nantonov/iStock via Getty Images

Published on the Value Lab on 22/3/21

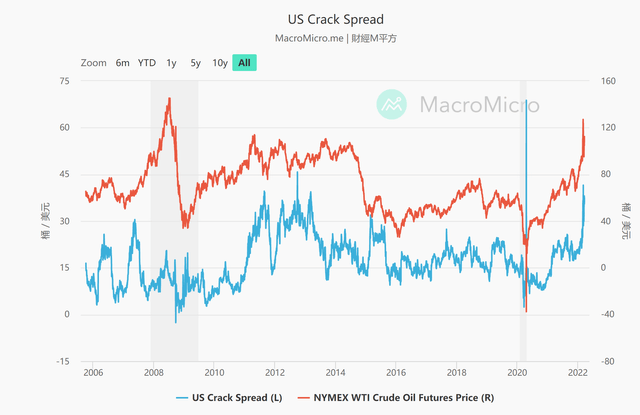

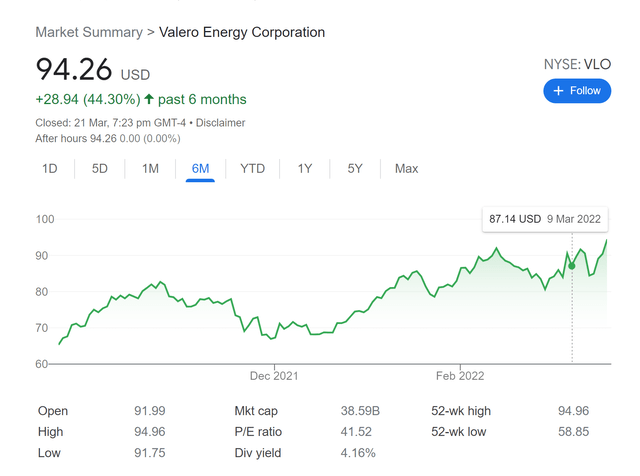

The situation with oil continues to be volatile around headlines for the Ukraine war. Even mentions of import bans shoots up the price, and any failure to complete peace talks does so as well. We don’t see the war ending soon, as Russia has the resources to carry it on despite how inefficiently it appears to be going, and while we think that more severe bans are unlikely given the dependence of Europe on Russian commodities, more sanctions will come as the war drags on. Oil has many reasons to be at the current levels, and this will be to the detriment of the crack spread, for the moment levitated by some very high product spreads, that refiners like Valero Energy Corporation (NYSE:VLO) earn their margins on. However, we think there are risks on the horizon that will reduce oil price, but contribute to a situation where refiners should be more resilient relative to E&P. With Valero trading at a pretty reasonable multiple, and with it being a stalwart during the 2020 crisis at least with its maintained dividend, we think it’s a pick that investors should watchlist, because it could even deserve to trade beyond the pre-war levels.

Why Oil Has the Most Chance To Fall

Capacity constraint has been the reason why we’ve seen the commodity boom that we are experiencing at the moment. The only booming commodity which doesn’t appear to be subject to capacity constraints is oil. The rise in oil is to do with several factors. The first is trading conditions, whereby traders are limiting their options and value by not working as much with major Russian oil exports as they want to avoid sanctions. We are also seeing somewhat of a recovery in the demand for oil as things begin to open up again. Finally, there is no reprieve coming from the US producers nor the Saudis or other OPEC nations.

What Could Change?

The thing is, high oil prices is a political problem for almost every world leader, except of oil producing countries where higher FX rates and better terms of trade are a boon. Biden is courting previously nixed governments like Iran and Venezuela to begin letting their production into the markets. There is some debate over how quickly that would ramp up, but they are both majorly endowed and their supply is capable of moving the markets. Moreover, if some countries break the general ranks that OPEC are keeping with tight taps on oil, OPEC may be incentivized to follow through with volume to maintain volumes of profits from their low breakeven cost oil fields. We could see some major declines as a consequence of these factors. Moreover, peace in Ukraine might also come suddenly, and be a catalyst to the downside for the oil prices.

There is also the possibility that Biden turns on the green agenda and allows for more shale expansions. Seems unlikely however, as his polls are underwater and the economic situation is already a reason for him to worry, and for democrats to worry in the midterms.

VLO Seems a Good Pick

Why are we interested in refiners then? Well if crude prices come down, that would be good for the crack spread. However, some situations in which crude falls, such as peace in Ukraine, might also come with the declines in crude product prices produced at Caucuses refineries. Crack spreads would not improve in this case, and perhaps even decline as the opportunity for markup falls. It wouldn’t be a disaster, it would just be more of the 2021 situation.

But in the situation where major oil comes in from Iran and Venezuela, the dynamics would be much more favorable for refiners. Crude would of course fall, but the crude coming out of these countries is very sour. What’s more is that their refineries are very old and poorly equipped due to years of sanctions. The sour crude that would be coming out of these geographies would need to be refined by high complexity refiners, and the best geography for that would be in the Gulf Coast. Growing volumes would reduce crude prices, and the value add of complex refiners also increases to deal with the sour crude that would be coming out of these potentially re-entering geographies.

The company currently trades at a multiple slightly above the 10x mark on 2021 EBITDA, in line with peer Hollyfrontier (HFC). The forecasts are rosy for EBITDA next year with crack spreads almost at 2012 levels.

Even if the current product spreads cannot be sustained with more shifts occurring in the oil markets, we think that in the more probable scenarios as politicians try to rectify the energy situation, oil prices will fall and the introduction of Venezuelan crude, which is still speculative, as well as Iranian crude which seems more likely with the Iran deal revived, will keep refinery margins ahead of the levels we are had seen in the market for 2021. VLO still is trading at the same levels as at the end of February. We think that in the majority of circumstances, including a continuation of current circumstances with crack spreads leading to a boom in refinery profits, VLO and others should be trading substantially ahead of 2021 levels. If crude falls and products spreads fall, then at least the DGD venture, now 25% of operating income, remains more steady in margin with tax credits and the more resilient demand in freight and logistics for diesel oil keeping that division healthy. Moreover, you’re only paying a little over 10x for the company in the worst case scenarios where EBITDA doesn’t particularly improve from 2021. For industrials assets with proven value, and room to grow in throughput still about 10% below 2019 levels in capacity, we think the risks are quite low, especially with a hardy 4.2% dividend.

Be the first to comment