selvanegra

Thesis

Acumen (NASDAQ:ABOS) is a biotech company with one Phase 1 asset, ACU193, an amyloid oligomer targeting antibody. In bringing this drug candidate to trials, Acumen is essentially trying to validate not the amyloid hypothesis of Alzheimer’s disease, but more specifically the amyloid oligomer hypothesis. This hypothesis had first been introduced in 1998, and has received quite extensive scientific coverage. Amyloid beta oligomers or AβOs have been considered as the most pathogenic form of amyloid structures in Alzheimer’s patients. This understanding did not led to focus on selective targeting of amyloid oligomers in trials.

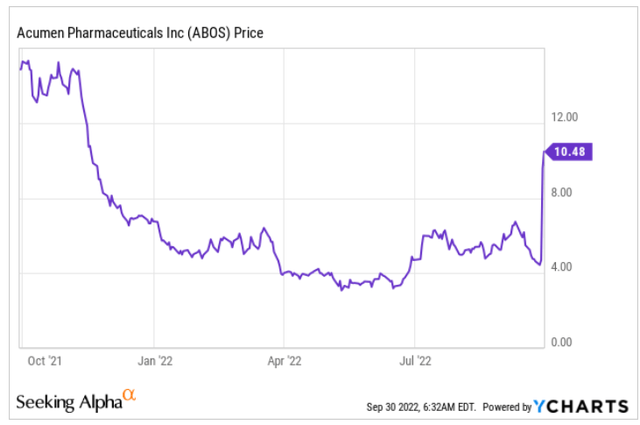

Acumen’s share price recently doubled, bringing its total market value to $424 million and therefore adding about $200 million on news that was not company-related. The news in fact related to Eisai’s (OTCPK:ESALY) lecanemab, showing 27% slowing of cognitive decline in a Phase 3 trial in Alzheimer’s patients. Acumen’s similar drug is in a Phase 1 trial. I see the reason behind the share price jump, but the company’s drug candidate here is very early stage which is mainly why I don’t expect Prothena’s share price to stay at current levels.

Acumen is realistic in its expectations, potentially seeing ACU193 as part of a combination therapy.

Given the all-in-all very moderate effect of lecanemab, I believe Acumen’s drug candidate may at best one day be eligible to replace its competing anti-amyloid-targeting drugs. It would be unrealistic to think that its effects would be far better than those of lecanemab, but they may be a bit better, and more importantly, the drug’s safety profile may be better.

Drug candidates with potentially far stronger efficacy in Alzheimer’s disease are in the pipeline of several other companies. To me, the best-in-class anti-amyloid targeting drugs may one day have their place in a combination therapy for Alzheimer’s. However, to get cognition in Alzheimer’s patients to stabilize or improve, solutions will have to come from another area of science altogether. And these solutions are forthcoming, even though the market does not seem to give most of them much value.

Company

Introduction

Acumen is a biotech company with one Phase 1 drug candidate for the treatment of Alzheimer’s, namely ACU193. The positive readout of Eisai’s lecanemab, an amyloid-targeting drug candidate, had Acumen’s share price almost double over the course of two days, with most gains made on September 28, 2022. The uptrend continued into September 29, 2022, at a moment when the entire market was dropping due to inflation worries. The spike is not related to any news the company released itself, but only due to Eisai’s positive readout. At market close on September 29, 2022, Acumen’s market cap was $424 million. Eisai’s news basically triggered about a +$200 million in added market value. That is still nothing compared to the +$1.3 billion addition in market value experienced by Prothena (PRTA) for its Phase 1 amyloid-targeting antibody.

One-year price chart (Ycharts)

As both companies’ share prices have moved up on essentially the same news from Eisai, with both drug candidates being in a Phase I trial and both touted as potentially best-in-class amyloid-targeting monoclonal antibodies, I will include a comparison of both companies’ drug candidates at some point. I will set out below why I believe the market reacted the way it did, and how I see Acumen’s Phase 1 drug candidate’s possible future.

