Sundry Photography

In my last article about Intel Corporation (NASDAQ:NASDAQ:INTC), I asked if the stock is a great buying opportunity or rather a falling knife. The article was published about three months ago, and in these three months, the stock has declined about 30%. When looking at these numbers, the answer seems to be pretty obvious: Intel is a falling knife and certainly was a falling knife over the last three months.

However, as a long-term investor, I am not so much interested in the performance over a few months. I am certainly trying to get the stock as cheap as possible, but the most important aspect is to buy Intel stock below its intrinsic value. And I remain confident that Intel is trading below its intrinsic value, and in the following article, I will analyze once again why I think Intel is a good investment. We will start with the last quarterly results, which were far from great.

Quarterly Results

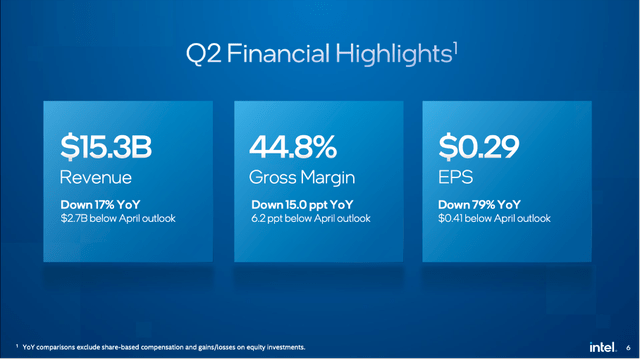

One of the negative points and catalysts for the decline was the last earnings results, which were not great. Not only did Intel miss revenue estimates by $2.63 billion (which is a huge miss), the company also missed non-GAAP earnings per share estimates by $0.41 and GAAP EPS estimates by $0.64 – another huge miss. When looking at these numbers, it was not surprising that investors were disappointed – and as a consequence, the stock declined, and analysts lowered estimates as well as price targets.

