da-kuk/E+ via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on May 27th, 2022.

Franklin Limited Duration Income Trust (NYSE:FTF) hasn’t been having a stellar year, but to be fair, not a lot of the market has in either the equity or fixed-income space. Of course, excluding energy here and utilities and consumer staples that have also done alright in 2022.

FTF has had another big factor that has pushed its price down, and that was the rights offering that it recently completed earlier this year. Stanford Chemist went over the details of that event previously. As is frequently the case, sidestepping the rights offering would have saved investors money. To be fair, though, the final subscription price was $7.61, and on February 23rd, on the expiration date, shares closed at $7.77. At the time of writing, the share price is $6.79, but that has a lot to do with how the market has been performing as a whole.

The other factor is that they announced the rights offering on January 11th, and shares closed at $8.81 that day. So investors could have sold then and bought back even more shares later at this lower price, without laying out any new capital at all. The market’s declines certainly impacted the result of this offering too. It wasn’t just the rights offering that put the pressure on the fund.

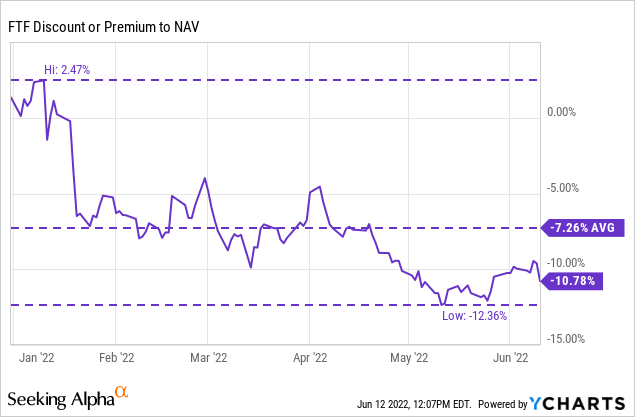

However, the rights offering did seem to put considerable pressure on the fund’s discount/premium. It was flirting with a premium, and then it went into the deep discount we see now. This is often the case and why it frequently works out best to sidestep these rights offerings.

Now that shares have collapsed, they are certainly looking more attractive at the latest discount. They run with a minimum 10% managed distribution plan. This means that investors will always receive a high distribution yield, whether it is earned or not. This is adjusted monthly, which some investors are not fans of since it means a change every month. In this case, though, we shouldn’t be surprised in which way the distribution is heading. If the fund’s NAV ticks higher, it’ll be boosted and vice versa.

The Basics

- 1-Year Z-score: -1.61

- Discount: 10.78%

- Distribution Yield: 11.25%

- Expense Ratio: 1.31%

- Leverage: 30.54%

- Managed Assets: $319.74 million

- Structure: Perpetual

FTF’s investment objective is “to provide high, current income, with a secondary objective of capital appreciation.” They do this by investing “primarily in high yield corporate bonds, floating rate corporate loans and mortgage- and other asset-backed securities.”

Since the fund has a tilt towards limited duration, this is where the floating rate corporate loans come in. This can keep the fund’s duration in check since they are less sensitive to interest rate risks. However, this portfolio is also going to be tilted towards lower-rated companies. This can leave it more vulnerable during recessions or economic slowdowns.

The fund’s leverage is fairly high, which should be considered before investing. Mixing junk-rated debt with higher amounts of leverage when the economy is expected to slow down with Fed rate hikes, and that isn’t generally a great mixture. That being said, it isn’t uncommon for these types of closed-end funds to be carrying around this amount of leverage either.

Additionally, the leverage has another headwind for the fund as the borrowings are based on 3-month LIBOR plus 0.90%. The other leverage is brought about through reverse repurchase agreements. These are short-term borrowings and also going to be based on floating rates. That means that even though a portion of its portfolio will benefit from higher rates once the floor rate is breached, the fund’s interest expenses will also be rising.

The fund’s expense ratio comes to 1.31%, and it comes up to 1.75% when including leverage expenses. In 2019, rates were highest in the last rate rising cycle, and the fund’s expense ratio touched 2.16%. This can give us some better context of where the expense ratio could go with higher rates. Of course, we are anticipated to go higher this time with rates than we did last.

