AnthonyRosenberg

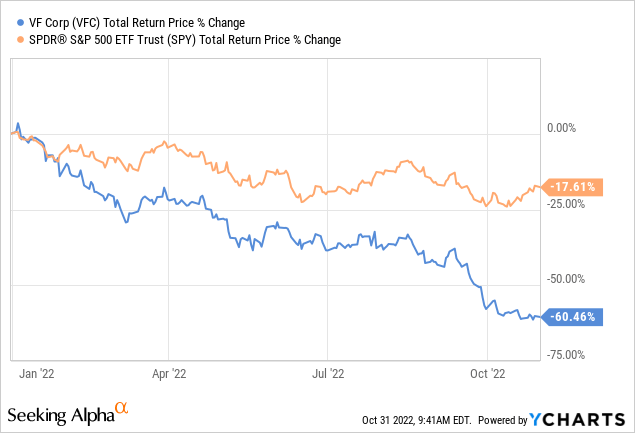

It is getting more difficult to buy into V.F. Corp’s (NYSE:VFC) message to investors that it is a growth company consisting of growth brands. While some of its brands are indeed continuing to post very attractive growth rates, such as The North Face, others are delivering extremely poor results, such as Vans and Dickies. So far investors are not impressed, with the company drastically under-performing the S&P 500 (SPY) year to date. In 2022 the company has managed to drop more than three times as much as the market. The natural question to ask is, does this mean that shares are cheap now despite the lackluster performance. As we’ll see, shares are indeed quite cheap now, but the risks have significantly increased, and earnings expectations are significantly lower now.

Starting with Q2 of fiscal year 2023, we see that the combination of performing and under-performing brands resulted in stagnant revenue growth. Revenue of $3.1 billion was -4% compared to the quarter the previous year, but up +2% in constant currency. Adjusted Gross Margin of 51.5% was -240bps lower than the previous year. Adjusted Operating Margin of 12.3% was a massive -440bps lower. All this led to an Adjusted Diluted EPS of only $0.73, -34% compared to the quarter the previous year, -27% in constant currency. When earnings are coming in 34% lower than the previous year, it is no surprise the share price has suffered and under-performed the market. For the whole year the EPS range is now anticipated to be $2.40 to $2.50 relative to $3.18 last year.

Brand Performance

Vans sales in the second quarter were lower, primarily as a result of a disappointing back-to-school season in the Americas. Q2 sales were down 8%, bringing year-to-date revenue to minus 6%. This performance is deeply concerning, especially when Vans is arguably the most important brand for the company, accounting for 35% of revenue. Traffic to stores and digital platforms continues to be below historic levels. North Face delivered strong with revenue up 14% versus last year, reflecting double-digit growth across all regions and channels, and leading to the biggest second quarter ever for the brand, bringing the year-to-date growth to 21%. For Timberland Q2 sales growth was up 3% versus last year and sales for the first half were up 7% versus last year. Dickies was another big disappointment, with global revenue down 15% in Q2, and 14% in the first half. Finally, recent acquisition of Supreme was another bright spot, with the brand growing revenue by 7%. If it wasn’t for Vans’ horrible performance, we would be a lot more optimistic about V.F. Corp, but at this point the turnaround of this brand has become critical for the stock’s recovery. To make things worse, elevated inventories have led to widespread discounting. The company believes that with new products and other initiatives it can returns Vans to mid-single-digit growth in the long-term, but we do not think turning around the brand will be easy. On the positive side, we believe growth in The North Face can continue to make up for further declines from Vans, overall resulting in moderate but positive growth.

Financials

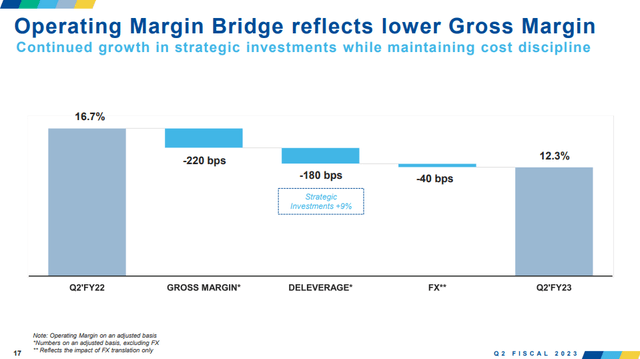

A combination of lower gross margins, resulting from a number of factors including supply-chain issues and input cost inflation, as well as deleveraging and foreign exchange impacts brought down the operating margin significantly. At this point it does not look like these issues will be resolved any time soon, so investors should expect earnings to suffer for the foreseeable future.

