bjdlzx

(Note: This article was in the newsletter May 20, 2022, and has been updated as appropriate.)

The Lundin Group of companies started another company, Africa Energy (OTCPK:HPMCF)(AFE:TSX) that is exploring a rather well-developed part of Africa. This company currently has some ventures focused on South Africa and Namibia. Those two countries are probably the most like the developed world in all of the continent. Both governments are stable, and the country infrastructure is considerably ahead of much of the continent. This marks the point where Africa Energy will likely transition from a development stage or story company to an operating model over the next five or so years. That transition would make the company acceptable to investors looking for a lower risk situation as “story” companies tend to be very high risk.

More importantly, this development stage company has the backing of an impressive organization behind the Lundin Group of companies. That puts management far ahead of many development stage companies and clearly puts the odds in favor of success. The Lundin Group of companies provides management and financing options (and resources) often not available to companies like this one.

The Lundin Group of companies has been in business for more than 40 years. In that time the organization has expanded considerably since it was founded. The organization has started and sold a considerable number of companies. The website currently lists quite a few that are under the management of the group itself. Many of these companies usually have the Lundin Family as the largest shareholder.

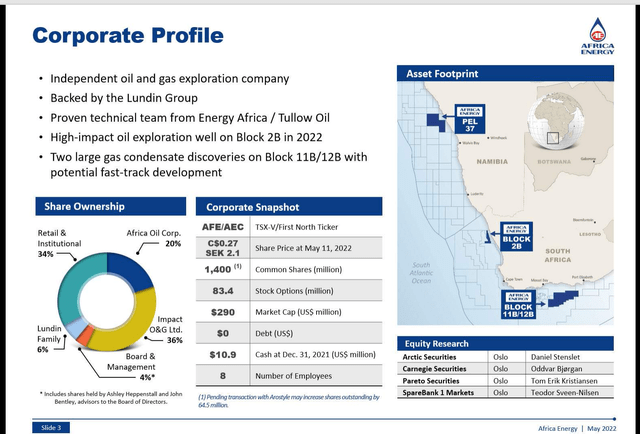

Africa Energy Shareholder Structure (Africa Energy May 2022, Corporate Presentation)

Africa Energy is controlled by the Lundin Family directly through the interest there and indirectly through the Lundin Family interests in Africa Oil (OTCPK:AOIFF)(AOI:TSX) and also through the Africa Oil ownership percentage of Impact Oil & Gas. There is more to the ownership structure. But this very brief description of some of the material ownership interests should give an investor the main idea that the Lundin Family controls the company one way or another.

Material Discoveries

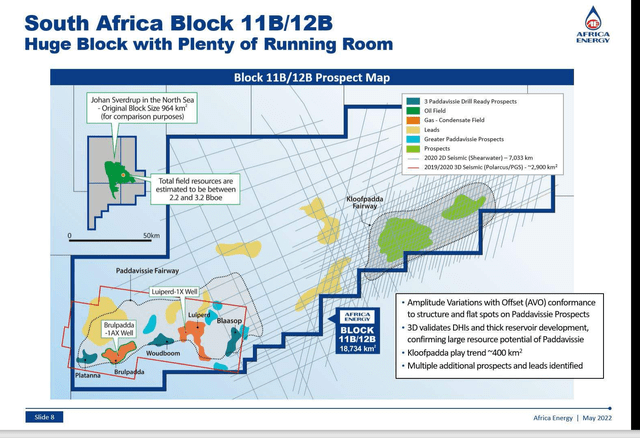

The company has an interest in a South African block that announced some discoveries over the years.

South Africa Block Discoveries And Future Potential Prospects (Africa Energy May 2022, Corporate Presentation)

The company is a participant in the discoveries shown above. One of those discoveries has proceeded far enough that the operator, Total (TTE) is going to proceed to apply for permission to produce the discovery. Should everything go as planned, production and actual cash flow is still a few years away.

