imaginima/E+ via Getty Images

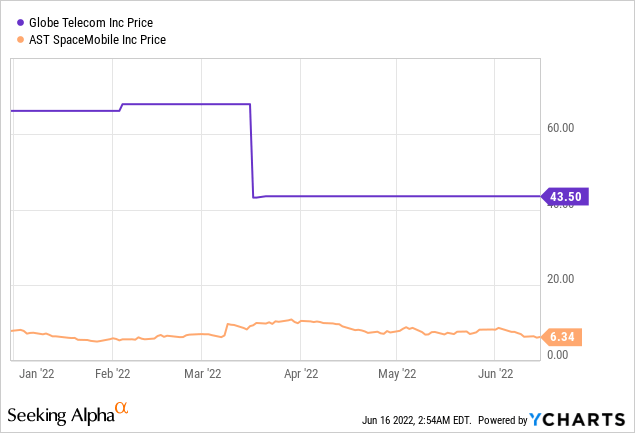

I already wrote about AST SpaceMobile (NASDAQ:ASTS) in March, highlighting the capability of its satellite-based cellular technology to disrupt communications services. I also made a comparison with Elon Musk’s Starlink (STRLK). This thesis aims to concretely analyze the benefits for Globe Telecom (OTCPK:GTMEY)(OTCPK:GTMEF) in the Philippines in order to expand its mobile broadband (high-speed) internet customer base. The company signed an MoU with ASTS on April 28.

At the time of the signature, there was no noticeable impact on either company’s stocks, most probably as a result of investors not being aware of the possibilities.

Now, in case things go as planned, the collaboration has the potential not only to rapidly accelerate the way digital connectivity is provided to remote rural communities in the Philippines, but also allow Globe to net in considerable cost savings.

I start with the benefits ASTS’ BlueWalker 3 (BW3) satellites can bring to a country consisting of over 7000 islands covering more than 300,000 square kilometers.

Reducing Capex Required For Mobile Broadband

This U.S. company aims to provide high-speed broadband internet service to remote locations and underserved communities. These locations are so far (from the main network hubs) and sparsely populated that Globe would not be able to cover the costs of connecting them with fiber. Alternatively, providing mobile cellular coverage is relatively easier as there is no need to dig trenches or lay submarine fiber cables, but nonetheless remains expensive.

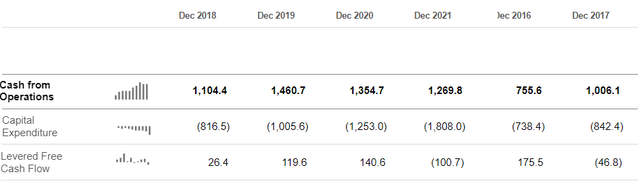

For investors, telcos (telecom operators) or mobile network operators (“MVNOs”) perform a lot of investment in cellular infrastructures like tower masts and associated gear, which take time to bear fruits. For Globe, as seen in the table below, capital expenses in 2021 were $1.8 billion, up by nearly 45% from $1.25 billion in 2020. Also, with ROI taking time to materialize, cash obtained from operations is now lower than Capex spend, resulting in negative free cash flow for 2021.

Annual income statement (www.seekingalpha.com)

Now, with annual revenues of $3.3 billion in 2021 and cash plus equivalents of $287 million, the company has the means to continue delivering growth. For this purpose, it can rely on its 87.4 million-strong mobile subscriber base. As an integrated communications services provider, it also has $3.5 million in residential broadband and 1.2 million landline customers.

Still, capex spending is on the rise with $393 million already reached in Q1-2022 or a 10% rise over 2021. Out of these, 82% went to upgrade the mobile and internet network. This comes to $322 million for a quarter and extrapolating for one year, I obtain an amount of $1.3 billion. Now, this is precisely the type of expense that can be addressed by using ASTS technology.

