million). I believe this is a significant development for a company that continues to be valued at over $3 billion.

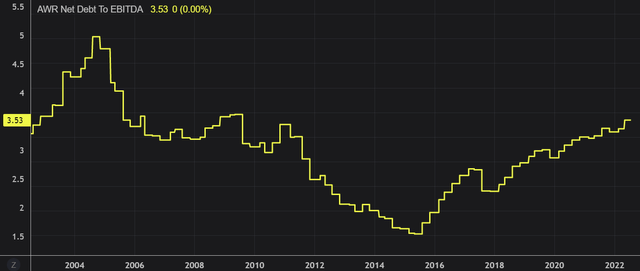

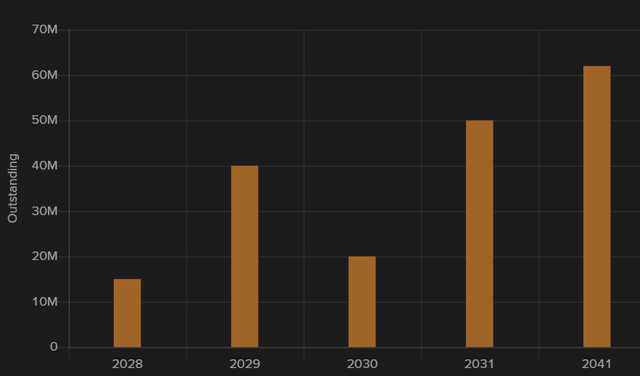

The company finished the quarter with $634 million of total debt. Nearly 5% of it is maturing over the next 12 months. As a result, I consider the risk of a credit event to be low. The estimated net debt/EBITDA ratio stands at 3.5, which is in line with other competitors.

Maturities are manageable since most of the debt is scheduled to be paid back from 2028 onwards. That is another sign that a credit event is not imminent. That said, it is highly likely that AWR will continue to use leverage extensively over the next 24 months to cover any free cash flow shortfalls when it comes to financing new investments and raising dividends.

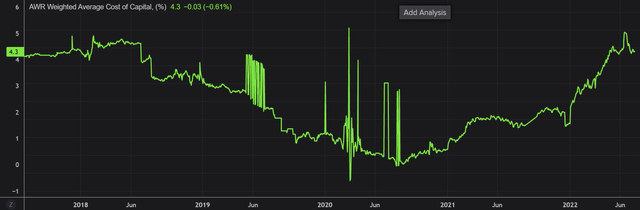

Higher rates are a factor of risk in this context since the company is likely to finance new investments at a higher cost. This is illustrated by market prices, especially in AWR’s weighted average cost of capital (“WACC”) which is currently substantially above the levels of 2020 and 2021, and near to the top of the previous five-year range. Investors shouldn’t disregard the impact of higher financing costs on AWR’s profitability.

Despite the selling in equities, AWR’s dividend yield is still at the lower end of the 10-year range. Thanks to its rich history, I believe that investors are still buying the idea that AWR is a safe dividend investment and are underestimating risks. If we assume the recent decline in stock prices continues and the dividend yield reverts to an average value of 2.5%, a potential buyer today would face a 25-30% loss.

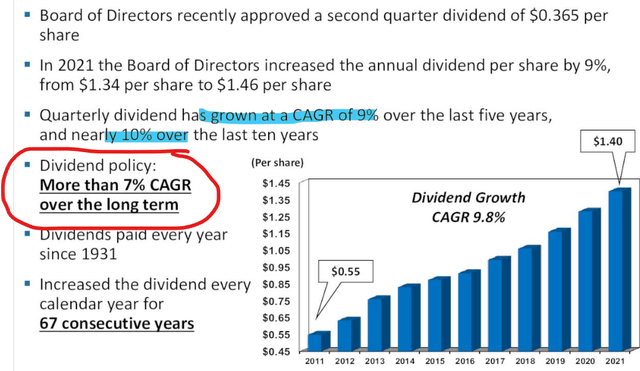

One of the main risks is the dividend policy which targets a 7% CAGR over the long term. In my opinion, this rate is unsustainable if the company continues to perform as it did over the last five years when sales grew at less than 4% annually. Inflation might provide a boost to sales in the short term but after all, AWR is not a growth story unless there is a material shift in the business model. Even management assumes future dividend growth to be lower than in the past.

Company Valuation

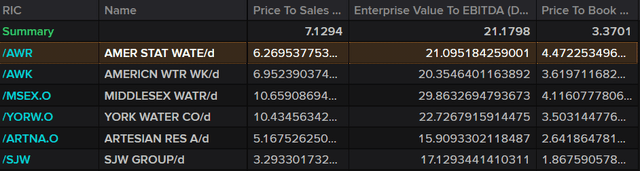

In my previous article, I concluded that AWR was fairly valued compared to peers but overvalued from an absolute perspective. At that time, the company was trading at more than 6x LTM sales and more than 21x LTM EV/EBITDA. I found these multiples to be extremely high given the fact that AWR wasn’t expected to grow at more than 10% annually.

The valuation remains high from an absolute perspective, which leads me to believe that downside risk will persist over the next months. AWR trades at ~6x sales and has an EV/EBITDA multiple of 21. Rising interest rates are making valuations increasingly relevant, which is likely to pressure high multiple stocks such as AWR.

And to get some perspective, AWR is trading near a multi-decade EV/OCF all-time high, indicating more room for it to go down. Investors shouldn’t forget that markets work in cycles and good times are generally followed by bad times. I think the likelihood to have a 30% drop from the current level over the next 18 months is very high. As a result, I think it is better to avoid investing in AWR for now.

Key Takeaways

AWR outperformed the market since early February 2022 by a ~8 percentage points margin, which is impressive. A large number of investors continue to see it as a safe haven asset thanks to its dividend history. That is illustrated in the short interest data (1.5%) and by Wall Street ratings (a single sell rating on this name). However, growing the dividend annually at 7 to 10% over the long term is unrealistic based on AWR’s last five years’ revenue growth rate. While the business is likely to benefit from a boost in revenue growth over the next one to two years, I remain skeptical of its chances to grow by more than 5% annually over the long term, unless there is a material shift in the business model. The company is still selling at more than 20x LTM EV/EBITDA, which is expensive in a rising rate environment. Based on historical multiples, I continue to believe the current valuation offers an unattractive risk-reward scenario for potential investors.

Be the first to comment