sefa ozel

Since the beginning of the year, Nvidia’s (NASDAQ:NVDA) business began to struggle due to the worsening macroeconomic environment, which cut the company’s market capitalization more than in half. While some might think that after such a decline the company’s stock has finally reached its bottom and represents a great buying opportunity at the current levels, the latest initiatives of President Biden’s administration give reasons to believe that there’s more room to fall for Nvidia’s shares.

In addition to successfully lobbying for a minimum global corporate tax rate of 15%, which is going to start being implemented in most countries of the world next year, the administration has also recently prohibited Nvidia and its peers from selling some of its latest chips to China, affecting as much as $400 million in sales for Nvidia. Considering that China itself is a relatively big market for Nvidia, there are reasons to believe that the company and its stock will likely continue to struggle from possible additional export restrictions by the White House, as Sino-American relations continue to worsen and are currently at historically low levels.

The New Geopolitical Reality for Nvidia

After publishing a bearish article on Nvidia last month, the company’s stock depreciated by nearly 30% and there are reasons to believe that it could continue to lose value in the foreseeable future. Since that article was published, Nvidia has released its full Q2 earnings results that were relatively weak, as its revenues of $6.7 billion were up 2.9% Y/Y and in line with the estimates that were revised at the beginning of August when the company initially released its preliminary quarterly report. At the same time, the non-GAAP EPS of $0.51 were below the estimates by $0.01, while the Q3 revenue expectations were only $5.90 billion, substantially below the street forecast of $6.92 billion.

What’s worse for Nvidia is that in addition to poor guidance, the lobbying efforts of the President Biden administration regarding the increase of a global tax rate to 15% were successful and most of the OECD countries are going to begin implementing changes to their tax codes starting 2023. The recently signed Inflation Reduction Act also sets a minimal 15% corporate tax rate for companies that earn over $1 billion in the United States, while the EU earlier this month agreed to commit to the initiative as well despite the Hungarian veto.

This is a big deal for Nvidia, as its effective tax rate in the last couple of years was less than 2% thanks to the legal scheme in which it recognized profits in low-tax jurisdictions such as Hong Kong and Israel, which are about to change their tax codes as well. As a result, investors now need to account for the fact that there’s a high possibility that the company’s bottom-line performance could deteriorate in the foreseeable future.

On top of that, the President Biden administration has been actively using export control tools to ensure that the high-end chips don’t get into the hands of the strategic adversaries of the United States. In addition to prohibiting the sales of any chips to Russia after the latter invaded Ukraine earlier this year, the White House has recently decided to also prohibit Nvidia and its peers from selling some of its most sophisticated chips to China. This is important news for Nvidia as well since China is an important market for the company. Out of $26.9 billion in revenues that Nvidia generated in FY22, which ended in January, $7.1 billion came from clients registered in China and Hong Kong and represented 26% of total sales there during the period.

Currently, the new restrictions prevent Nvidia from shipping its latest A100 and H100 data center GPUs, and the main goal of such an action is likely to prevent the Chinese military-industrial complex from using those chips to improve its own AI capabilities that could pose a threat to the strategic interest of the United States in the future. For now, Nvidia thinks that only around $400 million in sales in this fiscal year will be affected by the recently issued restrictions. However, this is a big deal nevertheless since the improvement of the data center business in Q2 helped the company to meet its revised estimates for the quarter after its gaming business experienced a decline.

At the same time, a couple of weeks ago, news came out that the White House considers imposing new sanctions that include additional restrictions for chip exports in order to deter Beijing from invading Taiwan. As a result, there’s also a risk that the sales of Nvidia’s powerful gaming GPUs could be restricted as well in the future since they also could be used on AI-related projects. Therefore, there’s a real possibility that the latest initiatives of the President Biden administration could create structural risks for Nvidia, as they already started to negatively affect the company’s abilities to improve its top and bottom-line performances.

What’s Next?

