MF3d

Global EV sales reached 6.75 million units in 2021, 108% more than in 2020. In 2021:

- China sold 3.3 million vehicles, more than in the entire world in 2020. Over 2.7 million BEVs (battery EVs) were sold in China in 2021, accounting for 82% of new electric car sales. Electric cars accounted for 16% of domestic car sales in 2021, up from 5% in 2020.

- Europe electric car sales increased in 2021 by more than 65% year-on-year to 2.3 million. Total car sales in 2021 were 25% lower than in 2019.

- United States sales were 630,000 units, of which 75% were BEVs, up from 55% just five years ago.

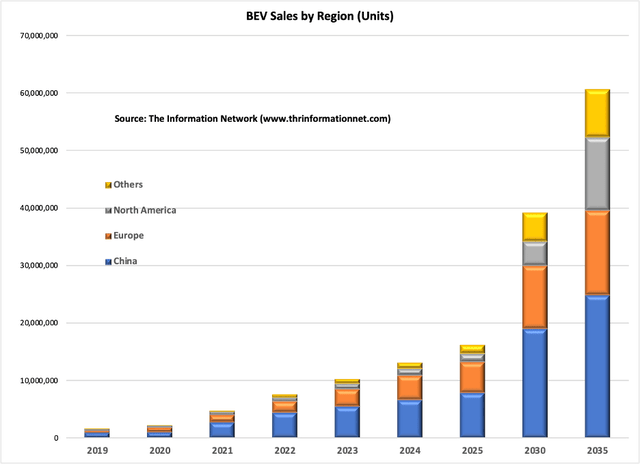

Looking forward to 2030 and beyond, Chart 1 forecasts BEV sales by region, according to The Information Network’s report entitled “Global and China EV Batteries and Materials: Technology, Trends and Market Forecasts.”

In 2025, North America sales will be less than one-third that of Europe, but U.S. president Biden signed an Executive Order that sets a new target of electric vehicles representing half of new vehicles sold in 2030. With that, I project that North American sales will nearly be equal to Europe at that time.

Chart 1

Battery Outlook

Production Capacity – China’s Dominance

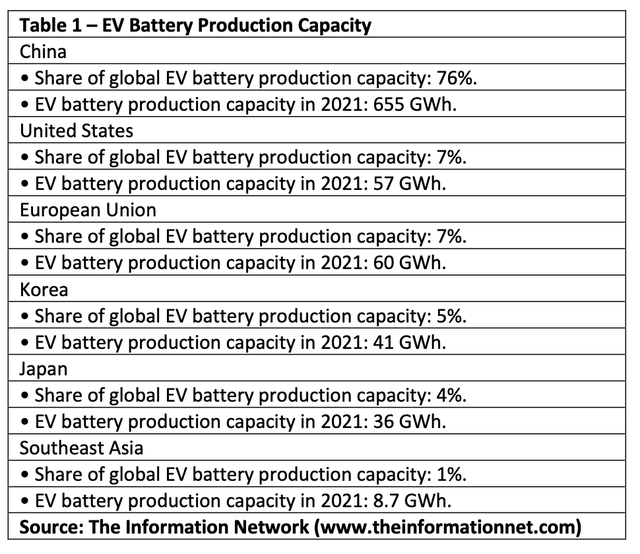

Battery demand is derived from BEV sales volume and vehicle battery capacity. Batteries are comprised of several highly specialized components including cathode and anode materials, electrolytes and separators.

China dominates production at every stage of the EV battery supply chain downstream of mining, as 76% of battery cell production capacity is in China, as shown in Table 1. The United States has a smaller role in the global EV battery supply chain, with only 10% of EV production and 7% of battery production capacity.

Metal Pricing

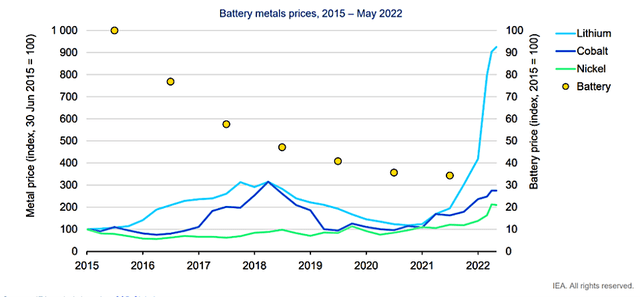

Chart 2 shows that battery prices (yellow dots) have been dropping even as demand for EVs has increased (Chart 1 above) and prices have increased.

