Co-produced with “Hidden Opportunities.”

Ilija Erceg/iStock via Getty Images

Introduction

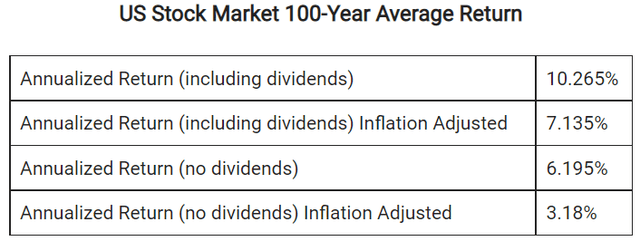

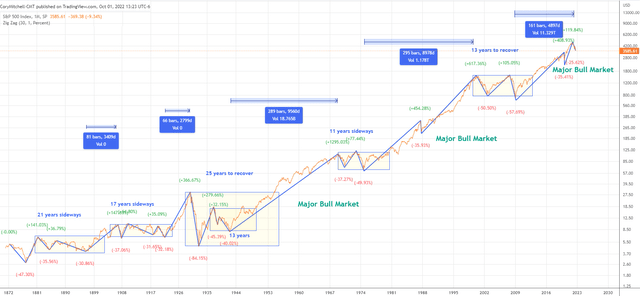

The stock market has the potential to provide strong returns in the long run. Looking at historical performance, a full equity portfolio would have returned more than 10% per year from 1922 to 2022. (Source.)

While looking at investing with a long-term lens is good, most investors need to utilize their portfolio returns from time to time to fuel their living expenses. This could be during retirement or during that sabbatical you always wanted to take from work. During these pursuits, a short-term market sell-off can be pretty painful since you are not earning a paycheck but are withdrawing money from your savings. You will be selling more shares at poor prices in a bear market. Weak portfolio performance and cash outflows can be a double whammy in the financial life of the average investor.

While bear markets are generally short-lived, stocks still take years to recover to their former highs. Investors must also be prepared for years of sideways trading. A well-diversified income portfolio is built to withstand these “temporary” phenomena. We don’t count on selling shares to fuel our expenses but work to transform our portfolio into a cash-producing machine. This machine runs as intended during bull and bear markets. While the value of this machine may drop during a market sell-off, remember that I have no intention of selling it. My portfolio generates more than my requirements and is well-positioned to beat inflation’s long-term effects.

I am protecting my income with preferred securities. These come with better shareholder protections than equities, and their discounted prices let me lock in bigger yields for the foreseeable future. This report will discuss two picks with up to 8.3% yields.

Pick #1: HT Preferred, Yield 8.3%

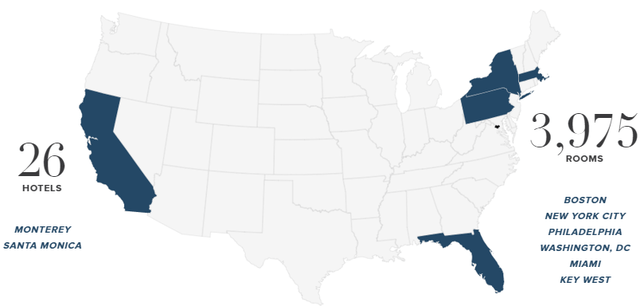

Hersha Hospitality Trust (HT) owns and operates 26 high-quality, luxury & lifestyle hotels situated in high-barrier-to-entry urban gateway markets and resort destinations. HT’s hotel portfolio includes leading brands like Marriott International (MAR), Hilton Hotels (HIL), Hyatt Hotels (H), and Intercontinental Hotel Group (IHG), along with Hersha’s independent hotel collection.

November 2022 Investor Presentation

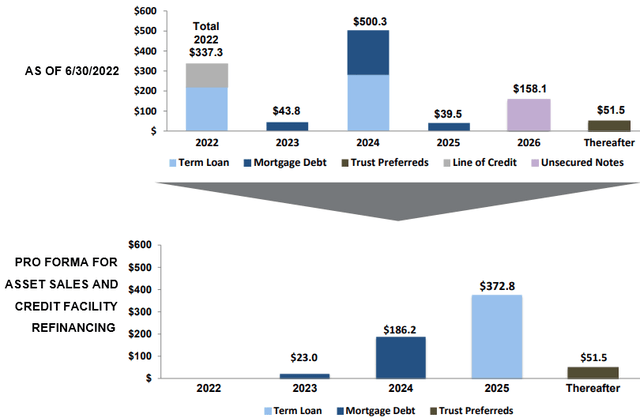

HT announced the sale of several properties at attractive valuations during Q2 and is using the proceeds to pay off high-interest debt and reduce its interest expense by $20 million. Additionally, the Q3 weighted average interest expense dropped to 4.34% (from 4.68% before refinancing). Looking at HT’s pro forma debt maturity schedule, we see no term loan maturities until 2025. (Source: November 2022 Investor Presentation.)

