Alfsky/iStock via Getty Images

Here at Mare Evidence Lab, we’re no strangers to transmission companies. After having analysed E.ON (OTCPK:EONGY), Red Eléctrica (OTCPK:RDEIY, OTC:RDEIF), Terna (OTCPK:TERRF) and Redes Energéticas Nacionais (OTC:RENZY) respectively the German, Spanish, Italian and Portuguese grid companies, today we move on with National Grid (NGG, OTC: OTCPK:NGGTF), the UK transmission provider. Since the 2000s, National Grid has been reinforcing its presence not only in the UK, but also expanding in the US, acquiring various entities such as New England Electric System, Rhode Island gas and many more.

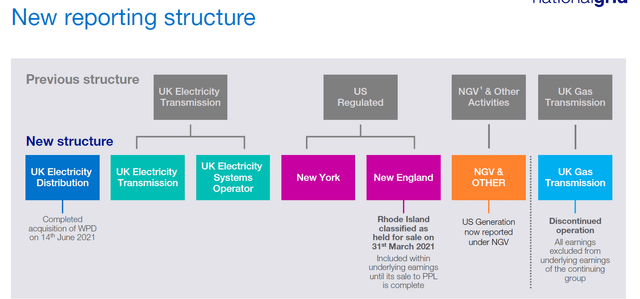

The company is pretty well covered in SA and as many other analysts have noted, the National Grid key date was 25 of January 2021 when the UK regulator called OFGEM, the Office of Gas and Electricity Markets, decided to separate the gas network and electricity network.

“A crucial part of our recommendation is that the system operator for electricity is made fully independent from the transmission network owner. We think there is also a good case for separating key gas network planning functions from the gas transmission owner and combining to create a new independent energy system operator“. Source: Review of GB energy system operation

After this breaking news, National Grid was not in the greatest position, being forced to sell a division when your counterparts know that your regulator is “recommending” that you sell and on the other hand you are looking to buy a new entity for investor dividend “obligations”.

Disinvestment & Acquisition

Just a few days ago, National Grid announced that it has agreed to sell a 60% equity interest in its UK gas transmission and metering business to a consortium made of Macquarie Asset Management and British Columbia Investment Management Corporation. The price paid was c36% RAB premium and the consortium has a call option on the remaining 40%. Looking at Wall Street expectations, analysts were looking at a 45% RAB premium. More importantly, as we already note, we see an ongoing and justified disparity in multiples between electricity and gas.

The transaction needs to be checked by the regulator and antitrust offices, but we are confident that the regulatory part will move on. If we add the sale of Neco, the new National grid will:

- have the electricity assets from 60% to 70% of its balance sheet;

- be able to reach UK’s net-zero target requirements;

- aim for a more pronounced asset growth;

- be able to get its strong investment-grade credit rating back.

National Grid new reporting structure

Long-term upside case

As we already mentioned, it is not the first time that we are looking at these entities. The reason why we saw positive trends were due to:

- new infrastructure in the EVs segment and heat pumps;

- higher forecasting in renewable capacity connections;

- grid modernisation, given the age.

Related to point two, it goes without saying that higher renewable energy generation means a more unstable grid as it depends on weather conditions. Combine this with the closure of controllable more conventional power stations, such as nuclear or coal, the grid must adapt to cope not only with changing demand but also with changes on the supply side.

Combining the effects and adding the closure of the more controllable conventional power stations, the UK grid must quickly invest in order to adapt to new demand/supply requirements.

Valuation

Our internal team believes that the above points are very much priced in. National Grid is very well positioned in the macro theme of net-zero transition and it is currently undergoing a transformation process.

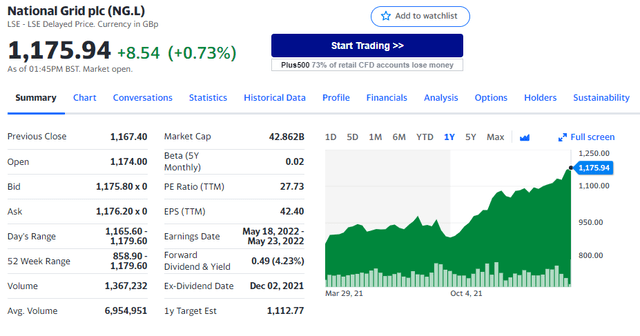

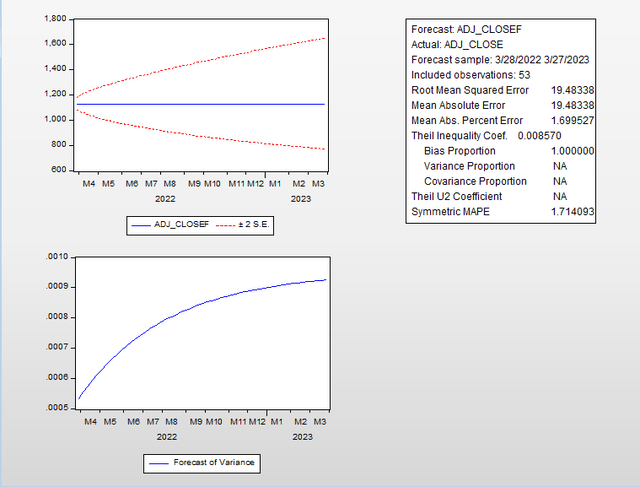

Our quantitative analysis suggests a very strong statistical relationship within the stock price, below, we present the next year’s forecast for the stock price and variance. Looking one year ahead, our worst-case scenario values National Grid at £8 but there is a higher probability that the company’s market cap will grow versus the current market price. For this reason, we initiate coverage with a neutral rating and we are more in favour of other players such as Terna with a more supportive dividend growth too.

If you are interested in our latest utility coverage, please have a look at:

Be the first to comment