Chart 2

Battery metal prices increased in 2021, led by lithium that increased 425%, as shown in Table 2. Prices continued to increase in Q1 2022 but decreased in Q2 2022 led by Nickel, which decreased 26%.

Rising demand and higher prices beg the question whether the world would have enough metals and minerals to support the global electrification ambition

Currently, only one active lithium mine is operating in the U.S., in the western state of Nevada. But new mining projects for lithium are now being developed in Nevada, Maine, North Carolina and California.

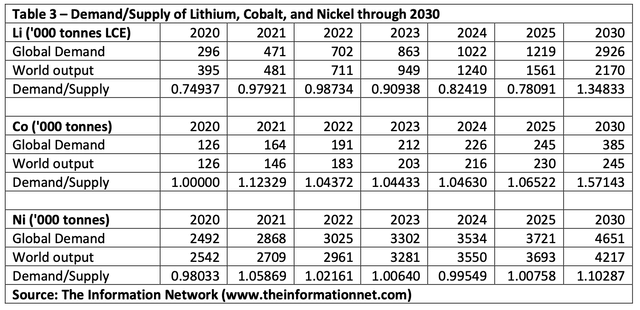

Table 3 shows that global battery demand will outpace lithium, cobalt, and nickel supply in 2030. For lithium, the demand/supply ratio will increase to 1.35, that of cobalt will increase to 1.57, and that of nickel to 1.10.

For the automotive sector, three broad categories of cathode chemistry are most relevant today:

- Lithium nickel manganese cobalt (“NMC”)

- Lithium nickel cobalt aluminum oxide (“NCA”)

- Lithium iron phosphate (“LFP”)

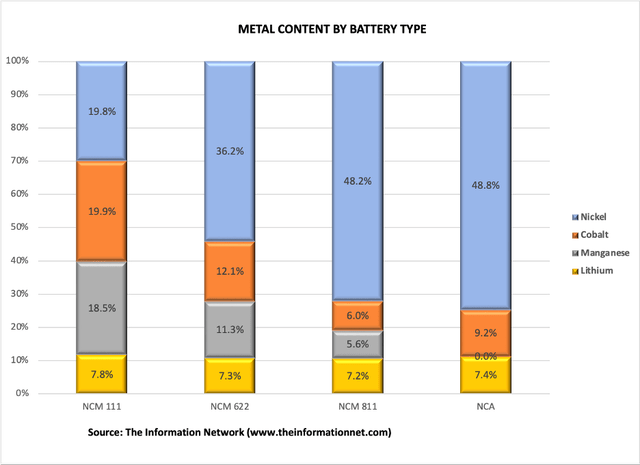

Metal content by battery type is shown in Chart 3.

The price of a battery is dependent on the metal content, which is dependent on supply-demand. Battery suppliers are moving from high-content cobalt (NCM111) to low-content cobalt (NCM811) cathodes for higher performance. Chart 3 shows the metal content of different battery types.

Converting from NCM 111 to NCM 811 increases the nickel content of a battery by 243% (blue color). In tandem, cobalt is reduced from 19.9% to 6.0% per cell.

Chart 3

Batteries that don’t contain cobalt or nickel already exist, but there are tradeoffs. Cheap and durable lithium iron phosphate or LFP batteries have made inroads in the Chinese EV market, where Tesla uses them in its standard-range Model 3 cars. However, these batteries also have limited energy storage capacity and range compared with lithium nickel manganese cobalt (“NMC”) batteries.

Different battery manufacturers have focused on the chemistry of their EV batteries based on several factors that are constantly being optimized, because each of these factors have tradeoffs. These include specific energy and specific power in favor of longer life, the number of charge/discharge cycles, reduced risk of fire, and increased charging speed. But an important factor is availability, particularly when China controls much of the capacity and mining as discussed above.

As a result, a current trend is tweaking existing batteries to maximize all these parameters.

Nickel-based chemistries, such as NMC and NCA, were dominant in the electric car battery market in 2021 with 75% of cathode material demand share due to their advantages for driving range. By 2030, high-nickel chemistries are expected to remain so. High-nickel Li-ion batteries require far more nickel than even lithium. For example, a NMC811 battery requires almost seven times more nickel than lithium by weight.

LFP reached an EV cathode material demand share of 25%, driven by the increased growth of EVs in China and the strong growth in Europe in the coming decade.