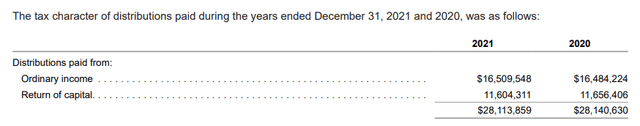

Performance – Attractive Discount

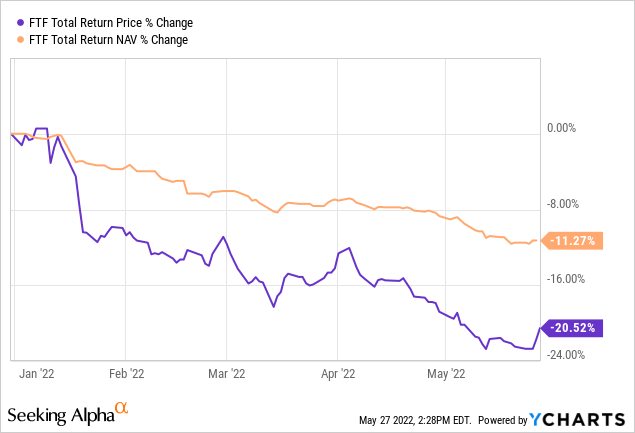

Overall, the fund has been struggling, similar to the other funds. As we touched on, a lot of the decline in the share price came as the result of a widening discount brought on by the fund’s rights offering.

YCharts

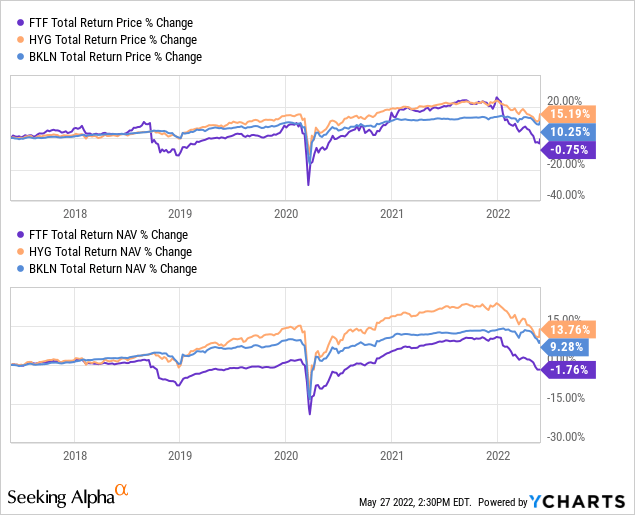

Given that the fund has a portfolio that is mostly split between high yield and floating rate, it’s a bit of a hybrid fund. In fact, it is listed as a multi-sector bond fund as there are some other exposures here too.

With that type of exposure, it would seem that it should have come in between the performance of iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and Invesco Senior Loan ETF (BKLN). Both of these ETFs have had positive returns over the last five years. Which then should have actually translated into FTF performing even better with its leveraged portfolio.

YCharts

To me, this is one area that isn’t too reassuring to make FTF a long-term investment. While being a bit different, it should have still generally trended with positive returns, in my opinion. Even with BKLN, the returns haven’t been too appealing since rates have been so low. With higher rates going forward, there is a better chance that performance could be stronger.

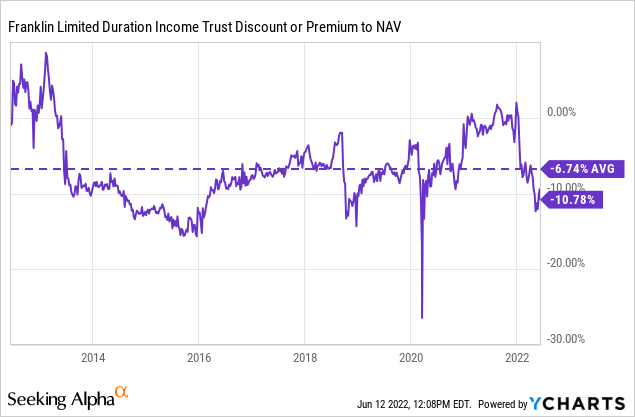

That leaves the discount at this time being really the only primary draw of the fund. The discount could be interesting if one believes they can turn their fortunes around going forward, despite the weak performance historically. We all know investing is about looking forward, not what has happened in the past.

Even with its rather persistent discount, the latest discount still puts it well below where the average comes in for the last decade. Additionally, yields have been coming down a bit at this time. That should mean that some of the pressure on FTF also is letting up.