ACU193 for Alzheimer’s

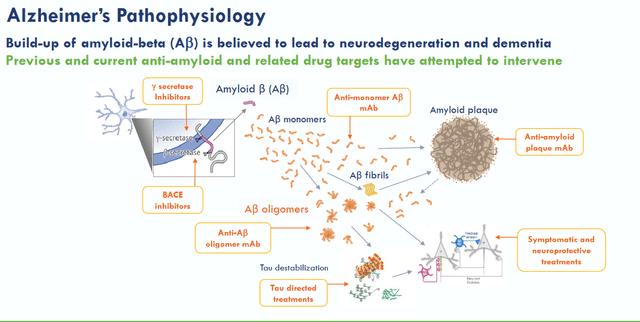

ACU193 is Acumen’s Phase 1 asset for Alzheimer’s. As there is no other drug candidate that may lead to commercialization for Acumen in the near term, Acumen’s Phase 1 drug candidate appears to be the reason for the addition of +$200 in market and enterprise value. ACU193 is an amyloid-oligomer-targeting antibody for the treatment of Alzheimer’s disease. Amyloid buildup is historically the first and foremost hallmark of Alzheimer’s disease, with hyperphosphorylated tau tangles historically being the second one. More recently, neuroinflammation has been added as a third hallmark across neurodegenerative diseases.

Alzheimer’s amyloid pathology (Acumen corporate presentation)

Billions of dollars have gone into efforts to find a cure for Alzheimer’s by eliminating amyloid buildup. That cost is estimated at $45 billion. Some months ago, some went so far as to consider that the science behind amyloid—targeting treatment candidates was based on a fraudulent study. Efforts to treat Alzheimer’s by removing amyloid plaques have led to almost consistent failures, but in recent years also two successes: the drug approval of Biogen’s (BIIB) Aduhelm only for the US which has been the subject of controversy and a commercial disaster which had been expected, and the recent positive Phase 3 trial readout for Eisai’s lecanemab.

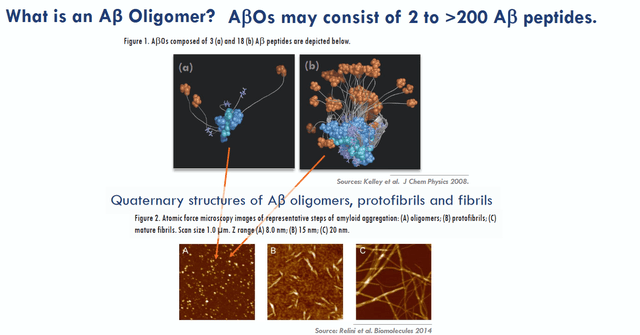

Acumen’s drug candidate targets Aβ oligomers or ABO’s, which are larger structures consisting of several amyloid proteins assembled into clusters.

AB oligomer slide (Acumen corporate presentation)

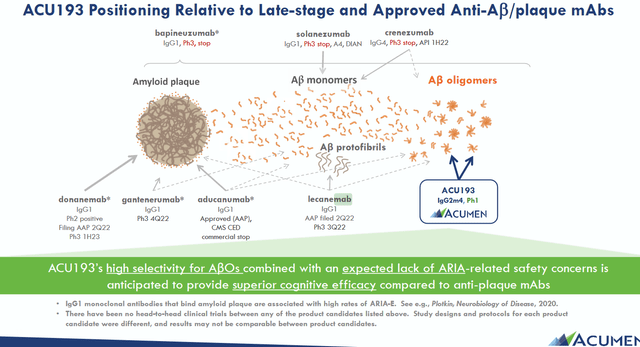

By only targeting ABO’s, Acumen tries to differentiate itself from other drug candidates, which may target amyloid plaques, amyloid monomers, amyloid oligomers and amyloid protofibrils. For reference, lecanemab targets all of these as shown in the slide below.

ACU193 positioning (Acumen corporate presentation)

ACU is basically an amyloid-targeting antibody that is selective for the immunoglobulin G2m4 subclass. This makes sense as amyloid oligomers seem to be considerable more toxic or pathogenic than other amyloid structures. Acumen’s best reference in that regard is a 2022 publication in Frontieurs in Neuroscience explaining the background to amyloid oligomers in Alzheimer’s disease and the characteristics of ACU193. In comparison, Prothena’s XPR012 is not selective in targeting amyloid oligomers, but has shown far stronger binding than Aduhelm in preclinical testing (slide 17).