November 2022 Investor Presentation

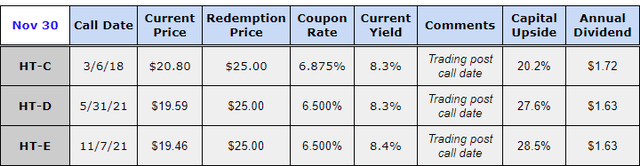

As a company, HT has demonstrated a fantastic turnaround from its crippled operations due to COVID-related travel restrictions. The preferred securities have well-covered dividends and trade at deep discounts, with up to ~28% capital upside upon redemption. All three of HT’s preferreds are trading post-call dates with similar coupons. This means you can invest in whichever preferred has the higher yield, which will change as prices move.

YTD, HT spent $39 million on interest expenses and $18 million on preferred dividends. These are adequately covered by the company’s operations, leaving $95 million in net income attributable to common shareholders.

HT completed Q3 with a 31% EBITDA margin. Moreover, the REIT demonstrated double-digit Average Daily Rate (“ADR”) growth vs. 2019 in every market while continuing to improve occupancy percentage throughout the year. We expect these metrics to enhance through the holiday season as more people are eager to travel this year vs. 2021, where the Omicron variant marred travel plans for many.

November 2022 Investor Presentation

HT projects a Q4 EBITDA margin of 33-34%, representing a 2-3% growth compared to 2019. This means that despite 40-year high inflation levels, HT is more profitable than in its pre-COVID days.

As a result of sustained profitability, after a 2.5-year hiatus, HT restored a common dividend of $0.05. The restoration of the common dividend provides additional safety to the cumulative preferreds. With HT, we have a management team whose interests are closely aligned with those of the shareholders. Insiders own ~18% of the REIT’s common stock, preferred securities, and restricted shares.

November 2022 Investor Presentation

In HT, we have high-yielding, deeply-discounted preferreds from a company with a shareholder-friendly management team. 8.3% yields and up to 28% upside for your patience from this REIT with a high-quality portfolio of luxury properties in popular tourist destinations.

Pick #2: AEL-B, Yield 6.9%

American Equity Investment Life Holding Company (AEL) specializes in selling fixed-index and fixed-rate annuities. Thanks to this rising rate environment, annuity sales are at all-time high levels, and investors are rushing to secure their retirement income. AEL business fundamentals are at their strongest, and the company reported a massive 112% YoY increase in Q3 net income. The company is aggressively buying back common stock, with 4.2 million shares purchased for $154 million in the third quarter. AEL has spent $522 million towards repurchases, making it almost 1/6th of its market cap. This year, J.D. Power has ranked AEL #1 for Customer Satisfaction among Annuity Providers.

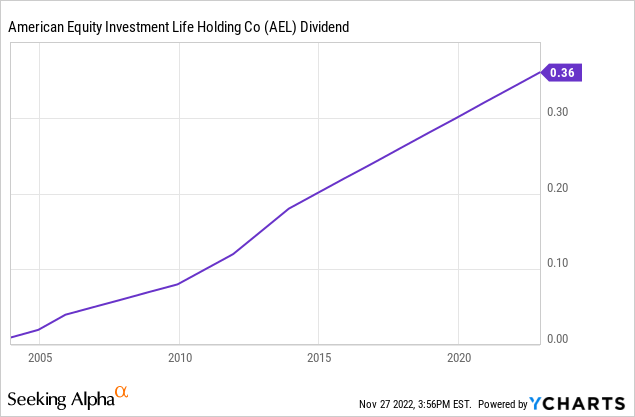

AEL is a solid dividend steward, with 18 years of continuous dividend increases since its IPO in 2003. With growing dividends and share repurchases, it is clear that this company is highly shareholder friendly. AEL’s common dividends come at an impressively low 7% payout ratio as calculated from its 2021 annual dividend and net income.

