panida wijitpanya/iStock via Getty Images

Editor’s note: Seeking Alpha is proud to welcome Aamir Jaffer as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

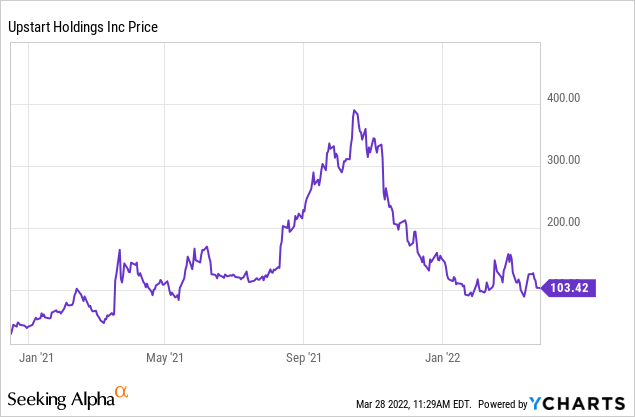

Upstart Holdings, Inc. (NASDAQ:UPST) has been a volatile stock since its IPO in December 2020. Since its all-time high in October 2021 of $400, UPST is down about 75% since then, currently trading at $103.42. Upstart shareholders have seen a -31% return YTD, significantly underperforming the S&P 500 (NYSEARCA: SPY) -5% over the same period. In this article, I outline what makes UPST a solid candidate at current prices.

Investment Thesis

Upstart’s mission is to “enable effortless credit based on true risk”. Founded in 2004, UPST uses a proprietary AI lending model to assess a borrower’s creditworthiness. It then partners with various banks and credit unions who issue the loans, and UPST collects referral fees for each loan originated. Upstart’s competitive advantage lies in the amount of data it collects to continuously improve its AI models. To date, Upstart uses over 1,500 variables within its model, and it continues to improve its algorithms the more data it collects.

Upstart solidified its expansion into the auto loan market with its acquisition of Prodigy Software in Q2 2021. In F’21, Upstart generated 5,300 auto loans through its platform. The auto loans market represents a massive $727 billion opportunity, of which UPST expects to generate $1.5 billion in auto financing volumes in FY’22 – a mere 0.2% of the total addressable market. Upstart has also increased the number of auto dealerships that use its platform to 411 in Q4’21, up from 111 in Q4’20. These are stellar numbers that point to Upstart’s commitment to increase the number of dealer rooftops which will lead to higher loan volumes. To further solidify UPST’s presence in the automotive market, Volkswagen (OTCPK:VWAGY) (OTCPK:VLKAF) and Subaru (OTCPK:FUJHY) (OTCPK:FUJHF) both announced partnerships with UPST to integrate their Retail Build & Price product. These two partnerships combined with the growth in the automotive segment confirm Upstart’s commitment to penetrating the market and driving growth within this segment.

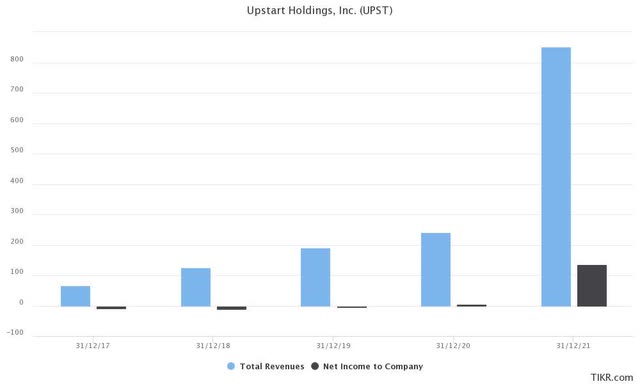

As Upstart collects more data and enhances its AI model, the company can increase approval rates (issue more loans) and lower interest rates (issue better loans), which will directly contribute to its top-line growth. Simply put, the more data Upstart collects and incorporates into its algorithm, the more accurate the model will be. This is reflected in the whopping 264% revenue growth UPST saw in F’21 to $864 million. Furthermore, UPST showed profitability in 2020 and 2021, with $5.58 million and $135.44 million in net income, respectively.

Upstart’s capital-light business model makes it an attractive investment. As of 2021, 70% of Upstart’s loans are fully automated – meaning there are no additional costs incurred for Upstart. While other fintech companies such as Block (NYSE: SQ) and SoFi (NASDAQ: SOFI) are pursuing bank charters, CEO Dave Girouard said he’d rather partner with banks than compete with them. By maintaining its position as a partner to banks rather than a competitor, Upstart does not hold any loans on its balance sheet. As banks and credit unions continue to use Upstart’s services and are satisfied with the results, it is inevitable that UPST will experience further customer retention and grow its existing suite of bank partners.

Financials

Compared to other growth companies, Upstart’s financials are quite stellar. In 2021, Upstart posted net income of $135 million and operating cash flow of $168.5 million. In the most recent Q4’21 earnings report, UPST beat its guidance and posted a whopping $305 million in revenue (205% higher than Q4’20). A day prior to earnings, management announced a $400 million share buyback plan, a positive sign for shareholders that shows management’s confidence in the stock. As depicted by the figure below, UPST has improved its operating margin by significantly reducing SG&A expenses as a percentage of revenue. As Upstart continues to grow the percentage of automated loans and scale its business, it is likely we will continue to see operating margins increase in the next few years. Upstart also has a very strong balance sheet with ample liquidity and limited long-term debt. With a quick ratio of 8.48 and a current ratio of 12.48, UPST has more than enough assets to cover its obligations.