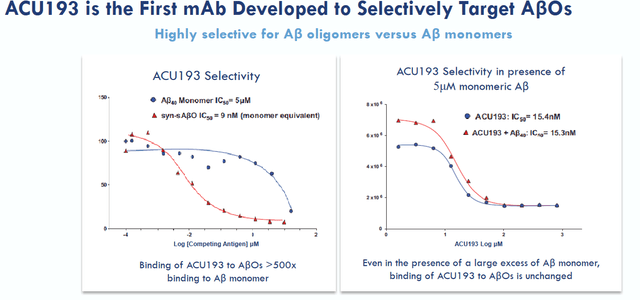

ACU193 selectivity slide (Acumen corporate presentation)

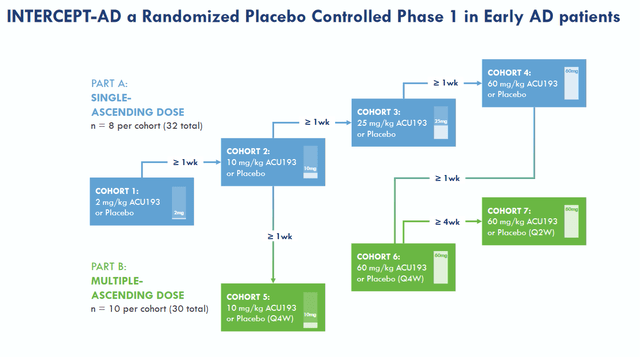

Acumen is doing a Phase 1 clinical trial in patients with early AD to assess safety, ARIA-E, PK and target engagement. Its part A is single-ascending dose with 4 cohorts consisting of 8 patients. Part B is a multiple-ascending dose with 3 cohorts and 10 patients per cohorts. Ascending dose regimens in amyloid-targeting antibody treatments make sense, as the higher the dosage is, the higher the risk of developing ARIA. Biomarkers will include phosphorylated tau and neurofilament light. Phosphorylated tau is the other historical hallmark of Alzheimer’s disease, and neurofilament light is a marker for neurodegeneration, or potentially neuroregeneration in case of successful treatment. In comparison, Prothena‘s Phase 1 study in drug candidate PRX012 has safety and tolerability, plasma PK and cerebrospinal fluid PK profile as objectives.

Intercept study design (Acumen corporate presentation)

For full information on ARIA, the goal of the amyloid-targeting antibodies, such as Aduhelm, is to allow the brain’s immune cells or glial cells to remove debris and toxic elements such as amyloid structures. It is their function to engulf and eliminate toxic debris such as amyloid buildup. Amyloid-targeting antibodies typically coincide with what is called ARIA or amyloid-related imaging abnormalities. ARIA is microglia’s inflammatory response to these antibodies’ actions, and in some cases lead to brain swelling or oedema. In neurodegenerative diseases brain, these microglia deviate from their normal phenotype, and have moved to an inflammatory M1 phenotype, creating an inflammatory loop. ARIA-E is the imaging abnormalities related to brain edema.

ACU193 would have >500-fold greater selectivity for AβOs over Aβ monomers. Acumen claims (slide 15) that AβO selectivity is expected to provide superior efficacy, safety and tolerability. Acumen expects ACU193 to be used as a stand-alone therapy or potentially in combination with other symptomatic, anti-inflammatory, and/or tau directed therapies.

The Phase 1 trial results are expected for some time in the first half of 2023. In comparison, Prothena‘s Phase 1 study in drug candidate PRX012 has safety and tolerability, plasma PK and cerebrospinal fluid PK profile as objectives, and will read out in 2024.