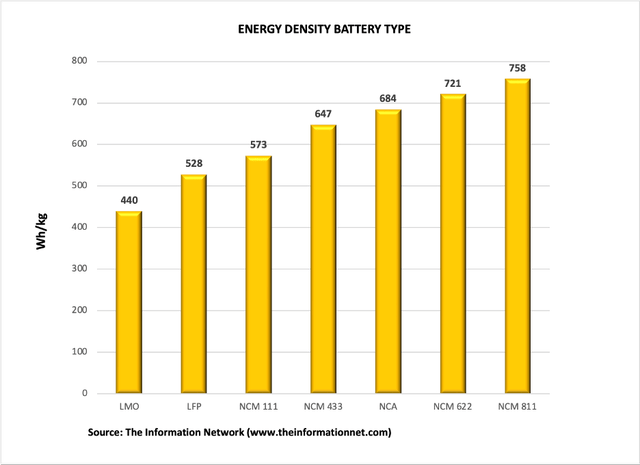

Energy Density by battery type is shown in Chart 4, with NCM 811 having the highest energy density at 758 Wh/kg and LFP one of the lowest at 528 Wh/kg.

Chart 4

What risks and opportunities exist for the EV battery market?

Demand for EV batteries will increase from 340 GWh today to over 3500 GWh by 2030. According to Fastmarkets, the London-based successor of the Metal Bulletin:

A total of 345,000 tonnes of processed lithium were produced in 2020, dominated by resources from the lithium triangle and Australia. Lithium production must quadruple between 2020 and 2030 to meet growing demand, from 345,000 tonnes in 2020 to 2 million tonnes in 2030.

Hence the concern that demand will outstrip supply as shown in Table 3 above.

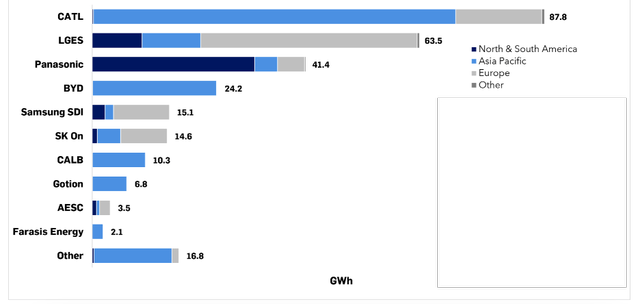

Globally, EV battery installations grew 113% YoY to 286 GWh in 2021, as shown in Chart 5. Contemporary Amperex Technology Co. Limited (CATL) held the lead in 2021 with a record 87.8 GWh deployed a 204% increase over 2020. South Korea’s LG Energy Solution was second place with 63.5 GWh deployed, up 72% over 2020 largely to Tesla (TSLA) in China, plus a handful of European and North American automakers.

Japan’s Panasonic (OTCPK:PCRFY) rounded off the top three with a record 41.4 GWh deployed, up 39% over 2020 on the back of Tesla sales growth coupled with modest sales growth from Toyota (TM), Lexus, Honda (HMC), Mazda (OTCPK:MZDAY) and a few of other EV makers that it supplies.

Panasonic, Tesla’s first battery supplier, plans to start mass-producing 4680 batteries in Japan during the financial year starting April 2023 and is reviewing sites for production in the De Soto, Kansas, and is working on new technology to increase battery energy density by a fifth by 2030. Tesla plans to use 4680 batteries to power new Texas-built Model Y cars.

Chart 5

What stocks/companies may be impacted by changes in the EV Battery market?

Solid-state Batteries next

Solid electrolyte, solid-state batteries promise 2X to 10X the energy density of lithium-ion batteries of the same size. That means:

- More powerful batteries without extra space

- More compact battery packs without compromising on power

- Longer range electric cars or more compact and lighter EVs

- Faster charge

- Don’t require the cooling and control components that lithium-ion batteries do

- Smaller overall footprint along with more chassis freedom

- Less weight

- Greater number of charging cycles by 5X before 90% degradation

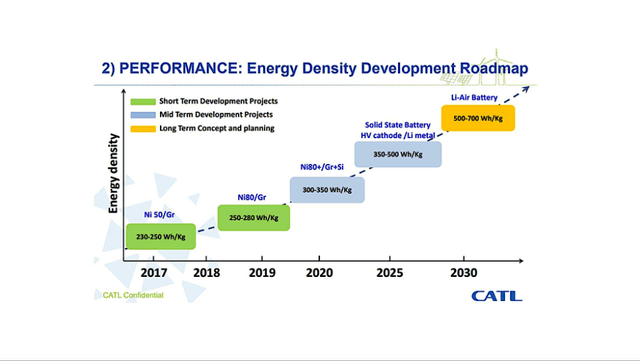

Chart 6 shows CATL’s energy density development roadmap, with lithium metal batteries entering the market in 2025.