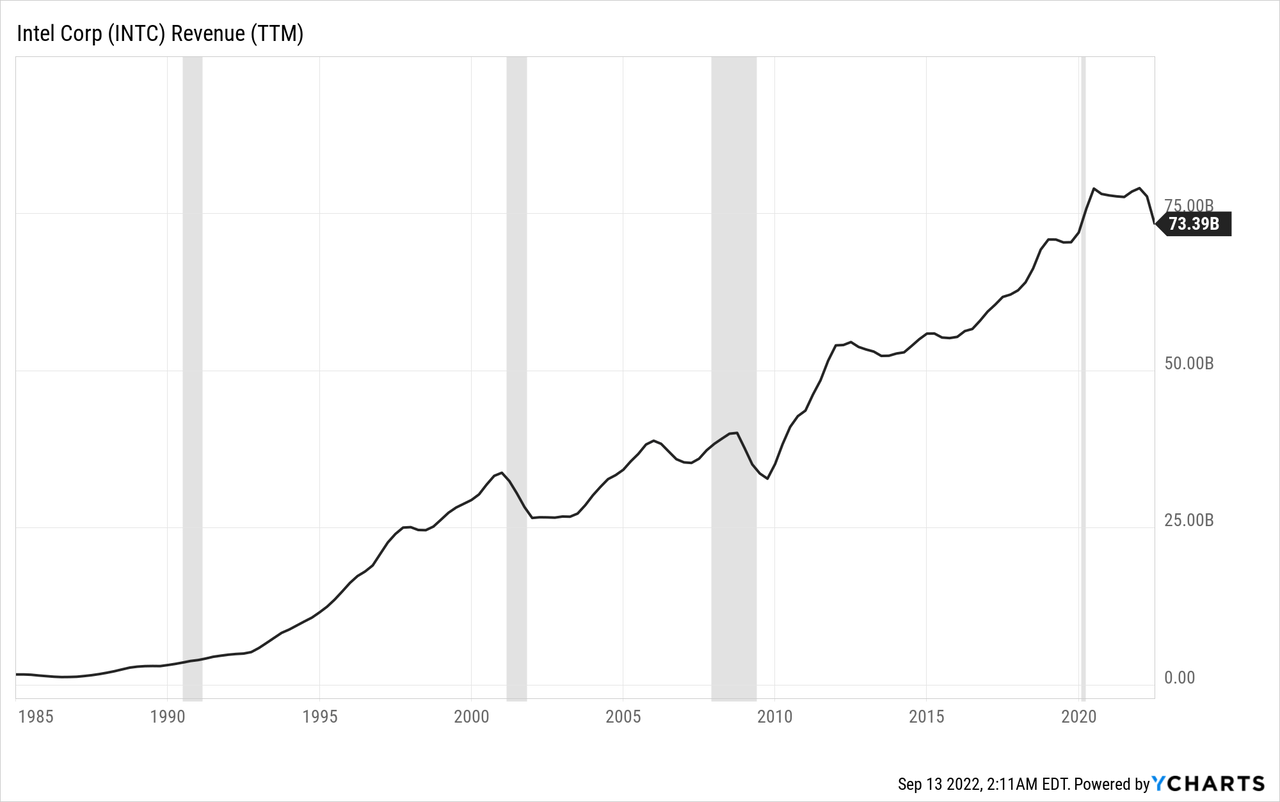

But quarterly results were not only a disappointment compared to previous expectations. When looking at the numbers, we saw revenue declining from $19,631 million in the same quarter last year to only $15,321 million this quarter – resulting in 22.0% year-over-year decline. And while revenue declined, cost of sales increased from $8,425 million in Q2/21 to $9,734 million in Q2/22, which resulted in a much lower gross income. Instead of an operating income of $5,546 million in Q2/21, Intel now had to report an operating loss of $700 million. And finally, diluted earnings per share declined from $1.24 in the same quarter last year to a loss of $0.11 this quarter.

When looking at adjusted earnings per share, we see still a positive number, but adjusted EPS also declined 79% year-over-year.

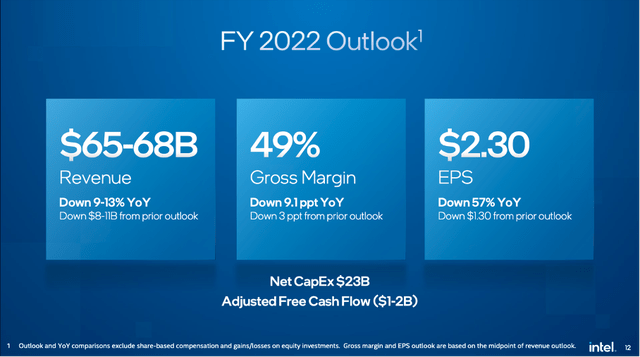

Management also lowered its full-year guidance. And as revenue is now expected to be only between $65 billion and $68 billion – about $8 billion to $11 billion lower than in the previous outlook – and earnings per share are expected to be only $2.57 – about $1.30 lower than in the previous outlook – we see how drastic these adjustments were.

CEO Pat Geisinger himself said the quarter was below the standards the company has set (for the business as well as the shareholders) and identified multiple factors that impacted revenue as well as profits: deteriorating macro conditions, inventory and supply disruptions, as well as competitive pressures.

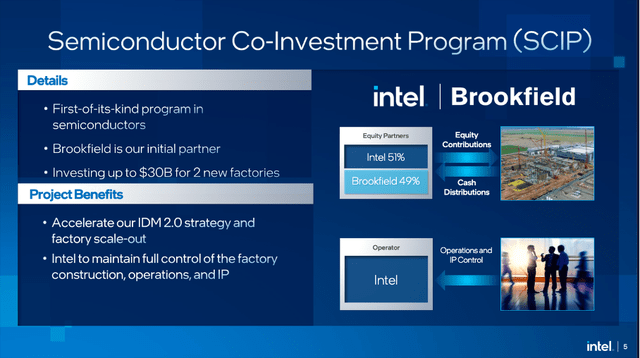

Semiconductor Co-Investment Program

Building new fabs is leading to a high financial burden for the company, and Geisinger has been telling investors for quite some time not to expect much free cash flow (“FCF”) in the coming years – as Intel must spend high amounts on capital expenditures. And at the end of August, Intel announced SCIP – its Semiconductor Co-Investment Program.

