DisobeyArt/iStock via Getty Images

Alpha Pro Tech: Investment Thesis

In my Jan 31, 2022 article, “Alpha Pro Tech: Building Supply Business Growing Strongly“, I concluded APT was a hold at $4.80.

I have again reviewed the outlook for Alpha Pro Tech (NYSE:APT) and conclude the shares are now a buy at the post market price of $4.00 on June 13, 2022.

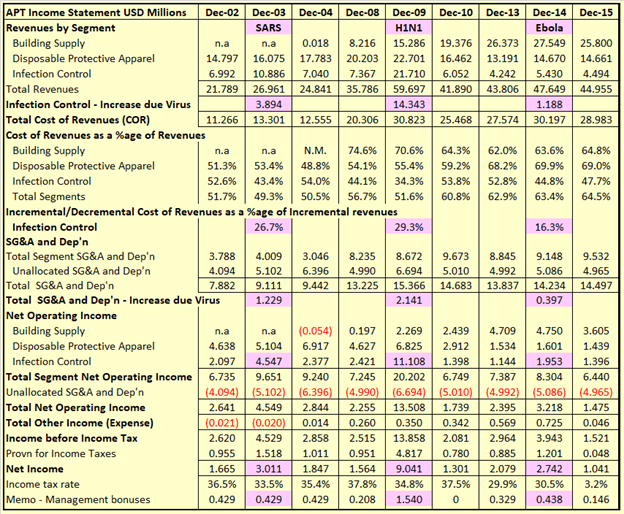

This is a good and well run little family business. The balance sheet is strong, with no debt. A dividend is not paid and there appears to be no intention to commence dividend payments. Therefore, the only avenue for gain is through share price increases. Idle cash will not drive share price gains so share repurchases are essential to reduce share count and thus potentially increase market price per share. The current share price of $4.00 is below the value of net assets (shareholders’ equity) per the balance sheet. A significant proportion of net assets is in the form of liquid assets such as cash and receivables, and other net current assets including inventories, able to be converted to cash. In the past few months the share price has fallen to as low as $3.85, and given the present volatility in the share market, share price could again fall to that level. Nevertheless, the present price of $4.00 appears a reasonable entry point to buy for a long term hold. A compelling reason for buying for a long term hold is the possibility of further disease pandemics and/or a takeover offer. Table 1 below, from my Mar. 16, 2020 article, “Alpha Pro Tech: The ‘Greater Fool’ Theory Is Alive And Well“, shows three disease outbreaks, previous to COVID-19, which caused earnings and share price to soar higher before settling back to normal levels.

Table 1 – APT Income Statement – Selected Years 2002 To 2015

SA Premium and SEC filings

Alpha Pro Tech: Sales Outlook

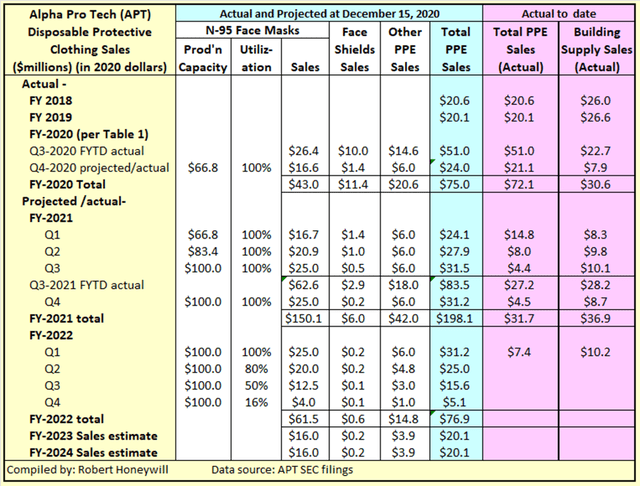

In my previous articles, I discussed massively increased supply capacity and decreasing mask demand may have permanently and unfavorably altered the outlook for APT’s personal protective equipment (“PPE”) business. On the other hand, APT’s fast growing, albeit lower margin building supplies business continues to impress. Table 2 below includes comparative sales figures for the two segments.

Table 2

Comments on contents of Table 2 follow.

Disposable Protective Apparel (“DPA”) Sales –

APT’s DPA sales comprise Personal Protective Equipment (“PPE”) including N95 face masks, face shields and other PPE as shown in Table 1 above. Prior to 2020, APT’s annual DPA sales were around $20 million (~$5 million per quarter). Following the onset of the COVID-19 pandemic APT set out to increase N-95 mask production capacity to meet potential annual sales demand of $100 million for masks. Total PPE sales peaked at $21.1 million in Q4 2020. While this fell far short of the increase in production capacity, there can be no doubt increasing capacity was a very profitable exercise. For Q1 2022, PPE sales of $7.4 million showed a resurgence and were above pre-COVID levels of ~$5 million. The high levels of PPE sales in Q1 2021 resulted in Q1 2022 being unfavorable in comparison to prior year. On a more favorable note, excerpted from APT’s Q1 2022 8-K filing,

Both face mask and face shield sales in the first quarter of 2022, which were aided by the Omicron variant of COVID-19, were significantly higher than all quarterly sales since the first quarter of 2021, but still down by over 59% and 52% respectively, on a comparative basis…New orders have recently improved, indicating that inventory levels have likely normalized. Although sales were down in the first quarter, and more in line with pre-pandemic levels, our major international channel partner’s sales to its end users for the same period were significantly higher than pre-pandemic levels. We are working closely with all of our channel partners to uncover new end-customer sales opportunities…

I believe APT may be benefitting from present supply chain disruption. Much of APT’s current excess stock is already with its channel partners available for meeting orders. This is likely why, after two poor sales quarters, sales surged in Q1 2022. It will be useful to monitor PPE sales achieved by APT in coming quarters (see profit outlook below).

Building Supply Sales –

For Q1 2022, APT Building Supply sales of $10.2 million are up 22.7% on Q1 2021. Management’s outlook for the segment from Q1- 2022 8-K filing,

Management is encouraged by the current demand for its Building Supply products and anticipates continued growth in 2022. The Company has continued to enjoy increased sales and being vertically integrated, having control of their manufacturing, unlike most competitors, aides in minimizing the effects of worldwide supply chain issues. This enables the Company to answer customer needs in a timelier manner than the majority of the competing products in their market space. Both the synthetic roof underlayment and housewrap family of products are expected to continue to grow, although the Company has recently seen some retraction in new home starts and re-roofing expenditures.

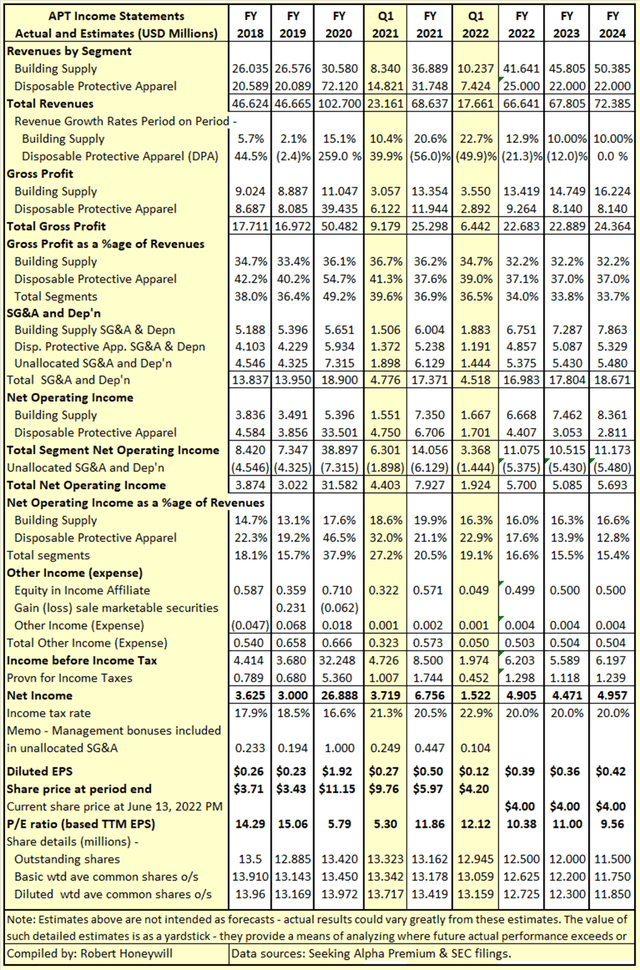

Alpha Pro Tech: Profit Outlook

There are no analysts EPS estimates for APT and APT management do not provide an outlook for EPS range, citing a number of uncertainties. In these situations I find it useful to make ‘what if’ estimates to see what the possibilities are for EPS under certain base assumptions. It is then possible to compare actual results against estimates and understand in detail the factors that are leading to an improvement in or worsening of EPS. This also facilitates an understanding of trends in key performance indicators. I have completed such an estimate for APT per Table 3 below.

Table 3

In Table 3 above, I have assumed Building Supply revenue growth will taper off due inflation impacting home building. Comments on assumptions adopted in Table 3 follow.

Sales revenue – For Disposable Protective Apparel (“DPA”), I have assumed the higher sales level of $7.4 million in Q1-2022 will decline to $5.5 million by Q4-2022 and continue at that level through end of 2024.

Gross profit margins – For both segments, I am assuming inflation will result in lower gross profit margins through end of 2024. Increased competition due new entrants to the DPA business increasing available capacity is also assumed to result in downward pressure on margins for APT DPA business through FY-2024.

Selling, General & Administrative (“SG&A”) expense and Depreciation – APT do not provide absolute amounts by business segment for SG&A expense. They do however include changes in SG&A by segment in the narrative in their SEC filings. The analysis of SG&A is based on the information available together with some arbitrary apportionments. Building Supply SG&A grew from $5.2million for FY-2018 to $6.0 million for FY-2021, due to growth in this business. Continued growth plus higher inflation is assumed to cause Building Supply SG&A to grow at a faster rate through FY-2024. DPA SG&A increased markedly with the additional growth in this segment due COVID-19, but has reduced as sales have declined. Inflation is expected to cause an upward trend after SG&A has bottomed out with return to more normal sales levels. Unallocated SG&A has increased markedly as Building Supply segment has grown and with the effect of COVID-19. It is expected to follow a similar trajectory to DPA SG&A with some further reduction in the short term followed by increases primarily due inflation impact in the longer term.

Outstanding shares – Share purchases are expected to progressively reduce share count through end of 2024. There is a risk here that share issues for employee stock compensation might substantially offset share repurchases. APT has sufficient cash availability, presently and future FCF to repurchase over 25% of its outstanding shares at current share price, so be prepared to be pleasantly surprised here.

Review Of Historical Share Price Performance For Alpha Pro Tech

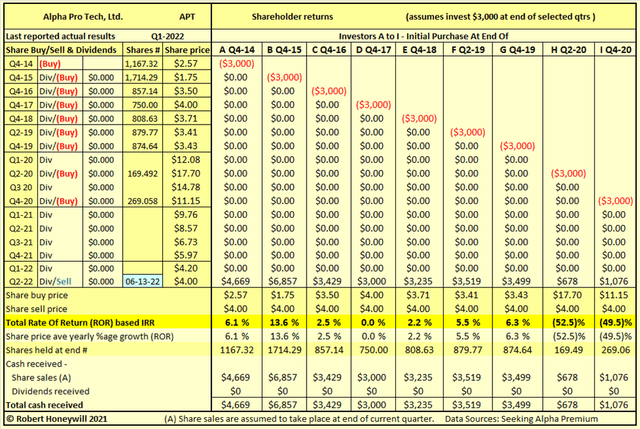

Alpha Pro Tech: Historical Shareholder Returns

In Table 4 below, I provide details of actual rates of return for Alpha Pro Tech’s shareholders investing in the company over the last six years.

Table 4

Table 4 shows returns have been mostly positive for investors buying shares in Alpha Pro Tech over the last six years. Because the company does not pay a dividend, positive returns can only be achieved through an increase in share price above buy price. Investors who bought at inflated share prices at the height of the COVID pandemic suffered negative returns of (49.5)% and (52.5)%. They obviously did not heed my warnings within my March 2020 and July 2020 articles. Of course, during that period of higher share prices, existing shareholders had the opportunity to exit and achieve super profits. I believe the history above is useful for those considering an investment in APT shares today. The rates of return in Table 4 are not just hypothetical results. They are very real results for anyone who purchased shares on the various dates and held through to second quarter 2022. In the above examples, the assumed share sale price is the same for all investors, illustrating the impact on returns of the price at which an investor buys shares.

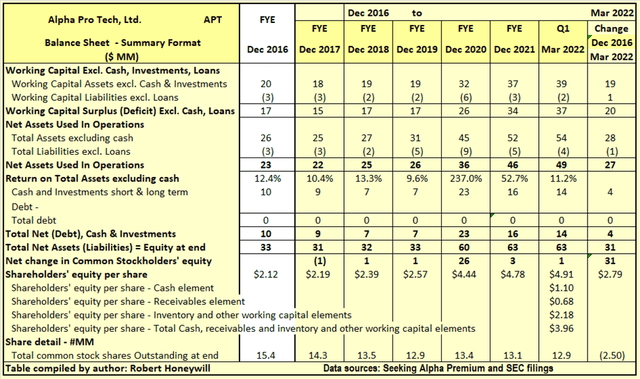

Checking Alpha Pro Tech’s Balance Sheet

Table 5

Alpha Pro Tech’s balance sheet at end of Q1 2022 shows shareholder’s equity of $4.91 is above the share price of $4.00 at post market close on June 13, 2022. In addition, the shares have liquid and current net asset backing of $3.96 per share, in the form of cash $1.10, receivables $0.68 and inventory and other working capital $2.18 per share. The balance of asset backing of $0.95 reflected in the balance sheet is comprised of tangible productive assets, including investment in the Indian production facilities. If PPE sales continue at Q1 2022 levels, there is a likelihood some of the excess inventories will be reduced, resulting in a further increase in cash balance.

APT: Summary and Conclusions

In my view, APT is a Buy at current share price for the following reasons:

- APT currently has sufficient cash to repurchase over 25% of its outstanding shares.

- A high proportion of APT’s earnings translates to free cash flow (“FCF”). As the company does not pay dividends, future FCF will be available for additional share repurchases.

- Share repurchases will grow EPS, even if earnings remain around current levels.

- Even if cash is used to repurchase shares, APT’s liquid and current asset backing per share of $3.96 will not change significantly, if shares are repurchased at current share price of $4.00.

- Excluding operating assets, the share price is almost 100 percent backed by liquid and current assets, and the company has no debt, making APT a possible takeover target. In a takeover scenario, debt could be raised to fund working capital. That would allow all present cash, and cash flow from realization of current inventories and receivables to be taken out by the buyer, without affecting continuing operating capability, and revenue generation.

- APT has so far benefited from four different disease outbreaks over the last 20 years, each of which caused large increases in share price, and an opportunity for existing shareholders to make large share price gains. Buying at current share price appears to have very little downside risk in the medium to long term, and offers the possibility of super profits should another disease outbreak occur. This could even include the possibility of a new variant of COVID-19 not being controllable by current vaccines.

Some risks to consider:

- The increase in DPA sales in Q1-2002 might not be sustained, and sales might fall below pre-pandemic levels, due increased competition in the space.

- Rising inflation might cause a cessation of growth, and even a decline in the Building Supply business segment.

- Share repurchases might be largely offset by increased share issues for employee stock compensation.

- A 100 percent takeover acquisition would likely need to be a “friendly” takeover to succeed due to the number of shares held by insiders, including founders, who might be committed to continuing to operate the business.

Taking the foregoing into account APT warrants a buy rating.

Be the first to comment