Risks

Risks for Upstart relate to its customer concentration and reliance on Intuit (NASDAQ: INTU) owned Credit Karma. In the year-ended 2021, UPST had a total of 38 bank partners. However, one bank partner, Cross River Bank (CRB) was responsible for 56% of the company’s revenue. While this number has decreased from 80% in 2019 and 63% in 2020, CRB still accounts for a significant portion of Upstart’s revenue. Additionally, in 2020, 52% of all customer traffic and loan origination were derived from Credit Karma, showing Upstart’s reliance on the personal finance company. UPST did not disclose the percentage of loans originated through Credit Karma in 2021, however, the 2021 Annual Report did mention that

a significant amount of our loan originations was derived from traffic from one of our partners, Credit Karma. Our most recent agreement with Credit Karma dated November 6, 2020 provides that either party may terminate our arrangement immediately upon a material breach of any provision of the agreement or at any time, with or without cause, by providing no less than 30 days’ notice.

Upstart shareholders should be aware of the company’s reliance on Credit Karma. Nevertheless, UPST has not seemed to face any negative repercussions from these risks so far. As UPST continues to increase the number of partner banks and organic traffic, both of these risks can be mitigated in the long term.

Valuation

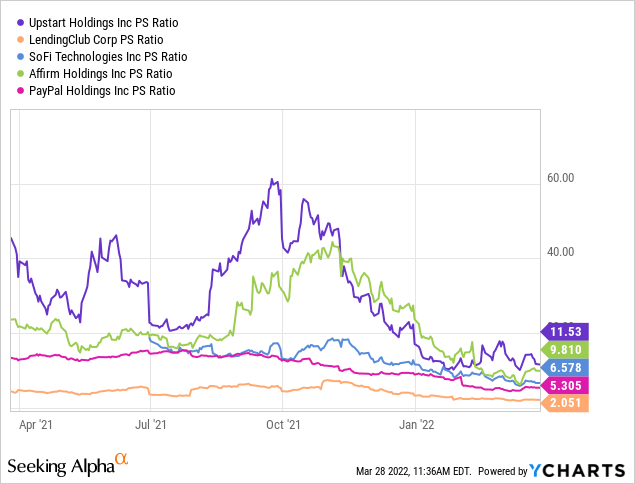

By traditional valuation metrics, Upstart is an “expensive” stock. As shown below, the P/S ratio is used to compare Upstart to industry peers including – PayPal (NASDAQ: PYPL), LendingClub (NYSE: LC), SOFI, and Affirm (NASDAQ: AFRM). While these are not direct pure-play competitors, investors can parse their valuations as a group since they are subject to similar market cyclicality exposure. P/S is a more accurate metric to use when comparing UPST to its peers, as some of its competitors are still earnings negative. While Upstart is currently trading at a higher P/S of 11.53x, its full-year revenue guidance is $1.4 billion, implying a forward P/S of 7.2x. The forward P/S was obtained using its current market cap of $10.10 billion and dividing it by management’s revenue guidance for F’22 ($1.4 billion). While a forward P/S of 7.2x is not “cheap”, factoring in UPST’s growth prospects and competitive advantage justifies the premium.

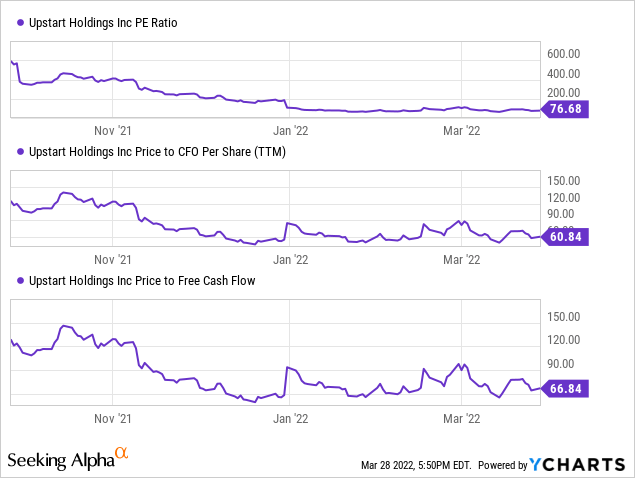

As shown below, even with multiple compressing over the past few months, Upstart is not cheap by any means. Trading at 77x earnings and 67x free cash flow, investors are paying a hefty premium to own a piece of this business. In order to see long-term market-beating returns, Upstart will have to sustain its top and bottom-line growth for years to come. So far, they have beaten expectations and raised guidance every quarter since their IPO and show no signs of slowing down. Hence, I believe it is worth paying a premium for this industry disruptor as we can expect to see tremendous growth for years to come.

Conclusion

Growth stocks have taken a beating so far in 2022, and UPST is no exception, down 75% from highs and 25% YTD. However, this presents a buying opportunity for shareholders to perhaps initiate or add to their position. Upstart’s strong and disruptive business model, coupled with its massive total addressable market and strong top and bottom-line growth poise the company for a bright future and long-term success. Nonetheless, shareholders should brace themselves for significant volatility in the short term as Wall Street determines the company’s fair value. Overall, I see long-term upside and value for UPST at current levels for potential strong total returns.

Be the first to comment