Wolterk

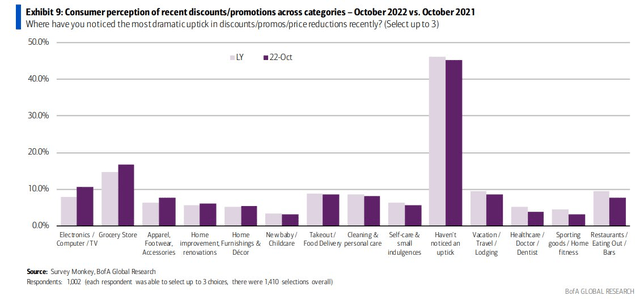

Consumers are noticing more promotions and sales in the electronics and apparel categories. That could have bearish implications for retailers heading into the holiday shopping season as margins could be under pressure due to high inventories. We’ll get fresh reads and outlooks on the consumer when Staples and Discretionary companies report in earnest over the next few weeks.

Rising Retail Promos

According to Bank of America Global Research, Urban Outfitters (NASDAQ:URBN) is a specialty retailer and wholesaler of unique private and third-party apparel, accessories, and home goods. It has three main concepts, Urban Outfitters, Anthropologie, and Free People, as well as Terrain and BHLDN. BofA estimates that the company’s store base is underpenetrated and has ample room to grow soon.

The Pennsylvania-based $2.3 billion market cap Specialty Retail industry company within the Consumer Discretionary sector trades at a low 10.9 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal. Ahead of earnings in a few weeks, the stock has a high 13.9% short interest.

The company has upside potential from its popular concepts and brands in specialty retail. Despite a challenging macro environment, margins should hold up due to decent differentiation. It appears much of the consumer pessimism in the market has been priced into the stock. Still, downside risks include a shrinking amount of excess savings among households and if discount retailers grab share from the specialty players. A sound balance sheet and customer loyalty are upside fundamentals.

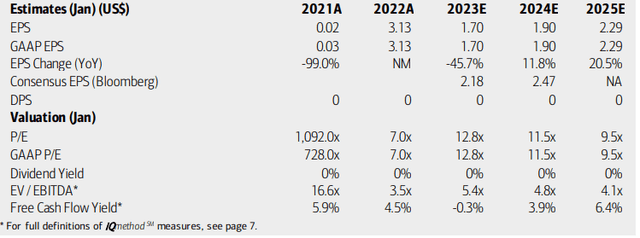

On valuation, analysts at BofA see a sharp drop in 2023 earnings (which is now more than halfway complete) before solid EPS growth resumes in 2024 and 2025. The Bloomberg consensus forecast is more optimistic than BofA’s. Urban is not expected to pay a dividend as free cash flow is mediocre in the coming quarters. The company’s operating and GAAP P/E ratios and EV/EBITDA all look good following a steep decline in the stock price over the last 14 months. Overall, I think the valuation reset is nearly complete.

Urban Outfitters: Earnings, Valuation, Free Cash Flow Forecasts

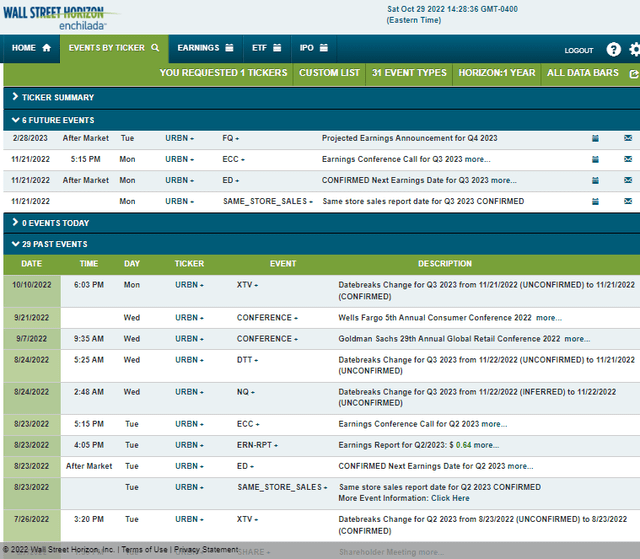

Looking ahead, corporate event data from Wall Street Horizon show a confirmed Q3 2023 earnings date of Monday, Nov. 21 AMC with a conference call immediately after results hit the tape. You can listen live here. Urban will also report October same-store sales then, so we will get a timely read on the consumer.

Corporate Event Calendar

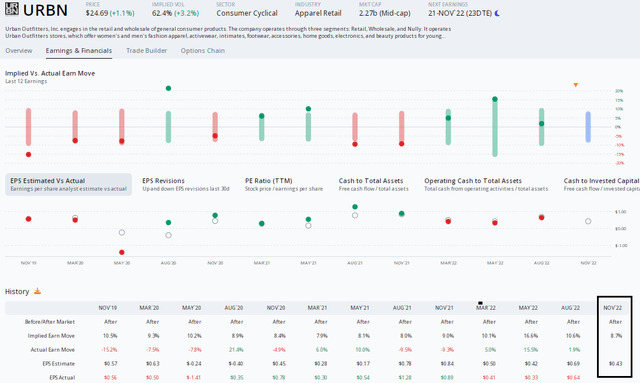

The Options Angle

Digging into the upcoming earnings report, data from Option Research & Technology Services (ORATS) show a consensus earnings estimate of $0.43 which would be a more than 50% drop in per-share profits from the same quarter a year ago. The company has missed analysts’ estimates in each of the past three quarters, but the share price has traded higher after all of those releases.

In terms of expected stock price moves this time, the nearest-expiring at-the-money straddle reveals an implied 8.7% share price swing post-earnings. Despite higher-than-average volatility in the market, that’s a narrower expected move compared to recent quarters. So, the options might be a bit cheap here.

URBN: A Steep YoY EPS Decline Expected

The Technical Take

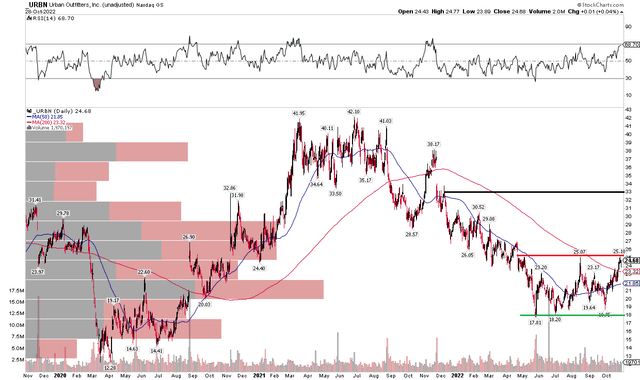

I like what I see in the chart of URBN. Notice how the stock has rallied above its flattening 200-day moving average. Moreover, the shorter-term 50-day moving average might cross above the longer-term average in due time – that would help signal a bullish reversal. I would like to see the stock climb above $25 on a closing basis. If it does, a bullish price object to near $33 would be triggered. The RSI indicator up top has also ventured out of bearish territory as higher lows were put in as the stock skidded along the $17 to $19 range. So we have some confirmation with that indicator.

Overall, I’d like to see the stock rally above $25 before getting aggressively long, but the chart appears constructive for a bullish reversal.

URBN: A Bullish Reversal Takes Shape

The Bottom Line

I lean bullish on URBN based on its valuation reset, but there still might be some tough times ahead before year-on-year EPS growth returns. The technical picture also exhibits reasons for hope. It is a hold for now as I think a bit more time is needed for the stars to align on URBN.

Be the first to comment