graphicnoi/iStock via Getty Images

Sapiens (NASDAQ:SPNS) is an overlooked small-cap with tremendous growth potential. It pays a decent dividend that should grow strongly in the future. It offers a good mix of potential capital appreciation and immediate shareholder returns.

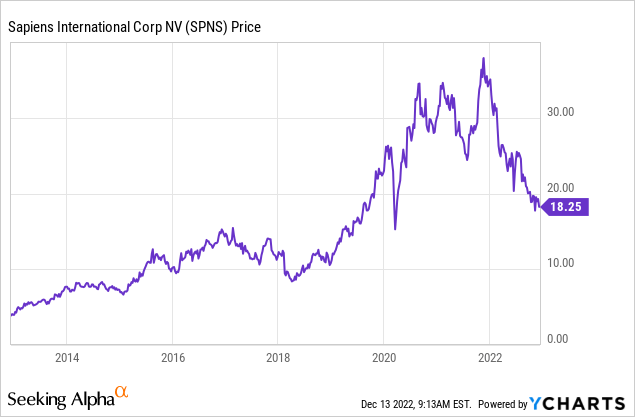

The stock price nose-dived in 2022 as currency headwinds slowed its growth. Guidance at the start of the year came in lower than expected. Currencies are hard to predict and such headwinds won’t stay forever. It impacted both revenues and margins for Sapiens. Throughout the year, it became clear that revenue declined stronger than expected but the company was able to keep its margins up.

Sapiens is a small-cap Israeli company with a sticky revenue model that leads to strong organic growth. Strategic acquisitions extend its products and markets. It’s a partner to insurance carriers that want to transform their business digitally. It delivers modular and easy-to-implement software to insurance companies.

2023 Bull Case For Sapiens

Sapiens is a long-term growth story with some near-term potential share price catalysts.

- Reduced currency headwinds could increase its USD revenue growth again to a normal pace of 7-9%. Acquisitions could add another 3% growth in line with its recent history.

- Margins could improve further due to offshoring benefits and more cloud sales.

- The renewed dividend policy likely attracts new shareholders.

My Selection Method For Long-Term Winners

I always look for strong growth stocks with high free cash flows and regular shareholder returns. These stocks often provide good long-term results when bought at the right price.

I look for four specific traits in my portfolio:

- Substantial revenue per share growth.

- A sturdy balance sheet with low leverage.

- Reasonable valuation based on FCF and PE ratios relative to their growth.

- Stocks that return cash to shareholders with buybacks and/or dividends are often run by shareholder-friendly management. I look for regular returns.

An overview of my recent articles with similar stocks:

Growth

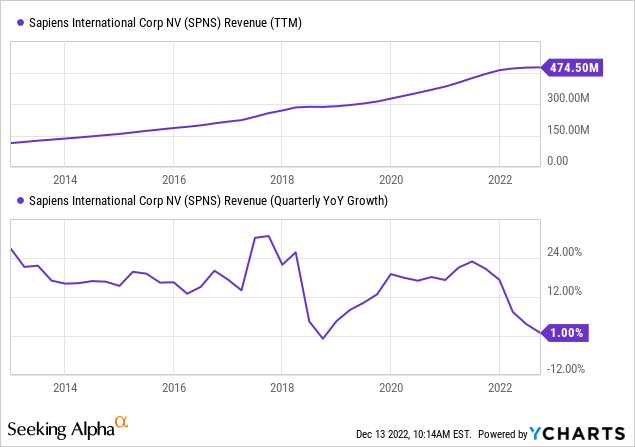

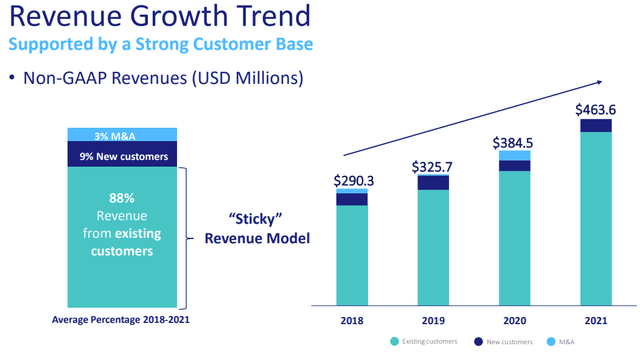

Sapiens has a growth strategy focusing on organic growth of ~8%. It uses acquisitions to expand its offerings and enter new markets like it did in Europe.

