typhoonski/iStock Editorial via Getty Images

Thesis: Underappreciated Income Growth REIT

Urstadt Biddle Properties (NYSE:UBA, NYSE:UBP) is primarily a grocery-anchored shopping center real estate investment trust (“REIT”) concentrated in the suburbs around New York City in the Tri-State area of New York, New Jersey, and Connecticut.

In a September 2021 article on UBA, I highlighted eight reasons to like UBA as an investment:

- Strong demographics

- High barriers to entry in its markets

- Mostly necessity-anchored centers

- Solid pandemic performance

- Strong post-pandemic rebound

- Heavy insider ownership among the Urstadt and Biddle families

- Long track record of dividend growth since 1969

- Fortress balance sheet with conservative debt profile

In this article, we’ll get a quick update on UBA and show why it is too cheap to ignore for dividend investors.

Spring 2022 Update On UBA

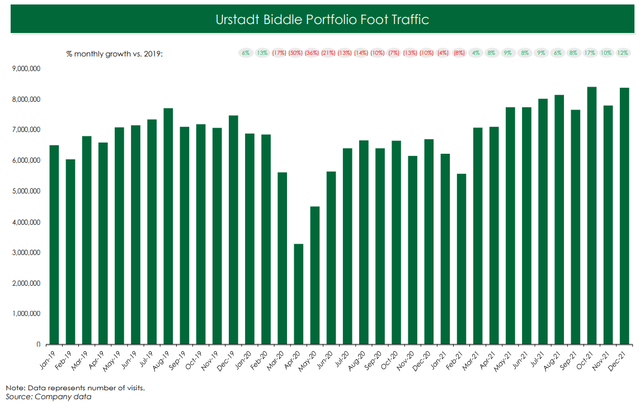

As of the final months of 2021, UBA’s portfolio was enjoying foot traffic well in excess (double-digit growth) of the same months in 2019.

UBA March 2022 Presentation

This, obviously, is a rebuke of the narrative popularized during the pandemic that the world of in-person shopping had changed forever and that people would never go back to physical stores in the same numbers as they used to.

During periods of disruption, it can be easy to extrapolate trends continuing to absurd lengths. But humans are still humans. Once the viral threat faded, humans naturally went back to doing the things that humans enjoy: traveling, attending in-person entertainment, eating out at restaurants (where someone else cooks the food and does the cleaning), and, yes, shopping at physical stores.

On the back of this return of shoppers, retailers likewise scrambled to lease space. At the end of January 2022, 92.6% of UBA’s gross leasable area was leased, up 70 basis points from the end of October 2021 and 280 basis points from the end of January 2021.

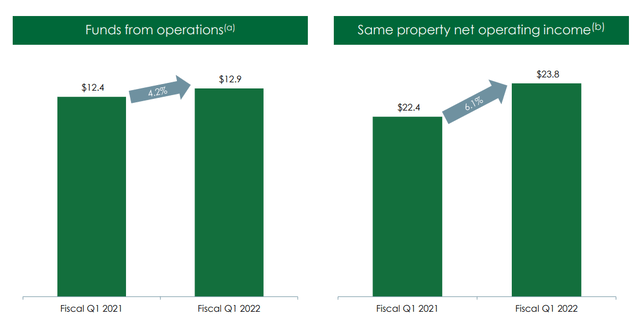

The rebound has continued for UBA, represented by 4.2% YoY gains in FFO and a 6.1% increase in same-property NOI.

UBA March 2022 Presentation

During fiscal 2021 (November 2020 through October 2021), UBA enjoyed most of the boost from collection of deferred rent. We can see this in FFO per share over the last four quarters:

- FQ2 2021: $0.31

- FQ3 2021: $0.36

- FQ4 2021: $0.37

- FQ1 2022: $0.33

During these twelve months, UBA acquired no properties, and rent collection only improved by a few percentage points. As such, about 3-4 cents of FFO per share in FQ3 and FQ4 were due to collection of deferred rent.

Leasing activity has been strong in recent months, with blended leasing spreads holding up well due to rent growth from renewals. Here were UBA’s leasing spreads in fiscal Q1 2022:

- 4.9% decrease on new lease rent rates (46,000 sq. ft.)

- 2.6% increase on renewal rent rates (185,000 sq. ft.)

