Drew Angerer/Getty Images News

LNG shipping in the world

The UP World LNG Shipping Index, the world’s only stock index focused on LNG shipping companies, gained 6.62% last week. U.S. stocks represented by the S&P 500 Index (SPX) gained 1.79%. UP Index consists of 17 global LNG shippers.

Last week was mega-successful for U.S.-listed LNG companies. The biggest gainer is Höegh LNG Partners LP (HMLP), which jump up 35%. No new information about general partner redemption was published.

FLEX LNG Ltd. (FLNG) added nearly 30% to its price, GasLog Partners LP (GLOP) rose by 25%. New Fortress Energy (NFE) gained over 20%, and Golar LNG Ltd. (GLNG) gained 16%. Dynagas LNG Partners LP (DLNG) followed a nearly 15% gain.

These vast gains were caused by the deal of 15 billion m3 of LNG for Europe announced by U.S. President Joe Biden.

In Europe, Awilco LNG ASA (OTCPK:AWLNF) or (OSE: ALNG) followed a 13% gain. Shell (SHEL), BP (BP), and Belgian Exmar NV (BSE: EXM) added 8%.

On the other hand, the Japanese trio Nippon Yusen Kabushiki Kaisha (OTCPK:NPNYY) or (TSE: 9101), Mitsui O.S.K. Lines (OTCPK:MSLOY) or (TSE: 9104) and Kabushiki Kisen Kaisha (TSE: 9107) lost between 10 and nearly 12%.

Russian aggression against Ukraine is changing the geopolitical situation, and LNG is finally a trusted energy source. A lot of new money comes to this rising but volatile sector.

Overview

The LNG shipping sector had a tough time when some shipping companies decreased their dividends. Time changed when the U.S. started the second phase of the LNG revolution, but only investors ignored this change as the LNG flew mainly to Asia. It was the Russian invasion of Ukraine that changed this point. Now Europe found that Russia is not a safe supplier of oil and gas and changed its energy policy toward LNG.

LNG is transported via LNG tankers – the midstream. Also, both liquefaction and regasification terminals can be set on a vessel – these are FLNG (Floating liquefication natural gas vessel) and FSRU (floating storage and regasification unit). One, two, or all three types of vessels are in fleets of these U.S. listed companies I write about. The UP World LNG Shipping Index now consists of 17 global listed companies. This article focuses only on the U.S. listed and pure LNG shipping companies, in alphabetical order.

A quick review of U.S. listed LNG shippers

On Friday, 25th March, a lot of money flew into U.S.-listed LNG shipping companies and partnerships. A huge percentage of it might be money from new investors that do not follow the LNG market for a long time.

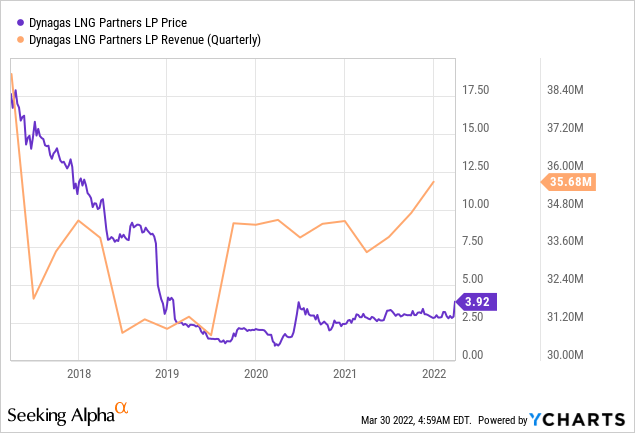

Dynagas LNG Partners LP

Ticker: (DLNG), (DLNG.PA), (DLNG.PB)

Legal entity: MLP

General Partner: Dynagas Ltd.

Domicile: Greece

Number of vessels: 6 LNG carriers with Ice class 1A classification

Type of contracts: Time charters, no spot now

Exposed to Russia: Yes

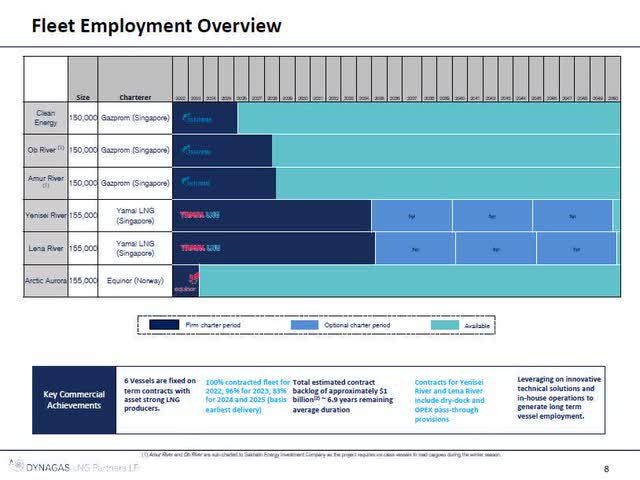

Dynagas fleet and charters (DLNG Q4-21 presentation)

Dynagas was the first company that reduced its distribution (“dividend”) to unitholders. Investors punished it with a price fall from $17 to $3.

