deepblue4you

Situation Overview

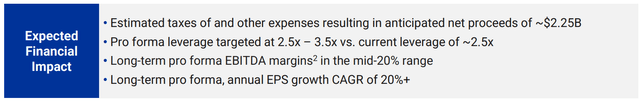

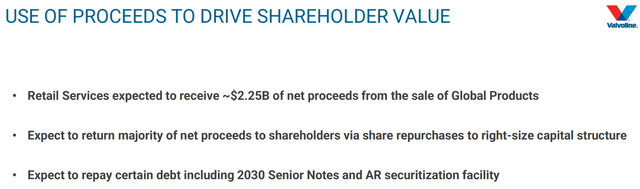

Aramco (ARMCO) agreed to purchase Valvoline’s (NYSE:NYSE:VVV) Global Products segment for $2.65 billion in August 2022. Net of taxes and other expenses, VVV will pocket ~$2.25 billion cash. While the majority of the net proceeds will be applied to share repurchase, VVV also publicly said that they expect to repay the 2030 senior notes and AR securitization facility to maintain the guided 2.5-3.0x proforma net leverage.

Investor Presentation Investor Presentation

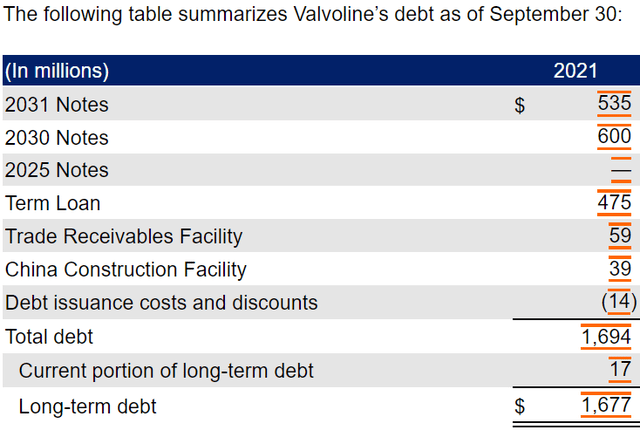

VVV’s current capital structure is consisted of a term loan, two senior unsecured bonds (2030s and 2031s), and a couple of operating credit lines, sums up to a net debt of ~$1.7 billion. On an LTM basis, the RemainCo (i.e. Retail Services segment) generated $1,432 million revenue and VVV’s long-term margin target is 23-26% after including for corporate cost and dis-synergies from the separation. At the lower end of the target, pro forma EBITDA without assuming any growth is roughly $330 million. At the midpoint of the leverage target (3.0x) VVV will carry roughly $990 million net debt. In other words, VVV will repay $710 million of debt, which roughly equals to the sum of the 2030 bonds and the trade facilities.

Valvoline 4.25% 2030

This transaction should trigger the Asset Sale offer:

This means Valvoline can first consider reinvesting the net proceeds back into the business (either organically or inorganically), and then it must make an offer to the 2030 bondholders at par. From management commentary, it doesn’t seem like any large scale investment program is in the play and they specifically commented on debt paydown, so it’s safe to assume that proceeds will be used to reduce debt first. In the indenture, Net Proceeds is defined as asset sale proceeds net of tax and expenses, as well as repayment of secured debt. In this case, taking the $2.25 billion net proceeds, subtract the $475 million secured term loan, leaves ~$1.8 billion net proceeds to make the par offer to the 2030 bondholders.

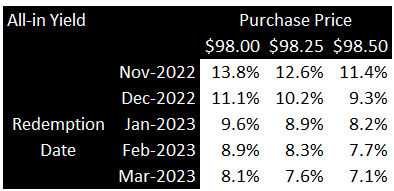

Note that the 2031 bonds are issued under a different indenture which doesn’t have an asset sale offer requirement. However, even if VVV is somehow required to make a par offer to both 2030s and 2031s, there is enough net proceeds to take to both (~$1.8 billion net proceeds vs. ~$1.1 billion combined face value). Depending on the purchase price and when the redemption takes place, the all-in yield ranges from 7% to 13%.

Author’s Estimate

Conclusion

There is some timing uncertainty to the inevitable par offer but in all likelihood the 2030 bond will turn out to be a 6-month paper. +7% yield with almost no duration risk with the possibility that the capital is returned sooner is a good place to park some cash in this environment.

Be the first to comment