peterschreiber.media

For decades, investors have seen utilities as the go-to sector for defensive stocks with higher dividend yields. Perhaps more than any other economic sector, utility companies are often benefactors of “economic rent.” This capability is derived from their lack of local price competition and electricity’s extremely inelastic demand structure (i.e., people do not reduce electricity use much as prices rise). Generally speaking, when utility companies face rising costs, they can easily pass those costs onto consumers, creating historically stable profit margins.

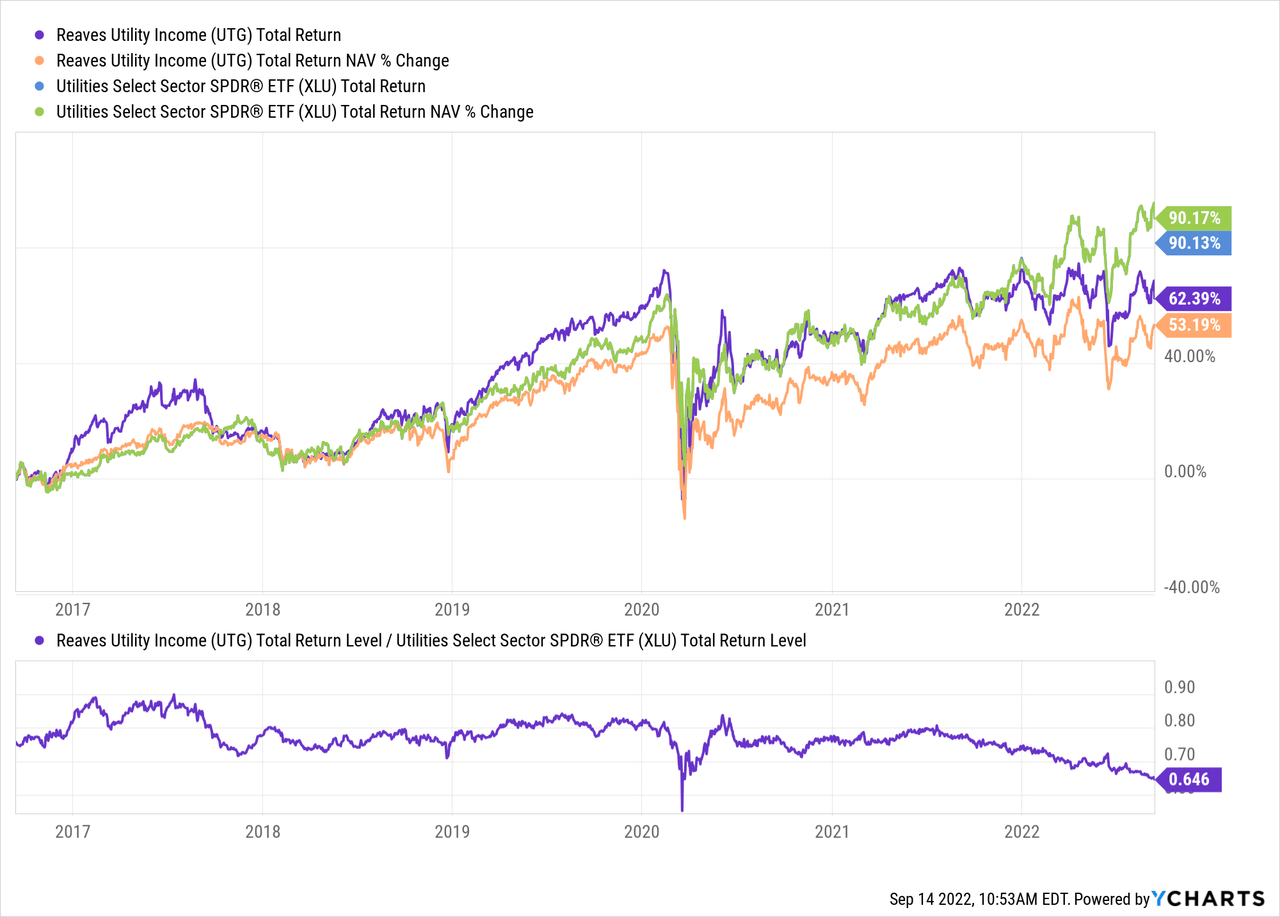

Due to their defensive quality, utility stocks have become a target for leveraged investing from closed-end-funds like the popular Reaves Utility Income Fund (NYSE:NYSE:UTG), which uses some leverage to maximize dividend returns from utility stocks. Despite this, UTG has underperformed the non-levered utility sector ETF (XLU) by a wide margin since 2021. See below:

From 2017 to early 2021, UTG’s overall total performance trend generally matched XLU’s. However, since 2021, UTG has underperformed relatively consistently, as seen quite clearly in the ratio chart above. There may be a few reasons for this underperformance, including rising interest rates, poor stock selection, and higher management fees. Regardless, UTG has underperformed XLU by around 16% since mid-2021, delivering flat returns while XLU continues to rise.

UTG faces a growing set of risks that may make it a poor investment choice. These risks include the impact of rising interest rates on the financial stability of many utility companies, lower fair values given the rise in bond yields, and a growing number of non-paying customers due to rising electricity costs. While utility companies can generally raise prices to offset some of these risks, the shifting market dynamic may be highly unfavorable for utility stocks and lead to significant declines in valuation. Given UTG’s underperformance and use of leverage, I believe the CEF will likely experience more considerable losses, which many investors may not currently expect.

