AndreyPopov/iStock via Getty Images

Introduction

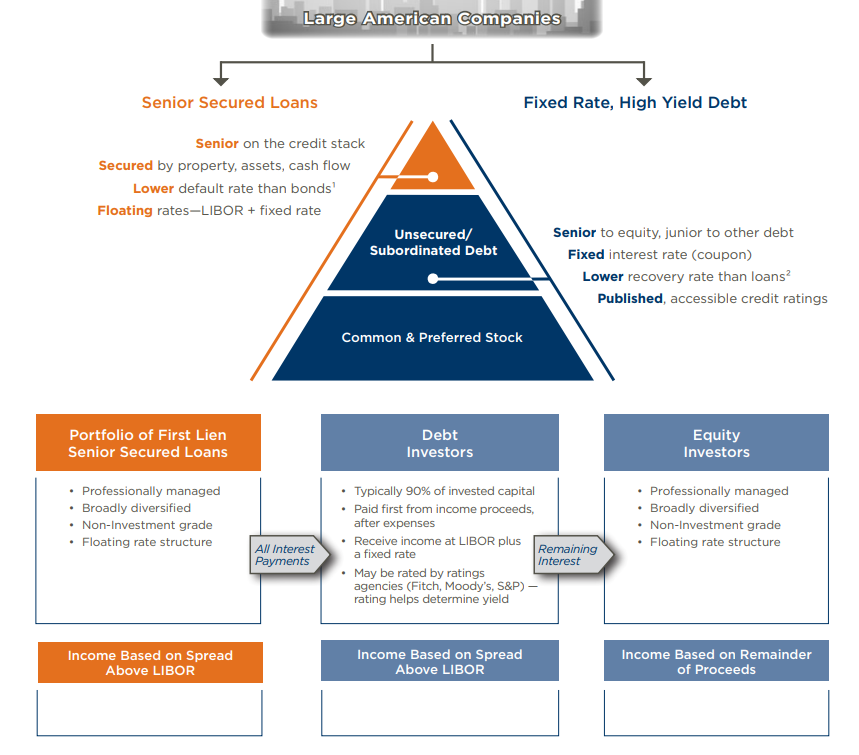

Priority Income Fund is a closed-end management investment company investing in senior secured loans issued by companies that do not have an investment grade rating. The Fund achieves this by making investments in senior secured loans directly and (mainly) by buying the junior and equity tranches of Collateralized Loan Obligations (which own the senior secured loans). While the Fund is not listed, it has issued several different types of preferred shares and most of them actually have a maturity date.

CLOs are a black box so I consider Priority Income to be a speculative investment

Before getting into the details of Priority Income Fund, I’d like to be clear. I consider this CEF a ‘black box’. You never really know what is included in the CLOs and you are basically ‘betting’ on the asset management team to do its homework and make the right decisions.

In fact, one should consider Priority Income Fund to be a higher risk investment as the CEF invests in the residual interest investments in CLOs and the assets are thinly traded so it is not easy for Priority to sell assets if there is a need to.

PRIF Investor Relations

My position in Priority Income Fund is a ‘legacy’ asset as I acquired the positions before the interest rates started to increase.

