loops7

The Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) is the best exchange-traded fund (“ETF”) on the market for long-term dividend growth investors.

SCHD is the unicorn of dividend ETFs. It offers a 3%+ dividend yield reminiscent of “high dividend” ETFs like the Vanguard High Dividend Yield ETF (VYM) and the iShares Core High Dividend ETF (HDV) while simultaneously producing a double-digit dividend growth rate reminiscent of lower-yielding dividend growth ETFs like the Vanguard Dividend Appreciation ETF (VIG) and the WisdomTree US Dividend Growth ETF (DGRW).

How does Schwab do it? Is it magic? Is it too good to be true?

More importantly, can SCHD’s unique blend of yield, quality, and growth continue to produce outperformance?

I think so. In what follows, I want to explain what makes SCHD so unique and why I, as a dividend growth investor, have built a huge position in it.

SCHD’s Simple Yet Elegant Design

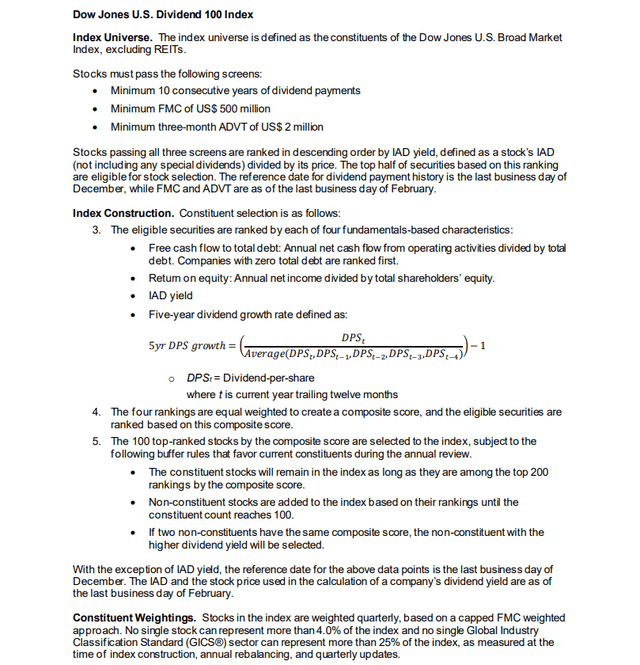

For those interested in reading the details of how SCHD’s fund is constructed and its stocks are picked, here’s the relevant section of the underlying index’s methodology:

S&P Global – US Dividend 100 Index

SCHD is based on the Dow Jones US Dividend 100 Index. I would summarize the index’s stock-picking methodology as three basic filters, presented below in the order of their sequential importance:

- Dividend Growth Record: SCHD first requires holdings to have at least 10 years of consecutive dividend payments as well as 5 years of consecutive dividend growth.

- Quality: SCHD next filters for quality factors like relatively low debt, high free cash flow as a share of debt, and high return on equity.

- Yield: Only after filtering down to companies with the required dividend histories and quality factors does SCHD weight by dividend yield.

Plenty of dividend growth ETFs have some sort of historical dividend growth requirement. That is not unique.

What’s more, some dividend ETFs weight holdings by yield in order to generate more income. Some believe this creates a value orientation that leads to outperformance via reversion to the mean, similar to the “dogs of the Dow” strategy.

Likewise, as we’ll discuss below, some dividend ETFs emphasize quality factors in order to arrive at greater safety and growth potential.

Ultimately, I believe SCHD’s particular blend of quality elements and yield-weighting is what makes it unique.

- The low debt piece ensures downside protection during the occasional interest rate hiking cycle such as we are experiencing now.

- The high FCF to debt piece rewards a large FCF stream without allowing heavily indebted FCF generators to sneak in.

- High return on equity is a way to measure management’s ability to produce returns based on shareholders’ hard-earned dollars.

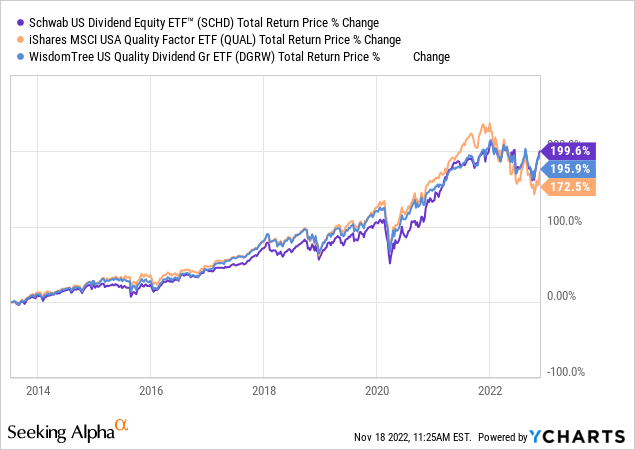

On a price chart, SCHD seems to act most similarly to quality ETFs like DGRW and the iShares US Quality Factor ETF, although, as of today, SCHD has outperformed both since late 2013:

Of the two other ETFs, SCHD is closest to DGRW, which has both quality and dividend elements. But SCHD is more concentrated than DGRW, as the former has about 100 holdings while the latter has about 300.