Recent growth stalled due to currency headwinds. Mainly in Europe, growth would have been much stronger on a constant currency basis. Such headwinds pass and could even become a tailwind if the forex situation changes.

Its past growth shows a steady evolution both organically and with acquisitions. Also, note that the company has been prudent with acquisitions and only does deals at reasonable prices.

Future Growth

Sapiens targets 8% to 11% CAGR for the long term. It seems achievable as it’s in line with its past growth. It adds new customers at a decent rate and has enough cash to make targeted acquisitions.

The trend of digitization is far from over. Sapiens’ target markets are already predicted to grow by 7.5% CAGR according to Gartner. Sapiens needs only to outpace the market slightly to achieve its target. It’s feasible in my opinion, especially since its offerings win XCelent awards.

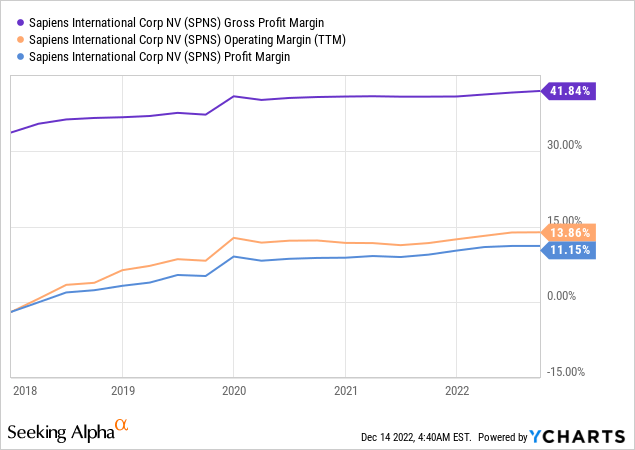

Margins

Sapiens’ margins held up much better than expected. Its adjusted operating margin guidance of 17.5% to 17.7% is the same as last year’s 17.6%. This is actually an improvement as it loses approximately 1.3% to currency changes.

Its margins are best-in-class and outperform larger competitors like Guidewire Software (GWRE) and CCC Intelligent Solutions (CCCS). I think the company shows dedication to its margins and it appears that it doesn’t just chase growth for growth. It goes for profitable long-term growth.

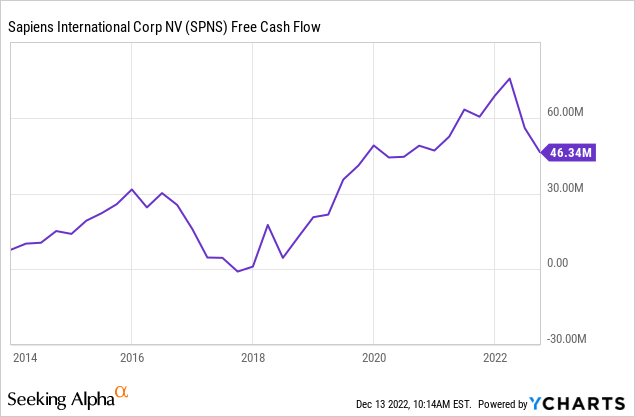

Free Cash Flow Generation

Free cash flow is vital as this is what a company could use for shareholder returns. Potential buybacks or dividends are only possible if the company produces enough cash.

Sapiens consistently increased its free cash flows and improved its cash conversion as it grew. Its SBC is negligible, so cash is used for acquisitions, paying back debt, and dividends.