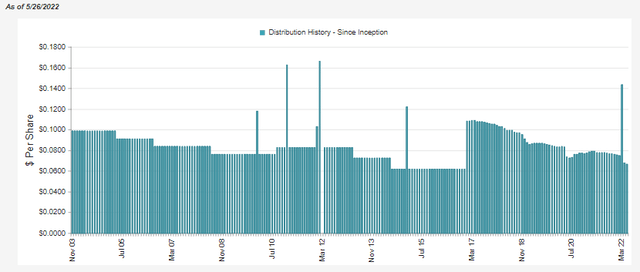

Distribution – Managed 10%

The fund pays out a monthly distribution that varies each month. It is based on calculating the average monthly NAV. This has translated into a distribution change every month. Since they haven’t been able to earn their distribution, that means that the trend has gone mostly one way, mostly lower.

FTF Distribution History (CEFConnect)

Going forward, if rates rise rapidly enough and to a high enough extent, the underlying floating rate loans could potentially start earning enough. That could translate into higher distributions at some point in the future. Of course, the hurdle they have to get over is the higher interest expenses on their leverage too.

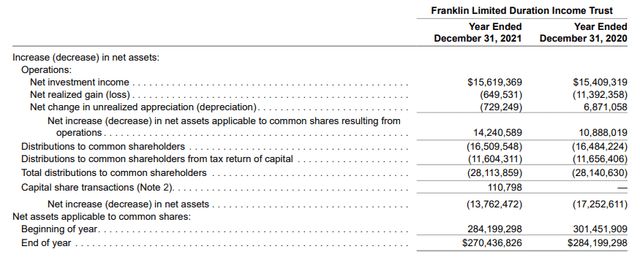

With what we are seeing, it comes to little surprise that the net investment income coverage of the fund is quite weak.

FTF Annual Report (Franklin)

They simply can’t earn 10%+ in this environment. They’d have to earn that 10% plus the expense ratio if they wanted to see the NAV increase and distributions head higher.

The bright spot here is that the fund’s distribution is at least mostly predictable given the 10% managed plan.

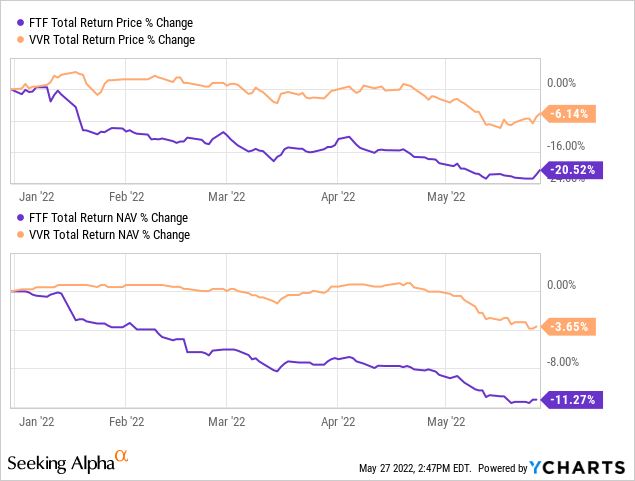

For tax purposes, the distribution is split between ordinary income and return of capital. In this case, the return of capital would be destructive due to the eroding of the NAV to continue paying investors.

FTF Tax Character (Franklin)

FTF’s Portfolio

The fund’s average maturity comes to 6.74 years. However, the average duration of the portfolio only comes to 1.78 years. Again, this is thanks to the floating rate exposure the fund is carrying. That does a lot to reduce the sensitivity to interest rates. Despite this, the fund has seen declines even on a NAV basis. Besides the duration, I believe the other factor here is the economic outlook becoming weaker.

We have seen this play out in pure floating rate funds. As an example, I hold Invesco Senior Income (VVR). The total NAV return has held up much better, but we still are seeing some small declines on a YTD basis. We even see the total return sagging further, which translates into widening discounts.

YCharts

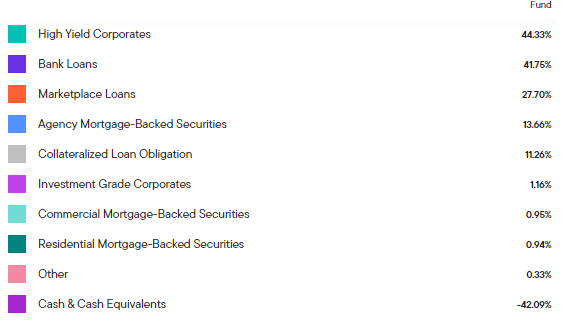

The breakdown of FTF shows us that high yield and bank loans make up over 85% of the managed assets. These were the sector allocations as of April 30th, 2022.