Chart 6

Lithium Metal Battery Companies

Founded in 2010 and based in California, QuantumScape (QS) is developing solid-state batteries for the next generation of EVs. QuantumScape wants to replace conventional lithium-ion batteries with its non-combustible anode-free lithium-metal technology that has up to 80% greater energy density for enhanced range and has the ability to charge from 10% to 80% in just 15 minutes. The company is targeting 2023 to begin its pre-pilot production line and 2025 for its start of production. Volkswagen (OTCPK:VWAGY) has financially backed QuantumScape since 2012.

SES AI (SES) is a producer of Lithium-Metal battery technology. SES AI Apollo is the flagship battery product for use in electric vehicles. There are a variety of manufacturers that have already signed deals with SES AI. These companies include General Motors (GM), Hyundai (OTCPK:HYMTF), Honda Motor Co., Geely (OTCPK:GELYF), Tianqi Lithium Corp., and others.

Solid Power (SLDP) has built one of the most impressive next-generation lithium-metal batteries. The company has partnered with OEM players, Ford (F), BMW (OTCPK:BMWYY), and SK Innovation.

Toyota are testing a solid state battery that uses sulfide superionic conductors for a better battery that can operate at super capacitor levels to charge in just seven minutes. Toyota expects to unveil its first mass-produced EV with a solid-state battery by 2025. In February 2020, Toyota and Panasonic announced the establishment of a new joint venture company called Prime Planet Energy & Solutions.

Main Takeaways

One approach to take advantage of the rise in the EV market is by investing in companies that make EV batteries. I presented the top companies in Chart 5.

A second approach is by investing in EV battery companies that are developing the new-generation battery, primarily the Lithium Metal battery, which could replace existing Lithium Ion Batteries. The companies I already mentioned are publicly traded and have programs with existing EV manufacturers.

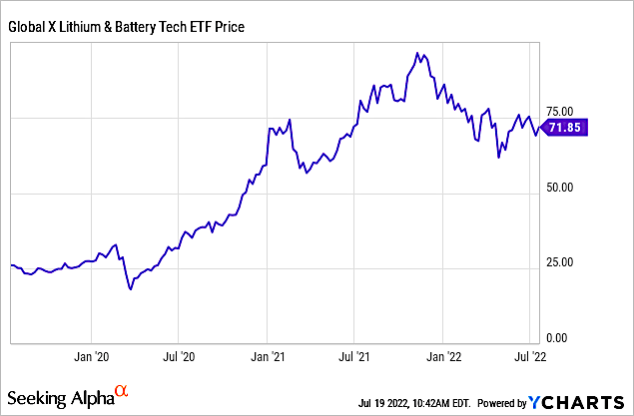

A third approach it to invest in those companies that mine and process the minerals those batteries use. In this case, I recommend Global X Lithium & Battery Tech ETF (LIT), which invests across a portfolio of companies that actively mine lithium or are involved in the production of batteries. LIT is an excellent fit for investors looking for niche lithium exposure as an ETF.

Chart 7 shows the share performance of LIT for the 3-year period.

YCharts

Chart 7

The largest current holding in the LIT fund is Albemarle Corp. (ALB) with an 9.98% weighting. The U.S. company with global operations is recognized as one of the world’s largest lithium mines. Other mining names among the top holdings include China-based Ganfeng Lithium Group (6.22%) and Sociedad Química y Minera de Chile S.A. (SQM).

Companies that directly manufacture batteries are also well represented in the fund, including Panasonic Holdings Corp. (OTCPK:PCRFY), LG Chemical Co., Ltd. (OTCPK:LGCLF), and Samsung SDI Co., Ltd.

Electric vehicle makers that also develop and utilize lithium batteries as LIT holdings include China’s BYD Company Ltd. (OTCPK:BYDDY) with a 6.22% weighting and Tesla which currently comprises 3.61% of the fund.

Be the first to comment