Prostock-Studio/iStock via Getty Images

Express, Inc. (NYSE:EXPR) reported a beneficial outlook for the year 2022 including sales growth and growing gross profit margin. In my view, with new designs and better customer experience, the company’s free cash flow will likely grow. If management also invests a bit more in its ecommerce site, I expect more sales growth in the coming years. I see supply chain risks in the United States and overseas, however the upside potential in EXPR’s stock price appears more significant than the downside risk.

Express

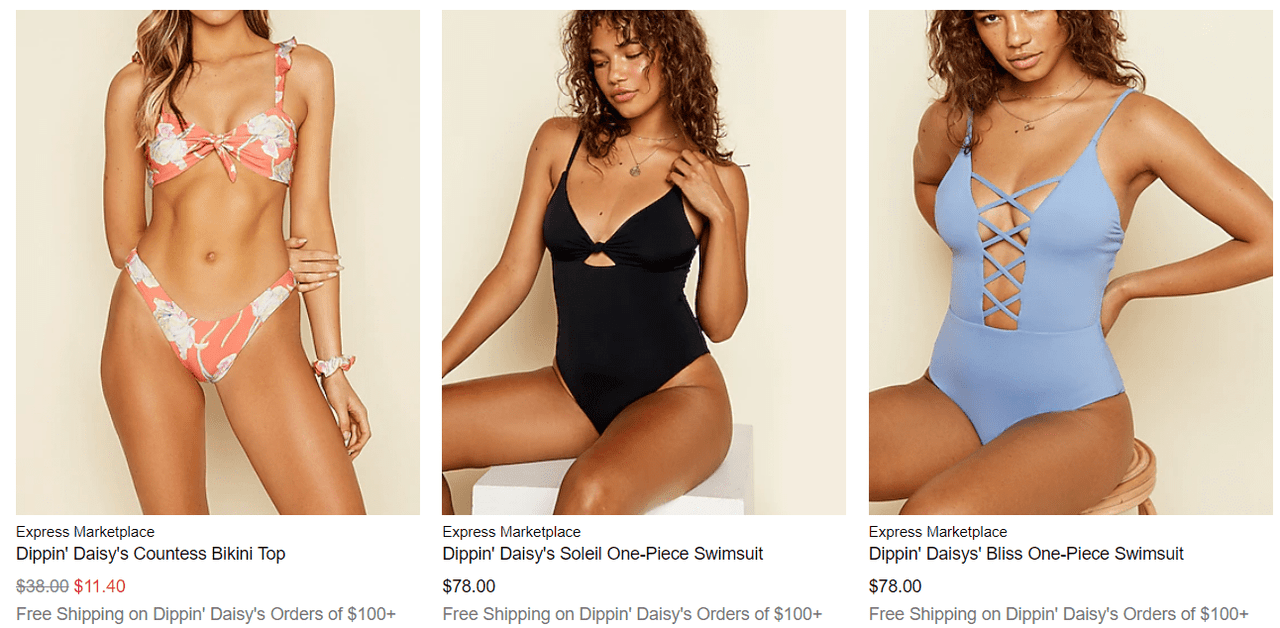

Launched in 1980, Express presents its business as a multichannel apparel and accessories brand.

The company targets style and quality. I didn’t see expensive prices on the ecommerce site, so I believe that the target market is large. Many consumers will likely afford the Express’ items:

express.com express.com

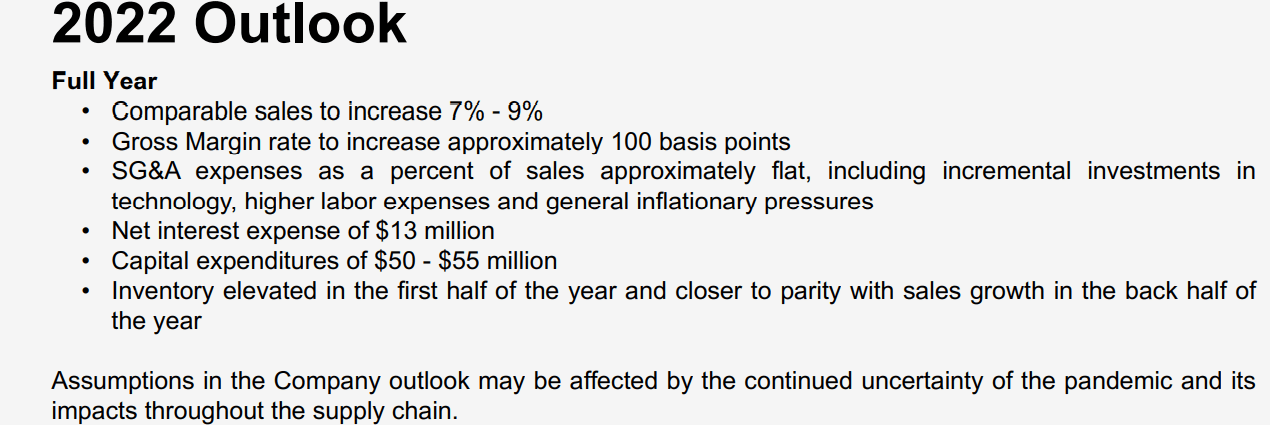

The company’s 2022 outlook is, in my view, very beneficial. Express expects comparable sales to increase to 7%-9%. Management also promised gross margin rate to increase, capital expenditures about $50-$55 million, and moderate SG&A. Have a look at the plan announced by management because I used some of the company’s figures in my DCF model:

investors.express.com

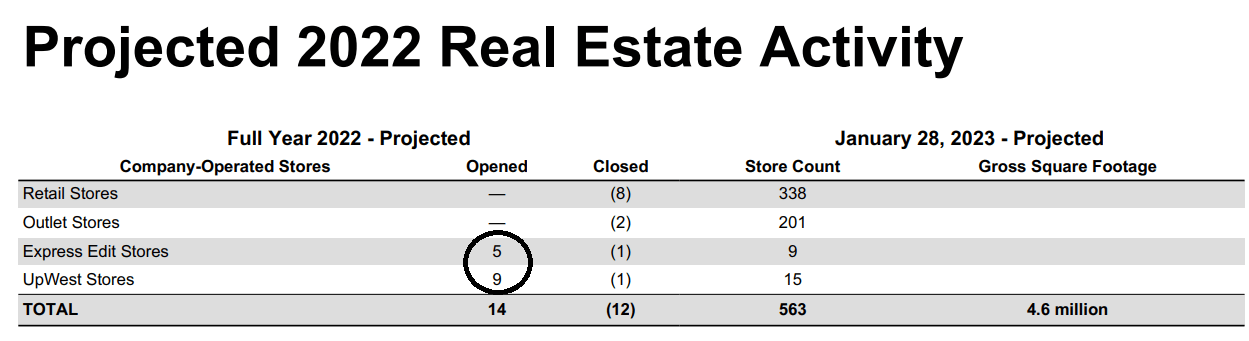

With the previous assumptions about 2022, the company’s real estate activity makes more sense. Note that management expects to open new Edit stores and UpWest stores, so that the store count should stand at 563 by January 2023:

investors.express.com

With New Good Designs, More Stores, And Better Omnichannel Customer Experience, The Fair Price Could Be Close To $5.8

The company designs products that can be used in multiple ways for multiple wearing occasions. Designers not only need to be very smart, they also have to come out with ideas that are different from that of competitors. Under this case scenario, I assumed that Express, Inc. will successfully continue to offer complementary items, so that users purchase several products in the same transaction:

We plan our product assortments and display them in our stores and online in a coordinated manner to encourage our customers to purchase items that can be worn in multiple ways for multiple wearing occasions. We believe this allows us to better meet our customers’ shopping objectives while differentiating our product offerings from competitors. On average, our customers purchase two to three items per transaction. Source: 10-k

