PeopleImages

From mid-March 2020 to mid-February 2021 Fiverr (NYSE:FVRR) had achieved an astounding performance of +1620% reaching $336 per share. After not even 2 years, the sentiment is exactly the opposite and those who invested on the highs have reached loss spikes of more than 90%. In this article I will show what I think were the causes of such a marked collapse and why I believe we are still far from a potential bottom.

Why Fiverr is collapsing

If any asset appreciates by 1620% in just under 1 year there is probably something wrong. Fiverr, as well as many other companies in 2020-2021, has been the subject of heavy speculation based on huge expectations from investors. It was believed that this company could have huge growth rates for years and years, but the estimates are turning out to be totally wrong. The reason for such a divergence between expectations and reality was due, in my opinion, to the erroneous consideration of how the macroeconomic environment would evolve.

The 2020 was the perfect year for all those companies like Fiverr and Zoom that took advantage of people having to stay at home due to various lockdowns. What’s more, interest rates were close to 0%, access to credit was facilitated, and there was a mania toward speculation in the stock market similar to that of the 2000s. How long could such a situation last?

As of today, interest rates are rising 75 basis points a month, access to credit is becoming a luxury, inflation is getting out of hand, there are still supply chain problems, and speculators no longer expect to make 50% a month by randomly buying a small-cap tech company.

Fiverr is paying for the current macroeconomic scenario, and further tightening could lead to an even more significant collapse. At the moment this company does not have consistent cash flows and still has everything to prove, which is why investors are turning their attention to more reliable companies.

Focus on core business and users not growing

Fiverr is a platform that allows anyone to become a freelancer and gets a commission in return for every order placed. The more buyers there are, the more they spend and the more Fiverr earns.

Fiverr Q3 2022

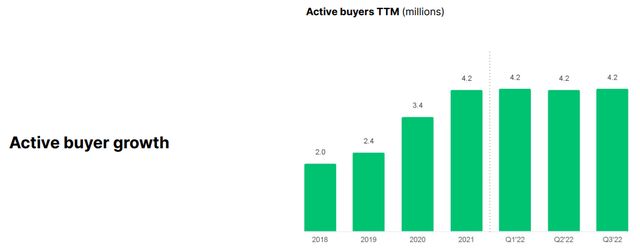

From 2018 to 2021, active buyers within the platform increased very fast and in just 2 years almost doubled. Suddenly, however, this growth came to a halt and for almost a year we have been standing still at 4.20 million active buyers. For those who believed in the strong growth of this company this is certainly an extremely negative sign, as it greatly limits Fiverr’s expectations for future growth. In itself, this is a signal that can discourage most investors and trigger a sell-off, which in fact has happened. What’s more, this data was taken from the latest quarterly report released a few days ago, so this difficult situation is more relevant than ever.

But what is triggering the lack of growth in active buyers? In my opinion, the causes are mainly two and closely related.

- Fiverr benefited from increased attention during the pandemic as many people were interested in doing online work. This phenomenon led to a boom in new freelancers and at the same time an increase in new buyers as the supply of services within the platform increased significantly. This virtuous circle came to an end, however, once the pandemic took on less and less weight and people returned “to normality.”

- The second relevant aspect might be related to the high commissions within the platform. A freelancer selling their own service will only get 80% of the amount set, while the buyer pays a 5.50% commission on the total amount to be paid. If the transaction is less than $50, the buyer pays a minimum commission of $2. This means that on a hypothetical order of $100, the freelancer pays $20 commission and the buyer $5.50. What’s more, on the $80 earned, the freelancer still has to pay tax. Try to assume this on an order of $500 or more. Personally, I think this is disfavoring both the entry of professionals into the platform and new buyers who have to pay a commission in addition to the cost of the service. The initial hype and the need to start working online during the pandemic hid this downside, which is taking on greater weight today. The company has not stated that it plans to change anything in this regard, so I assume that it will continue to operate the same way in the future.

Why Fiverr is worth so little compared to two years ago

Fiverr’s fair value, like that of any other company, is obtained by discounting future cash flows. If future cash flows decrease or the discount rate increases, the fair value will inevitably be lower. Let’s see through some data what this means.