Going into details, one BW3 costs around $68.7 million to build and launch. Assuming that two of these can cover the Philippines territory, it would mean $135 million, or 9.5 times less than the $1.3 billion required for building towers and buying equipment for mobile networking. Even if assuming that satellite-based internet broadband requires two times more satellites to cover the Philippines and that the U.S. company makes a markup of 100% on each BW3, the total costs would still be around $540 million (multiplying 135 by 4), or less than half of what classical technology can achieve.

Thus, satellite-based 4GLTE or 5G can bring real benefits to Globe in its endeavor to satisfy its subscribers’ need for social networking, crowdsourced content, and media applications.

However, its partner ASTS faces competition.

The Competitive Risks

Since ASTS is a newcomer, one may wonder whether it may not come too late. For this purpose, the company plans to launch its BW3 test satellite in the middle of August this year. This will be followed by field tests in Texas and Hawaii while Starlink already has about 1,735 satellites in low earth orbit (“LEO”) and is making money selling kits to subscribers in many countries including Ukraine where the invading force has destroyed a large part of the telecommunication infrastructure.

Well, there are three reasons why ASTS still makes for a valid investment.

First, Starlink does not cover the whole planet earth yet. In order to do so, the company plans to send a total of 42K satellites into orbit, and considering that it started launches in May 2019, there are still many years of work ahead.

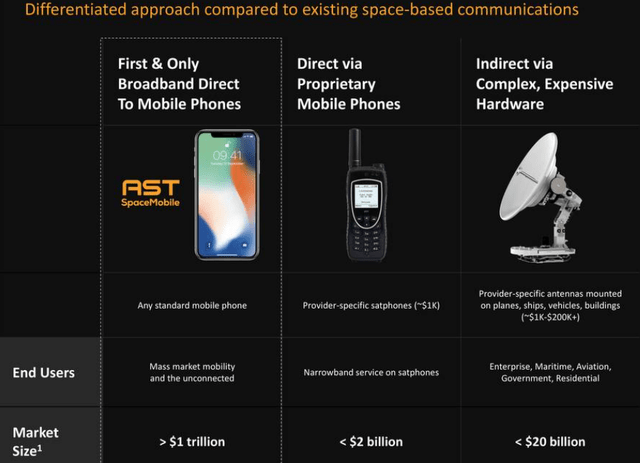

Second, it is also about the technology, as BW3’s phased array antenna has been designed to beam 4GLTE and 5G signals directly to standard mobile phones. This is different from Starlink, whose system needs an antenna somewhat similar to a TV satellite dish. Hence, when someone subscribes to a plan, he first has to hook the antenna to his roof and power it on before being able to capture the internet Wi-Fi signal on his smartphone. For ASTS, it is more direct, as BW3’s signal can be obtained on Globe’s subscribers’ mobile phones.

Company’s presentation (www.seekingalpha.com)

In this respect, ASTS works with local telcos for interconnecting with other subscribers and can be viewed as a space-based cellular network that circumvents the need for an intermediary antenna or dish, which may be problematic to acquire for a remote villager. Tellingly, the U.S. company allows for the use of standard mobile phones to get internet access, not the specialized satellite phones that you buy from the likes of Viasat (VSAT).

Third, there is also the speed factor. By design, SpaceMobile provides connectivity going up to 5G speeds everywhere on earth, whereas Starlink’s median download speed of around 105 Mbps (at the end of 2021) is more equivalent to 4G. For this matter, ASTS’ technology has been field-tested back in 2019 when a mobile phone which was placed on board an LEO satellite was able to communicate with a ground-based test version of BW3 located on earth. Therefore, this amounts to a kind of reverse testing.

Therefore, with ASTS’ direct-to-mobile satellite-based no proprietary kits are required and this represents a big advantage for deployment in the remote islands of the Philippines while saving Globe a lot on Capex.

Thus, the two partners should be valued accordingly.