Growing Economic Risks Facing Utilities

In my view, investors may benefit from reassessing their views regarding the defensive nature of utilities. European utility companies are currently experiencing elevated volatility due to rising gas costs that may not be quickly passed onto customers, going as far as needing to bail out Germany’s utility giant Uniper (OTCPK:UNPRF). Europe’s situation is far more dramatic than North America’s since natural gas prices and supply are more stable here. That said, U.S. natural gas (and other) prices are still rising due to growing exports to the E.U.

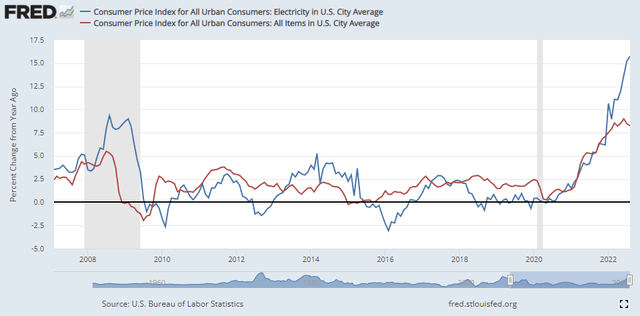

U.S. fuel commodities are generally the most expensive since the 2000s. Additionally, many utility companies face significant labor shortages, with around a quarter of the utility workforce looking to retire soon. The utility supply chain also faces substantial shortages. As noted in Duke Energy’s (DUK) recent call and my recent article regarding Peabody Energy (BTU), the coal mining sector, the railroad industry, and natural gas producers and transporters are all facing a mix of significant labor and materials shortages that are leading to higher costs. These costs are inevitably passed on to electricity consumers, making electricity bills a major inflationary force today. See below:

U.S CPI vs. U.S Electricity CPI (Federal Reserve Economic Database)

As you can see, electricity’s inflation rate shows no signs of slowing despite the slight moderation in overall consumer price inflation. The electricity CPI is currently up around 16% year-over-year and has risen almost every month in 2022 despite the slight decline in overall CPI. The electricity CPI index is currently 22.6% above its 2020 level and has been growing fastest since the early 1980s.

