cagkansayin

Introduction

Despite ONEOK (NYSE:OKE) fighting to sustain their burdensomely large dividends during the severe downturn of 2020, thankfully 2021 saw surprisingly strong performance bringing about a new era for their dividends, as my previous article discussed. This raised hopes that their moderate dividend yield of 5.77% would see better sustainability going forwards, especially as the first half of 2022 saw the operating conditions within the energy sector surge to their best point in many years. Although upon digging into the moving parts of their earnings, the good and the bad of higher gas prices temper this view, as discussed within this follow-up analysis that also reviews their recently released results for the second quarter of 2022.

Executive Summary & Ratings

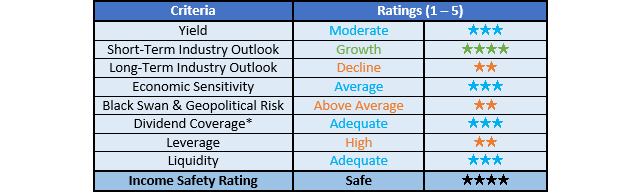

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

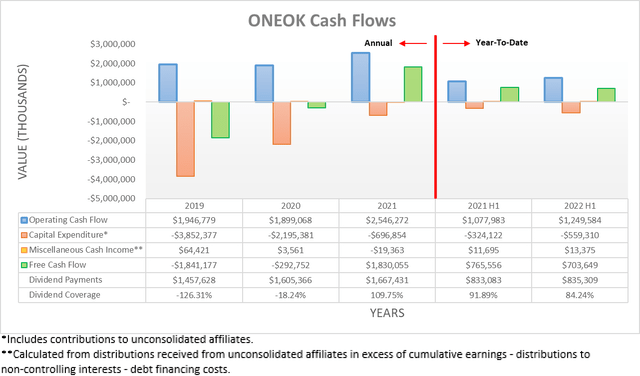

Following their cash flow performance enjoying a dramatic improvement during 2021, it was positive to see 2022 has not been a disappointment so far, as the first half saw their operating cash flow landing at $1.25b versus their previous result of $1.078b during the first half of 2021. This represents an impressive increase of 15.92% year-on-year, which is slightly more than twice the increase of 7.11% year-on-year that was expected when conducting the previous analysis, given their guidance for 2022 adjusted EBITDA, as per my previously linked article. Despite this impressive start to 2022, their dividend coverage was only a weak 84.24% during the first half and thus down versus their full-year 2021 adequate coverage of 109.75%, which my previous analysis hoped would bring about a new era for their dividends with better sustainability.

Thankfully this disappointment should only be temporary because they traditionally see more of their operating cash flow weighted towards the second half of the year. If looking back at 2021, they saw $1.078b of their operating cash flow in the first half, which amounted to only 42.34% of their full-year result of $2.546b. Whereas 2020 saw $736.4m during the first half, which was relatively even less at only 38.78% of their full-year result of $1.899b. Meanwhile, their capital expenditure was also another factor because the first half of 2022 saw $559.3m, which represents slightly more than half of even the upper end of their full-year guidance of $1.05b, as per my previously linked article. When combined, these indicate that the second half of 2022 should see higher operating cash flow than the first half, whilst also likely seeing less capital expenditure and thus as a result, their dividend coverage should improve back to an adequate 100%+ by the time the year ends.

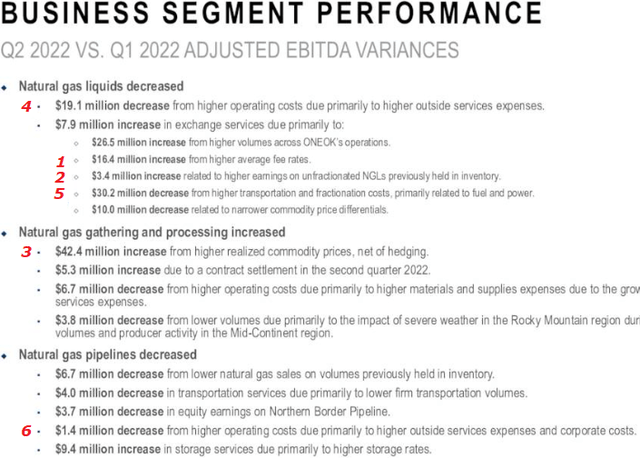

The first half of 2022 saw booming operating conditions across the energy sector on the back of the otherwise tragic Russia-Ukraine war, especially during the second quarter and thus raises the question of whether the second half could see their earnings accelerate even faster, especially with gas prices above $9mmbtu. Whilst these are certainly not hindering their financial performance, after digging into the moving parts within their earnings, it can be seen that higher gas prices are a double-edged sword, as the slide included below displays.