FTF Asset Breakdown (Franklin)

However, they still have marketplace loans and agency MBS that makeup fairly meaningful allocations for the fund too. The marketplace loans are through several platforms such as Upstart Network, Freedom Financial Asset Management, LendingClub and Prosper Funding.

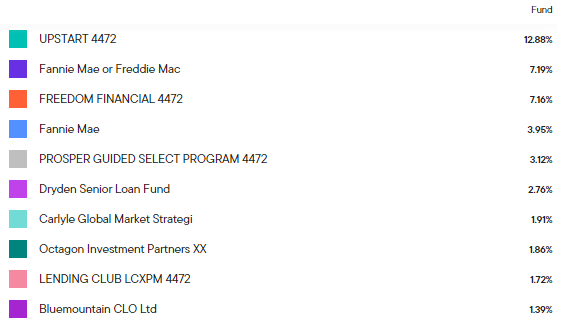

When looking at the top ten holdings, these marketplace loan platforms come in as some of the largest exposure.

FTF Top Ten (Franklin)

However, these are further diversified because they aren’t just one position. There could be hundreds or thousands of underlying loans within these platforms. For Upstart, they list that they are receiving interest rates of 5.16% to 32.71%. These loans expire anywhere from September 16th, 2024, to December 16th, 2028.

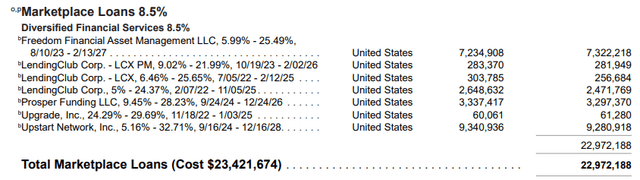

Here is the list in the last Annual Report that shows the details of each of these platforms.

FTF Marketplace Loan Exposure (Franklin)

Marketplace loans aren’t necessarily a bad investment but are riskier. Here is what they have to say in the “important information” in their reports that everyone reads:

Marketplace Loans generally are not rated by rating agencies; are often unsecured; not guaranteed or insured by a third party; not backed by any governmental authority; and are highly risky and speculative investments similar to an investment in lower rated securities or high yield debt securities (also known as junk bonds). Lenders and investors, such as the Fund, assume all of the credit risk on the loans they fund or purchase and there are no assurances that payments due on the Marketplace Loans will be made. In addition, investments in Marketplace Loans may be adversely affected if the Platform or a third-party service provider becomes unable or unwilling to fulfill its obligations in servicing the loans. The Fund intends to have a backup servicer in case any Platform or third-party servicer ceases or fails to perform the servicing functions, which the Fund expects will mitigate some of the risks associated with a reliance on platforms or third-party servicers for servicing of the Marketplace Loans. Moreover, the Fund may have limited information about the Marketplace Loans and information provided to the Platform regarding the loans and the borrowers’ credit information may be incomplete, inaccurate, outdated or fraudulent. It also may be difficult for the Fund to sell an investment in a Marketplace Loan before maturity at the price at which the Fund believes the loan should be valued because these loans typically are considered by the Fund to be illiquid securities.

These are essentially higher-risk positions within the portfolio as they aren’t regulated the same way companies are when they are issuing debt. These are also listed as the largest contributor to the level 3 securities within FTF’s portfolio. So this would just be one area of the portfolio I’d want to keep an eye on as it looks like they are increasing their exposure here.

Conclusion

FTF doesn’t come off as a great closed-end fund investment option for the long-term holder. They have poor historical performance, and as soon as they got to a premium for the first time in nearly a decade, they pulled a rights offering. That isn’t necessarily a bad thing, as these are historical events. What is more important is what could happen going forward.

Unfortunately, there were really only two bright spots I could find from the fund. The first was the discount is back to being attractive but not necessarily thinking that it should rapidly reverse anytime soon. The second characteristic is a high managed distribution plan.

However, even these two positives are a bit overshadowed by the lack of a catalyst to close this discount. The managed distribution plan gets reset monthly, and the distribution also hasn’t been close to being covered.

All this being said, an argument could still be made that it makes a compelling short-term position if one believes it could get pushed back to a premium level again. At the very least, history has shown that the discount hasn’t gone too much wider than where it is now.

Be the first to comment