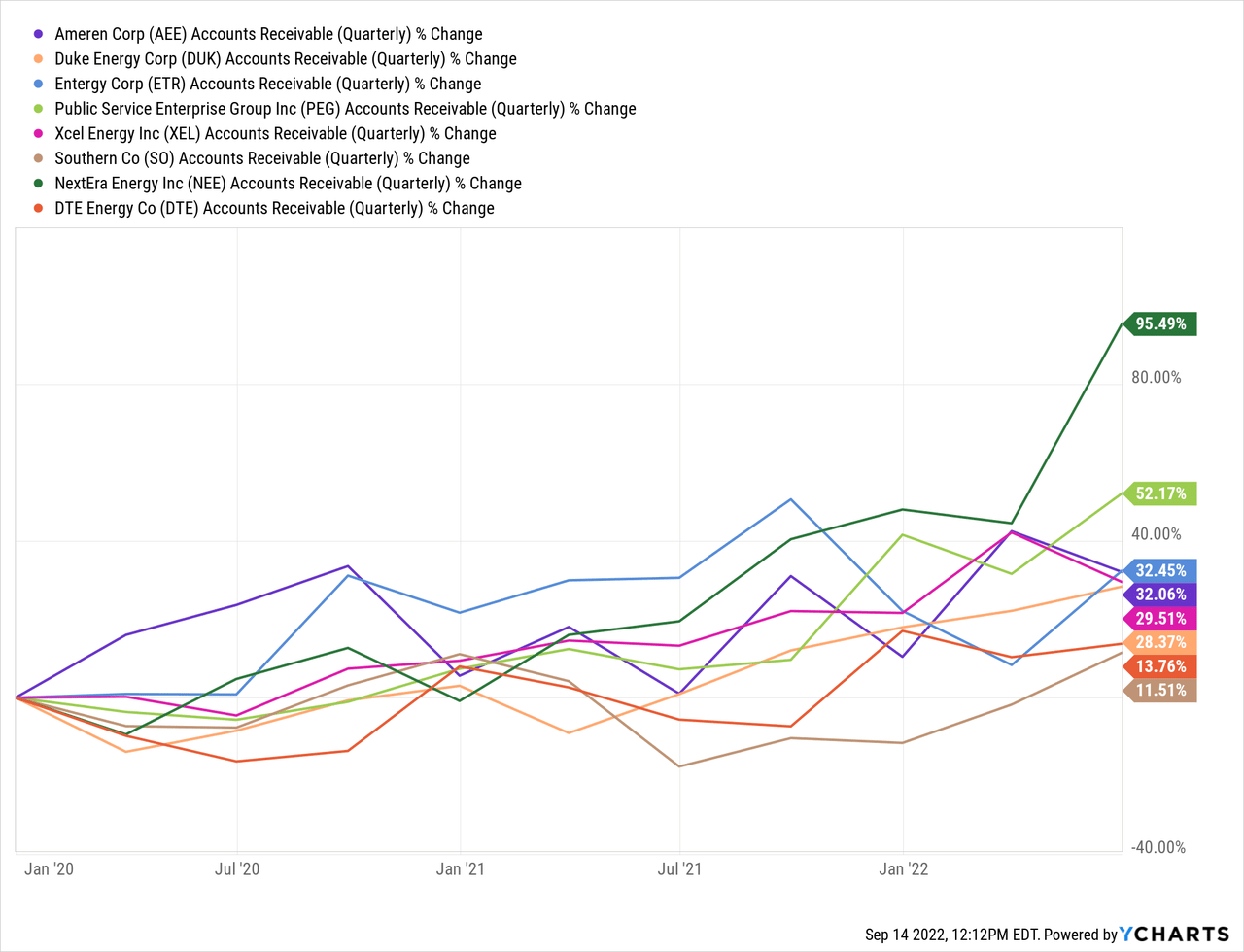

On the surface, utility companies successfully pass rising costs onto customers. However, a record number of U.S. households, roughly 1-in-6 or 20 million, are behind on utility bills. Many utility companies report a 40% jump in customers being shut off since 2020. This trend is reflected in the rising accounts receivable levels for all of UTG’s most prominent energy utility holdings. See below:

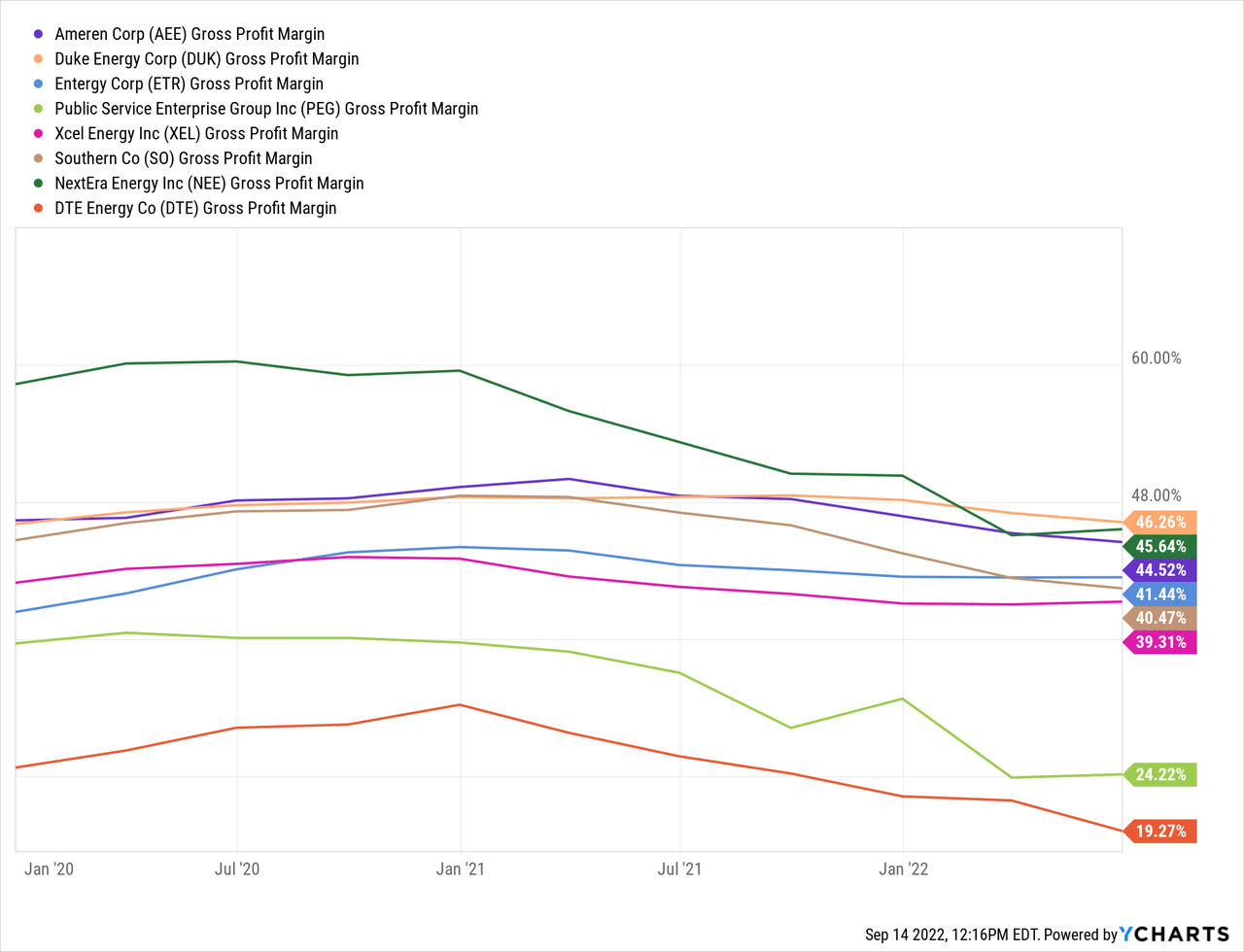

Total overdue U.S. utility balances are currently at elevated levels of around $16B and are likely to rise given the immense growth in electricity prices. To an extent, many utility companies may be underestimating the number of customers who will not pay these bills, creating potential financial risks. At this point, the total amount of unpaid bills is not large enough to negatively impact most utility companies. However, as prices rise and real wages trend lower, or if there is a rise in unemployment, I believe utility firms may struggle with many customers not paying bills. Even more, we’re already seeing gross profit margins trend lower for all of these significant utility companies:

Again, the current decline in gross margins is, at this point, not significant enough to force these firms to reduce their dividends. However, if we assume electricity costs will continue to rise, utility companies will likely face growing difficulty passing costs onto customers. In my view, no strong signs indicate the shortage of fuel commodities or labor will end, and numerous signals that they could grow.

While utilities generally carry a strong defense against rising costs, we may see more lawmakers look toward legislation restricting utility’s ability to raise prices. Given most utility companies are government-regulated monopolies, they carry immense exposure to regulatory risk factors since many voters may disagree that utility firms should be essentially guaranteed a profit while customer costs skyrocket. At the same time, many utility companies could face rising non-operating expenses due to their high debt and sharply rising interest rates.

I believe these economic risk factors make utility stocks far less defensive than in the past. Of course, a material portion of UTG’s portfolio (~25%) is invested in other utility companies such as rail and telecommunication. Telecommunication companies carry potentially more significant risks as their electricity costs soar at the expense of customer demand since data purchasers likely have greater price-demand elasticity. This trend in data centers is starting to grow more quickly in the U.K, where electricity costs are rising faster. Rail companies do not carry these particular power-related risk factors but may face losses due to growing union battles and related labor shortages. Overall, it appears UTG’s portfolio carries material negative exposure to the broader labor and goods shortages and the corresponding rise in inflation and interest rates.