More than $200 million in added value on the back of lecanemab’s readout

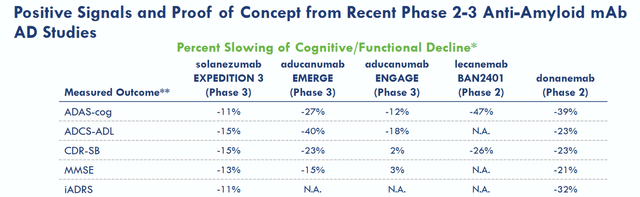

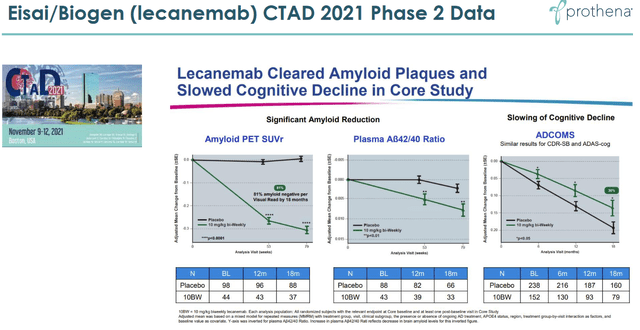

Eisai’s September 287, 2022, positive readout for lecanemab showed that there was a 27% slowing of decline in treated patients. That is a first in a well-controlled trial in Alzheimer’s disease for an amyloid-targeting antibody. It is also a first for any Alzheimer’s treatment. As such, that is fantastic news which leads the way to amyloid-antibodies becoming part of future treatments for Alzheimer’s disease in the long run. Lecanemab’s results were in line with its Phase 2 results, which also showed slowing of cognitive decline, as well as with Eli Lilly’s (LLY) donanemab which had shown the same in a Phase 2 trial. The slide below is from Acumen’s corporate presentation and the second one is from Prothena’s, as both companies hope that their respective drug candidate would lead to equal or better outcomes.

Overview of competitors’ results (Acumen corporate presentation)

Eisai Phase 2 reporting (Prothena corporate presentation)

A 27% slowing of cognitive decline may unfortunately not mean much in practice. Well-respected biotech authors Damian Garde and Adam Feuerstein mentioned that such a fractional improvement on an 18-point scale could be imperceptible in real life. Seeking Alpha contributor Derek Lowe mentioned as well, and I concur, that such a difference might be too small a thing to notice for Alzheimer’s patients, their families, and their caregivers. Such an effect would basically mean one will see their cognition decline less than one third slower than in case they would not have been on treatment. Patients will not see their disease improving at any stage, nor will they see their cognition stabilizing around a certain level. This will not alter the devastating character of the disease. If this is all we can do about this disease, Alzheimer’s disease treatment would still be in dire straits. I am of the opinion that it’s not, and that other neurodegenerative diseases are neither.

Still, in a market driven by inflation worries, Eisai’s Alzheimer’s news has been the talk of the week with valuations of Biogen, Eisai and Eli Lilly up several billions. In comparison, Prothena’s enterprise value increased by +$1.3 billion.

My take on PRX012 and the future of Alzheimer’s treatment

I believe ACU193 holds promise as a future amyloid-targeting antibody mainly for two reasons. The first is that it seems to have a very strong binding affinity to amyloid oligomers, which are reported to be the most pathogenic amyloid structures in Alzheimer’s disease. The second is that its ARIA profile could be much better than those of current amyloid-targeting antibodies.

Contary to Prothena’s PRX012 which can be delivered subcutaneously, ACU193 will still need to be administered intravenously.

There is no reporting for Acumen’s drug candidate PRX012 on any other measures, either on a biomarker or on a cognition level, nor will there be any time soon. In that sense, I would say ACU193 remains a very early-stage disease candidate with not much preclinical data to go on. The same holds true for Prothena’s PRX012.

Acumen is realistic in its expectations for ACU193, stating that it may be effective as a standalone therapy or in combination with other inflammation- or tau-targeting therapies. Whereas tau-targeting have so far not led to much efficacy, inflammation-targeting therapies have. Inflammation is third and most recent hallmark of Alzheimer’s disease and perhaps the main cause of neurodegeneration across several if not all neurodegenerative diseases. Lowering inflammation and modulating glial states seem to have beneficial effects across neurodegenerative diseases. First results that are now seen coming from this manner of treating neurodegenerative diseases have the potential to outperform effects seen from amyloid-targeting antibodies. Those who have read some of my articles before, such as coverage on Athira Pharma (ATHA), Anavex (AVXL), BioVie (BIVI) and INmune Bio (INMB), will have noticed that I am trying to cover the area of neurodegenerative diseases broadly, and to identify the possible future winners. If I am, like Acumen, convinced that amyloid-targeting antibodies will eventually be part of the total solution to Alzheimer’s disease, I believe other drug candidates have shown far greater success potential as disease-modifying drugs than PRX012 or even Eisai’s lecanemab.

