hadynyah

Vail Resorts, Inc. (NYSE:MTN) stock is heading higher and we think you should buy it here and every 5 points lower if this market inexplicably takes this stock lower. This is a major contrarian call to how the market is pricing the stock. We may not be at the very bottom, and we may be heading into a mild, or even moderate recession, but yes, we see the stock as a buy. The thesis here is incredibly simple. No fancy charts. No technical analysis (though support at the $200 level is there). No reaching assumptions. Though our first portion of the thesis is kind of a commonly talked about ‘assumption’. So how simple is this thesis? Elementary my dear contrarians. First, the clientele that visit these resorts generally are more well to-do than say your average consumer. It is not cheap to ski or hangout at a lodge. It simply is not, and is an activity often reserved for the wealthy and upper middle class, largely speaking. These folks are going to be less impacted by price inflation, and less impacted by an economic slowdown versus the average person.

Now the second part of this simple thesis is that COVID-19 was a huge pain for the company, trying to enforce rules, people afraid to go out, etc. That is in the past. It was largely in the past last season, but is all but gone now (even if the virus is still here). And yet, after amazing comps last year versus the 2020 pandemic season, performance is set to improve again in the coming fiscal year. Yet at the same time, the stock has pulled back to $200, down 46% from highs. Let us repeat this. The stock has been almost cut in half, but the company is in growth mode. While revenues and earnings remain seasonal, with a near 3% dividend yield (and higher at the latest rate), we are buying on the belief that the market will rebound, and take Vail with it, but happy to be paid to wait. The market has this wrong and the just reported earnings are quite telling. The stock has pulled back enough, and we think season passes sales set this company up to do well, on top of expanding its footprint.

Entering a strong period

The market has had a major run lower, and while the fundamentals here are likely to suffer a little due to cost inflation on food and energy costs, as well as labor, the customers are coming out. The market has priced the stock as if revenues and earnings will be cut in half, maybe more. One could argue valuation was stretched a year ago, but we could argue about a lot of things. In this case, the valuation has been sharply reduced ahead of the unknown and fear of the Fed’s actions.

Of course, Q4 is part of the slow season, and Q1, which is underway, is looking like it could be a good start and lead into the busier times of year. at least considering COVID spiking the last few weeks. This Q4 report came in much stronger than expected. Let’s talk about some financials. The quarter showed huge improvement on the top line, as well as a solid performance on the bottom line. We thought it might be better than 2021 which was still dealing with some COVID-19 issues. The top line increased nicely from a year, as expected. The result was well above consensus, beating by about $5.1 million, but was up 30.8%, coming in at $267 million. Kind of amazing to see a company with revenues up this much, but their stock nearing 52-week lows. It is all about the future expectations. And the market has no clue how to value it. We are taking the contrarian side of this. There is so much pent up demand for vacations, reopenings, travel, and leisure. Obviously, a lot of this pressure was relieved a year ago, but we are as close to normal as ever. The market is pricing the stock as if people will not go on vacation.

So how about earnings? Q4 is always a money losing quarter, make no mistake about it. Net loss was $109 million for the Q4 2022. Now look. The company usually loses money this quarter. No big deal. But it was a much lower loss versus the $145 million loss in the same period in the prior year. This is trending in the right direction. Vail Resorts reported EBITDA that improved $36 million versus last year. EBITDA was a loss of $64 million but down from $100 million in EBITDA losses a year ago. On a per share basis, losses were worse than expected and came in at negative $2.70, but were improved from the loss of $3.49 a year ago. Keep in mind, the company is performing much better now, and the stock has much lower. This comes as season pass sales are up versus a year ago at this time, a reason to be very bullish.

Season pass sales are key

Season pass sales matter for the company and they are an absolutely key outcome indicator that we watch. Folks if pass sales are up, it suggests more lodging and food sales will follow that season. Makes sense right? Season passes make up a ton of revenue. Season pass sales through September 23, 2022 for the upcoming 2022/2023 North American ski season increased approximately 6% in units and increased approximately 7% in sales dollars as compared to the period in the prior year through September 24, 2021. Folks this is really impressive when we consider two years ago pass sales were horrific as we were in the pandemic in September 2020. So 2021 was a huge gain. The fact the company is selling more than a year ago, that is stellar.

This is a key result that the market has yet to price into the stock. We expect the stock to move higher off of this news.

Expanding its footprint

Not only is there organic growth, but the company is also expanding its operational footprint. The company has operations in North America as we know but also has 3 resorts in Australia. On top of that, on August 3, 2022 Vail closed on its purchase of a majority stake in Andermatt-Sedrun. This is the first chance for Vail to operate a ski resort in Europe. This location is less than 90 minutes from three of Switzerland’s major cities. It close to Italy as well.