UTG’s True Yield Is Very Low

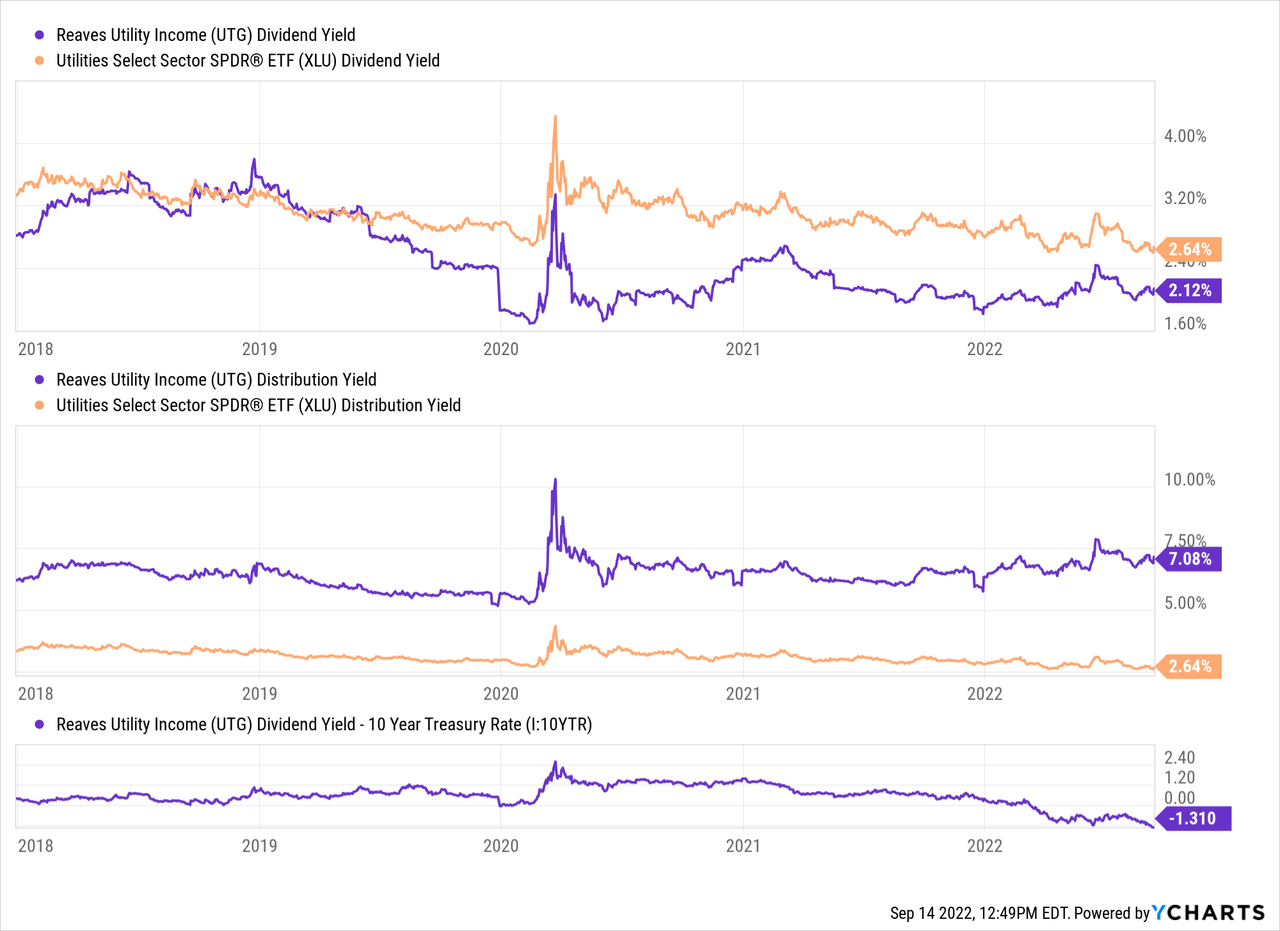

Closed-end-fund investors can be confused between “dividend yields” and distribution yields. UTG has a distribution yield of around 7%, but its actual dividend yield is much lower at roughly 2%. The distribution yield is derived from the repayment of the fund’s capital and not necessarily income received from its holding dividends. Essentially, the bulk of UTG’s “yield” is just shareholder’s money being returned to shareholders. In fact, the ETF XLU has a higher dividend yield of 2.64% compared to UTG’s 2.1%, despite the CEF’s leverage. See below:

In my view, there is no benefit to UTG’s leverage because borrowing costs on short-term money are now nearly as high as dividend yields on utility stocks, so leverage does not necessarily increase yields. UTG’s dividend yield is also moderately lower than the non-levered utility ETF XLU. The comparative value of UTG’s yield is extremely low to Treasury bonds, with a -1.3% difference between UTG’s and the current 10-year Treasury bond yield. In other words, a moderately higher yield could be achieved simply by purchasing Treasury bonds which, in my opinion, carry far less risk than UTG’s utility holdings.

The Bottom Line

I believe UTG is a poor investment option in the current market dynamic, given the rising risk factors facing most utility companies. Over the coming year, we may see a growing number of utility companies report cash-flow declines as they struggle to pass costs onto customers and unpaid balances climb. As long as inflation remains a critical economic factor, utility companies will likely be lackluster investment choices, particularly in light of regulatory risks in the energy market.

Even if utilities were more attractive, I do not believe UTG would outperform a non-levered ETF like XLU. The fund has not outperformed since 2016 and has underperformed dramatically over the past twelve months. Further, many investors may misunderstand the difference between a distribution yield and a dividend yield. UTG does not “generate 7% per year”; it generates around 2% per year in income and gives customers ~5% of their capital back while charging an average 1.23% expense ratio. In my view, combined with the economic risks in utilities, this situation makes UTG an inferior risk-adjusted investment choice today.

Be the first to comment