In addition to the regulatory changes that undermine Nvidia’s ability to deliver top-notch results, the current uncertain macroeconomic environment also creates significant troubles for the company to create additional shareholder value. As inflation continues to rise Y/Y, it’s safe to assume that the Fed will continue to raise interest rates and engage in quantitative tapering for a considerable time, which could result in a global recession in the following quarters. In addition, as videogame sales continue to decline, while the crypto market goes through the structural changes that could negatively affect the sales of Nvidia’s GPUs in the foreseeable future, it becomes hard to imagine whether the company’s stock has any chances for a rebound anytime soon.

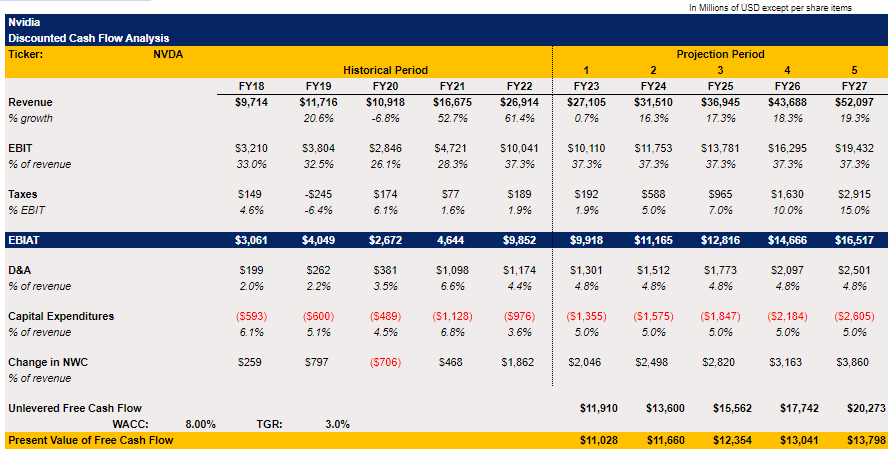

To find out whether there is any significant upside or downside to Nvidia’s shares, I decided to update my DCF model by changing several assumptions in it. First of all, the top-line growth rate was updated and in the current model, it’s in line with the street estimates for the next two years, while the rate in the remaining years continues to gradually increase. All the other metrics in the model are either the same as in the latest fiscal year, averages of recent years, or experience a gradual increase year over year. The WACC in the model is 8%, while the terminal growth rate is 3%.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

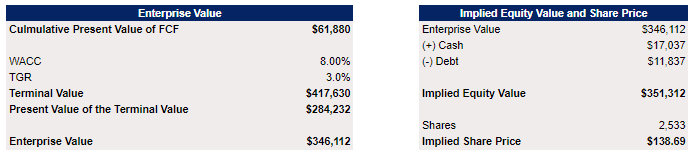

The model shows that Nvidia’s enterprise value is $346 billion, while its fair value is $138.69 per share, which represents an upside of around 10% from the current price.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

However, while it appears that Nvidia trades at a discount, the upside itself is relatively small and several factors could easily affect the most important assumptions in the model. Even if we assume that EBIT as a % of revenue remains at historically high levels in the following years, the latest initiatives of the President Biden administration could easily affect the revenue growth rate itself and the amount of taxes that Nvidia will actually pay in the following years.

If we assume that additional sales restrictions will be implemented in the future, then it’s more than likely that the revenue growth rate will be significantly lower than it’s currently assumed in the model and by the street. At the same time, if the jurisdictions in which Nvidia is registered manage to successfully implement a 15% tax rate much sooner, then the company will be required to pay much more in taxes than it’s currently assumed in the model as well. As a result, the changes described above could easily diminish any upside that Nvidia currently has and that’s why it’s safe to say that it’s too soon to justify a significant long position in the company as there’s no margin of safety at this stage, while the risks currently outweigh the growth opportunities.

Be the first to comment