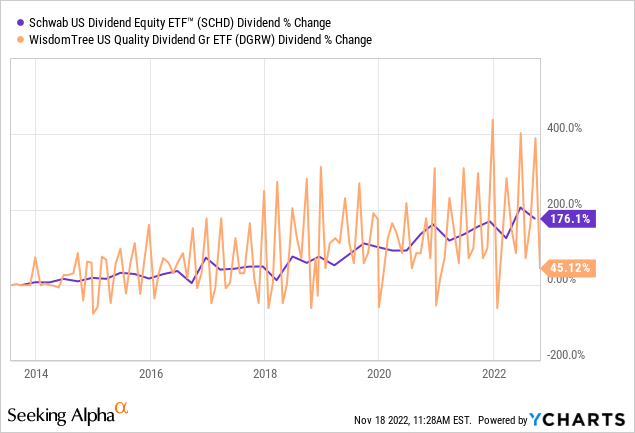

The two ETFs have exhibited similar levels of dividend growth since Summer 2013, when DGRW’s dividend was initiated, although DGRW shows much more volatility in the chart below because of its monthly payout schedule.

Since 2014, here’s how fast each ETF has grown its respective dividend payout on an average annual basis:

Moreover, starting yield is crucially important for dividend growth investors who want to generate the most possible income over time. The key is to obtain the highest starting yield possible without sacrificing growth.

You may look at the total return chart above and conclude that a higher dividend yield doesn’t make that much of a difference, at least when comparing SCHD to DGRW. And that is true. But it makes a big difference if one’s goal is to generate a maximally large income stream that is growing as fast as possible.

Riddle me this: If your goal is to generate the most possible income 10 years from now, would you rather buy a 3%-yielding stock that is growing its dividend at a pace of 11% per year or a 2%-yielding stock that is growing its dividend at a pace of 15% per year?

You might think the answer is the 2%-yielding stock because of its faster growth rate. But actually, the 3%-yielding stock does better at generating more income 10 years out.

- 3% Yield + 11% Growth = 8.5% 10-Year Yield-On-Cost

- 2% Yield + 15% Growth = 8.1% 10-Year Yield-On-Cost.

How long would it take the 2%-yielder to catch up to the 3%-yielder in terms of YoC in the above scenario? The answer is 12 years. Thus, in this scenario, if your time horizon (length of time until you want to tap into your portfolio income stream) is 12 years or more, then the lower yielding but faster growing option is better. But if your time horizon is less than 12 years, then it’s better to go with the higher yielding and slightly slower growing option.

But what if you could have your cake and eat it too? What if you could enjoy higher starting yield and faster dividend growth?

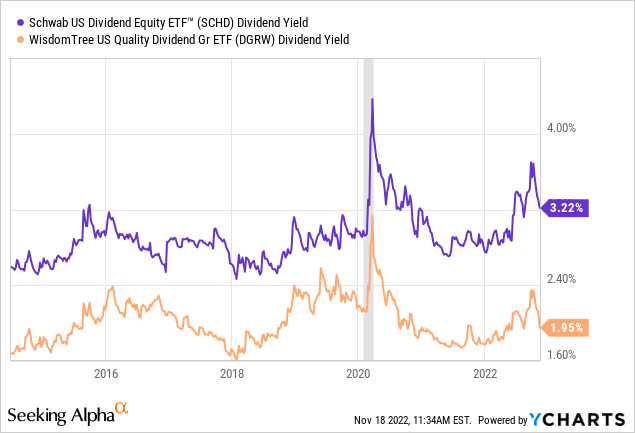

Let’s look at SCHD’s yield versus that of DGRW:

As part of its design, SCHD always trades at a higher dividend yield than DGRW.

Many quality-focused dividend growth ETFs purposely filter out the highest yielding, say, 20-30% of potential holdings because of the (mistaken, in my opinion) notion that high yield necessarily translates into worse performance. To my knowledge, DGRW does not do that but instead simply weights its quality and growth factors more heavily. The difference between it and SCHD is probably just that SCHD actually filters out some of the lowest-yielding potential stocks by holding only 100 stocks in its portfolio rather than DGRW’s 300.

In any case, SCHD’s unique blend of filters somehow results in outperformance of both dividend growth and yield.

This is what makes SCHD a dividend growth investor’s dream ETF.

Using the TTM dividend yields reported by YCharts above, let’s consider what each ETF’s yield-on-cost would be in 10 years if each were able to achieve the same average annual dividend growth as what they did from 2014 through 2021.

- DGRW: 7.0% 10-Year YoC (1.95% x 13.6% Annually)

- SCHD: 12.3% 10-Year YoC (3.22% x 14.3% Annually).

As a reminder, yield-on-cost is dividend income per dollar invested.

With SCHD’s unique blend of yield and dividend growth, it achieves far better future yields-on-cost than DGRW.

Or, at least, that holds true as long as SCHD can keep up its impressive record of rapid dividend growth. Past returns are no guarantee of future results, of course. The 14%+ dividend growth rate of 2014-2021 may prove to be unrepeatable.

Even so, if SCHD’s strategy continues to generate roughly equal or better dividend growth as DGRW (and other similarly low-yielding dividend ETFs), it will continue to be the best dividend growth ETF on the market.

For more on this topic (including comparisons to other dividend ETFs), see my discussion of SCHD’s historical dividend growth in “Bear Market Dividend Conundrum: High Yield Or Dividend Growth?”

Bottom Line

Successful dividend growth investing ultimately rests on two factors:

- Starting dividend yield

- Dividend growth rate.

The higher one’s starting dividend yield, the more income you will generate with which to reinvest for compounding (or the more income you will be able to withdraw to for spending purposes). And the higher the dividend growth rate, the faster than income stream will grow over time.

The ever-present question for dividend growth investors, or DGIers, is how to balance these two factors. Investors closer to retirement typically emphasize yield over growth, while younger investors should emphasize growth over yield.

What makes SCHD so attractive is its ability to thrive in terms of both yield and dividend growth. Its stock-picking methodology is second to none in this regard. It’s the ultimate sleep-well-at-night, set-it-and-forget-it ETF for DGIers.

That’s why I have it as my largest ETF holding and commend it to dividend growth investors at any stage of life.

Be the first to comment