To put it simple, Intel has made a deal with Brookfield Infrastructure Partners L.P. (BIP). Under that deal, Intel will now fund only 51% of the expansion at the Ocotillo campus in Arizona, and Brookfield Infrastructure is financing the remaining 49%. Intel, however, will keep intellectual property rights and will be operating by itself.

Intel Semiconductor Co-Investment Program Announcement

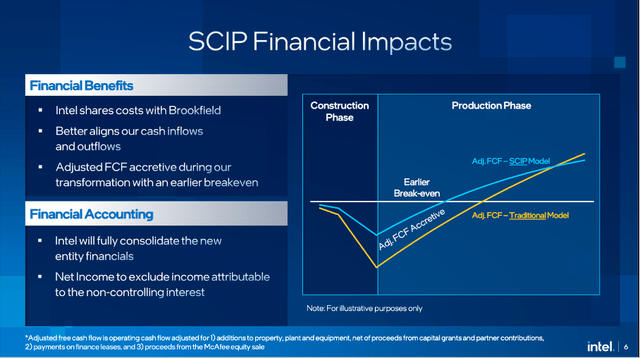

As a result, Intel will have to invest lower amounts in the next few years, and free cash flow will improve in the next few years, which can be seen as good news for investors. However, selling a 49% stake will also lead to lower profits for Intel in the years to come.

Intel Semiconductor Co-Investment Program Announcement

I honestly don’t know if the move is a good decision. On the one hand, Intel must invest really high amounts and the investments would have resulted in several years of extremely low (or even negative) free cash flow for Intel. And it is not atypical to sign contracts for strategic partnerships and companies investing together – especially when billions of dollars are necessary.

On the other hand, Intel must share profits – even if it keeps operational control. The company improved its financial situation for the next few years, but if Intel’s grand strategy is working out, it must share a huge part of its profits.

Short-Term Headwinds?

SCIP might ease one of the problems Intel has – at least in the short term. Due to SCIP, the capital expenditures will be lower in the next few years, and it will enable Intel to generate a positive free cash flow again.

Another problem Intel has – together with most other semiconductor companies – is the cyclical nature of the business. And it is getting more and more difficult to ignore the warning signs for the world economy slowing down. Semiconductor companies are highly cyclical businesses and demand is declining during recessions – the last quarterly results for Intel were already a strong warning sign.

But Intel is not just struggling due to the economy slowing down. Intel certainly has made mistakes and several wrong strategic decisions in the past. And these decisions led to Intel losing market shares to Advanced Micro Devices (AMD), for example, and resulted in Intel growing with a slower pace than several competitors. But calling intel’s business model broken is going one step too far – we just should not bet on high growth rates for Intel in the years to come.

While we can’t ignore the headwinds, I think these headwinds will remain short-term and Intel will be able to resolve the problems in two or three years.

