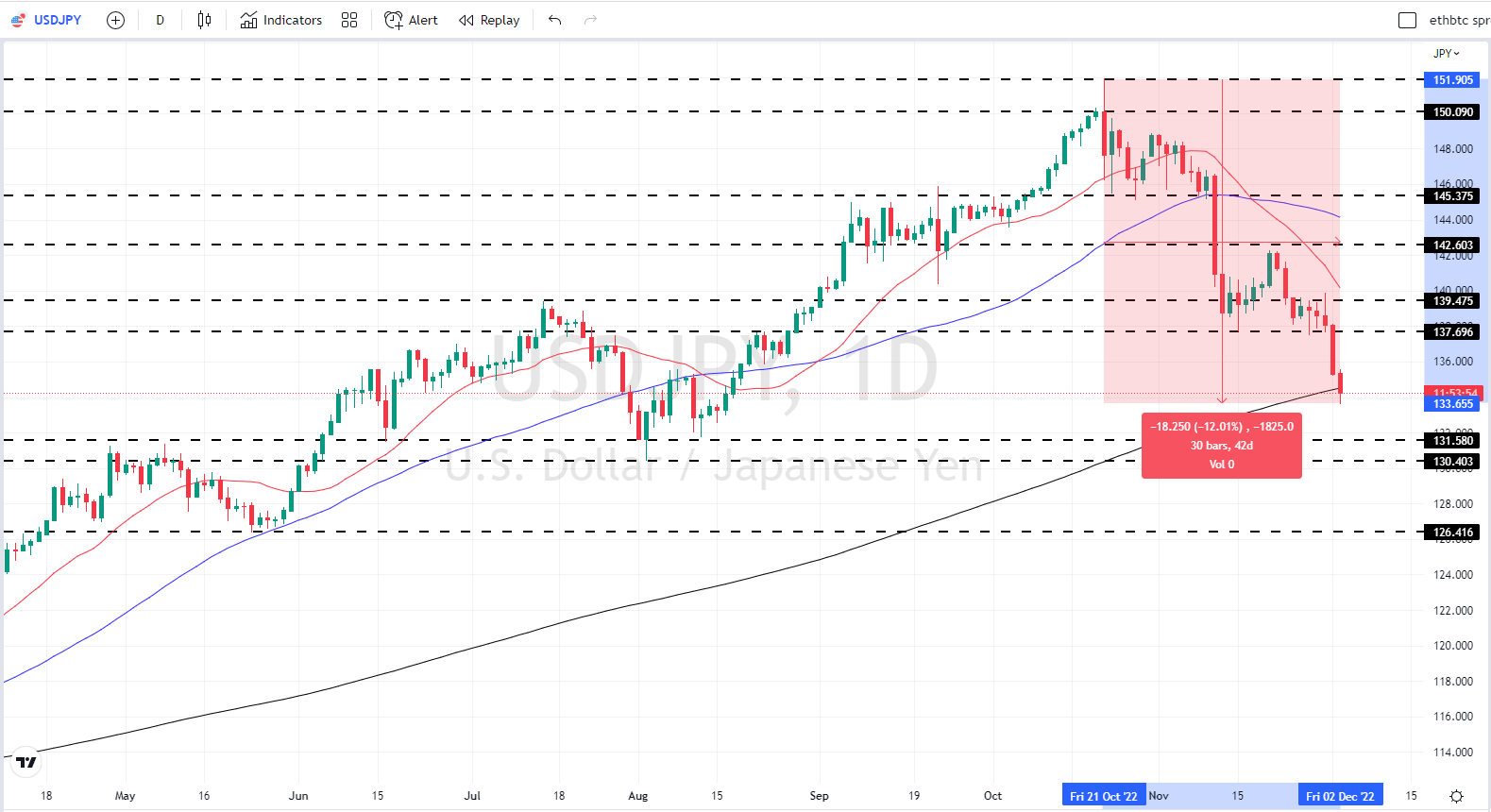

USD/JPY Price and Chart Analysis

- USD/JPY breaking below the 200-day moving average.

- US Jobs Report (NFP) is now key ahead of the mid-December FOMC meeting.

Recommended by Nick Cawley

Get Your Free JPY Forecast

Most Read: USD/JPY Collapsing Towards a Fresh Three-Month Low

The US dollar continues to make fresh multi-month lows against a range of other currencies with USD/JPY now down just over 12% from its October 24 multi-decade high. The latest leg lower, fueled by comments from Fed chair Jerome Powell on Wednesday and a benign core PCE reading on Thursday, may not be over yet with the latest US Jobs Report (NFP) set for release at 13:30 GMT today. This report, already a known market mover, now takes on increasing significance after Wednesday’s ADP report showed a sharp slowdown in private job growth. While any correlation between ADP and NFP is always up for debate, a slowdown in today’s NFP report will add to the belief that the Fed’s aggressive rate hikes this year are now starting to crimp the jobs market.

Monthly ADP Figures

Recommended by Nick Cawley

How to Trade USD/JPY

USD/JPY has taken out a previous area of support over the last two days and is now testing the 200-day moving average. The violent break below 137.70 now changes this level to initial resistance and with the pair currently trading around 134.20, this resistance is unlikely to be troubled in the short term. The next area of support is seen around 130.00 to 131.58 and again this should hold in the short term, barring any shock NFP number.

For all market-moving economic data and events, see the DailyFX Economic Calendar.

USD/JPY Daily Price Chart – December 2, 2022

Chart via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 12% | -8% | 1% |

| Weekly | 9% | -5% | 2% |

Retail Traders Increase Net-Long Positions

Retail trader data show 53.06% of traders are net-long with the ratio of traders long to short at 1.13 to 1.The number of traders net-long is 21.07% higher than yesterday and 12.59% higher from last week, while the number of traders net-short is 11.06% lower than yesterday and 9.83% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/JPY prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/JPY-bearish contrarian trading bias.

What is your view on the USD/JPY – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Be the first to comment