Nordroden

Investment thesis: While Vale’s (NYSE:VALE) base metals products are not likely to be in high demand in the next few quarters, as the global economy seems set to slow dramatically, its stock is already selling at a price that is starting to look attractive from a fundamental point of view. The dividend is currently projected to be $1.37/share, while the stock price is just over $14/share, which makes for a very attractive dividend investment opportunity. The healthy profit margins suggest that the dividend is sustainable. Once we get past the impending global economic slowdown, its stock price is likely to see some appreciation as well. When factoring in the generous dividend payment, Vale seems like a very low-risk investment at current levels, although there will most likely still be an opportunity to pick up its stock at a lower price than currently, which I see as a further potential opportunity to invest.

Vale’s most recent financial report shows very impressive profit margins, which bodes well for its prospects going forward, as we enter a period of hard global economic times.

For the latest quarter, Vale reported 52.1 billion reals in revenue. With a net income of 23.3 billion reals, its profit margins came in at almost 45%. For the first nine months of the year, profit margins were at almost 41%, therefore it is not just a quarterly fluke. These profit margins have been helping to underpin the generous dividend, which is currently sitting at 10%.

With an impending global economic slowdown, which is likely to drive down commodities prices somewhat, as well as an inflation rate that is running rather hot, even in the face of what is already arguably a decelerating global economy, Vale’s profit margins are likely to get squeezed going forward. For this reason, it is a good thing from the point of view of shareholders that its financial position is overall solid because it should help to keep its dividend afloat, as long as the downturn will not be overly steep or overly prolonged.

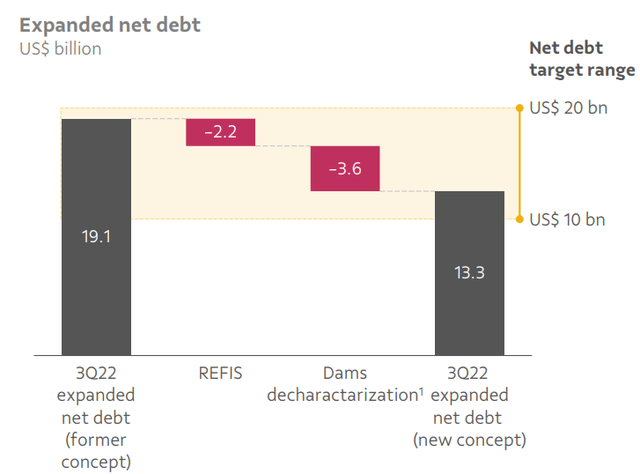

As we can see, net debt is expected to end somewhere between $10-$20 billion this year, with $13.3 billion being the likely expected outcome. Net earnings of 23.3 billion reals for the latest quarter is the equivalent in USD terms to $4.55 billion. In other words, its net debt is equal to about two and a half quarters’ worth of net earnings, or just a bit more than a recent quarter’s-worth of revenues. It is a comfortable debt situation, which should help it weather the coming global economic downturn, as well as perhaps higher production costs, given that the price of most inputs continues to go up.

The Global Iron market could see a significant downshift in demand & prices in the coming months.

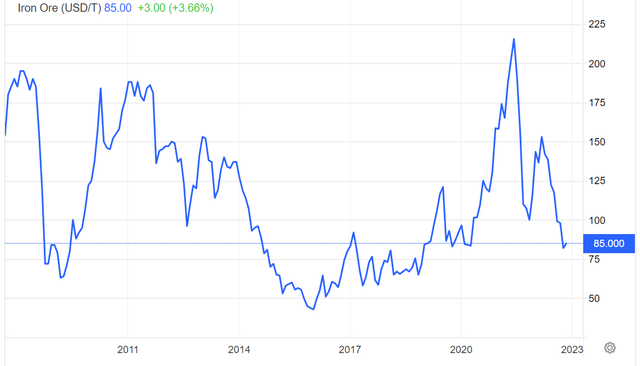

Iron is by far Vale’s most important source of revenues & profits. A recent spike in prices helped to shore up its financial performance in the last few quarters, but that boost is already starting to go into reverse.

