AsiaVision/E+ via Getty Images

The travel from farm to plate that our food takes is a mystery to most Americans. Behind the scenes, there are a number of large and small companies alike dedicated to growing or raising, harvesting, transporting, and otherwise dealing with the food that we consume every day. One of the vital players in this network is US Foods Holding Corp. (NYSE:USFD). With a distribution network servicing around 250,000 customers throughout the US, and a market capitalization of $6.4 billion, US Foods is a large player and a force to be reckoned with. In recent years, the financial performance of the company has been rather volatile. At the same time, shares are trading at levels that are, on an absolute basis, fairly attractive. But between the mixed performance in terms of revenue and profitability, and how the company is priced relative to similar players, I do think a ‘hold’ rating would be more appropriate.

A vital player for everyday Americans

As I mentioned already, US Foods operates as a major distributor of food nationwide. According to management, the company services its customers, a list that includes single and multi-unit restaurants, regional restaurant chains, national restaurant chains, hospitals, nursing homes, hotels and motels, country clubs, government agencies, colleges and universities, and retail locations across the US. Through its network, the company makes available over 400,000 fresh, frozen, and dry food SKUs to its customers. It also sells certain nonfood items. It does all of this through the roughly 6,000 suppliers that it has relationships with and through the efforts of approximately 4,000 sales associates that it employs. The company’s current network consists of 69 distribution facilities and a fleet of trucks numbering roughly 6,500 in all. The company also has 80 cash and carry locations at its disposal. These particular locations offer customers with a retail option in between deliveries when and where appropriate.

To get where it is today, US Foods has grown both organically and inorganically. On the inorganic side, the company has engaged in a number of acquisitions. For instance, in 2020, it purchased Smart Foodservice in order to grow into the cash and carry store business in certain states. That deal cost the company $972 million. And in September of 2019, the company acquired five food service companies for a combined $1.8 billion.

At present, the types of products the company sells are highly diverse. However, its single greatest exposure is to meat and seafood. During the company’s 2021 fiscal year, sales under this category accounted for 38.1% of the firm’s revenue. Dry grocery products came in second, representing 16.9% of sales. This was followed by refrigerated and frozen grocery products at 15.1%. Other major product categories include dairy, equipment, disposables, and supplies, beverage products, and produce.

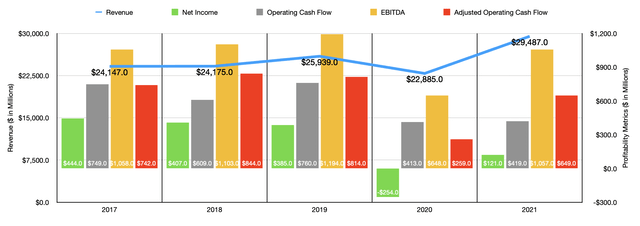

Author – SEC EDGAR Data

Over the past few years, the management team at US Foods has done a really good job growing the company’s top line. Driven in large part by acquisitions, revenue rose from $24.15 billion in 2017 to $29.49 billion last year. This is not to say that there was not some volatility along the way. Revenue actually fell from 2019 to 2020, dropping from $25.94 billion to $22.89 billion. But as the global economy reopened and consumers began eating out again, sales ultimately rebounded and even surpassed what they were before the pandemic. When it comes to the 2021 fiscal year specifically, management did say that total case volume increased by 16.9% while independent restaurant case volume grew by 28%. The aforementioned acquisition of Smart Foodservice added $1.18 billion to the company’s revenue, accounting for 17.9% of the increase in sales year over year.

Although it’s nice to see revenue increase, profitability has been a different animal entirely. Net income actually fell for four years in a row, declining from $444 million in 2017 to negative $254 million in 2020. In 2021, the company generated a profit of only $121 million. Of course, there are other important profitability metrics to consider. For instance, there’s operating cash flow. But like net income, it has been all over the map in recent years, ranging from a low of $413 million to a high of $760 million, with no clear trend visible. Even if we adjust for changes in working capital, there really is no clear trend for this metric. The same can also be said of EBITDA, but to a lesser extent. Between 2017 and 2019, this metric improved year over year, climbing from $1.06 billion to $1.19 billion. It then plummeted to $648 million in 2020 before coming in at $1.06 billion last year.

