oversnap/E+ via Getty Images

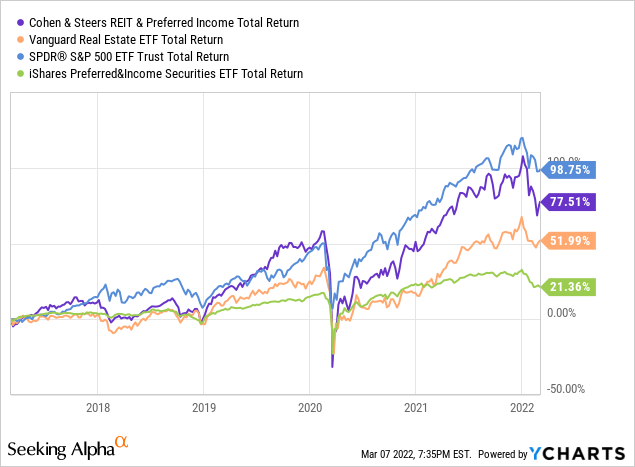

The Cohen & Steers REIT & Preferred & Income Fund (RNP) is a top performing closed end fund with a diversified and high quality portfolio REITs and preferred stocks. The fund outperformed the S&P 500 and its respective benchmark in 2021 through a combination of industry tailwinds and security selection on the part of management. The success culminated in a nearly 10% increase to the regular monthly distribution from $0.124 per share to $0.136 per share per month.

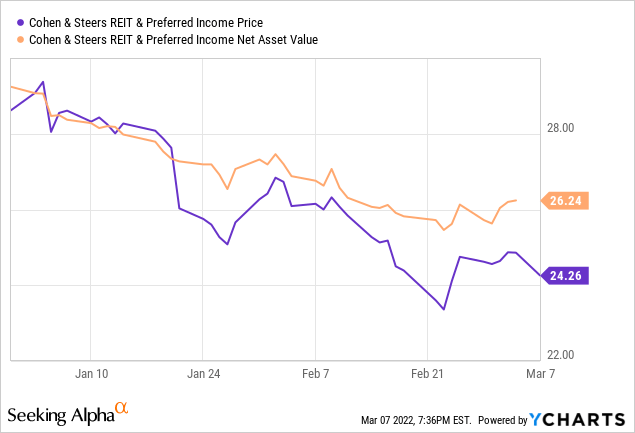

Despite ending the year on a strong note, RNP has struggled through the first quarter as investors take account of risk factors including rising interest rates and geopolitical turmoil. Over the past three months, RNP has declined in terms of both share price and net asset value. While NAV declines have been inevitable as the market broadly struggles through the first year, shareholders have exacerbated the losses by selling shares of RNP into a deep discount.

Today, we dive back into one of our all-star closed end funds and look at the year ahead.

Overview

RNP is one of our favorite closed end funds for a simple reason. It has operated in a unique niche for decades, generating impressive income with relative stability along the way. RNP is a closed end fund which operates a best in class portfolio of REITs and preferred stock. The fund is managed by Cohen & Steers (CNS), a New York based asset manager specializing in real assets and income solutions. CNS is unique in that it is one of few asset managers who emphasize listed real estate. The manager has applied this expertise well resulting in strong performance relative to its respective benchmarks and the market alike.

CNS

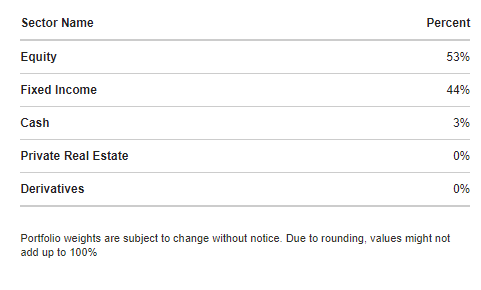

As we mentioned above, RNP’s portfolio is a blend of real estate investment trusts and preferreds stock providing a multi-cylinder income approach. These two sources bring diversification and a blend of income and growth opportunities. The fund is split roughly in half between REIT equity and preferred stock. Geographically, the fund is well diversified, mostly allocated to North America with small global allocations added more opportunistically.

