energyy/E+ via Getty Images

The last time I covered American Tower (NYSE:AMT) and Crown Castle (NYSE:CCI) in February, they had sold off significantly in the first couple months of 2022. I also explained why I was buying positions in the family portfolio I’m running. They represent solid dividend growth investments with good track records and long-term tailwinds that should power future dividend increases. Both have sold off by more than 10% along with the broader market, and now might be a good time for investors to start nibbling on shares of these two cell tower REITs.

Investment Thesis

American Tower and Crown Castle are the two dominant cell tower REITs available to investors. Shares have sold off recently, giving new investors a chance to buy these two dividend growth investments at reasonable valuations. Investors that prioritize current yield might prefer Crown Castle, with its 3.8% dividend. Others might prefer American Tower for its international footprint and quarterly raises on its 2.4% dividend. Both are trading at good valuations given the long-term tailwinds for the communication sector and the quality of the businesses. American Tower trades just under 24x price/FFO and Crown Castle sits just under 22x price/FFO. I own both and plan to own them for a long time to come for the growing income stream and the potential for price appreciation as a long-term investor.

A Brief Update on the Businesses

American Tower recently completed an equity offering at the beginning of June. They priced 8.35M shares at $256, raising just under $2.1B dollars. With the investment opportunities they have, they should be able to put this dry powder to work in attractive investment opportunities around the world. The equity offering is likely part of the reason behind the recent selloff, and it is a buying opportunity in my opinion.

As I mentioned in the previous article, American Tower is more focused on international investment opportunities, while Crown Castle has prioritized US investment in small cells, which is going to be a key component of the 5G network. If readers are interested in a more detailed summary of the businesses, as well as the CoreSite acquisition for American Tower, I would recommend skimming my past articles on the two REITs.

Valuation

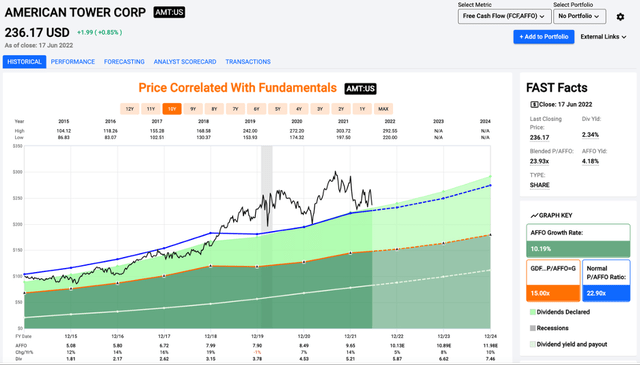

American Tower has traded at an average multiple of 22.9x price/FFO in the last handful of years and has routinely traded above that for the last couple of years. Shares currently go for 23.9x, and I think a mid to high 20s multiple would make sense for American Tower. If you are very picky on margin of safety, you could hold out for a drop into the low 200 range. If broader markets continue to sell off, it’s possible that we see lower share prices in the coming months.

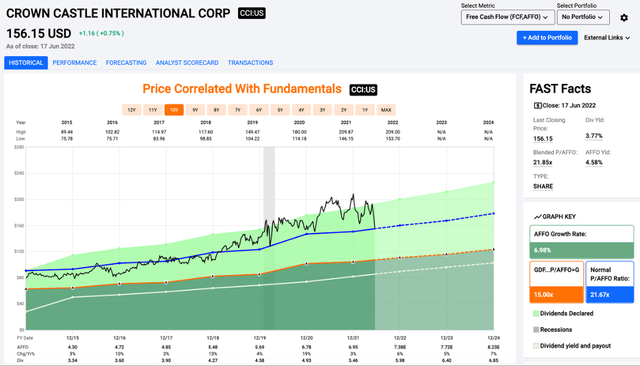

Crown Castle is slightly cheaper than American Tower, with a 21.9x price/FFO multiple. I am curious to see how the two different strategies between the two REITs plays out, but I think Crown Castle is a good buy below $160. Shares have also traded at a higher multiple in recent years, and I think that is likely to continue. Like American Tower, I think Crown Castle is worth a mid to high 20s multiple.

These REITs are different from the typical REIT that owns a property and leases it to one tenant. They can lease their towers (or small cells) to multiple tenants, which creates better margins and returns. That is part of the reason why they have been able to generate impressive dividend growth for much of the last decade.

Dividend Growth Machines

You will be able to find higher yields in the REIT world, but the consistency of the dividend growth for these two cell tower REITs is what attracts dividend growth investors. They have both been able to grow the dividend for years at a double-digit rate, and I think that is likely to continue for the foreseeable future with the long-term tailwinds due to the 5G rollout (primarily for Crown Castle in the US) and new towers being built internationally for American Tower. It might not be as impressive as the last decade due to the law of large numbers, but I think investors can count on dividend increases for years to come.

Conclusion

The last couple months have been rough on investors. Some think that we are headed into a recession, and many have said it is going to be a deep recession or even depression. While that could be the case, I think American Tower and Crown Castle are well positioned to handle any economic weakness that is headed our way. People aren’t likely to give up their cellphones and all that it entails. American Tower and Crown Castle both trade at reasonable valuations, and investors get paid growing dividends from a business sector with long-term tailwinds. I plan to hold my shares for years to come, but investors looking to start a position in either of these two REITs might consider taking advantage of the recent sell-off.

Be the first to comment