AnthonyRosenberg

The key to investment success is not to try to hit a home run every time, but rather to hit singles and doubles, as Warren Buffett once noted. In other words, it’s hard to go wrong with a diversified basket of reliable dividend growers, especially when they are bought at material discounts.

This brings me to V.F. Corporation (NYSE:VFC), which I view as now trading well within bargain territory. In this article, I highlight why V.F. Corp is a buy for potentially strong long-term returns, so let’s get started.

Why VFC?

V.F. Corp. is a global leader in branded lifestyle apparel, footwear and accessories with 40,000 employees worldwide and annual sales of nearly $12 billion. VFC’s product offerings span multiple channels including retail, wholesale and e-commerce. The company’s portfolio of iconic lifestyle brands includes Vans, The North Face and Timberland, which combine to make 80% of its sales.

Current investors in VFC know that the stock has seen plenty of pain over the past year. As shown below, the stock has declined by 46% over the past 12 months, and it’s now trading even well below its pandemic low of $46 in March of 2020.

Based on this information alone, one would think that the sky is falling for VFC, but that’s simply not the case, as revenue was up 3% YoY (+7% in constant dollars). This was driven by The North Face, which saw 37% constant currency revenue growth in the first fiscal quarter 2023 (ended in July), partially offset by Vans being down by 4% constant currency.

While Vans’ performance was disappointing, it’s worth noting that this was due to weakness in China during the shutdowns there. Excluding China’s results, Vans’ sales were actually up by 4% YoY. Moreover, Timberland continues to demonstrate strong brand appeal with consumers, with sales growing by 14% constant currency.

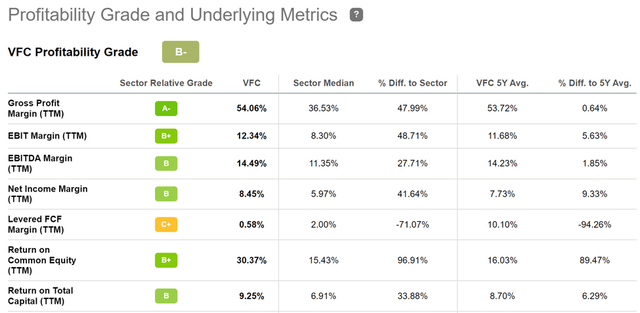

VFC also isn’t immune to cost pressures, as gross margin landed at 53.9%, 260 basis points lower than the prior year period. However, it VFC still enjoys premium pricing due to the strength of its brands. As shown below, VFC scores an A- grade compared to peers for its gross margins, a B+ for return on equity, and an overall B- profitability grade.

VFC Profitability (Seeking Alpha)

Looking ahead, I would expect for Vans’ performance to normalize towards growth, as short-term noise abates and as it continues its long-term upward trajectory. This is supported by VFC’s collaborations with top consumer tastes, which is resonating well with consumers, as noted during the recent conference call:

Vans is healthy, which is clearly evident when we launched truly innovative product as indicated with the recent global collaborations, all of which resonated with our consumers and generated high rates of sell-through.

We continue to see strong growth in our Vans Family membership, where members have higher frequency and rates of spend. Overall, we are encouraged with the early progress being made with actions underway and confident in long brands, long-term prospects to reignite growth.

Our Stranger Things collaboration was the second biggest customs launch since Harry Potter and the in-line product will launch in early September. We hosted pre-launch events for our new clinical business unit at Paris Fashion Week with top tier accounts including a sell-in event and a twitch live stream of the Brain Dead launch. The Joe Freshgoods Pinnacle Colabs sold through quickly with 3 times average sales price in resale market. A second drop is coming in holiday.

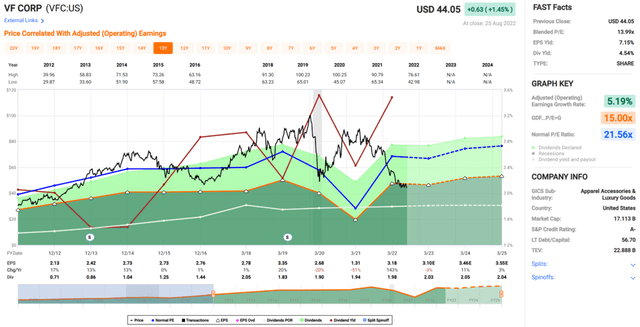

Meanwhile, VFC sports a strong A- rated balance sheet and has 48 years of consecutive annual dividend raises under its belt, putting it well on track to be a dividend king in 2 years. The yield is now 4.85%, and is well-supported by a 66% payout ratio. As shown below, VFC’s dividend yield has never been this high over the past 10 years.

At the current price of $41.16, VFC trades at a forward PE of 13.1, sitting well below its normal PE of 12.6 over the past 10 years. Analysts expect for annual EPS growth to resume in the 9% – 12% range starting in the next fiscal year and have an average price target of $52.84, equating to a potential one-year 33% total return including dividends

(Note: the following price is based on close price as of 8/25. The 8/26 close price is $41.16)

Investor Takeaway

Despite a challenging operating environment, V.F. Corporation remains a high-quality name in the retail sector. The North Face and Timberland continue to be strong growth drivers, while Vans should return to positive territory in the near future. Moreover, VFC’s dividend yield is at an all-time high in recent memory, making it an attractive income and growth investment over the long-term.

Be the first to comment