Thomas Barwick/DigitalVision via Getty Images

Vacasa, Inc. (NASDAQ:VCSA) showed astonishing growth year-over-year in its gross revenue despite the unfavorable effects of the pandemic in 2020 and inflationary pressures. It now generates solid and intact fundamentals. So this year, additional alluring growth triggers are predicted. This is thanks to its innovative approaches to clients, homeowners, and improved digital service capabilities. Similar to that, the stock price points to a bright future for investors. This optimism is justified by its developing fundamentals and room for growth in the industry.

Company Performance

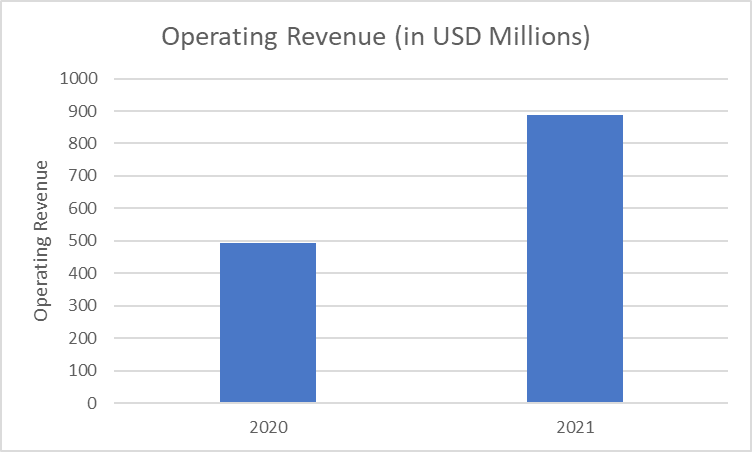

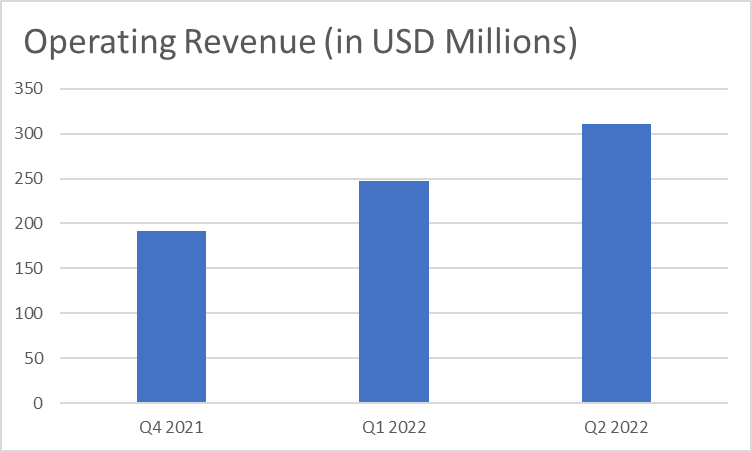

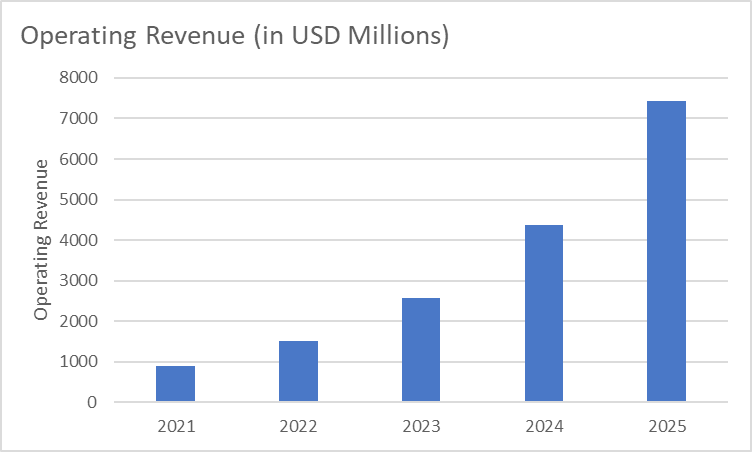

VCSA keeps increasing its operations, causing a 25.51% increase in revenue growth in only a quarter. It reached $310.35 million from $247.26 million in 1Q 2022. Operating Revenue was significantly increasing because of new home additions and individual approaches. An increase in management operations produced more sales, plus the company strengthened its enterprise technology solutions. This positioned the company for better customer satisfaction.