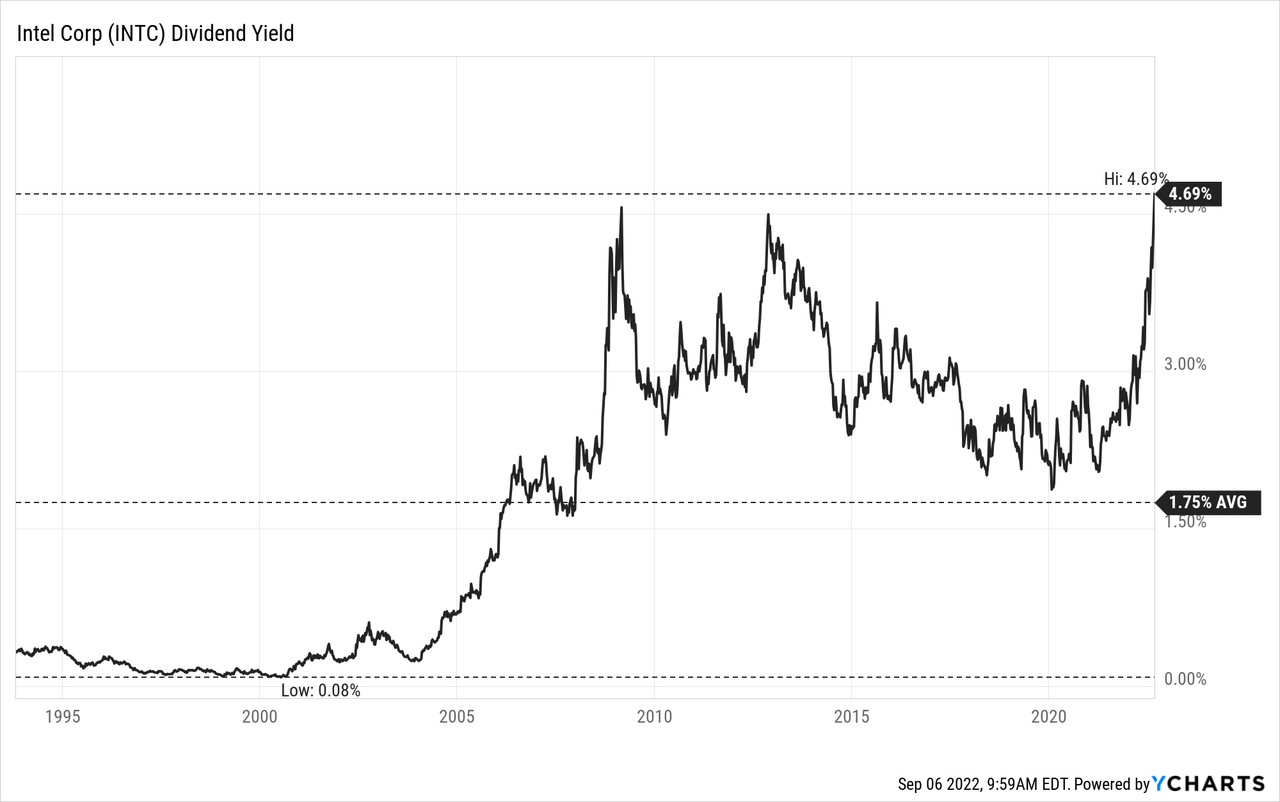

Dividend

Intel is also becoming more and more interesting for its dividend. The company is paying a quarterly dividend of $0.365 right now, which is resulting in an annual dividend of $1.46 and a dividend yield of 4.69%. And this is the highest dividend yield ever since Intel started paying a dividend in the early 1990s.

When assuming earnings per share of $2.59 for fiscal 2022, we get a payout ratio of 56%, which seems still acceptable and is no reason to worry. But, of course, the dividend should not be protected at all costs and one can argue – like other contributors have also argued – that Intel should have cut the dividend or suspended the dividend completely for some time. Instead of paying a dividend, the company could use the amount of $5.8 billion annually (which is now used for dividend payments) to finance the building of new fabs. It seems like Pat Geisinger is trying to protect the dividend and is using the generated cash rather for dividend payments than investments.

It is nice when shareholders can rely on constant dividend payments or on constantly increasing dividends, but management should do what is best for the business. And in the last twelve months, free cash flow was negative. When a business is not able to generate a positive free cash flow, dividend payments must be financed otherwise – for example, by using cash, cash equivalents or short-term investments. And for one or two quarters, this is not a problem, but when this is the case over several years, it could become a problem. It is essential that dividend payments are covered by the free cash flow the company is generating.

