robertcicchetti

ChargePoint Holdings (NYSE:CHPT) is still reporting fast revenue growth without much in the way of gross profits. The EV charging space is still too focused on throwing up charging stations without much in the way of actual demand for usage. My investment thesis remains ultra Bearish on the stock at just about any valuation until the business model changes.

Big Revenue Miss

ChargePoint reported FQ3’23 revenues of $125.3 million missed analyst targets by a very large $6.8 million due to supply constraints. The company had guided to October quarter revenues of $125.0 to $135.0 million placing the actual revenue at the low-end of guidance.

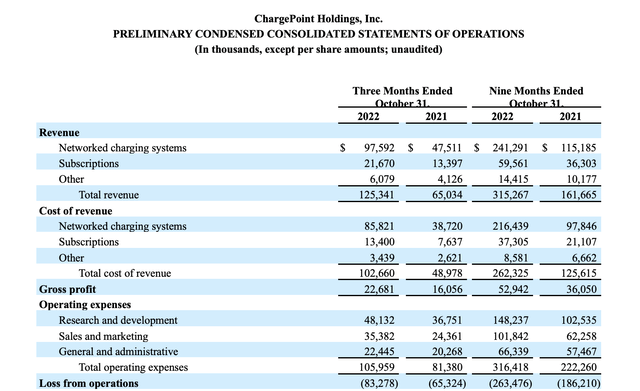

Either way, the story with ChargePoint has long been about revenue growth and the market wrongly placed too much focus on revenues. What isn’t in doubt is that the EV charging station company still generates the vast majority of revenues from equipment sales with low margins rather than crucial subscriptions. Subscription revenue only reached $21.7 million in the quarter, up only $1.5 million sequentially, with a gross profit of just $8.3 million.

Source: ChargePoint FQ3’23 earnings release

On a GAAP basis, the gross profit only grew $6.6 million while operating expenses surged $24.6 million. The problem missed by the market is this very big disconnect in the business model.

ChargePoint boosted networked revenues in FQ3 by 105% to $97.6 million, but these revenues are all low calorie. In reality, investors should only look at the subscription revenues and possibly the other line for the revenue base and gross profits in order to value the business.

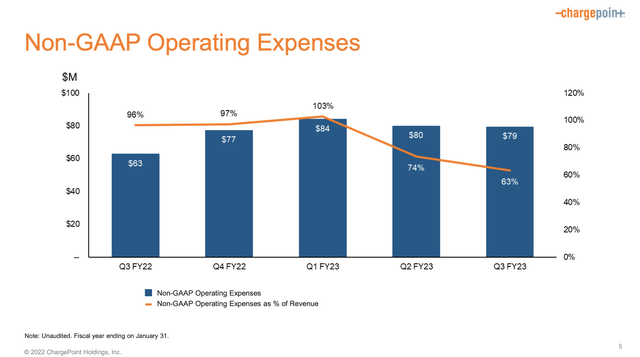

The EV charging station company is currently spending $102.7 million in operating expenses on a GAAP basis and $79.0 million on a non-GAAP basis in order to generate $21.7 million to $27.8 million in valued revenues. ChargePoint has made substantial progress in reducing operating expenses over the last year, but the company still spends 63% of revenues on operating expenses.

Source: ChargePoint FQ3’23 presentation

Remember though, total gross margins are only 20%. All of this progress comes with ChargePoint still far away from the goal.

Guidance With a Hitch

Despite missing revenue estimates for FQ3, ChargePoint actually guided up numbers for the full year as the supply constraints holding back revenue in October were generally solved in November. The company now forecasts revenues of $475 to $485 million for FY23, up $5 million from prior guidance.

Just about any company would read a very bullish outcome from this guidance. Revenues are going to surge $40 million sequentially to $165 million for 108% growth over last FQ4. The numbers sound too good to be true.

In reality, the numbers are all built on low calorie charging station sales. ChargePoint guided to gross margins below the annual gross margin guidance at 22% to 26% for the year in a strong sign the revenue boost isn’t coming from subscription growth.

The big boost to equipment sales should in theory lead to more subscription revenues in the quarters ahead, but this category never seems to catch up with the growth of charging stations. ChargePoint continues to burn over $75 million in cash per quarter in order to add a near immaterial subscription revenue amount.

Investors need to remember the charging stations installed in the prior years could quickly become outdated. ChargePoint only has a net cash balance of $104 million now after burning all the SPAC cash to build an $85 million subscription business with relatively low gross margins.

The stock still has a market cap of $4 billion and ChargePoint has limited value with a large focus on low calorie revenues producing limited gross profits.

Takeaway

The key investor takeaway is that investors have wrongly chased ChargePoint since the stock went public. The EV charging station company continues to have a flawed business model not worthy of investment.

Be the first to comment