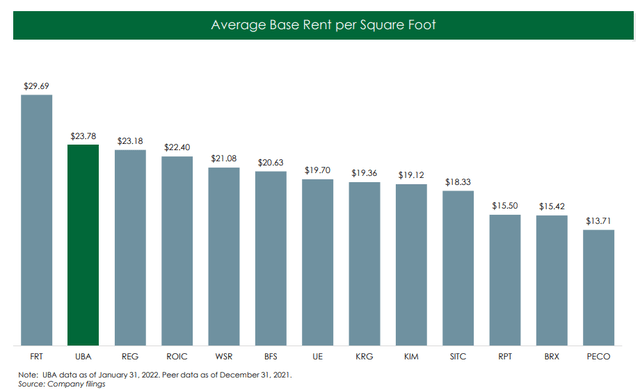

This was the third consecutive quarter of increasing renewal rent rates. As for the new lease rents, these are mostly being compared to rent rates from before the pandemic. Moreover, UBA already has some of the highest average rents per square foot in the retail REIT space:

UBA March 2022 Presentation

At some point, new leases should break even with the expired leases they are replacing and begin showing positive growth again. But this is taking a bit longer for UBA because its neighborhood centers do not have the same desirability as those of REG, whose properties are on average in more business-friendly areas of the country.

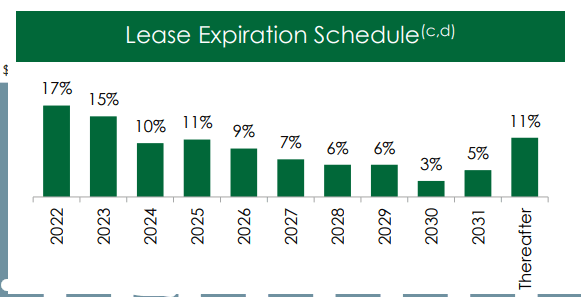

The good news, such as it is, is that UBA has over 30% of its leases scheduled to expire in the next two years.

UBA March 2022 Presentation

This gives UBA the opportunity to up rents for those tenants that will be renewing (which will probably be most of them), thus helping the REIT’s average rent per square foot to hold up.

The balance sheet also remains quite strong, with all recent refinancings significantly lowering the interest rate.

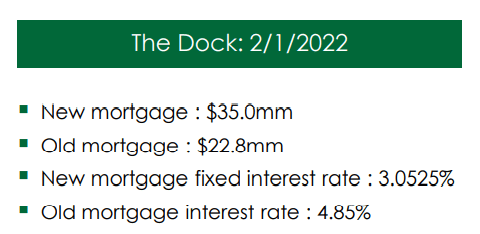

During FQ1, UBA refinanced a mortgage for its Boonton, New Jersey property, increasing the principal from $6.5 million to $11 million while lowering the interest rate from 4.2% to 3.45%. And immediately after quarter end, UBA completed another refinancing for its property called “The Dock”:

UBA March 2022 Presentation

These interest expense savings should go straight to the bottom line and incrementally increase FFO.

With $24.6 million in cash and zero drawn on the credit facility as of the end of January 2022, UBA’s liquidity also appears to be in great shape.

Bottom Line

In my estimation, UBA is excessively cheap. Based on trailing twelve-month FFO per share of $1.37, UBA’s current stock price of around $19.25 represents a price-to-FFO of ~14x. Compare that to other grocery-anchored REITs:

- InvenTrust Properties (IVT): 21x

- Regency Centers (REG): 18x

- Phillips Edison & Co. (PECO): 16x

- Brixmor Property Group (BRX): 15x

The bright side of UBA’s lower valuation is that it gives the REIT a dividend yield above 4.9%. This is far and away the highest yield in its peer group. Keep in mind also that if UBA restored its pre-pandemic dividend of $1.10, the yield would jump to 5.7%. Given management’s historical preference for high income over faster growth, it would not be surprising to see the pre-pandemic dividend restored sometime in the next year or so.

Then again, using excess cash flows for share buybacks rather than dividend raises would also be welcome, as it would accelerate FFO per share growth and allow for higher-than-otherwise dividends down the road.

In any case, I trust management to allocate capital in shareholders’ best interest, because they are heavy shareholders themselves. UBA is a buy for both current income and income growth.

Be the first to comment