Valuing The Partners

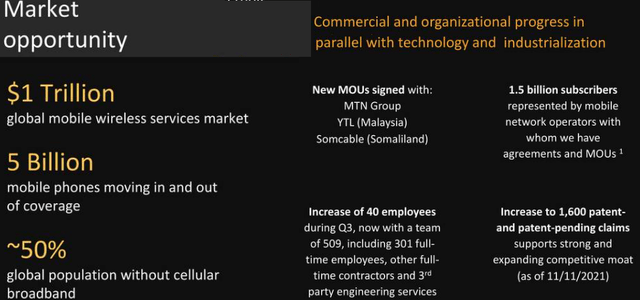

First, use cases like Globe form part of a $1 trillion market opportunity in the global wireless market, with ASTS being an alternative to traditional ways of providing high-speed internet connectivity.

Company’s presentation (www.seekingalpha.com)

In addition to Globe, the company has signed MoUs with others like YTL in Malaysia and MTN in South Africa, totaling 1.8 billion subscribers. These agreements are based on a revenue share scheme pertaining to the sales generated by ASTS in the local operator’s network, which is also responsible for the spectrum (4G or 5G operating frequency).

Now, Globe generated $313.4 million in revenues out of its 87.4 million mobile accounts in 2021, which comes to about $3.6 per subscriber. Multiplying this by 1.8 billion, having in mind deployment in the Philippines, Malaysia, and South Africa, I obtain around $6.45 billion. Assuming that ASTS just obtains one-tenth of this amount based on a revenue split of 1:10 in favor of the local telco (who will also be in charge of the retailing), I get an amount of $645 million.

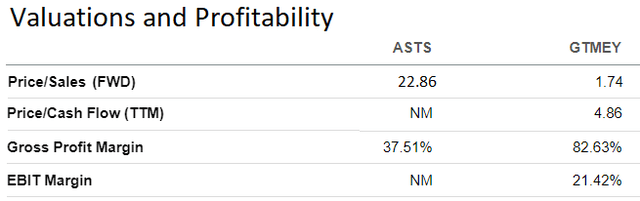

This would represent a 52x rise from ASTS’ current income of $12.4 million for 2021. As for valuations, this would then translate into a forward Price to Sales multiple of 0.44x (22.86/52) based on the current value of 22.86x. This would in turn signify that the company is undervalued with respect to the sector median of 1.3x by 66%. This leads to a target of around $10 for ASTS based on the current share price of $6.

Table built from data on (www.seekingalpha.com)

However, investors should bear in mind that telco-related revenues will only appear in the company’s income statement from 2023 to 2024 when the commercial constellation has been deployed. In the meantime, investors should brace themselves for more stock volatility as the value strategy is detrimental to companies like ASTS, which operate at a loss. Additionally, there are risks of the shares fluctuating widely around launch time for BW3 in mid-August.

As for Globe, its cash position should improve significantly with the sale of about 50% of its tower assets in a $1.5 billion deal, which should translate into better cash flows. In this respect, the company’s price to cash flow multiple of 4.86x (table above) is undervalued with respect to peers by more than 40%. Adjusting the current share price (of $45), I obtain $63. This may seem to be a high target but is justified in view of its operating margins of 21.4% beating the communications services sector by more than two times. These high margins show that Globe is able to compete with local rival PLDT (PHI) while maintaining control over marketing expenses.

Conclusion

After considering opportunities enabled by space-based communications services, competitive risks, and valuations, both ASTS and Globe are buys, but, wait for the market to stabilize first. To this end, ASTS’ stock has lost more than 20% in the last month as growth stocks got hammered, but the company has $253.7 million of cash with only $13.2 million of debt. Thus, it has sufficient funds to sustain operations till revenues start materializing in 2023-2024. It also has collaborations with big players like Vodafone (VOD) and Orange (ORAN).

As for Globe, in the current risk-on environment for stocks due to global high inflation and recession risks, it deserves better valuations due to its higher margins. The company’s MoU with ASTS will help it to improve its competitive positioning with respect to PLDT and is also an indication that it is innovative. Finally, its partnership with ASTS is likely to induce some volatility in the stock from 2023, especially during launch times, but, the stock will ultimately rise as more investors realize the benefits that space technology can bring to its bottom line.

Be the first to comment