CNS

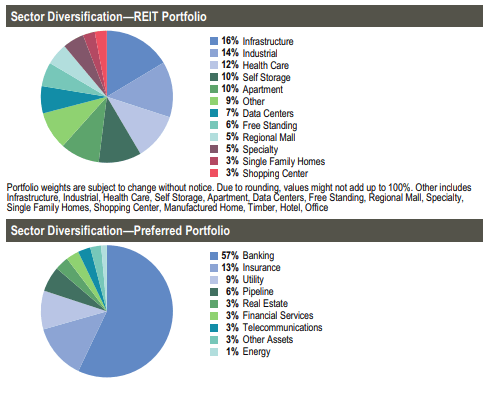

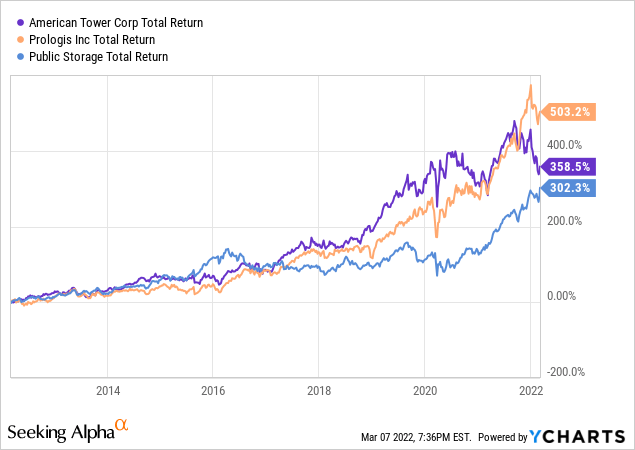

The real estate portion of the portfolio is dedicated to some of the highest quality landlords available on the public markets. The top positions are dominated by top tier operators including American Tower Corporation (AMT), Prologis, Inc., (PLD), and Public Storage (PSA). These three alone are some of the strongest players in their respective industries with long histories of outperformance. Without diving too far into RNP’s portfolio, the emphasis on quality in apparent in their strategy, avoiding smaller capitalization and higher yielding REITs.

The preferred portion of the fund is slightly smaller at an allocation of approximately 45%. The vast majority of the preferred portfolio is allocated to financials and insurance issuers. While the concentration may raise questions at first glance, there is a simple explanation. These industries are the dominant issuers of preferred shares, so a diversified approach can appear concentrated. Rest assured, the portfolio holds hundreds of different preferred positions which have historically provided an effective moat of diversification and dependable income for the fund.

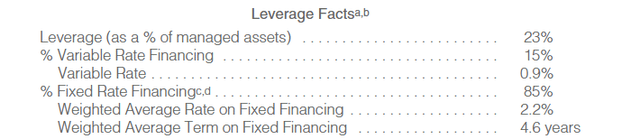

RNP employs leverage as a cornerstone of its strategy. Similar to the Cohen & Steers Quality Income Realty Fund (RQI) which purely focuses on REITs, RNP uses leverage to enhance returns for shareholders. RNP may use leverage up to 33.3% of its managed assets through borrowing or issuing debt securities. The concept is relatively simple, RNP borrows capital and deploys it at a higher rate of return, sending the spread to shareholders as excess return. However, facing rising rates, this cornerstone feature may soon prove problematic.

Performance Update & Valuation

As we mentioned in the introduction, RNP has struggled since the beginning of the year. Rising rates pose a risk to REITs and preferred shares as yield pressure begins to mount. Additionally, geopolitical risk has spread throughout the market as Russia’s invasion of Ukraine creates risks unseen in decades. All of these factors have converged, creating a storm that many shareholders were simply unable to weather. As the market became rocky, RNP shareholders fled causing share price declines to far exceed NAV declines

However, these risks come at the tail end of a wildly successful year and many of those fundamental strengths remain. In their annual report, CNS cited a variety of positive fundamentals which aided the real estate allocation throughout the year. These examples include progress in vaccine distribution, strong consumer spending related to reopening, and low borrowing costs which have continued to propel the hungry market. Specifically, the manager notes that Self Storage proved uncharacteristically resilient as nationwide moving activity propels pricing and demand. The movement has also fueled market rent growth for residential landlords across high quality markets. Interestingly, RNP’s management notes that its underweight allocation to these operators detracted from performance. Finally, management notes that the broad, sustained strength of industrial operators such as PLD and Duke Realty (DRE) continues to defy gravity.

On the other side of the portfolio, management notes that the preferred market remains strong. As is consistent with history, CNS has indicated that security selection is an important part of RNP’s strategy. With the market remaining strong and stable, the preferred portion continues to move at an expected pace for RNP.

All in all, the fundamentals of these two markets are still solid despite ongoing risks which are not directly related to the capital markets. With systemic risk factors flaring up, these two asset classes remain poised to capitalize on positive long term performance.

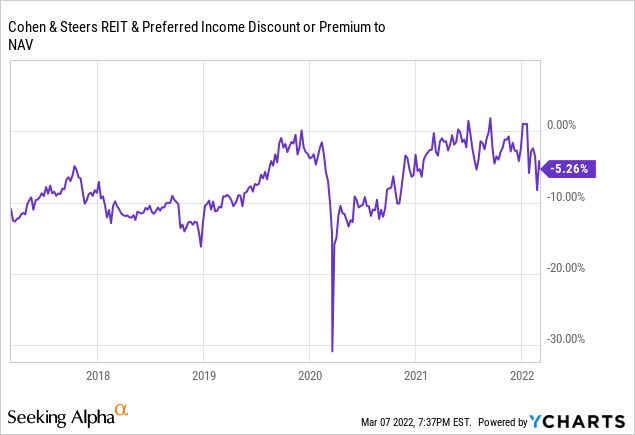

Today, RNP prices at a relatively steep discount to net asset value. For current shareholders, this has been painful as paper losses mounted quickly since the start of the year. However, for those with a long term lens, the declines open up an opportunity to further capitalize on the recent distribution increase.