Iron ore prices can be highly volatile, and generally, iron ore miners and smelters can experience wild stock price swings as a result. The recent speculation on China’s COVID policy relaxation is an example of how such highly cyclical industries can see massive market moves on the slightest change in potential global economic outlook changes.

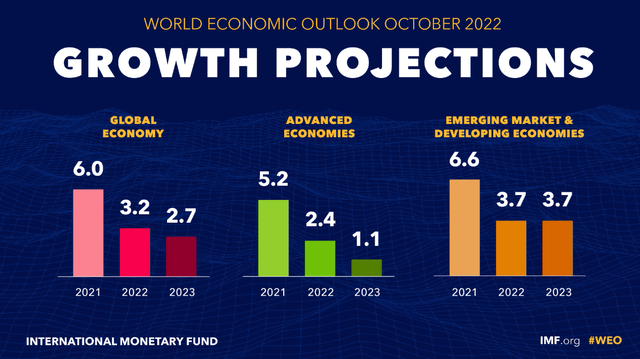

Looking at the latest global economic forecasts, the IMF now expects global growth to slow to less than half the growth rate of 2021 by next year.

Given the nature of the headwinds, with Russian energy exports being curtailed, even as we are experiencing a global energy supply crisis, things could yet get worse. China’s assumed to be continuing Zero-COVID policy, which is slowing down its economy, and could potentially cause some unpleasant systemic surprises down the line, as well as trade frictions that could escalate, could arguably provide us with even more downside risk to current expectations of economic growth.

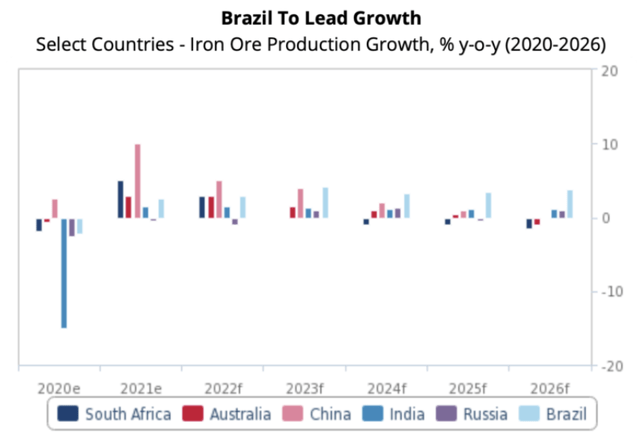

What is worse, current iron ore mining investment plans around the world are set to lead to an accelerated path of global iron ore production growth, with Vale being no exception in looking to increase production significantly in the coming years.

The combination of a slowing global economy and mining investment plans that are already being implemented and are set to cause a significant rise in production could inflict a serious blow to global iron ore prices next year and perhaps beyond. It should also be noted that contrary to precedent and expectations, the cost of some of the inputs that go into mining, such as energy, as well as manufactured equipment may still follow the current increasing path despite the slowdown in global economic activities. Global oil & gas supplies may fall short of demand, even as demand will take a hit due to a slowing economy.

Investment implications:

Given the fundamentals of the company, and the attractive dividend, the current entry point in terms of its stock price is already enticing. A far more advantageous entry point may occur next year if I am correct about the direction that the world is taking in terms of the economy’s expected trajectory. In case my thesis turns out to be wrong, perhaps due to factors such as China and Vale’s stock will rally next year, instead of seeing a further decline from current levels, it might be worth taking up a small position in this stock at some point before the end of the year, with an eye on keeping cash allocated for increasing one’s position in case that I am correct and next year will be a much better time to invest in cyclical stocks, including Vale. Looking beyond current short to medium-term issues, stemming from the wider global economy, this is definitely a good long-term buy & hold investment opportunity.

Be the first to comment