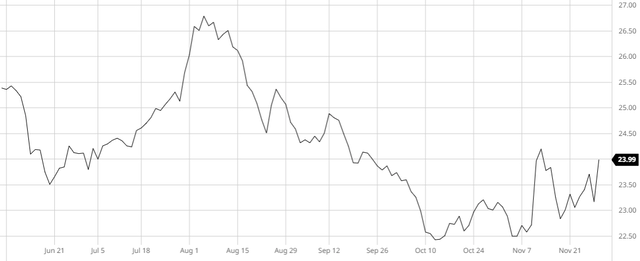

Despite having an excellent track record, the common stock dividend yield is below 1% and doesn’t meet HDO’s portfolio requirements. At a time when annuity firms are having their best year ever, we find an interestingly attractive discount in the AEL preferred securities. AEL-B trades at a 4% discount to par value and provides a fixed-rate qualified dividend that transitions to a floating-rate coupon after its redemption date. (Source.)

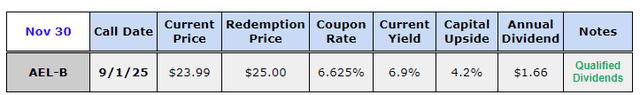

barchart.com Author’s calculations

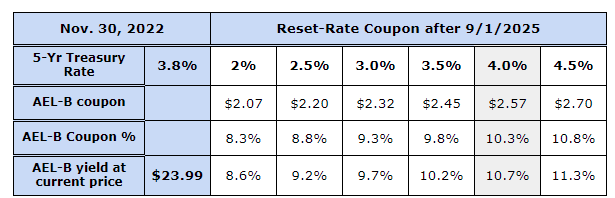

At current price levels, AEL-B yields 6.9% and has ~4% upside to par. Following the redemption date (Sept 1, 2025), AEL-B’s coupon resets to a coupon that is 6.297% + the 5-year Treasury rate at the time. This new coupon resets every five years.

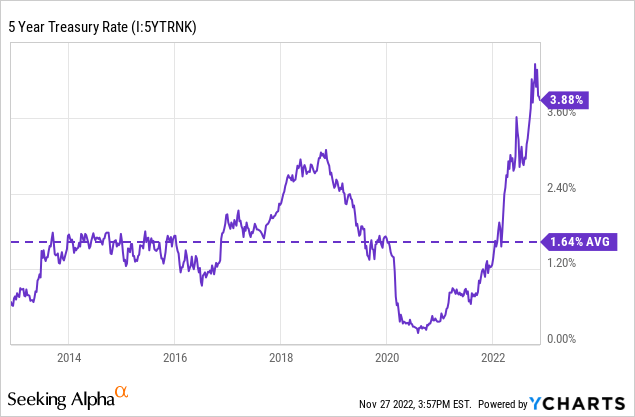

The average 5-year Treasury rate was 1.64% in the past ten years.

In every scenario for the 5-year Treasury Rate studied below, we see a significantly higher yield from AEL-B, making this an excellent hedge against the effects of long-term inflation. Additionally, AEL-B’s current discount to par makes it a compelling buy for substantially higher yields in 3 years.

Author’s calculations

We can examine the safety of the preferred dividends by looking at AEL’s financials.

The firm spent $26 million YTD towards interest expenses and $33 million towards preferred dividends. Notably, AEL spent $31.5 million on common stock dividends last year (AEL pays common dividends only once per year). AEL maintains a healthy balance sheet and carries a Long-Term Issuer Credit Rating of A-. AEL-B itself has a BB rating and presents a high-quality preferred investment among several unrated peer securities. To summarize the Q3 performance, AEL’s YTD $1.13 billion in net cash from operating activities provides adequate coverage for the company’s debt interest payments, preferred dividends, and a growing common stock dividend and leaves sufficient funds for share buybacks.

The current discount to par is an attractive opportunity to lock in a high-yielding qualified dividend from AEL-B. Post redemption date (3 years from now), this preferred will pay more than it does today, providing much-needed inflation protection for income investors and retirees.

Conclusion

After decades of hard work and diligent savings in your 401(k), IRA, and other vehicles, you deserve a happy and healthy retirement. Don’t let a stock market downturn delay the start of your golden years. Be creative and make your portfolio do the heavy lifting for a change.

Unrealized gains don’t pay my rent, and unrealized losses don’t make me lose sleep. The market is more driven by emotion than logic and has exhibited volatility from time to time. Stocks drop hard when investors are afraid, and they rally when the fear subsides. I don’t base my retirement on the unpredictability of the stock market, nor do I want to spend my retirement trying to buy low and sell high. Instead, I build my retirement on the income generation potential of my portfolio. Companies that pay dividends are generally more mature with better fundamentals than their non-dividend-paying counterparts.

Despite being in a deep bear market, 2022 has been a record year for U.S. dividend payments. This is why I like the income method – it lets me generate cash through thick and thin. I am buying deeply discounted preferred securities to increase the reliability and sustainability of my income stream while adding some stability to my overall portfolio. You can do the same; two picks with up to 8.3% yields to get you started.

Be the first to comment