Valuation

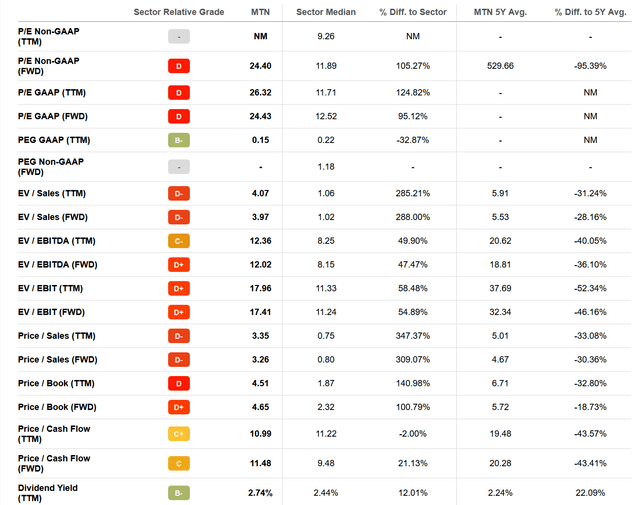

As the stock has pulled back, the valuation is simply getting more and more attractive. Folks, this is a growth stock. Ok. A growth stock. We are buying for growth. It boasts an A- rating for overall growth metrics. Incredible. But the valuation measures at first glance look poor relative to consumer discretionary stocks. However, the key that you need to hone in on is what the valuation shows relative to the five-year average.

Seeking Alpha MTN Valuation page

As you can see, the grades look poor. If there was not growth, we would argue it was poor valuation. But the metrics are attractive when you consider the far right column. Every metric is trading way below the five-year averages. And massively below them. The FWD p/e/ is most notable, trading 95% below the average. That is value, especially with the growth on display. We also would point to the price-to-cash low ratio of 11.48 being 43% historical norms. The only metric that is higher is the dividend yield at 2.74%. And frankly, as we discuss more below, the dividend yield on a forward basis is well over 3% now. This is a winner.

Looking ahead

Despite facing broad cost inflation and labor costs our team sees meaningful growth for fiscal 2023 relative to fiscal 2022 and solid EBITDA. Resort EBITDA was $836.9 million in fiscal 2022 and this figure is being guided significantly higher to $893 million to $947 million. That is solid growth. Now some of the reason net income will be down is due to massive investments being made. The company will spend just under $200 million to upgrade a bunch of lifts across many properties modernizing many of them.

The cash on hand is also strong here. They have $1.1 billion of cash on hand and another $417 million available on a revolving credit facility they can draw from if needed. There is a bit of debt, but the net debt is just 2.0X EBITDA. More than manageable.

Did we mention you are also getting paid to wait for the bounce. The company is paying $1.91 per share dividend in October, or $7.64 annualized if that level were to be maintained, which it likely will be, after not paying one in the COVID impacted 2020 and some of 2021. We really like the prospects here. Oh, and the company is reducing the float opportunistically. The company in fiscal 2022 repurchased 304,567 shares of common stock at an average price of $246.27 for a total of approximately $75.0 million.

Risks

Like any investment there are risks. Vail has some general risks, and some company specific ones to be aware of. Back in 2020, during the pandemic, the company introduced its so-called “Epic Coverage”, which is included with the purchase of all seasons pass products for no additional charge to the customers. So what this is, for those unaware, is basically an insurance policy for customers. Epic Coverage offers refunds to season passholders if certain there are events that cause a resort or lodge to close before or during the ski season. There is no telling what could happen to cause a bunch of closures. There could be acts of God, such as earthquakes or even avalanches or forest fires. There could be extremely warm weather which make the trails impossible to ski on. There could be devastating injuries that require investigations, or malfunctions of ski lifts. So this was first introduced with COVID-19, but any of these possibilities could require the company to offer a significant amount of refunds and devastate financial performance.

Now, in our opening we had stated that we believe the more affluent among us will not be as hard hit by a recession or inflation as the average consumer. We stand by this assertion. That said, skiing, snowboarding, travel and, and generally high spending tourism are discretionary recreational activities that could see reductions if the economy gets real bad. The degree to how severe a recession is could impact fiscal performance.

There is also a ton of competition for tourism dollars. And not just tourism dollars, but also specific to skiing and lodging. Vail has a dozen or so resort destinations, but there are hundreds, nearly 1,000 skiing and lodging destinations in North America alone. Now factor in that the company is expanding its global footprint. The property in Switzerland is exciting, but skiing in the Swiss Alps comes with extreme competition. The fact is the company has to fight for customer loyalty as their guests can easily pick another destination to attend or travel to. This is a prevalent risk that is not going away.

Our recommendation

This is a contrarian play relative to the market and how it is being priced. Yes there are ongoing risks, but we believe the risk-reward ratio is favorably in contrarian’s favor to start buying right here, and right now near a 52-week low. Yet, there is growth in many key metrics. While EPS may increase to a degree, keep in mind the massive investments being made. You will be paid very handsomely to wait. The fact is the company is expanding its footprint, is seeing increased season pass sales, and we believe the clientele will be only slightly impacted by any recession. The COVID-19 impacts are a thing of the past, and EBITDA looks to expand significantly. We want to own shares here before the market wakes up.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today.

Be the first to comment