V.F. Corp. Investor Presentation

Growth

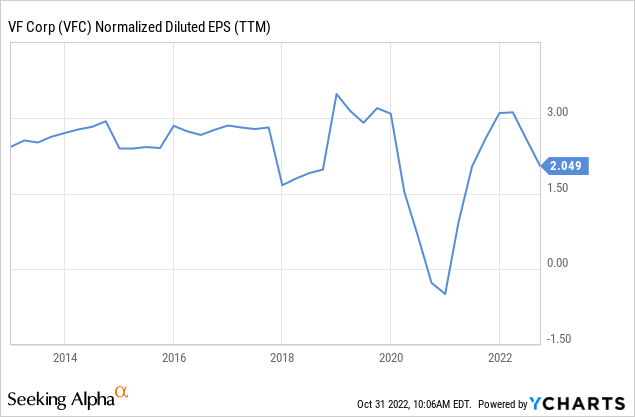

With revenue stagnating and profit margins declining, earnings per share have suffered. The trailing twelve months normalized diluted EPS has gone from more than $3 per share, to around $2 currently. One thing that is clear is that the stable of “growth brands” that V.F. Corporation owns has so far failed to result in very significant earnings growth for the company.

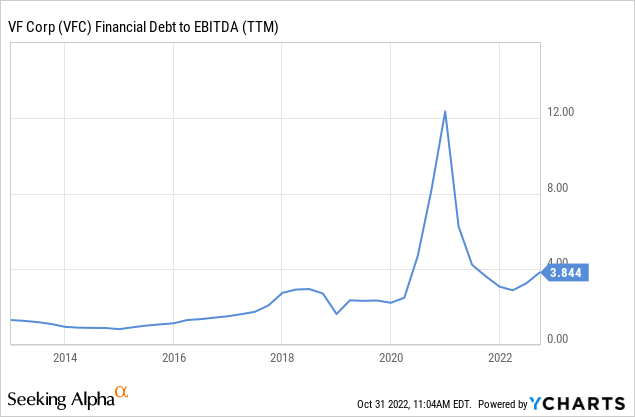

Balance Sheet

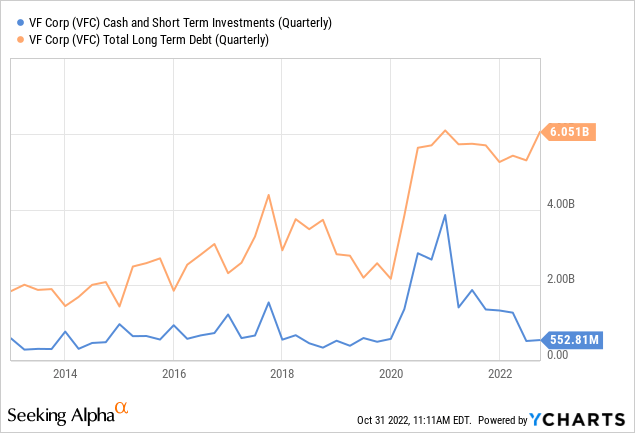

Inventories were up 88% compared with the same period last year as VF modified terms with the majority of its suppliers in the first quarter of fiscal 2023 to take ownership of inventory at point of shipment rather than destination. Gross debt remains very significant at ~$6 billion, with cash and short-term investments declining to ~$552 million.

This reduction in liquidity, combined with higher debt levels, mean the company has less flexibility to make the necessary investments to course correct the business, or to add new acquisitions to reignite growth.

Guidance

V.F. Corp maintained its fiscal 2023 constant-currency revenue growth range of 5%-6% and it lowered guidance for adjusted gross margin and adjusted operating margin (to 11% from 12%). The new adjusted EPS range was reduced to $2.40-$2.50 from $2.60-$2.70.