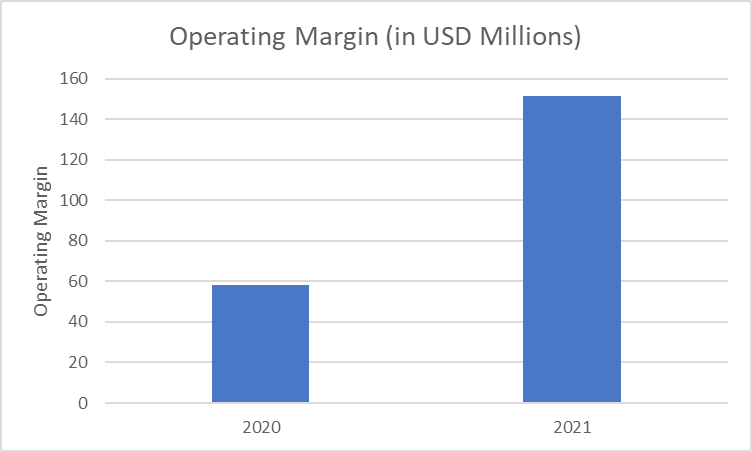

Similarly, expenses were cut to keep the core business operating. As a result, by decreasing its costs, the company was able to raise its margin to 72.56%, or $77.68 million. The company remained open all year long. Coping up with digitization allowed it to deal with challenging market conditions.

The operations of Vacasa are still growing. Its operating revenue of $889.06 million in 2021 increased by 80.79% from the previous year. Even better, the half-year value is already 64% of that annual value. It may be higher this quarter due to seasonality factors. In reality, summer entices more leisure and business travel. The operating margin has also increased to 160.25% because of its merger with TPG Pace solutions. Also, as more people adopt the technology, its digitalization becomes a growth catalyst.

Operating Revenue (MarketWatch)

Operating Revenue (MarketWatch)

Operating Margin (MarketWatch)

VCSA is now the largest vacation rental management company in North America. Currently, it doesn’t have a strong challenger aside from hotels and timeshares after buying its strongest competitors. It serves millions of customers daily from over 35,000+ homes across the 35 US States including Mexico, Belize, and Costa Rica.

Surprisingly, sales and profits rose last year, given the 60% new home additions in 2021. The opening of more houses could aid in meeting more demand and serving more customers. Given that Vacasa has 3 million clients per year, further improvement is quite likely to be achieved.

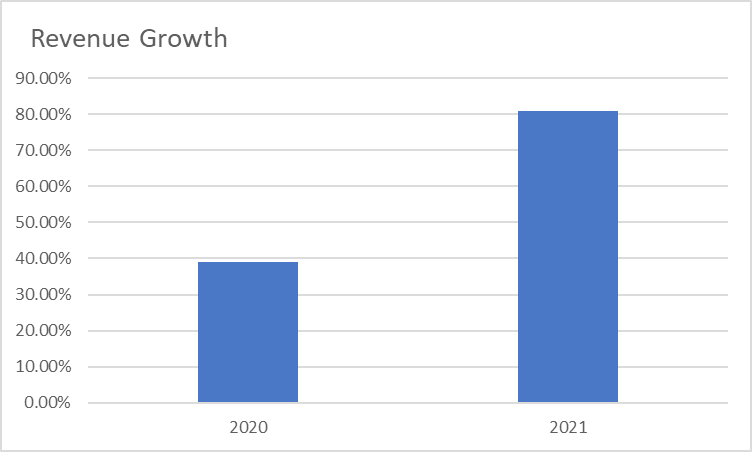

Vacasa holds the majority of the market share of the vacation rental management industry. The company shows an 80.79% year-over-year revenue growth vs. 39.14% from 2020. The data demonstrates its performance and ability to consistently increase its revenues moving forward. Also, it appears to demonstrate a stronger grasp of its operations as it improves its profitability.