I like the preferred shares for a few important reasons

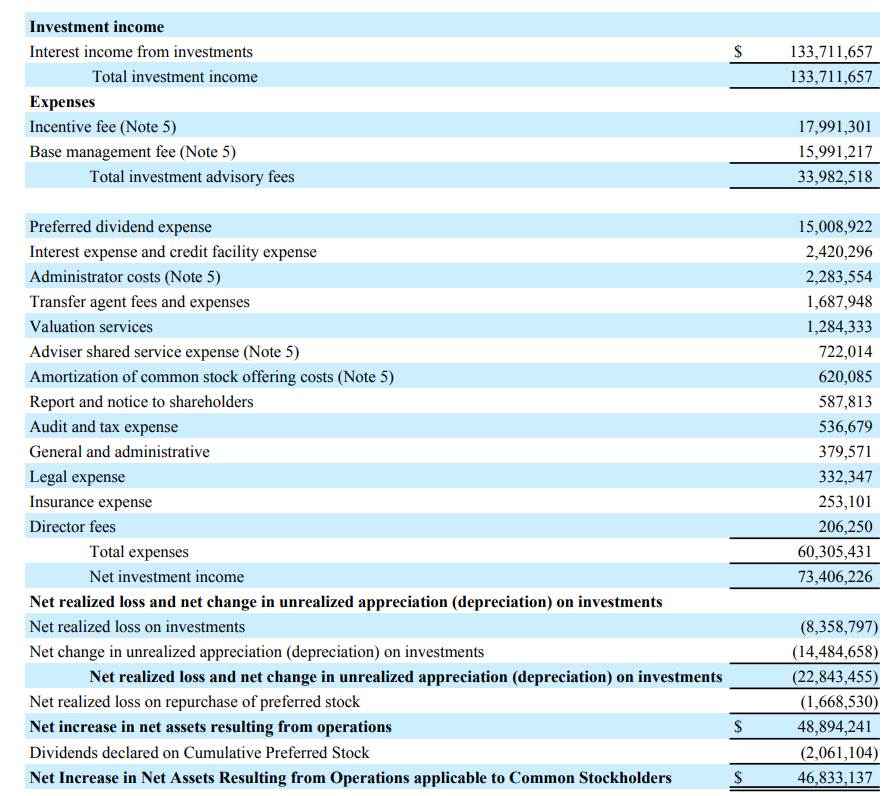

Priority Income’s financial year ends in June, so we have access to the fund’s most recent annual results. In FY 2022, PRIF reported a total investment income of just under $134M and after paying the incentive fees and base management fee, almost $100M in gross income was reported.

PRIF Investor Relations

As you can see above, the remaining operating expenses are just around $27M and in excess of $15M is related to making the preferred dividend payments. 2022 was a good year for PRIF as its net investment income came in at $73.4M and even after taking the realized and unrealized losses on investments into account, the net income was roughly $49M while the net income attributable to the common stockholders was just under $47M after taking the $2.06M in additional preferred dividends into account.

As you can see, there are two types of preferred dividends. The majority of Priority’s preferred securities have a mandatory call date and should be seen as a debt-like security. Those preferred dividends are included in the operating expenses.

Priority Income Fund also has one security outstanding (NYSE:PRIF.PK) that is a perpetual preferred security and due to the perpetual nature, the preferred dividends on that security are deducted from the net income.

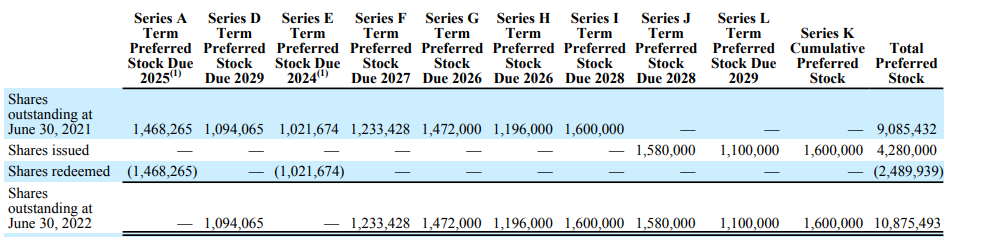

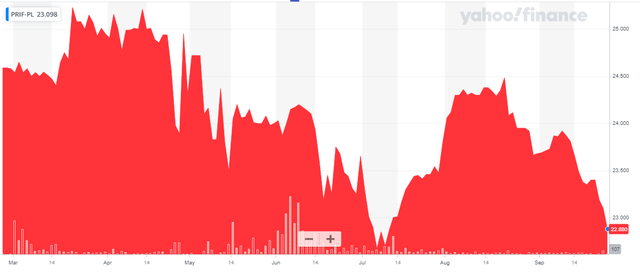

I wanted to have a closer look at the preferred shares L, trading as (PRIF.PL) which were issued earlier this year. It’s a rather small issue with just 1.1M shares outstanding for a total value of $27.5M.