The major risk is that a small company like Africa Energy needs to acquire adequate financing. That would happen either-in the form of debt of the issuance of more shares. Excessive dilution or worse is always a risk with a development stage company. Hence, it is important that the company has the backing of the Lundin Family and the associated organizations. Because of that backing, there will be some funding options that are not typically available for a company of this size.

Note that the company still has to get to first production and what happens between now and then has to be successful. However, if the operator is applying for a production permit, then the chances of getting to actual production are good. Still, until then, this company has no revenues. So, this stock is nothing close to a “widows and orphans” stock. Instead, speculative is probably an understatement. But the stock is speculative with considerable deep management that exceeds the usual management of a company of this size.

South Africa Speculative Upside

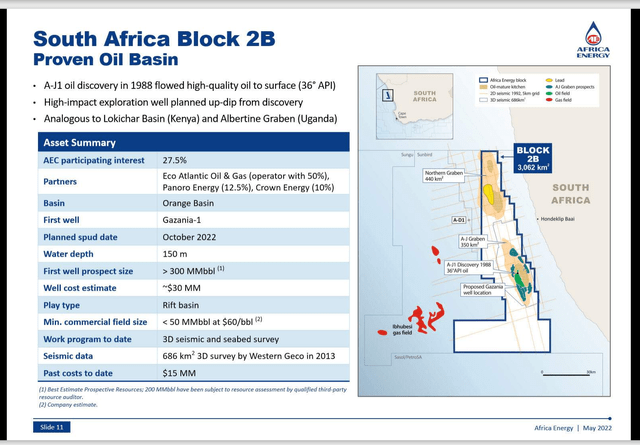

The other big block in which the company has an interest has no discoveries at the current time. But management has high hopes for a discovery in the future.

Africa Energy Block 2B Potential Upside (Africa Energy May 2022, Corporate Presentation)

On this block, the company itself is partnered with a lot of smaller operators. There are no “name” players in the venture that most investors would realize. Still, this particular lease appears to offer some decent chances of a profitable discovery.

As of this time, the company has not done a lot with the Namibia leases except apply for a lease extension. There are some neighboring operators that plan to drill some exploration wells. Most likely, based upon the success or lack thereof of those exploration wells, the partners will make future plans after those neighboring wells have been completely evaluated. This is a smart way to reduce risk and increase the chance of success (when you do not have a lot of money).

Finances And The Future

As of the first quarter report, the company had more than $9 million on hand and no debt. The report itself focused on the drilling of an exploration well and the progress made towards production as discussed above.

This is risky because a small company like this needs more than $9 million until sufficient cash flow arrives. How the company gets through the next few years is normally a cause for concern. Fortunately, this management has navigated that issue several times in the past successfully. There are quite a few companies mentioned on the Lundin Group of Companies’ website to prove this point. That is no guarantee of success this time around. But it sure improves the odds.

Whenever an investor considers a speculative investment, that speculation needs an “edge”. Too many speculative investments really have no chance at all. Since the risk of a total loss of the investment principal is high in any development stage company, the presence of an organization like the Lundin Family and the Lundin Group of companies is essential to improve the chances of success.

There remains a risk of “too much” dilution and there is likely to be considerable dilution ahead. However, the upside of the offshore projects combined with management experience make this investment a consideration for those that know how to handle this type of speculation.

This management is very unlikely to overleverage the company at any time. Therefore, that kind of risk is low. The discoveries made along with the plans to apply for permission to develop a discovery put this development stage company ahead of many in the industry. The presence of Total as an operator for that discovery also adds credibility to the project.

The current strong commodity price environment will make the ability of the company to obtain necessary financing easier than was the case a year or two ago. The terms are likely to be more favorable than many companies could get due to the backing of the Lundin family.

In summary, despite all the development stage risks, this speculative idea has a lot going for it. It will take a fair amount of patience and the investment is likely to prove to be a long-term success rather than an immediate run-up. But the Lundin family has a lot of successful history, and the average investor now has the chance to speculate along with one of the more known families in the industry. That is the kind of speculation to consider. But a lot of patience is going to be very necessary.

Be the first to comment