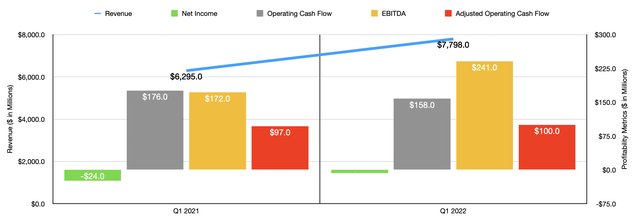

Author – SEC EDGAR Data

For the 2022 fiscal year, financial performance has been generally positive. Revenue, for starters, came in during the first quarter at just under $7.80 billion. This represents an increase of 23.9% compared to the $6.30 billion generated one year earlier. Management attributed this sales increase to a couple of different factors. For instance, total case volume increased by 4.1% while independent restaurant case volume jumped by 9.2%. At the same time, the company also so average inflation of 17.3% spread across multiple product categories like beef, poultry, and pork. Ultimately, management was successful in transferring these costs over to the customers.

When it comes to profitability, the picture this year has also been positive. The company went from generating a net loss of $24 million in the first quarter of 2021 to generating a loss of $7 million the same time this year. Operating cash flow did worsen, falling from $176 million to $158 million. But if we adjust for changes in working capital, it would have risen from $97 million to $100 million. During the same timeframe, EBITDA managed to grow, rising from $172 million to $241 million. When it comes to the 2022 fiscal year as a whole, management has offered some guidance. They currently expect earnings per share to be between $1.95 and $2.25 on an adjusted basis. This gives me a rough estimate for adjusted earnings of $470.2 million, up from the $388 million achieved one year earlier. The company also provided guidance when it came to EBITDA. This should ultimately rise to between $1.2 billion and $1.3 billion for the year. Stripping out some other assumptions included by management, we get a rough estimate for operating cash flow of $730 million for the year.

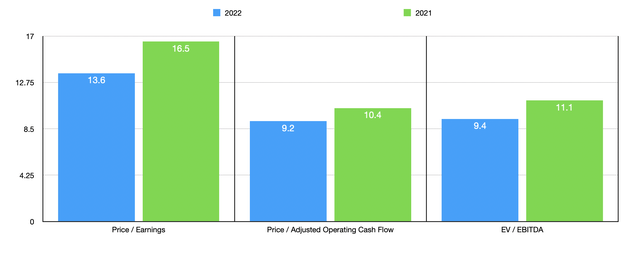

Author – SEC EDGAR Data

Using this data, I calculated that the company is trading at a forward price to adjusted earnings multiple of 13.6. This compares to the 16.5 reading that we get for 2021. Personally, I think that operating cash flow and EBITDA make for better ways to value the enterprise. Doing this, we get a forward multiple of 9.2 for the price to operating cash flow approach. That’s down from the 10.4 reading we get if we use 2021 data. And for the EV to EBITDA approach, the multiple should be 9.4. That compares to the 11.1 that we get if we rely on 2021 results. To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 9.2 to a high of 89.7. When it comes to the EV to EBITDA approach, the range is from 6.1 to 21.3. In both cases, three of the five companies were cheaper than US Foods. Using the price to operating cash flow approach, the range was from 5.1 to 584. In this scenario, two of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| US Foods Holding Corp. | 16.5 | 10.4 | 11.1 |

| Performance Food Group Company (PFGC) | 89.7 | 21.4 | 14.5 |

| United Natural Foods (UNFI) | 9.2 | 9.3 | 6.1 |

| The Chefs’ Warehouse (CHEF) | 84.8 | 584.0 | 21.3 |

| The Andersons (ANDE) | 12.2 | N/A | 9.3 |

| SpartanNash Company (SPTN) | 14.4 | 5.1 | 7.3 |

Takeaway

Over the past few years, the management team at US Foods has done a good job growing the company’s top line. At the same time, I wish they had paid the same attention to the firm’s bottom line. Financial performance has been all over the place when it comes to profitability and that makes it difficult to justify buying the stock. On a forward basis especially, shares look attractively priced. But when put into context, including how the company is priced compared to similar firms, I cannot help but to rate the business a ‘hold’ at this time.

Be the first to comment