Revenue Growth (MarketWatch)

Digital Transformation and Customization of Customer Needs

Today’s opportunities are greater due to the industry’s unmet demand as the pandemic comes to an end. The enhancement of its technology has revolutionized the needs of its customers. Transforming booking to check-out experience, having 3D virtual tours of the rental houses means customers can be sure what they see is what they get. Listings are also synced in major channels such as Airbnb and Booking.com. Therefore, the company might manage to keep expenditures under control. Because of this, VCSA should strategically enhance its IT spending.

According to Rentals United statistics, the vacation rental industry may reach $20 billion. Fortunately, the business keeps up with changes in the market and customer preferences. These are the potential areas of growth for Vacasa.

Competitive Advantage and Home Openings

To attract more customers this year, vacation rental openings are identified. Vacasa already had 37,000 vacation rentals by 2021. VCSA targets to increase this figure by 30% by the end of 2022.

If the operating revenue is divided among all vacation rental properties, the average revenue rises from $24,000 to $31,000 in this case. That is the contrast between things before and after the establishment of the additional 30% vacation rental properties. VCSA can, therefore, accommodate more guests when additional vacation rentals will be opened and increase demand. It displays marginal revenue of $5,300 on average for vacation rental properties. As a result, VCSA keeps growing its capacity and expanding into new areas. As costs and expenses become more controllable due to digitization, the operating margin may rise to 30%.

Operating Revenue (Author Estimation)

More Stable Financials

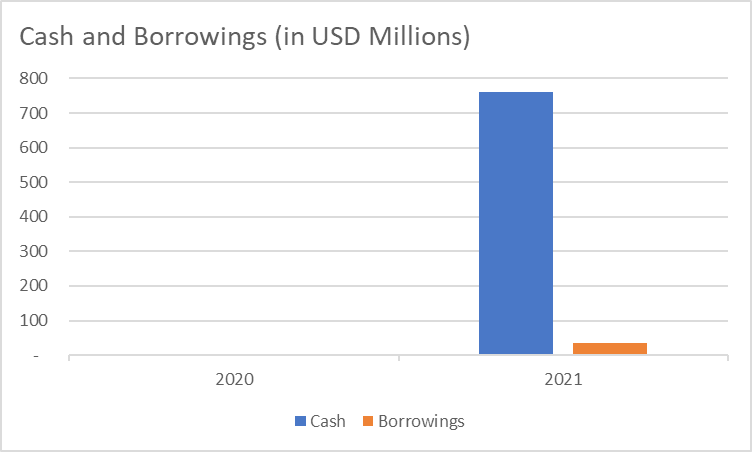

The company shows healthy fundamentals. The long-term borrowings increased in 2021 due to capital spending. Cash and equivalents rose from $192 million to $310 million. Given this, we can see that the company is positioned to pay off its obligations. It also reaps the benefits of issuing its stock to the public.