ONEOK Second Quarter Of 2022 Results Presentation

It can be seen that they saw a number of both positive and negative moving parts influence their earnings during the second quarter of 2022 versus the first quarter as gas prices climbed to levels not seen in many years. If aggregating the benefits of higher gas prices, it boosts their adjusted EBITDA by $62.2m, as per items 1, 2 and 3 on the slide included above. Meanwhile, there were also associated costs arising from these booming operating conditions that helped propel industry-wide inflation, which aggregated to $50.7m, as per items 4, 5 and 6 on the slide included above. After subtracting the latter group from the former, it brings down the net benefit of higher gas prices to only a mere $11.5m.

Whilst there were other factors at play that influenced their earnings, these are related to other operating factors outside of the scope of higher gas prices, which was the focus of this discussion. In my eyes, investors should not count on higher gas prices to provide a sizeable boost, especially since even the gross benefit before associated costs was still only relatively small given the size of their existing earnings base that sees adjusted EBITDA guidance for 2022 of $3.62b at the midpoint, as per slide twelve of their second quarter of 2022 results presentation.

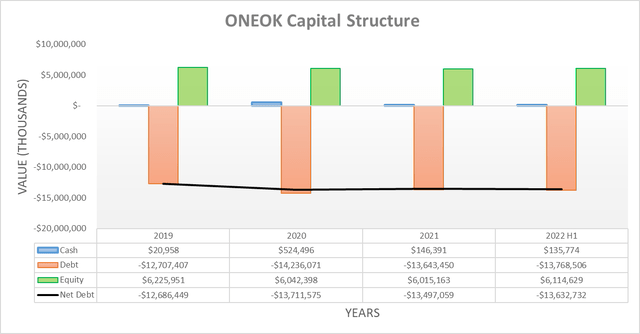

When conducting the previous analysis, it was hoped that 2022 would cement an end to their net debt consistently increasing every year but alas, the first half saw their net debt edge slightly higher to $13.633b versus its previous level of $13.497b at the end of 2021. If their operating cash flow picks up during the second half as expected, this minor increase should reverse and see the year ending with net debt back where it started or even slightly lower, although their temporary working capital movements may skew this result.

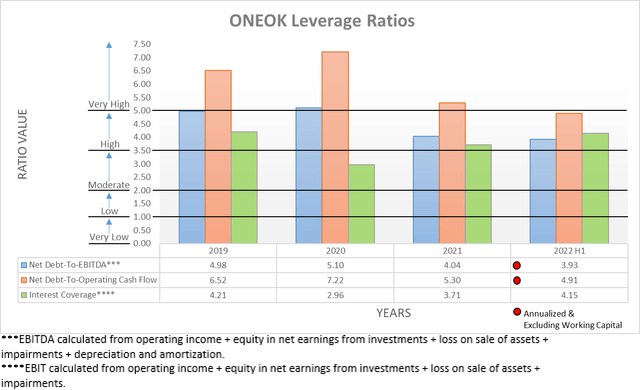

Despite their slightly higher net debt, their leverage still decreased following the first half of 2022 thanks to their stronger financial performance, as was expected when conducting the previous analysis. This now sees their respective net debt-to-EBITDA and net debt-to-operating cash flow down to 3.93 and 4.91 versus their previous respective results of 4.04 and 5.30 at the end of 2021. Whilst their net debt-to-EBITDA was already comfortably beneath the threshold of 5.01 for the very high territory by the end of 2021, the same could not have been said for their net debt-to-operating cash flow. Thankfully their latest result is now beneath this threshold and thus represents a modest improvement that helps strengthen their financial position with the second half of 2022 likely to see further small improvements as their net debt hopefully edges back lower.

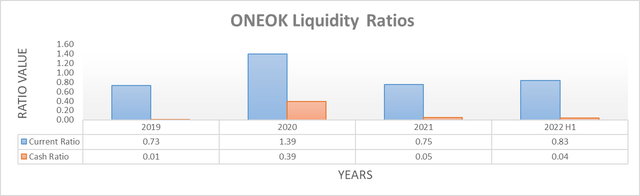

Apart from the modest improvement to their leverage, it was also positive to see a comparable improvement to their liquidity, as observed by their current ratio increasing to 0.83 following the first half of 2022 versus its previous result of 0.75 at the end of 2021. Even though their cash ratio is still low at only 0.04, their liquidity remains adequate because as one of the largest midstream companies they should retain access to debt markets as required for refinancing and so forth, even if central banks further tighten monetary policy.

Conclusion

The booming gas prices of 2022 created the best operating conditions for the energy sector in many years, although in this situation, they carry both good and bad implications for their financial performance, thereby netting out to an immaterial benefit. Thankfully their financial performance nevertheless enjoyed a strong with 2022, thereby helping improve their leverage and liquidity with the second half poised to see better dividend coverage. Whilst the future years may see slightly higher dividends, their only just adequate coverage leaves relatively minimal scope for growth and thus I once again believe that maintaining my hold rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from ONEOK’ SEC filings, all calculated figures were performed by the author.

Be the first to comment