AnthonyRosenberg

Years ago, a journalist asked Warren Buffett why he doesn’t invest in physical real estate. He replied that first off, real estate wasn’t his wheelhouse, and investing out of one’s core competency is a recipe for trouble. Another reason he provided was that unlike stocks, real estate was almost always accurately priced, leaving little upside for bargain seekers like him.

I agree with his comments, as mispricing in the stock market happens all the time. If you don’t believe this, then just look at pharmaceutical stocks, like Merck (MRK), Gilead Sciences (GILD), Bristol-Myers Squibb (BMY), and Amgen (AMGN), which have all rebounded significantly in recent months.

This brings me to V.F. Corp (NYSE:VFC), which remains cheaply valued from a historical standpoint, while paying a high dividend yield. This article highlights why VFC is a long-term value and income buy for the long-run.

Why VFC?

V.F. Corp. is a global leader in branded lifestyle apparel, footwear and accessories with 40,000 employees worldwide and annual sales of nearly $12 billion. VFC’s product offerings span multiple channels including retail, wholesale and e-commerce. The company’s portfolio of iconic lifestyle brands includes Vans, The North Face and Timberland, which combine to make 80% of its sales.

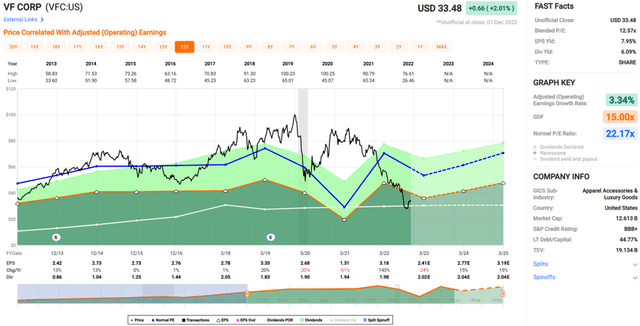

It’s no secret that VFC is very cheap from a technical standpoint. As shown below, the stock is now trading at less than half its 52-week high of $78, and remains well below its pandemic low of $46 during March of 2020.

Of course, a stock doesn’t get this cheap without some headwinds. This includes supply chain disruptions over the past year, and more recently COVID lockdowns in China, which has hampered consumer demand in that country. Like many retailers, VFC misjudged demand, resulting in heighted inventory levels, resulting in markdowns, which negatively impacted gross margin by 240 basis points YoY during its fiscal second quarter (ended in October). It’s worth noting, however, that VFC’s premium brands still command an industry-leading gross margin that sits well ahead of the 36% sector median.

Moreover, Vans has shown weakness after years of unfettered growth, with sales declining by 8% YoY on a constant currency basis during the fiscal second quarter (ended in October). However, this was more than offset by strength in The North Face, which saw 14% YoY sales growth, resulting in total revenue being up by 2% constant currency. It’s worth noting that like all U.S. global companies, VFC is facing currency headwinds from a strong dollar, which resulted in a 4% total sales decline including currency effects.

I don’t believe currency effects should be a long-term concern, as this should normalize over time. Also, there are positive signs emerging from China, as recent protest there have led to signals from the government that strict COVID policies may begin to ease. Importantly, The North Face is an innovation leader, with eight products highlighted by Outdoor magazine as being must haves this year, and its FUTURELIGHT Boot received the Editor’s Choice Award.

Moreover, VFC’s management has a strong track record of brand management, including the initial turnaround of the fledgling Vans brand when it was bought out by VFC in 2004. The CEO highlighted the company’s renewed focus on Vans during the recent conference call:

We have a deep and broad bench of strong talent at VF, and are now strategically deploying this into the Vans business. We recently made two important appointments adding a new position of Chief Product and Merchandising Officer and bringing a key leader from North Face to head up digital.

In terms of Vans product, innovation in the progression footwear line, which today represents 25% of brand sales, continues to drive an uptick in demand with the new UltraRange EXO, MTE Hi showing strong initial sell-through. As you heard from Kevin Bailey at the Investor Day, it will take some time for the product facing initiatives to be introduced. And when they come, we are confident that they will have a positive impact on the brand’s results.

Meanwhile, VFC maintains a strong BBB+ rated balance sheet, and has 48 consecutive years of annual dividend raises. The dividend remains covered at an 83% payout ratio, based on full-year adjusted EPS guidance for $2.45 at the midpoint. While this doesn’t seem very exciting in the near term, management does plan on raising EPS in the low to mid teens annually through 2027 to $5 per share to be driven in part by a step up in share repurchases.

Turning to valuation, VFC remains cheap at its current price of $33.48 with a blended PE of 12.6, sitting well below its normal PE of 22.2 over the past decade. I would expect for VFC to carry a PE of at least 15, considering its strong brands, track record, and analyst estimates for 13 to 15% annual EPS growth over the next two years.

Investor Takeaway

The market appears to be overly rotated on VFC’s near-term headwinds, and I believe the stock is an attractive long-term buy at these levels. The dividend being well covered by EPS provides an additional buffer in the event of a prolonged recession, and there are positive signs emerging that could lead to a turnaround next year. Given VFC’s strong brands, track record of innovation, and current valuation levels, I believe it is an attractive option for long-term value and dividend growth investors.

Be the first to comment