Intrinsic Value Calculation

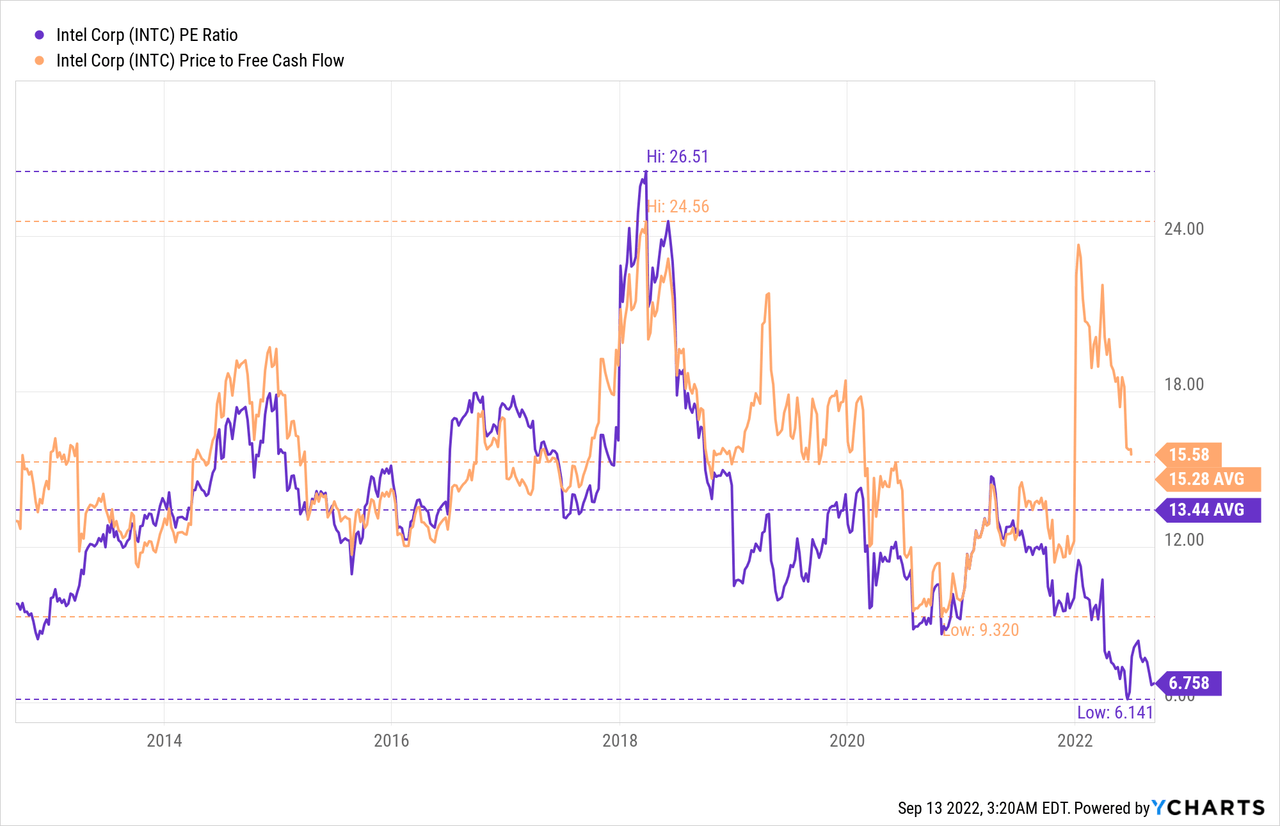

It seems quite obvious that Intel is trading for an extremely low P/E ratio at the moment. When using fiscal 2021 earnings per share of $4.86, Intel is trading for only 6.4 times earnings, and when using trailing twelve months’ numbers, Intel is trading for about 6.75 times earnings. Of course, one could argue these EPS numbers are not really describing the business in an accurate way. Instead, we can use the expected earnings per share for fiscal 2022 (which are $2.61), and Intel would be trading for 12 times earnings. And while Intel might seem now twice as expensive, we still must keep in mind that a P/E ratio of 12 is way below the market average and absolutely reasonable for a high-quality business.