Now its management focuses on debt payments and increasing the value of units. Till 2024 the company will not pay any distribution.

My opinion: Good company with a short-term risk due to its exposition to the Russian LNG business. Its vessels mostly śail to Asia. If the sanctions force Dynagas to terminate the contracts, it should have only a minor concern for new ones. No distribution payment till 2024.

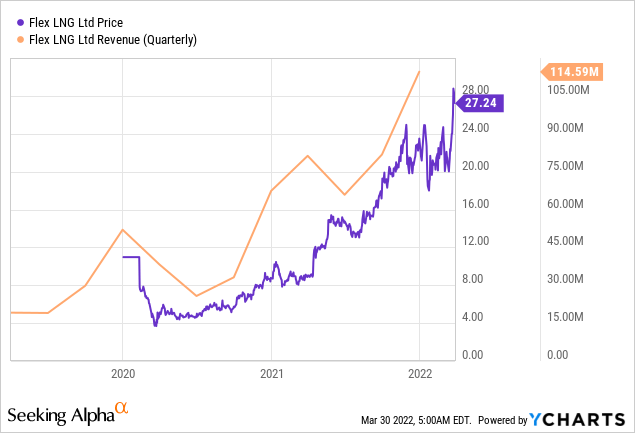

FLEX LNG Ltd.

Ticker: (FLNG)

Legal entity: Company

Domicile: Norway

Number of vessels: 12 LNG carriers

Type of contracts: Time charters with fixed and variable hire

Exposed to Russia: No

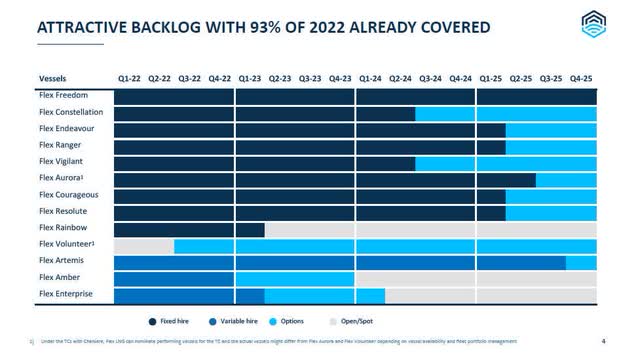

FLNG fleet and charters (FLNG Q4-21 presentation)

Dual-listed company in Oslo and New York. It has a very modern fleet with ME-GI engines with low boil-off. They fixed their vessels at a reasonable price.

My opinion: Well-managed company that holds very informative earning calls. It pays $0.75 per quarter now, which might be less in the second quarter.

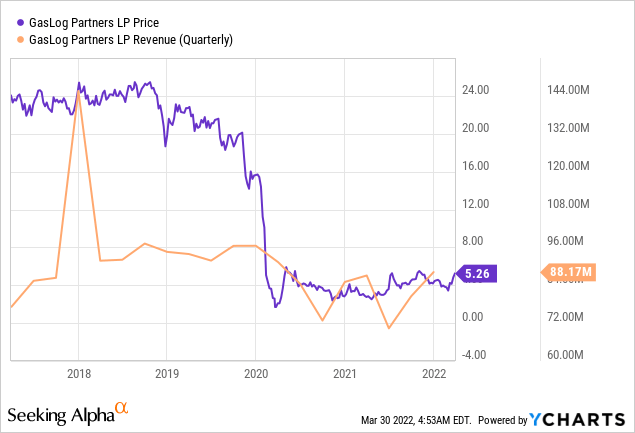

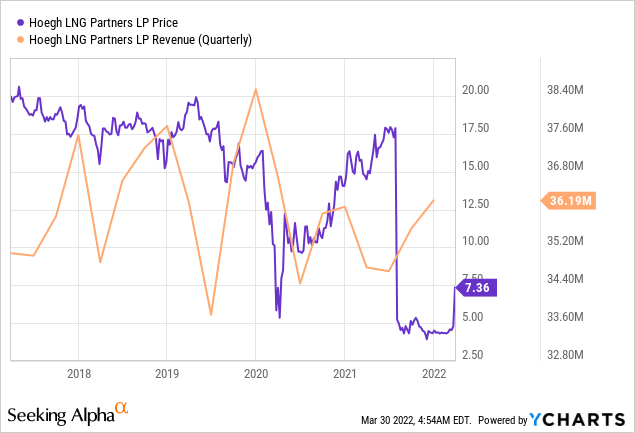

GasLog Partners LP

Ticker: (GLOP)

Legal entity: MLP

General Partner: GasLog Ltd. (ex-GLOG)

Domicile: Greece

Number of vessels: 15 LNG carriers

Type of contracts: Time charters, no spot now

Exposed to Russia: No

GLOP fleet and charters (GLOP Q4-21 presentation)

Partnership with many vessels, but five of them are with a steam engine. Charter rates are usually much lower for such a vessel, and even IMO and EU regulations will push them to scrap yard in the future. At least their speed will be limited, which will increase costs. Russian invasion might prolong their steam business.