I also expect management to further enhance its omnichannel customer experience in the store and eCommerce channels. I also expect management to open more new Edit stores and UpWest stores. Take into account that many customers first check the items in the physical stores, and then buy the items online:

We are committed to enhancing our omnichannel customer experience that offers a seamless shopping experience whether the customer is shopping in a store or online through a desktop, tablet, or mobile device. We believe the lines between our store and eCommerce channels are disappearing as customers increasingly interact with us both in-store and online and often through mobile devices while in stores. As a result, we are focused on leveraging the best of both channels to create an exceptional omnichannel shopping experience. Source: 10-k

According to analysts, Express’ target market could grow at close to 6% y/y until 2025. Market experts are also disclosing a declining growth rate, which suggests a moderately flooded market. With this in mind, under this case scenario, I used 6% sales growth until 2025, and 5% growth in 2027 and 2028:

Of the five categories considered by ecommerceDB, Fashion is the largest segment in the U.S., as indicated by the Statista Digital Market Outlook. Over the last year, the revenue of this market has grown by 21%. The predicted compound annual growth rate (CAGR 21-25) for the next four years is 6%. The declining growth rate suggests a moderately flooded market. Source: U.S. Fashion Market – Data, Trends, Top Stores | ecommerceDB.com

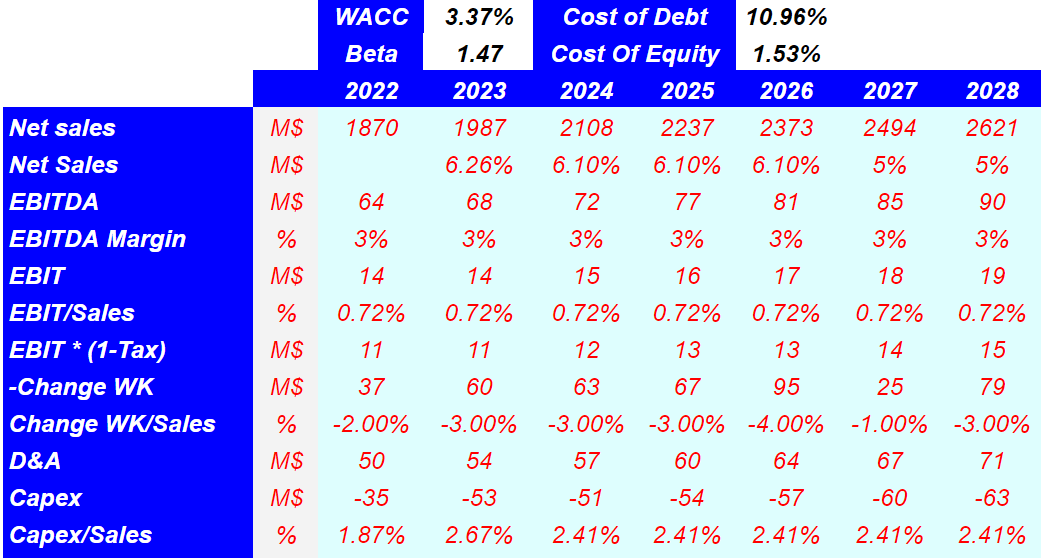

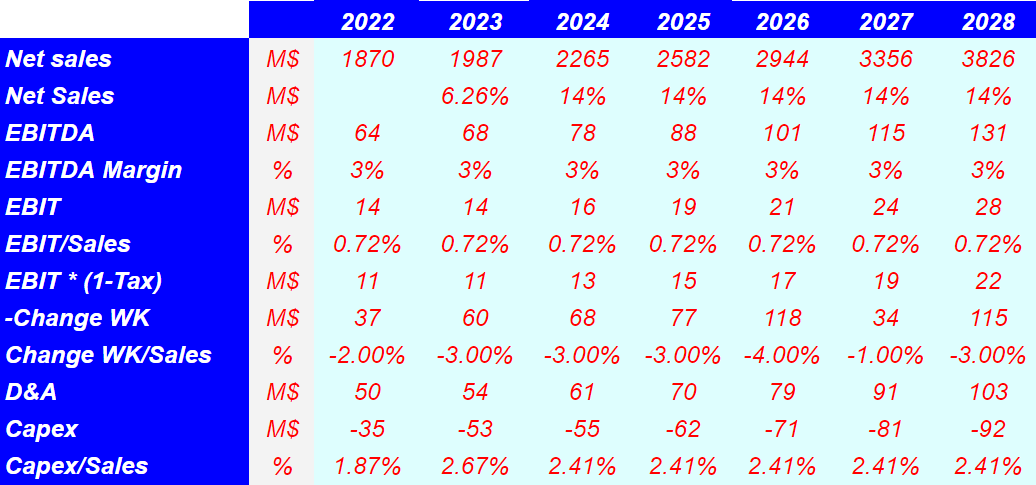

I also assumed an EBITDA margin between 3% and 3.1%, which appears conservative, and 21% effective tax. With these figures, 2028 NOPAT should be close to $15 million. I also assumed changes in working capital/sales of -2% and -3%, D&A of $50-$71 million, and growing capital expenditures of $35-$63 million:

YC

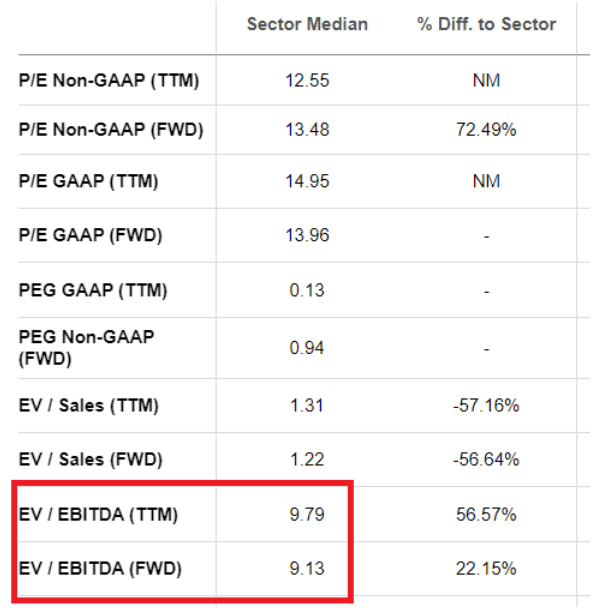

With the sector median at 9x-10x, I decided to use an exit multiple of 9.7x, which does seem achievable. I also used a WACC of 3.37%, with cost of equity of 1.53%, and cost of debt of 10.96%. Other investors reported a WACC close to that of mine, so I don’t think I am using very extraordinary numbers:

SA

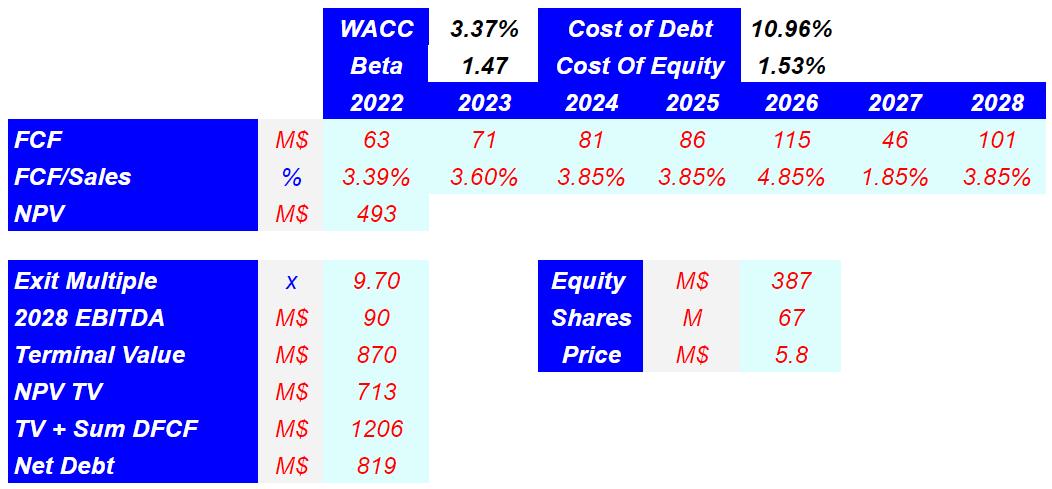

My results include a terminal value of $0.8 billion, and an implied valuation of $387 million. The fair price should be close to $5.8:

YC

Supply Chain Risks Overseas And In The United States Could Imply A Valuation Of $1.5

Express, Inc. could suffer from supply chain issues as it acquires a lot of merchandise from vendors in Vietnam, China, Indonesia, India, and Pakistan. If manufacturing facilities cannot send their merchandise, or they try to increase their selling prices, the company may see its revenue increase less than expected. As a result, expected free cash flow would decline significantly, and the stock price could fall:

We purchase the majority of our merchandise outside of the United States through arrangements with approximately 105 vendors utilizing approximately 321 manufacturing facilities located in approximately 26 countries throughout the world, primarily in Asia. The top five countries from which we sourced our merchandise in 2020 were Vietnam, China, Indonesia, India, and Pakistan, based on total cost of merchandise purchased. The top 10 manufacturing facilities, based on cost, supplied approximately 29% of our merchandise in 2020. Source: 10-k

The company could also suffer significantly from supply chain issues in the United States. The company receives all its products in facilities operated by third parties. In the worst case scenario, these partners may deliver less merchandise, or decide to block most deliveries:

We utilize two facilities for the distribution of our product, both of which are owned and operated by third parties. Virtually all of the merchandise sold in our stores and on our website is first received and processed at a central distribution facility in Columbus, Ohio. Merchandise is typically shipped to such stores and to the Richwood Facility via third-party delivery services multiple times per week, thereby providing them with a steady flow of inventory. Source: 10-k

