DSCimage/iStock via Getty Images

Investing is always in a state of flux. From time to time, something that was just a mediocre prospect can turn into a stronger prospect. As an example, I would like to point to a company called Watsco (NYSE:WSO). This firm operates as a major player in the air conditioning, heating, and refrigeration equipment space. Though not the most exciting segment of the market, it does provide a good and service that is almost universally demanded. Previously, I had a rather mixed feeling about the company, believing its fundamental performance to be impressive but recognizing that shares were more or less fairly priced. Fast forward to today though, and the performance of the company has improved enough that I feel comfortable increasing my rating on the company from a ‘hold’ to a soft ‘buy’.

Heating up

Back in September of this year, I wrote an article that took a rather neutral stance on Watsco. I found myself impressed by the strong growth the company had on both its top and bottom lines. At the same time, however, I understood management’s own caution regarding the 2023 fiscal year and the uncertainty it would hold. After all, rising interest rates could have a negative impact on a business like this. Add on top of that the fact that shares of the company had looked more or less fairly valued, and I could not help but to rate it a ‘hold’ to reflect my view that shares should generate upside that would more or less match the broader market moving forward. Since then, the company has not exactly lived up to those expectations. While the S&P 500 is up 10.6%, shares of Watsco have generated upside of only 6.5%.

Looking at this return disparity, you might initially think that there is something wrong with the company’s financial performance. Rather, I think the issue has to do with the perception the market has of the future and the valuation that the company was already trading for at the time. From a purely fundamental perspective, things are going quite well. To see what I mean, we need only look at financial performance covering the third quarter of the firm’s 2022 fiscal year. This is the only quarter for which new data is available that was not available when I last wrote about it. During that time, sales came in at $2.04 billion. That’s 14.2% higher than the $1.78 billion the company generated the same time last year. Of the $253.2 million increase in revenue the company experienced during this time, only $2.1 million was attributable to new locations the company acquired, while $6.6 million was from other locations opened during the prior 12 months. The company was hit to the tune of $4 million from locations closed during that time as well. The real increase for the company then came from higher prices the business charged its customers. For instance, under the HVAC equipment category, the company saw a 14% rise in average selling price at a time when volume actually decreased by 1%.

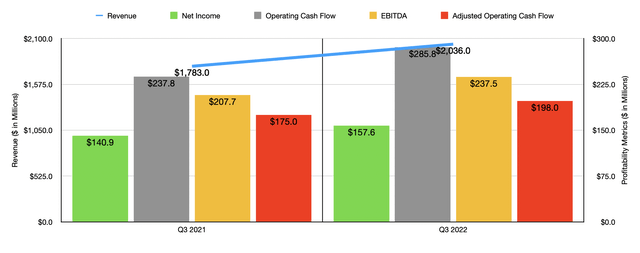

This rise in revenue brought with it improved profitability. Net income popped from $140.9 million to $157.6 million. Naturally, other profitability metrics followed the same trajectory. Operating cash flow, for instance, grew from $237.8 million to $285.8 million. If we adjust for changes in working capital, it would have risen from $175 million to $198 million. Also getting better year over year was EBITDA, with the metric climbing from $207.7 million to $237.5 million.

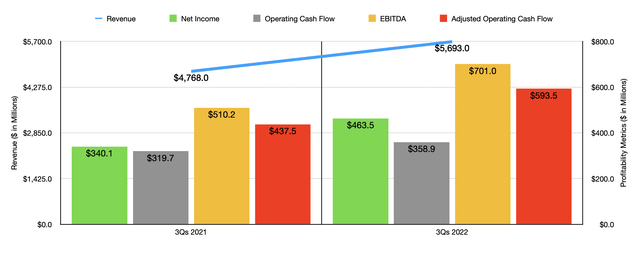

The performance the company saw during the third quarter was helpful in keeping results for the full 2022 fiscal year so far robust. As an example, revenue for the company grew from $4.77 billion in the first nine months of 2021 to $5.69 billion the same time this year. This brought with it increased profitability as well, with net income jumping from $340.1 million to $463.5 million. Over that same window of time, operating cash flow jumped from $319.7 million to $358.9 million, while the adjusted figure for this expanded from $437.5 million to $593.5 million. Another improvement came from EBITDA, with an increase from $510.2 million to $701 million.

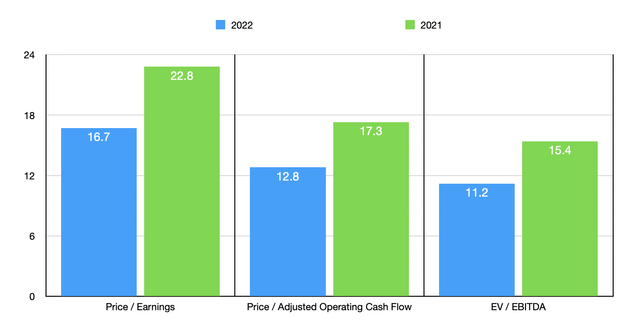

In the absence of guidance, the best thing that we can do for figuring out the current fiscal year is to annualize results experienced so far. This would give us net income for 2022 of $570.9 million, adjusted operating cash flow of $747.9 million, and EBITDA of $876 million. Based on these figures, the company is trading at a forward price-to-earnings multiple of 16.7. The forward price to adjusted operating cash flow multiple would be 12.8, while the forward EV to EBITDA multiple would be 11.2. By comparison, using the data from 2021, these multiples would be 22.8, 17.3, and 15.4, respectively. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 15.6 to a high of 93.7. Using the EV to EBITDA approach, the range was from 10.8 to 28.6. In both of these cases, only one of the five companies was cheaper than Watsco. Meanwhile, using the price to operating cash flow approach, the range was from 17.9 to 41.5. In this scenario, our prospect was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Watsco | 16.7 | 12.8 | 11.2 |

| Comfort Systems USA (FIX) | 20.0 | 19.7 | 15.8 |

| SPX Technologies (SPXC) | 93.7 | 41.5 | 28.6 |

| EMCOR Group (EME) | 20.7 | 17.9 | 11.4 |

| CSW Industrial (CSWI) | 23.6 | 25.9 | 14.1 |

| Carlisle Companies (CSL) | 15.6 | 18.9 | 10.8 |

When it comes to next year, management did say that, when it comes to HVAC equipment, minimum federal efficiency standards will increase, resulting in the sale of products that bring with them higher price points that should ultimately benefit the company’s results. In fact, in general, rhetoric and the company’s third-quarter conference call was rather upbeat, with the company saying that they don’t see anything significantly negative on the horizon.

Takeaway

Based on what data we have at our disposal, I must say that I continue to be impressed by the fundamental performance achieved by Watsco. Although not a deep-value prospect by any means, this is a high-quality operator with attractively priced shares. With a favorable outlook on the future as well, I do believe that further upside is warranted, leading me to increase my rating on the company from a ‘hold’ to a soft ‘buy’.

Be the first to comment