My opinion: The steam vessel still brings some cash but has to be solved shortly.

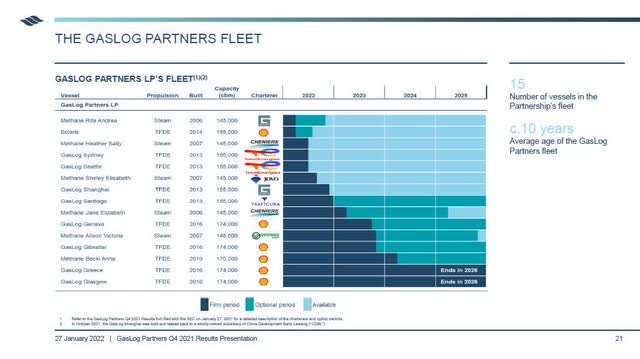

Golar LNG Limited

Ticker: (GLNG)

Legal entity: Company

Domicile: Norway

Number of vessels: 1+1 FLNG, 1 FSRU, 1 LNG carrier (for conversion probably)

Type of contracts: Time charters, no spot now

Exposed to Russia: No

GLNG fleet (GLNG Q4-21 presentation)

Tech revolution company. This company was the first that re-build an old LNG carrier to the FSRU and even to FLNG (Hilli Episeyo). At the beginning of this year, they moved all eight TFDE LNG carriers to a new Coolco listed in Oslo (OSE: COOL) and kept only FSRU and FLNG business. GLNG also sold their MLP Golar LNG Partners LP (ex-GMLP) to New Fortress Energy (NFE). Unitholders were squeezed out. NFE now operates the ex-GMLP LNG carriers, but its LNG business is much broader; it is not a pure LNG midstream player. Golar Limited keeps stakes in New Fortress Energy, Avenir LNG (a small-scale LNG supplier), and Coolco.

My opinion: Focus on FLNG looks excellent, but all the changes are too new to review.

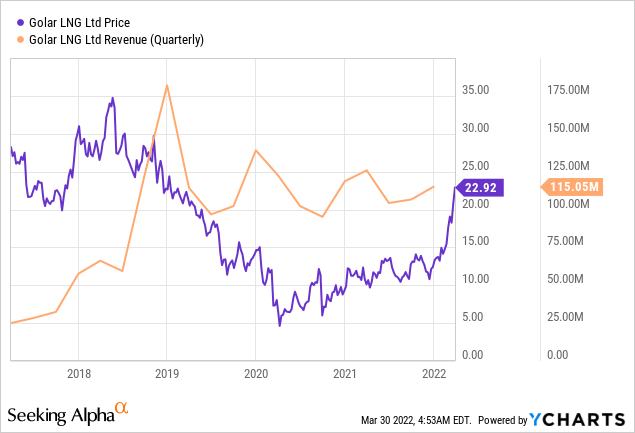

Höegh LNG Partners LP

Ticker: (HMLP)

Legal entity: MLP

General Partner: Höegh LNG Ltd. (ex-HLNG)

Domicile: Norway

Number of vessels: 5 (2 FSRU/LNG carriers, 3 FSRU)

Type of contracts: Time charters, no spot now

Exposed to Russia: No

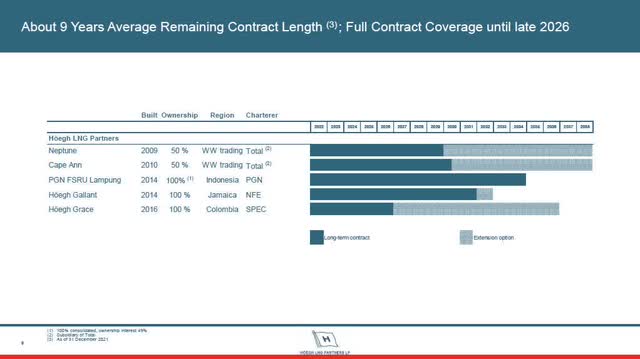

HMLP fleet and charters (HMLP Q4-21 presentation)

My opinion: FSRU specialist, its problem with the charterer of PGN FSRU Lampung pushed the units price down. Later the GP announced a repurchase of shares for $4.25. At the time of this announcement, the price was below this level. The big question is if the GP will offer a better price. This is why I consider this MLP as only a speculative opportunity.

Conclusion

LNG shipping is finally a respectable sector that can make money for investors. After the first investment wave in 2015, when many MLPs were formed, this sector is much stronger and can be considered developed. Investors should also look back to history and remember this great and rising sector is cyclical, and safe and robust cash flow is still valuable.

Be the first to comment