busracavus

Investment Thesis

Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) is a cheaply valued highly profitable toll bridge on our digital economy. Indeed, few investors question Alphabet’s free cash flow potential.

What investors care about today is, when will the pain end. Here, I attempt to shine some light on the path out of this darkness.

We’ve already embraced the worst of this bear market, contrary to what many seem to believe. The risk-reward here is very good.

How Did We Get Here?

The market’s multiple has substantially compressed in 2022. We went from a period of 0% interest rates to 4% extremely quickly. That pace of change had not happened in 40 years. We have to embrace that change. The pace at which interest rates climbed can’t even make mathematical sense, it’s impossible to calculate (4%/0%= not calculable)

Today, investors are waiting to find out at which point will the Fed pivot. Allow me to say that you don’t want to invest worrying about what the Fed will do every 6 weeks. That’s an extremely tough investing style that even the hedge funds that are supposed to excel at that, struggle to outperform in those instances.

Instead, what I propose you should think about is that if there is a further increase from 4% to perhaps 5%, that is a 25% increase in the underlying interest rates. And even then, I don’t believe that having rates at 5% is a serious topic of discussion. Indeed, a more moderate rate has been signaled to the market.

Consequently, for all intents and purposes, we are already done with the bulk of the heavy lifting.

Google and the Most Expensive Commodity

Time is the friend of the wonderful company, the enemy of the mediocre. (Warren Buffett)

Again, as I’ve attempted to make the argument, the bulk of the work by the Fed has already been done. That’s it. All we need to do is wait. But I fully recognize that today time is the most expensive commodity.

Investors are incredibly short-term oriented at the best of times. But today, we are bombarded with ”macro bear” news, because it drives up both cortisol and clicks.

For my part, I think, Alphabet today is being priced at the same price as it was 19 months ago, nearly 2 years ago! It’s as if someone said, all the investment, capex, and hard work that Alphabet put in the past 2 years, you can get that for free! It’s as if someone wound back the clock, and said, here you can have Alphabet for the same price as it was then.

Indeed, the whole point of the bear market is to shed out weaker competitors. Competitors that have little more than a colorful story of how they’ll succeed in delivering targeted high ROI adverts with a technology platform to measure the impact of those adverts, but behind the curtain have no real viable business model. These peers will fall by the wayside, and lose market share in times of market turbulence. And the strongest will survive and gain market share.

But again, this all takes time.

GOOG Stock Valuation – 17x 2023 EPS

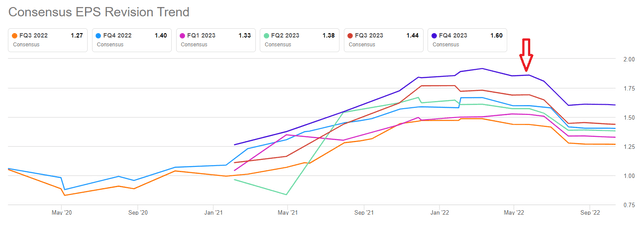

What the red arrow above points to is that analysts have started downwards revising Alphabet’s non-GAAP EPS estimates. That’s exactly what you want to see.

Now, realistically, I suspect that there is more work to be done. I believe that analysts will have to further downwards revise Q4 2022 (blue line) and Q1 2023 (magenta line).

In my opinion, there’s little chance that those estimates have come down enough given all the insights we’ve gained from different companies and CEOs in the past few weeks. For example, Micron (MU), AMD (AMD), FedEx (FDX), as well as commentary from Jamie Dimon.

But even if analysts are slightly wrong, and Alphabet’s multiple ends up extending as earnings come down, and rather than the stock being priced at 17x next year’s EPS, it’s actually priced at 20x its 2023 EPS, that’s a very attractive valuation, for a really long-term compounder such as a Alphabet.

Ultimately, there are certain companies that simply don’t trade for 10x earnings. I believe that in two years we’ll look back to Alphabet priced under $100 per share and say ”it was obviously cheap then”.

The Bottom Line

Every few years there are bear markets. And every few years, investors forget that there are bear markets.

Any time we invest, we know that stocks can go down as well as up. And we get all cut up when stocks go down. But if stocks didn’t go down, we would not have a properly functioning market, where price discovery could take place, deals made, and funds raised. It’s perfectly healthy to have down periods.

In fact, the worry would be if the market had lost control. Remember, we’ve done so much of the work already. And when I hear people call today for a further 20% drop, I think, so what?

Firstly, we’ve already done more than that already. And secondly, it’s not that it’s impossible to get a further 20% drop, but the bulk of the problem here we had was the Fed’s tightening cycle. And we’ve all already endured that. What new material news is not yet factored in?

Could it not be that the time to be openly pessimistic has already come and gone? Allow me to make this clear, saying that the time to be pessimistic has come and gone, is not the same as saying that the coast is all clear. My point throughout is that it’s now just a waiting game. The bulk of the work has already been done.

Be the first to comment