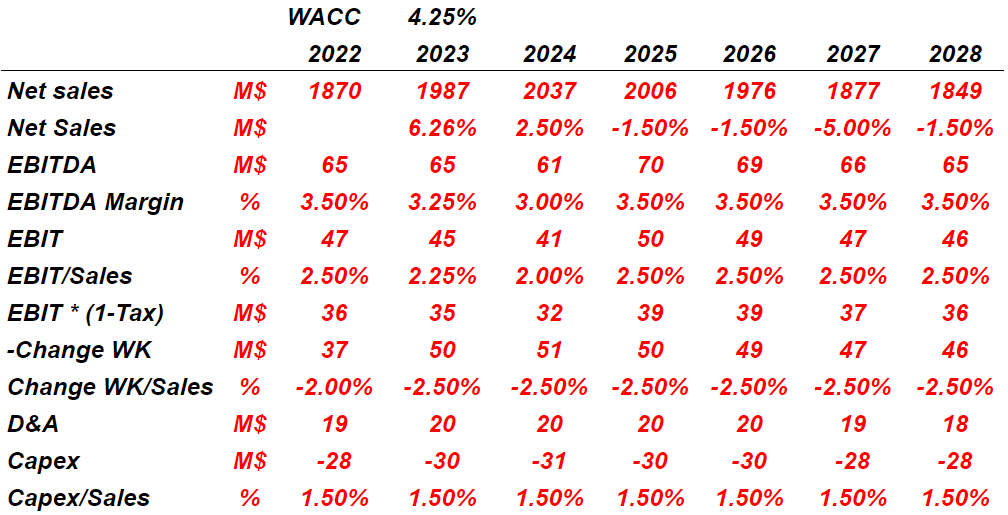

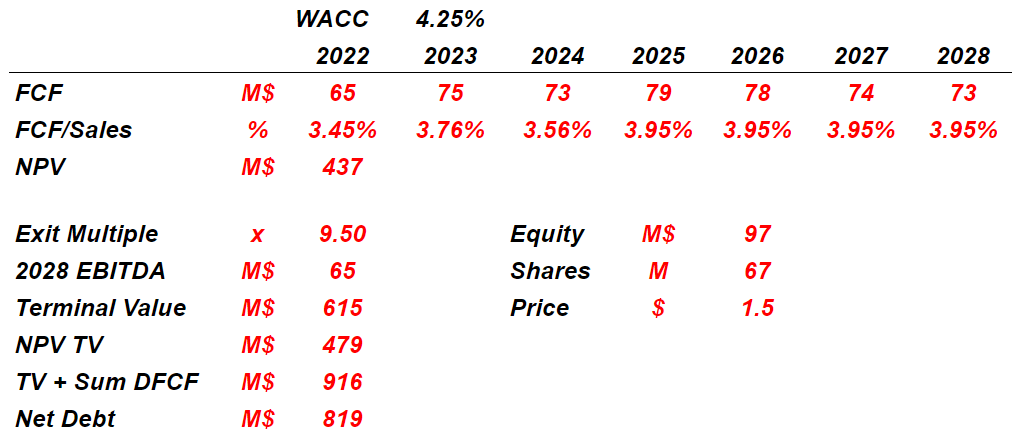

Under this scenario, I used a decline in the sales growth of -1.5% y/y from 2024 to 2026, and also declines in the sales growth in 2027 and 2028. I also included EBITDA margin of 3%-3.5%, changes in working capital/sales of -2.5%, and capex/sales of 1.5%:

YC

With a FCF margin of 3.45%-3.95%, the sum of the FCF discounted with a WACC of 4.25% should be close to $450 million. The implied equity value should be close to $100 million, and the implied price will likely stay close to $1.5:

YC

Sufficient Investment In The Ecommerce Business Could Imply A Valuation Of $12.5

According to analysts, the ecommerce fashion industry could grow at a CAGR of 14.2% from 2017 to 2025. With the company reporting an online business, in my view, if management invests in its ecommerce site, sales growth will likely grow more than 6%-5%:

According to Statista, the ecommerce fashion industry’s compound annual growth rate is tipped to reach 14.2% between 2017 and 2025, with the industry hitting a $672.71 billion valuation by 2023. Source: Fashion Ecommerce Industry Trends

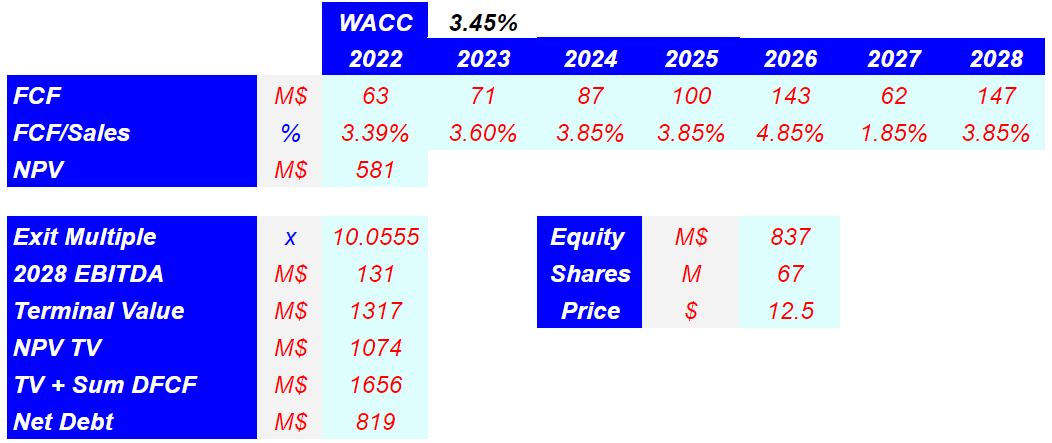

Under very optimistic conditions, I used sales growth of 14.5% from 2024 to 2028, an EBITDA margin of 2.5%, change in working capital/sales close to -2.5%, and capex/sales around 1.85%-2.45%:

YC

With a WACC of 3.45% and FCF margin close to 3%-5%, the net present value of future free cash flows should stand at around $580 million. With an exit multiple of 10.05x, the implied equity should be $837 million, and the implied stock price would be close to $12.5:

YC

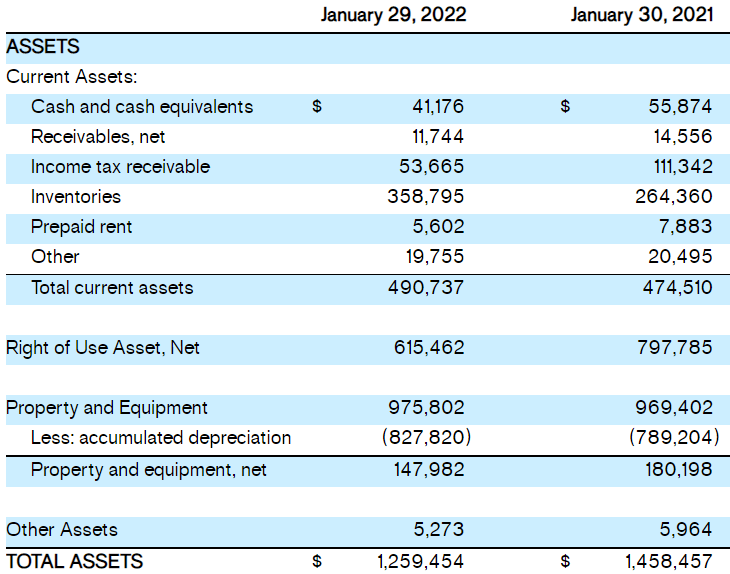

Balance Sheet

With an asset/liability ratio of 1x, $41 million in cash, and inventories worth $358 million, in my opinion, the balance sheet looks healthy. With much more inventory than in January 2021, once management sells the accumulated inventory, we may see a small increase in revenue.

Express Reports Strong Fourth Quarter 2021 Results

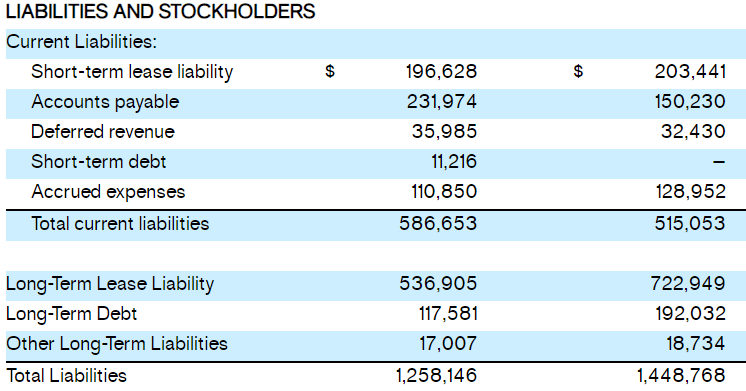

Express’s short term contractual obligations include short-term liabilities worth $196 million and short-term debt worth $11 million. Long-term lease is equal to $536 million, and long-term debt equals $117 million:

Express Reports Strong Fourth Quarter 2021 Results

Conclusion

Express, Inc. shows a beneficial outlook for the year 2022. The company expects to open new stores in the coming months and report sales growth and growing gross margins. In my opinion, with new good designs, more stores promised, and better omnichannel customer experience, future free cash flow should trend north. If the company also invests much more in its online business model, in my view, revenue could even touch double digit marks. Yes, I see some supply chain risks outside the United States, and in the company’s distribution network. However, the upside potential in Express’ stock price is more significant than the downside risk.

Be the first to comment