imaginima

I’ve been covering a number of energy stocks lately, searching for opportunities in the oil and gas sector due to its insulation from inflation, interest rates, recessions, whilst the energy sector is seeing heightened prices thanks to ongoing geopolitical turmoil.

Today’s article highlights a firm I am going to be putting my strongest buy recommendation on within the sector. VAALCO Energy, Inc. (NYSE:EGY) is focused on exploration and exploitation of crude oil and natural gas, and enjoys a very healthy balance sheet and very favorable peer comparison valuation.

(Data & prices correct as of pre-market 6th September, 2022)

(The Top Oil and Gas Exploration and Production Stocks referred to can be found on this Seeking Alpha screener)

Want to skip the analysis & go straight to finding out who had the best (or worst) valuations in Oil & Gas? Download my research for free here

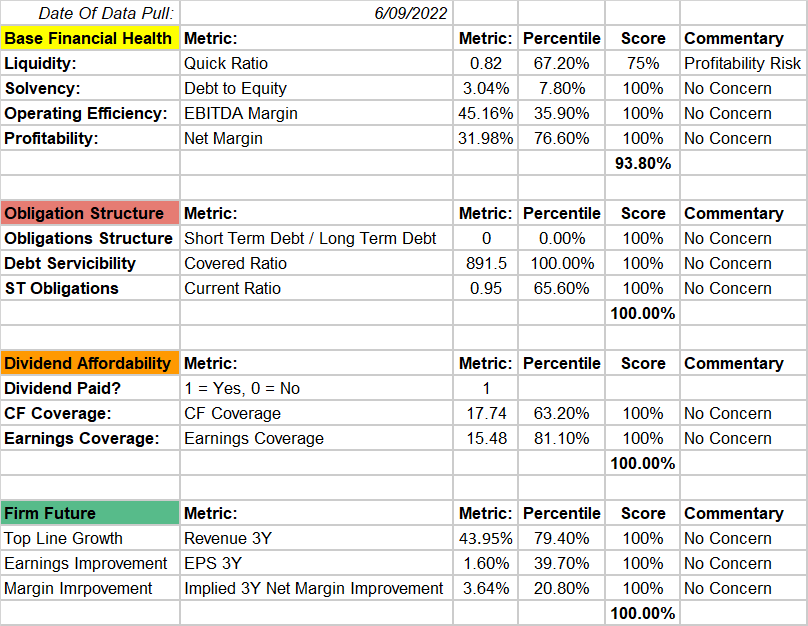

VAALCO Energy, Inc.’s Base Financial Health

We begin by diving into the base financial health metrics for EGY, considering how the firm has managed its balance sheet to date.

Here we see a fantastic picture of health for EGY. The only mark-down against the firm comes from a slightly poor quick ratio. However, this is a worst-case scenario acid-test, so investors should consider the energy sector’s outlook (specifically around oil and gas prices) before determining if the firm is likely to face a worst case scenario.

What follows is extremely low debt, very healthy margins, excellent obligations coverage and dividend coverage, and solid future outlooks, with strong top-line revenue growth prospects that will benefit from present-day margins.

Author, Seeking Alpha

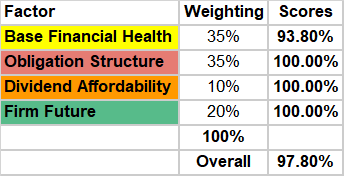

Weighting each of these scores and tallying the overall score, EGY earns an enviable overall financial health score of 97.8%

Author, Seeking Alpha

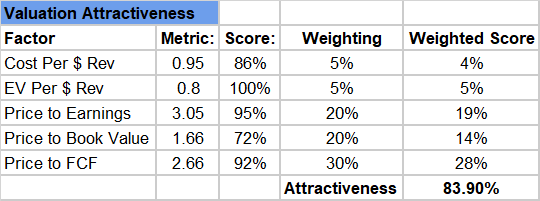

Assessing VAALCO Energy, Inc.’s Pricing Attractiveness

Here’s where things get particularly interesting for EGY. The firm boasts the lowest enterprise valuation to revenue metric in the top 65 firms peer group.

Further, it has a peer group lowest 5% P/E ratio and extremely attractive price to free cash flow.

Weighting these metrics gives us a very healthy 83.9% valuation attractiveness score, which should lead to some exciting numbers when we look at pricing mechanisms next.

Author, Seeking Alpha

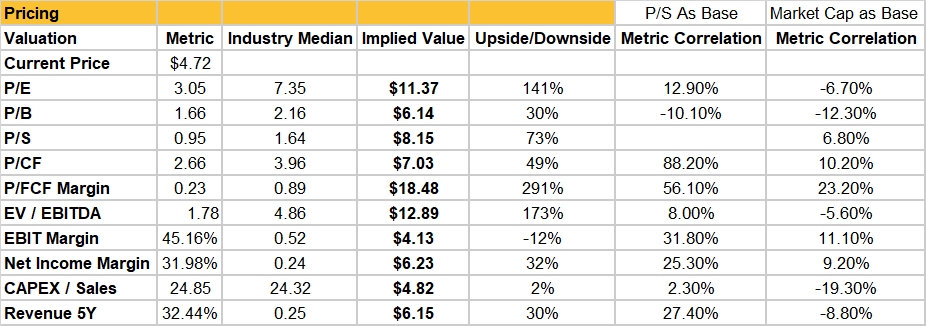

Finding An Appropriate Valuation Method For VAALCO Energy, Inc.

Early in the series, we did our homework on finding the metrics that best suited the oil and gas industry for comparison pricing. So, all that’s left to do now is eyeball the full list of normal and abnormal metrics and then focus on the most appropriate ones for the industry.

Author, Seeking Alpha

We already knew to expect big things from the firm thanks to our valuation attractiveness score earlier, and we have not been disappointed.

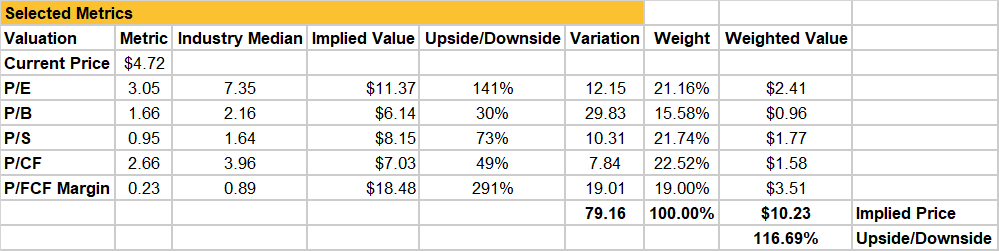

Thanks to a market-leading value P/E and P/FCF, EGY’s peer comparison lands us at an implied price target of $10.23, giving a potential upside risk of 116%.

Author, Seeking Alpha

Closing Remarks

As mentioned in the beginning, this peer analysis leads me to provide my strongest buy recommendation since beginning my coverage of the oil and gas industry, thanks to phenomenal financial health of the firm and extremely attractive peer comparison pricing.

With my own views around the likelihood of an impending Fed-driven recession, paired with the energy market’s historical outperformance in high-inflationary environments and geopolitical instability driving higher energy prices, I see a period of opportunity ahead for energy firms.

Author’s Note: The commentary in this article is general in nature and does not consider your personal circumstance. The opinions expressed in this article are opinions only, and data referenced is sourced from third party sources including Seeking Alpha and other publicly available sources.

I make no warranties or guarantees around any of the views expressed in this article and suggest all investors consider my writing to be for interest purposes only and not considered exhaustive investment research or advice.

Be the first to comment