PRIF Investor Relations

The L-series can be called from February 2025 on, and have a mandatory maturity date on March 31, 2029. The preferred dividend rate is $1.59375 per year (payable in four quarterly tranches) and as PRIF.PL is currently trading at $22.88, the yield has increased to around 7% based on the current share price. However, as these preferred securities have a mandatory redemption in 2029, we should focus on the yield to call, and assume that call will only happen in 2029. The yield to call is approximately 8.1% based on the current situation and sub-$23 share price.

The preferred shares are passing the dividend coverage test. Even after taking incentive fees and base management fees into consideration, PRIF has to spend less than 20% of its net investment income on the preferred shares.

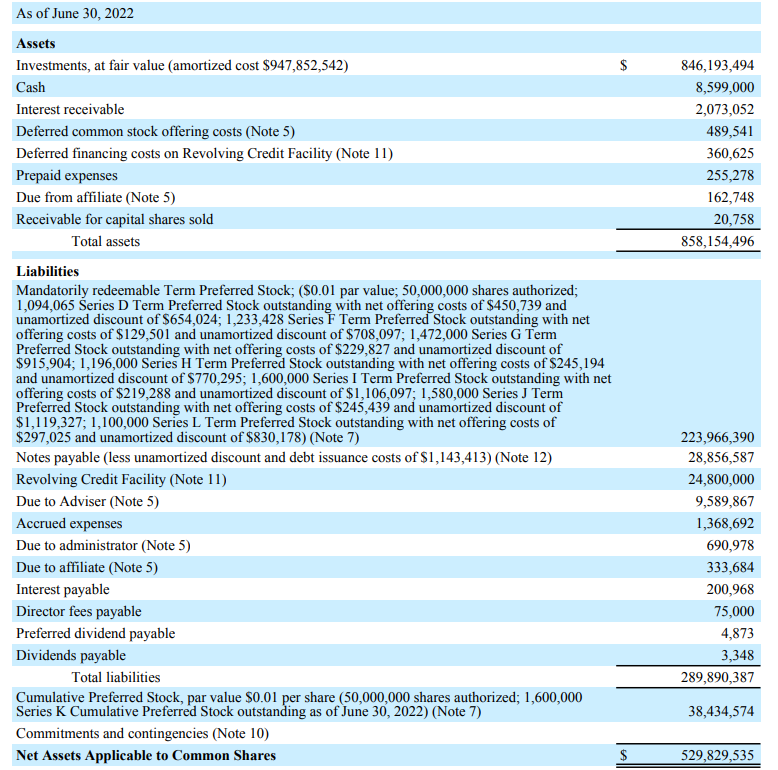

The balance sheet is also very interesting. The vast majority of the balance sheet consists of equity and as you can see below, there’s only $53M in debt which ranks senior to the mandatorily redeemable preferred shares.

PRIF Investor Relations

Additionally, there is in excess of $500M in common equity, which ranks junior to all preferred shares. Based on $846M in investments, even if Priority Income would lose half of the remaining book value, it would still have enough cash to cover the repayment of all debt and preferred shares.

Of course, investing in CLOs is about managing risks, and as Priority Income Fund invests in the junior tranches of CLOs and if things go sour, Priority Income is at the bottom of the list of CLO investors that need to be ‘made whole’. I would likely never consider being in the common equity of the fund, but being a preferred shareholder is not a major deterrent for me.

Investment thesis

I initiated my long position in the preferred shares of Priority Income Fund last year when the interest rates were substantially lower and as such, this position is more a ‘historical’ investment and I am not a buyer of additional preferred shares right now. But for certain types of investors that don’t have a position yet, the preferred shares issued by Priority Income Fund could be an interesting but speculative addition to the income portfolios. These securities, despite ranking senior to the common equity in the fund, may not be suitable for just any portfolio.

What’s entertaining is that the yield to call of some of the term preferred stock is higher than the yield of the perpetual preferred shares. Those K-series are trading at $22.75 and assuming no call will occur, the 7% preferred dividend yield based on the $25 principal results in a yield of just 7.7%. And that makes the term preferred stock more interesting as the K-series may never be retired while the L-series will for sure be called by the end of Q1 2029.

Be the first to comment