Valuation

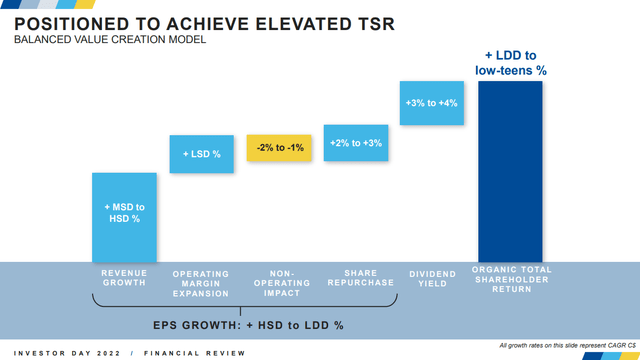

The company has been making the case that it can deliver very significant total shareholder returns, as can be seen in one of its slides from its recent investor day. While we see the valuation as relatively low, we are not convinced that it can both deliver revenue growth in the mid to high single digits while expanding its operating margin. For that to happen a lot of things have to go right, and so far, things have been getting worse.

V.F. Corp. Investor Presentation

Our base case is that the company continues to muddle along, with some brands performing well, and some others, such as Vans, continuing to underperform. Under that scenario revenue growth would be closer to low- to mid-single digits growth, and there would be relatively little operating margin expansion. Still, even under that less optimistic scenario we can still see decent returns for investors. Especially with a dividend yield that is already at ~7%, it doesn’t take much growth to move potential returns to the double digits.

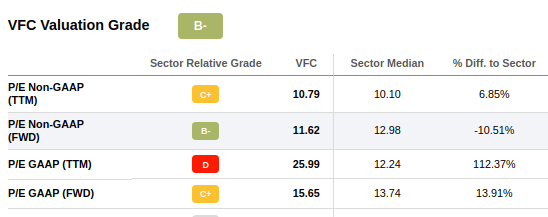

Because earnings have been declining, despite the much lower share price, the valuation is still not a screaming bargain. We agree with Seeking Alpha’s ‘B-‘ valuation grade, with a forward GAAP price/earnings ratio of ~15x, and Non-GAAP P/E of ~11.6x, shares look relatively attractive.

Seeking Alpha

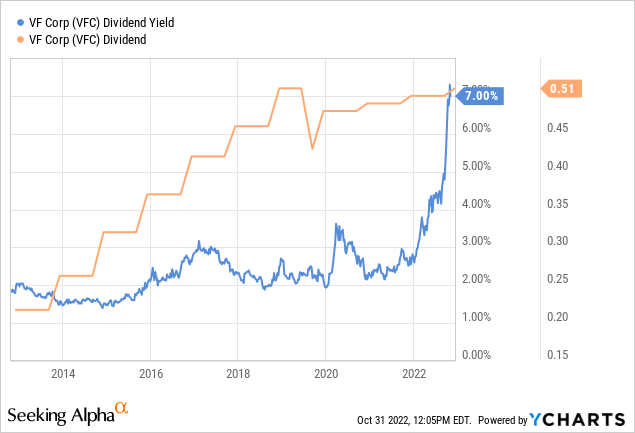

What is attracting a lot of investors to the company is the very high dividend yield of ~7%. Which is particularly impressive given that the company is a dividend aristocrat, having paid uninterrupted dividend for decades. Unfortunately the dividend is not looking that well covered, with a trailing twelve months normalized diluted EPS of ~$2, it means the company is paying basically all its profits as dividends at the moment. Should earnings decline further a dividend cut would probably be necessary.

Risks

We have two big concerns with V.F. Corp that go beyond the temporary headwinds of supply chain issues and input cost inflation. One is the weakening balance sheet at a time when profitability is also declining. The second one is the decline of the Vans brand. We have seen that brands that enter a decline cycle often see the deterioration accelerate. Mid-single digit declines could easily turn into double digit declines, and that could result in overall negative revenue growth for the company.

Conclusion

We believe shares are cheap enough to warrant investor’s attention at the moment. The big concern we have is the health of the Vans brand, and whether it will enter a cycle of further deterioration. If the company manages to deliver anything close to what they are guiding to in terms of revenue growth for the next few years, then investors are likely to enjoy very healthy total shareholder returns. Just keep an eye on the health of the brands, in particular the Vans brand. Same with the dividend, it is quite attractive, but the risk of a cut is not negligible.

Be the first to comment