In 2021 there were high expectations for Fiverr’s future growth, as the company came from two years of strong growth.

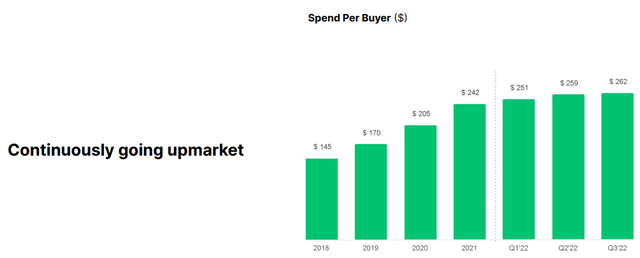

Fiverr Q3 2022

Spending per buyer was increasing more and more, and investors assumed that this growth would continue for the following years. With the release of Q3 2022 we have seen that this is not the case at all, and the reality has been much more disappointing than expected. Expected future cash flows have declined, and with them fair value. Moreover, to make matters even worse, there has been the increase in the discount rate. This rate is calculated according to theory through the WACC formula, which also takes into account the risk-free rate. As interest rates rose as a result of tight monetary policy, the discount rate increased and the fair value sank even further down. All these dynamics caused Fiverr to collapse by 90%, but what surprises me most is that, despite this, I think the company is still overvalued. And by a lot.

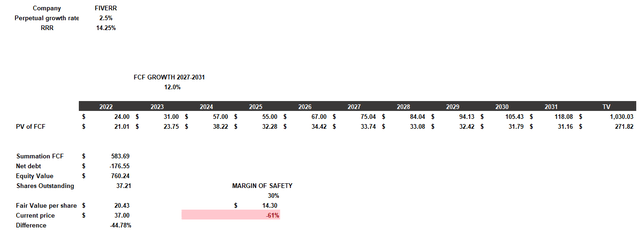

To calculate its fair value, I constructed a discounted cash flow. These are the inputs entered:

- RRR was calculated through the WACC formula and will be 14.25%. Since Fiverr is debt-free, I assumed that the WACC was equal to the cost of equity. The latter value considers a beta of 1.67, risk-free rate of 4%, country market risk premium of 4.20% and additional risks of 2%. Overall this is definitely a high discount rate, but I think it is inevitable given that we are talking about a very speculative investment in an economic environment where the risk free rate is 4%.

- The free cash flow from 2022 to 2026 was estimated by TIKR Terminal analysts. From 2027 to 2031 I have included a growth rate of 12% per year.

- The source of outstanding shares and net debt is again from TIKR Terminal.

Discounted cash flow

According to my assumptions, Fiverr’s fair value is about $20.43 per share, so this is an overvaluation of 44.78%. If we also wanted to apply a margin of safety (30%), at that point we would have to wait for $14.30 per share before thinking about a purchase. I realize that these are conservative inputs, but after all, when buying such a speculative company, precaution is never too much. Keep in mind that this company in 2019 still had negative cash from operations and often diluted its shareholders.

Final Thoughts

Fiverr is one of those companies that, with the outbreak of the pandemic, achieved sudden growth that generated a lot of hype about it. Over the course of a few months, the speculation became excessive, and along with the worsening macroeconomic environment, interest in Fiverr plummeted dramatically. As of today, although the days when this company traded at more than $300 per share are long gone, we are still far from an eventual bottom as its fair value I believe is only $20. Its commission-based business model is interesting, however I believe it is overly costly from an economic standpoint for both buyers and freelancers. The fact that active buyers are not growing is evidence of their disinterest in the platform, and the slight increase in their spending is a sign that this company’s growth rates may not be that high. Finally, the macroeconomic environment certainly does not favor Fiverr, one more reason to doubt its short- to medium-term performance. In any case, I do not rule out that this company, being very young and with an already positive FCF, may in a very long-term perspective recover and prove to be a good investment, but personally I would avoid buying it at more than $15 per share.

Be the first to comment