Roman Stasiuk/iStock Editorial via Getty Images

To follow up with Stellantis N.V. (NYSE:STLA) is interesting to share a few pieces of positive news. After our analysis of Porsche’s IPO which will go live tomorrow, this outcome might be beneficial to set the right benchmark to value Maserati and have a better Sum-of-the-Part valuation for the entire Stellantis group. Indeed, according to Tavares, the new Maserati GranTurismo “is one of the most beautiful cars if not the most beautiful one that I’ve seen in my life“. These words are coming from the most important CEO in the industry, explaining also that “there will be extraordinary things in the future for Maserati“. You can have a look at the brand new GranTurismo on Maserati corporate website. According to the analysts, Maserative valuation is around €7/8 billion which is equal to approximately 20% of the Group’s market cap. The idea of spinning off Maserati is not new; Marchionne was already thinking about that. With the latest developments, new cars launched, CAPEX investment, and new fully electric models, we are confident that Porsche’s IPO could be the new key catalyst for another public offering in the Stellantis/Exor family.

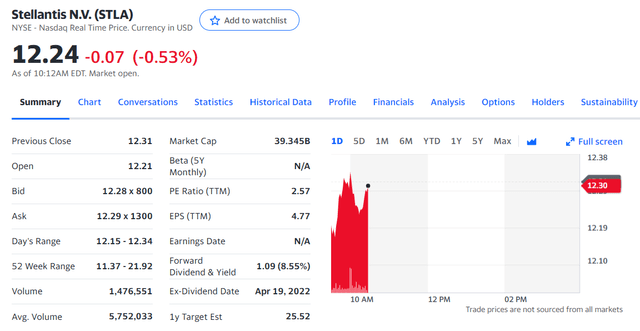

Stellantis N.V. stock price evolution

Aside from Maserati, there was a first positive sign for the European car market. In August, after 13 straight months of declines, car registrations marked an increase of 3.4% compared to the same period last year, with positive performances across all markets. However, this recovery only reduces the gap compared to the volumes achieved in 2021 and versus the pre-COVID-19 level, which amount respectively at -11.8% and -33.3%. Market conditions remain difficult with weak demand and problems in the supply of electronic components, in addition to the rising cost of energy and the effect of inflation on car prices. Stellantis outperformed the market by a plus 11% with a good performance by all brands (excluding Jeep). Looking at the year-to-date performance, car registrations remain in negative territory, with volumes down by almost 17%. A very positive outcome was also recorded in the new electric vehicle registration.

About EV, there are two important actions at the Stellantis Turin plant. A new agreement with Punch Powertrain was signed to satisfy the growing EV demand and to achieve the strategic objectives included in the plan called “Dare Forward 2030”. The updated plan will increase the production of 1) electrified dual-clutch transmission components and 2) plug-in electric vehicles hybrids.

Secondly, the Turin plant will host Stellantis’ main hub for the circular economy, which will be launched in 2023. It will begin operating with three activities designed to increase production sustainability: 1) components remanufacturing, 2) car reconditioning, and 3) vehicle dismantling. This is a further important step in the implementation of the strategic plan for the circular economy business. Moreover, in financial terms, this aims to generate a turnover of over €2 billion by 2030.

Ford profit warning and Conclusion

The latest auto development can be summarized as follow: fewer cars and more profits. We should also add – until when? So far, components shortage has benefited auto manufacturers. The gap between high demand and low supply of cars has allowed auto players to raise prices, resulting in unprecedented profit margins. Inflation surges and recession fear are pushing consumers to postpone the most demanding purchases and the increase in interest rates certainly does not favour the underwriting of car loans. On September 19, Ford (F) unexpectedly announced a downward revision of the operating result for the third quarter of this year in the range of $1.4-1.7 billion dollars against a Bloomberg consensus expectation of around $2.6 billion with the inability to complete 40-45 thousand vehicles due to the lack of components.

Regarding the company’s valuation, here at the Lab, we believe that Stellantis is really undervalued and Maserati is just the last piece of new information that supports our analysis. We reiterate our buy rating, and we suggest Stellantis investors to check up on the two previous publications in which we comment on the:

- Dare Forward 2030 plan;

- Half-year result with the General Motors (GM) agreement.

Be the first to comment