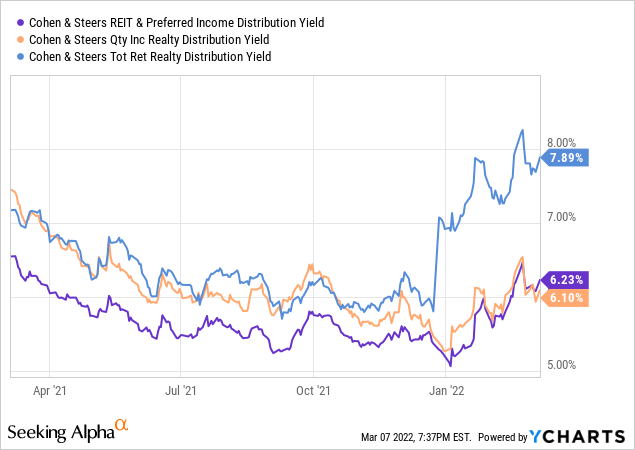

Considering the increase from the end of the year, RNP’s yield is attractive when compared to the past twelve months. Today, the fund offers a yield which is also the most attractive amongst its siblings as well.

Patience proves key when approaching funds such as RNP. As recently as two months ago, RNP traded at a premium to net asset value. With the discount now expanded, a purchase of shares at that price has a painful loss irrespective of declines in the underlying assets. This is a painful combination given RNP’s YTD performance.

The silver lining is the ability to play the opposite direction. Should the fund return to a neutral or premium valuation, as it has done opportunistically over its long history, newly purchased shares will enjoy a positive return relative to the market. If you have confidence in management and the fund, market risk can create significant opportunity in the form of yield, the benefits of which are apparent over long time horizons.

Risks

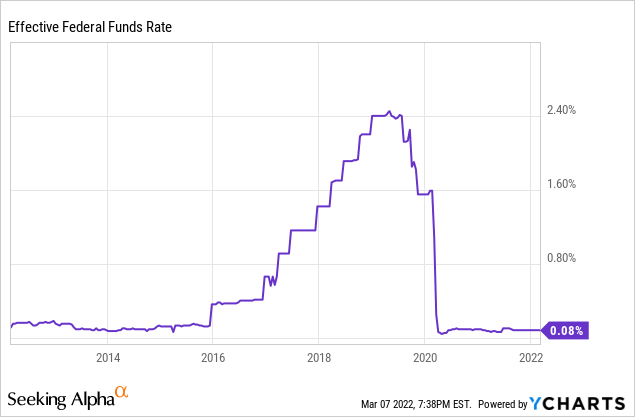

As we mentioned, RNP uses leverage to supercharge portfolio returns. Historically, leverage has been positive for the fund, contributing to solid performance over long time horizons. However, it’s important to take into account that the past decade has been extremely accommodative to leveraged investments. Whether fixed or floating rate, RNP’s leverage is inexorably tied to current interest rates or prevailing rates at the time of refinancing. Looking at the past decade, the federal funds rate has remained close to zero, save a brief and unsuccessful attempt to increase rates leading up to the pandemic.

Today, rates remain at rock bottom which means funds like RNP can borrow at low costs. Redeploying this capital means spreads are wide and leverage risk is significantly lower. As rates rise, it creates two sides of pressure for RNP. First, rates post a risk to the performance of REIT and preferred investments. As it pertains to REITs, rising rates will make internal financing more expensive and make comparative yields less attractive. Both of which apply pressure to earnings and ultimately share prices. Preferreds see similar pressure as their yields become comparatively less attractive when other fixed income assets begin to provide comparable yields.

With the Federal Reserve remaining unclear about the details of their interest rate strategy, it is difficult to assess these risks in the near term. The fed has consistently stated they intend raise rates multiple times in the coming years, but external risk factors such as commodity prices, geopolitics, and inflation will surely come into play.

Whenever the first bump in rates arrives, shareholders will surely be paying close attention. As it stands today, the fund is well prepared to face rising rates. RNP’s leverage is split between fixed (85%) and floating (15%) rate debt. Additionally, the fund has used instruments including interest rate swaps to account for these almost certain risk factors. According to the annual report, management has locked in interest rates on a significant portion of its leverage through 2027 meaning the fund is protection from near term rate increases.

With protection in place and an experienced management team, RNP is poised to take these challenges head on. Obviously, the risks are not completely avoidable, but management’s actions recognize that there is at least consideration of present risk factors.

Conclusion

RNP is an all-star closed end fund. Having operated for nearly two decades with an impressive history of level (even increasing) distributions, the fund has earned a spot as one of our favorites. Current turmoil has created short term pain as some investors flee, however the long term opportunity is attractive. Buying yield often comes at times when pessimism has blanketed the market. However, as history has repeatedly proven, being greedy when others are fearful can pay dividends.

Be the first to comment