Shareholder Returns

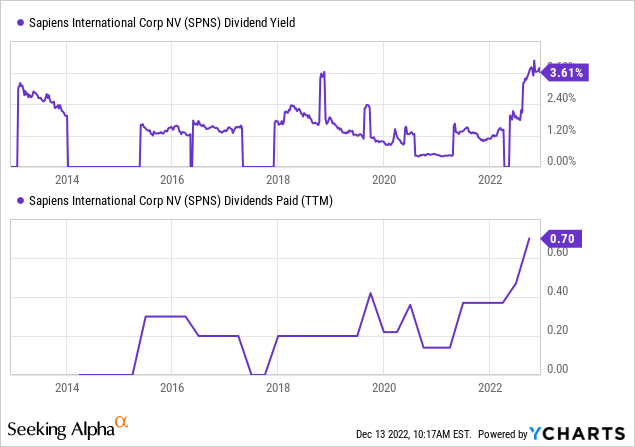

Sapiens recently paid its first semi-annual dividend according to its new policy. This slightly deformed its TTM dividend yield as it also paid an annual dividend in May.

Moving forward, I expect a growing dividend that provides steady shareholder returns. The first semi-annual dividend was $0.23 per share and I expect the second one to be around the same level. That would bring the current dividend yield to 2.35%.

Sapiens doesn’t have a buyback program and hasn’t shown interest in repurchasing shares. This would be fiscally more attractive for shareholders in my view.

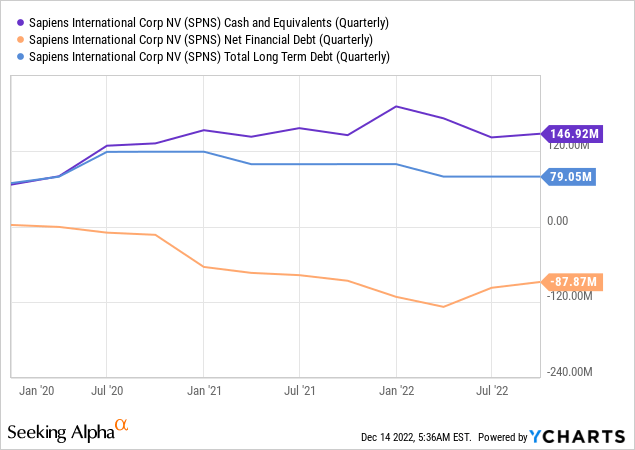

Balance Sheet

Sapiens’ strong free cash flow and lack of acquisitions over the past two years built a strong balance sheet. It has an increasingly large net cash position.

The net cash position is an asset in an environment of rising interest rates and more prudent lenders. I think the company could profit from a suitable acquisition soon. The dividend remains safe as its free cash flow covers it.

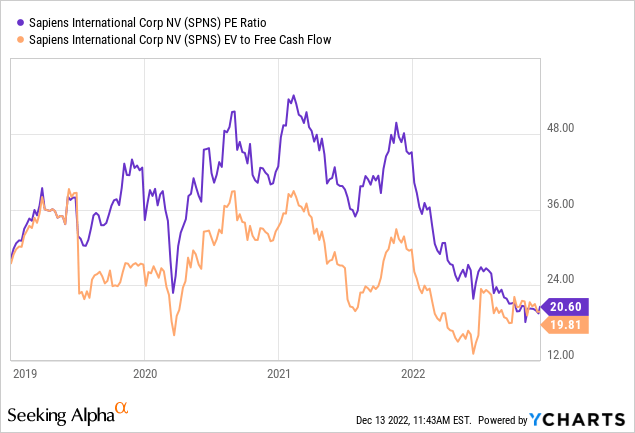

Valuation

Sapiens hovers around its lowest valuation levels in the past five years. Investors are probably phased by the low growth rate in 2022 which is mainly due to fluctuating currencies. The current valuation leaves a lot of potential upside for a company with double-digit revenue growth ambition and improving margins below the surface.

Risks

Sapiens negotiates with large insurance firms that look to cut costs as well. This has already led to delays in purchases. It should be just a postponement of revenues but could lead to less growth in the next year or two. I see it as a short-term risk just like the currency headwinds of the past year.

Conclusion

Sapiens manages its headwinds excellently. On an operational level, the company performs strongly and seems to do better than its competitors. It has excellent margins that haven’t deteriorated despite these headwinds. The cost control could pay off handsomely if the forex situation changes.

2023 should bring the company back to a normal growth pace as it should keep organic growth going. It could even profit from delayed orders.

In the meantime, Sapiens pays a sturdy dividend every six months to its shareholders. The dividend will likely grow in line with its EPS growth. The policy leaves enough cash to do strategic acquisitions to expand its offering or markets.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment