Alex Wong/Getty Images News

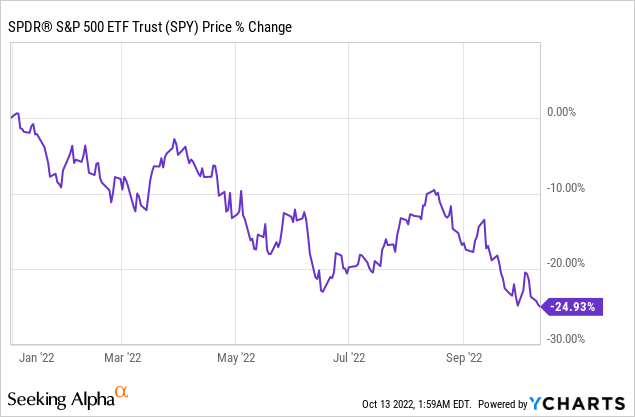

The SPDR S&P 500 Trust ETF (NYSEARCA:SPY) is already down by ~25% year-to-date, putting us firmly into bear market territory:

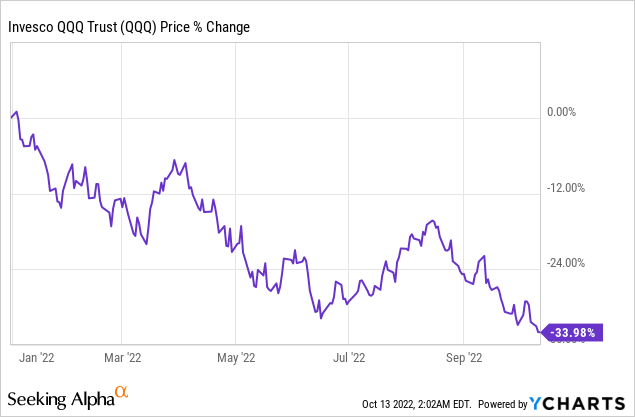

As painful as this has been for SPY, the Nasdaq (QQQ) has gotten hit even harder, down ~34% year-to-date:

As bad as this pullback has already been for retirement accounts and pension funds, billionaire JPMorgan Chase & Co. (JPM) CEO Jamie Dimon seems to think that the market could still drop considerably further. In this article, we share our perspective on this risk and some of our favorite strategies for navigating the current environment.

Jamie Dimon’s Warning

Earlier this week, Mr. Dimon told investors that he expects the SPY to remain highly volatile and even become increasingly “disorderly” in the coming months, and thinks that the index losing another fifth of its value is a very possible outcome in response to continued aggressive Federal Reserve interest rate hikes. He elaborated, saying:

It may have a ways to go. It really depends on that soft-landing, hard-landing thing and since I don’t know the answer to that it’s hard to answer…it could be another easy 20%. The next 20% could be much more painful than the first. Rates going up another 100 basis points will be a lot more painful than the first 100 because people aren’t used to it, and I think negative rates, when all is said and done, will have been a complete failure.”

He went on to state that he expects the U.S. to slide indisputably into a recession within “six to nine months” though he does not know whether this recession will be very mild or “quite hard.” He then urged investors and companies to prepare themselves for a worst-case scenario.

Our Outlook For SPY

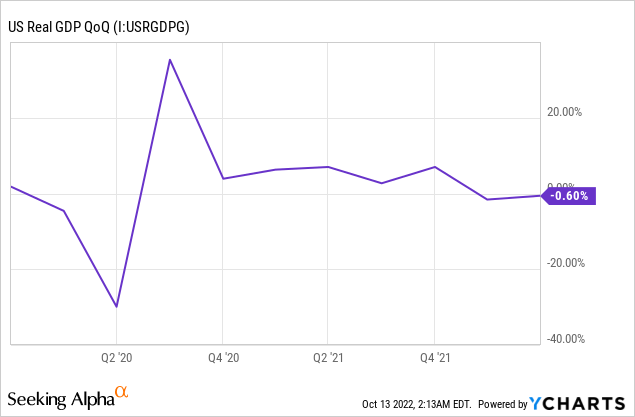

We certainly agree with Mr. Dimon that the U.S. has a recession in store for it and believe we could actually be in a recession already. After all, Q1 and Q2 of 2022 were already in the red, which is for many already a textbook recession:

While the Q2 number in particular was barely in the red and we realize that in an election year the exact rhetoric used to describe current economic conditions can get a bit sensitive, it is safe to say that at a bare minimum we are in a zero growth environment. However, with interest rates rising, major tech companies announcing thousands of layoffs, the housing sector already in a severe recession, inflation continuing to rage near four-decade highs, and an increasingly negative outlook weighing on economic activity, it is very difficult to see how the economy returns to growth anytime soon and the odds are heavily in favor of the U.S. economy sliding into an indisputable and meaningful recession in the coming months.

While this all sounds very gloomy for the SPY, it is important to remember that the stock market is largely a forward-looking machine, so some – if not all – of this negativity is probably already priced in by the 25% sell-off in the index already this year. To get a better sense of where the market is right now, let’s look at a set of popular market valuation models.

The Yield Curve Model implies that the market is currently slightly over valued as the spread between the 10-year Treasury yield and the 3-month Treasury yield is 0.51%, which is 100 basis points below the historical average spread since 1950. This makes it slightly above the fair value line, but not an extreme departure.

The Buffett Indicator – the ratio of the total U.S. stock market cap to the GDP – is also slightly above historical trend average at 153%, but no longer enough to be considered clearly overvalued.

The same can also be said for the P/E ratio model, which is the ratio of the total price of U.S. stocks against the total average earnings of the market over the past 10 years via the cyclically adjusted PE (i.e., CAPE). At a level of 26.6, it is above the long-term historical trend of 20.1, but not nearly as extreme of a level as has been seen at times in the past.

The Interest Rate model – which is simply a comparison between the relative S&P 500 position and the relative interest rate level – indicates that the market is pretty much at perfect fair value right now.

One positive indicator for the stock market right now – and one that should help mitigate the chances of a flash crash moving forward – is that margin debt has declined rapidly in recent months. In fact, margin debt as a percentage of total stock market value is currently below the historical trend, indicating that the market may actually be undervalued at the moment.

Overall, it is hard to say that the SPY is undervalued given that most of the prominent valuation models seem to indicate that it is either fairly valued or even slightly overvalued. Furthermore, if the economy continues to weaken and the recession ends up being quite severe and the Federal Reserve raises rates aggressively, stocks could definitely get hit significantly harder in a manner similar to what Mr. Dimon suggested the other day in his comments. That said, it is good to see that much of the speculative froth has already left the market and the stock market no longer appears to be seriously overvalued.

To us, this indicates that right now is not a bad time to dollar cost average into SPY for those with a long-term time horizon. Bottoms are impossible to time, and the valuations have fallen to a level that is close enough to fair value according to many of these models that over the long-term, investments made today are likely to generate solid total returns.

Investor Takeaway

While further economic pain is almost guaranteed to be in store for the United States and many other major economies, that does not necessarily mean that the stock market will continue to plunge. This is because SPY has already lost a quarter of its value this year due to rising interest rates and the negative forward outlook for the economy.

On the other hand, valuation models do not seem to indicate that the market is meaningfully undervalued either, so further meaningful hikes in interest rates and/or a worst-case scenario playing out for the economy could drive another major leg down in the market.

Regardless of where stocks head from here, we think that it is likely that the market will at the very least remain highly volatile and the ongoing war in Ukraine and OPEC’s decision to cut oil production will mean that energy prices are likely to remain elevated for the foreseeable future. As a result, we are being extra careful at High Yield Investor by investing in stocks that are positioned to benefit from increased volatility and elevated energy costs, while also guarding against recession. Some of our favorite picks of the moment include Virtu Financial (VIRT) – a market-maker that benefits from spikes in volatility (VIX) – as well as energy midstream businesses like Energy Transfer (ET) and Enterprise Products Partners (EPD).

For passive investors, now is still a decent time to be dollar cost averaging into the stock market, especially if you have a long time horizon. However, we believe that picking and choosing individual high yielding stocks that trade at discounted valuations in recession-resistant sectors like energy midstream and market-making as a complement to a more broadly diversified portfolio is prudent. For us, it has enabled us to generate flattish returns year-to-date at a time when the SPY has lost a quarter of its value.

Be the first to comment