Cash and Equivalents and Borrowings (MarketWatch)

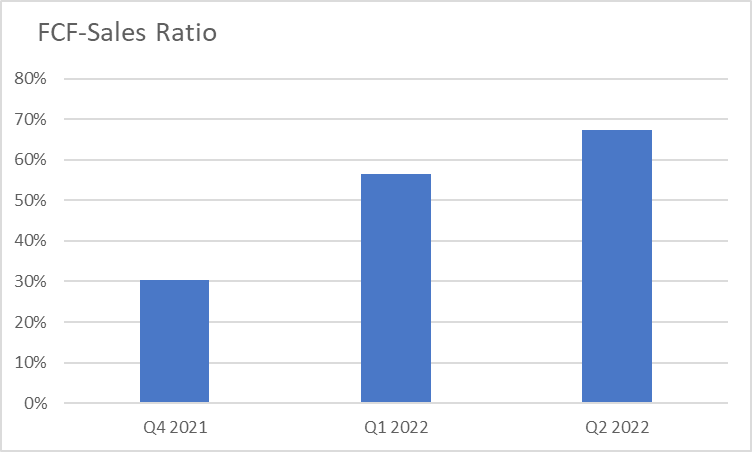

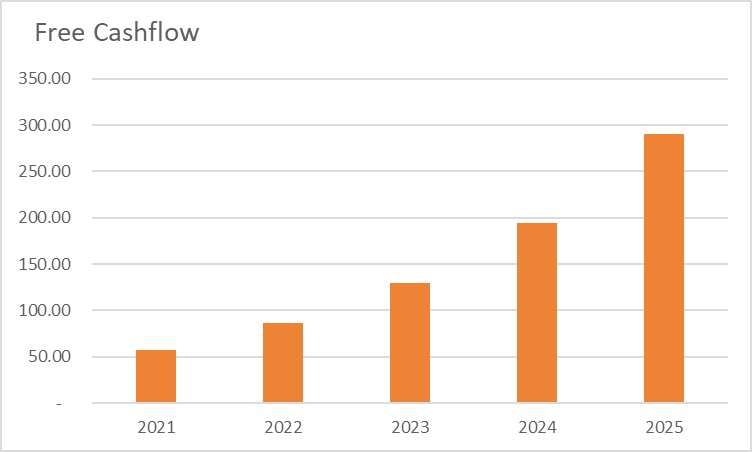

Additionally, the company will be profitable while continuing its operations. Free Cash Flow (FCF) of $209.1 million enables us to verify the growing profitability and sustainability. Despite a $5.36 million CAPEX and $67.13 million net assets from acquisitions, the FCF-to-Sales Ratio is presently 67%. The business now keeps its costs and expenses low as it strives to grow. I predict that the FCF-to-Sales Ratio will be at 50% over the next four years due to the rise in CapEx driven by new rental vacation properties. Therefore, the value might increase from $11.24 to $56.90 million.

FCF-to-Sales Ratio (MarketWatch)

Free Cash Flow (MarketWatch)

Price Valuation

VCSA has somewhat increased in price since August 11. However, no reversal has been found. The price shows downward momentum at $5.56, and the share price may decline even more. Despite these declines suggesting overvaluation, you might consider the company anyway considering its strong financial position.

Also, if we compare the estimated EPS of NASDAQ at -$0.19 vs $0.02 as reported, it only shows that the company is forward-looking. The P/E Ratio is at 278 and only shows that it is still overvalued. It agrees with the potential overvaluation, as shown by its PTBV of 1.74. To assess the stock price better, we may use the EV/EBITDA.

EV $1.06 billion

Net Debt -$0.72 million

Common Shares Outstanding 224,782,000

Stock Price $3.11

Derived Value $4.12

There is a potential upside of 30% for the next twelve to thirty-six months given the company’s continued expansion and improving fundamentals, so the price may keep increasing. Vacasa’s store openings and digital transformation adaptation keep it on the right path. It may flourish more or maintain its stable financials, sustaining the uptrend.

Bottom Line

Vacasa is now exhibiting solid and intact fundamentals. Its enterprise technology upgrade and vacation rental openings demonstrate its extraordinary ability to produce income. Additionally, cash and borrowings are now steady, and it can continue to have liquidity. Another thing to think about is the potential increase in the stock price, as the vacation rental industry may reach $20 billion per statistics. The recommendation is to continue holding VCSA.

Be the first to comment