We could determine an intrinsic value for Intel by using a discount cash flow calculation once again, but I can also refer to the calculations in my last articles as the assumptions are pretty much the same. I calculated three different scenarios in my last article and when taking the most realistic one – the base case scenario – Intel should be trading around $65, as this is the fair value for the stock.

Another Company Betting Big

Although we are talking about two completely different businesses, I would like to compare Intel a bit to Meta Platforms (META) at this point. Both companies and both CEOs – Pat Geisinger as well as Mark Zuckerberg – are betting rather big right now and are spending huge amounts of cash on a vision that might lead to a much higher free cash flow. And, in both cases, some uncertainty remains if these high amounts of cash are money well spent and how profitable these investments will be.

Whether Meta Platforms can be seen as a bargain depends a lot on the question of how you buy the vision of Mark Zuckerberg about the Metaverse. Intel and Pat Geisinger will have to spend lower amounts than Meta Platforms, and Intel’s bet seems more reasonable and predictable. Intel is making a huge investment, but an investment that has already been made in similar forms in the past by many different companies (building fabs for the production of semiconductors is nothing new).

As often in investing, we try to anticipate the future to some degree, and we also must be patient as it might take some time before the investment pays off.

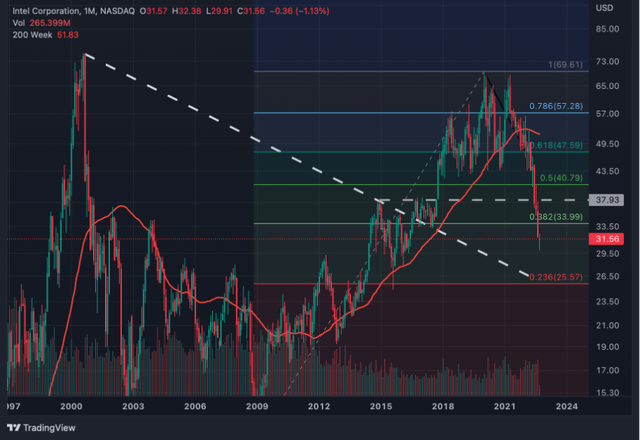

Technical Picture

Even if pessimism surrounds Intel and lower lows must be expected constantly, we seriously must ask the question how low Intel could fall and where the stock might find a bottom (after all, the stock has already declined 54% from its former high). In previous articles, I thought that the stock could find support around $42 as I considered Intel already undervalued at this point. But the market was obviously more pessimistic than I assumed, and the stock broke through that support level and a rather steep sell-off followed.

Right now, I would identify a next potential support level around $25. At that level, we find a trendline connecting the Dotcom high and the break-out level. And at that level, we also find the 23% Fibonacci retracement of the last big upward wave (since 2009) when the stock finally bottomed around $12 after declining for almost one decade. I don’t know if the stock will fall so far (in my opinion, Intel is already undervalued, and even lower stock prices are not justified) nor if the stock will find its low at $25 and stop falling further (I expect a brutal bear market in the next one or two years, dragging most stocks to lows most investors can’t imagine right now).

When using estimates for fiscal 2022 (earnings per share being $2.61), we get a P/E ratio of 9.6 for Intel. When using EPS estimates for fiscal 2023, which are $1.98, we get a P/E ratio of 12.6. Both seem like reasonable valuation multiples for Intel, and the stock could find its bottom around $25.

Conclusion

I was already bullish about Intel in the past. I identified $40 as a strong support level in my last article, which did not hold. And I will not change my fundamental opinion about Intel at this point – the stock is undervalued, and the steeper it falls the more undervalued Intel gets. But while I am still bullish about Intel over the long run, I would wait a bit right now as I consider it a realistic possibility for Intel to drop lower – at least to $25. And while the waiting can be called speculation at this point, $25 seems like a good entry point to buy Intel.

Be the first to comment