Let’s take an example. The ratio of ratio of p-tau / A b is believed to be a predictor of cognitive decline. Where lecanemab reported a 0.005 decline over the course of a year in its Phase 2 results as shown above, last month BioVie reported an improvement of 0.002 in 60% of patients with MMSE >=20 over the course of only 3 months. At the same time, BioVie also reported a cognition improvement of 2.6 points on ADAS-Cog12 in the same patients. These improvements in cognition do not stand alone any more at this point. Of note, we are not talking about slowing of decline. Or, if one were to translate the improvement, BioVie would have reported more than 100% slowing of cognitive decline in line with reporting in the ratio of p-tau / A b. A stabilization of cognitive decline is something patients and caregivers would notice and favor.

ACU193’s main attractiveness resides in its potential to be more efficacious without being accompanied by ARIA. With the Phase 1 trial mid-stage, that potential is still far from validated. The overall likelihood of approval from Phase I for drug candidates over 2011–2020 was7.9%, and even in light of recently announced regulatory flexibility on the side of the FDA, I don’t expect this to suddenly become higher in Alzheimer’s disease. Acumen will have to prove its efficacy and safety, and historical odds are against it.

In that sense, though I would like to be bullish on Acumen’s longer term share price evolution, in the current market conditions I am not. As a result, I cannot recommend this stock as a buy, and would sell if I were a shareholder.

Financials and interests

As of June 30, 2022, Acumen had approximately $210 million in cash and marketable securities on hand. Its cash burn for the last quarter was $26 million. At the current cash burn, cash on hand should last Acumen well into 2024.

Acumen’s stock has a 21.2 million float. About 5.5% of the stock is held by insiders, and 64% is held by institutions according to latest reporting. About 5% of the stock is shorted.

Risks

Market volatility at this very time is high, and market bearishness is unescapable at this time. Biotech investing is generally accompanied with extreme volatility. This is all the more so in the Alzheimer’s space, where the addressable market is so huge that numbers can quickly get out of control. The risk of investing in Acumen would in my eyes be related to the early-stage character of most of its assets. Early-stage assets have a high failure rate, and the FDA may at any given time delay or halt any trial. This is a realistic risk given the above-mentioned risk of ARIA. Finally, the high level of competition specifically in either amyloid-targeting drug candidates make investment here extra risky. I have mentioned Prothena’s PRX012 as a possible amyloid-targeting competitor, but competition may also come from the area of neuroinflammation where I see far more promising results. In the case of BioVie, there is a drug candidate that is in the middle of its Phase 3 study having shown improvement in cognition in a Phase 2 study that has just been reported on. And I do not even consider BioVie’s drug candidate the most promising one in trials for Alzheimer’s disease.

Conclusion

Acumen’s share price has over the past days taken a turn for the better on news that essentially related to another amyloid-targeting drug. In an obvious risk-off mood, the market has interpreted that news as if all of the consistent failures of amyloid-targeting drugs could now be thrown overboard, and that the future would be bright for these drug candidates. I am moderately skeptic of that mood, though I see the potential benefit of Acumen’s ACU193. Still, this drug candidate will have to face the hurdles accompanied with drug development. It is still a phase 1 drug candidate, with no reporting in human patients yet. Its main advantages could be that it is selectively targeting amyloid oligomers which are considered to be more pathogenic than other amyloid structures in Alzheimer’s disease, and that it could lead to less risk of developing ARIA.

Realistically, the maximum effect of an amyloid-targeting drug is to moderately slow the decline in cognition. As a standalone therapy, I wonder if patients or caregivers would even notice such slowing, as there will still be clearly progressing decline. Far more promising results are being seen coming from the area of inflammation-targeting drug candidates, and there are other drug candidates with different mechanisms of action that have shown potential improvements in cognition as well.

ACU193’s benefits may one day make it the preferred go-to as an amyloid-targeting treatment. At this point, the potential is there, but there is not much more than that to go on. Realistically, approval would not happen before several years will have passed, and I believe the Alzheimer’s treatment landscape will look well different at that time. The future of Alzheimer’s treatment may be combination treatment in which amyloid-targeting antibodies may play a role. But I don’t expect that role to be a primary one.

For the reasons above, my view is that Acumen’s market price is not sustainable in the long run, at this point of Acumen’s drug development.

Be the first to comment