Images we create and what actually happens are always beautiful when we have imagination./iStock via Getty Images

Investment Thesis

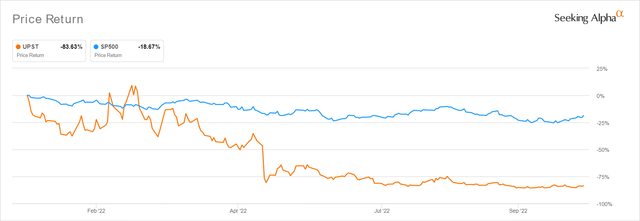

UPST YTD Stock Price

With an -85.88% plunge YTD, it is no wonder that Upstart Holdings (NASDAQ:NASDAQ:UPST) continues to boast a record-high 32.05% in short interest at the time of writing. For now, we hold a similarly mixed opinion, since there are minimal catalysts for a sustained short-term recovery, with 38.5% of analysts predicting a 75 basis points hike for the Fed’s December meeting as the September PPI and CPI continue to show sticky inflation rates with a surprisingly robust labor market.

The UPST stock had naturally reversed all of its previous gains from the past week, with the S&P 500 Index also falling steeply by -2.5%, as the Feds resumed its somewhat hawkish stance. Many were obviously disappointed by the unnatural optimism that the Feds would pivot this early, since it is attributed to the Bank of Canada’s moderate hike of 50 basis points. In the meantime, the stock will also be sorely tested by its upcoming FQ3’22 performance. Consequently, more pain will be felt if the company misses its already low guidance as it did in the last quarter. These estimates are truly not promising, which brings us back to the naturally elevated short interest.

However, we are a little more optimistic since it will not take much to excite the already hyped-out crowd, due to the massive baked-in pessimism in the UPST stock and earning guidance. Combined with the presumed strength of its newly announced funding partnerships, the company may potentially outperform expectations and induce a moderate recovery by 08 November. Of course, the critical question is, will the rally be meaningful and sustainable through H1’23, assuming a persistently stubborn PPI/CPI? Unlikely, barring a meaningful profitability then.

UPST May Potentially Overperform In FQ3’22 Due To The Suppressed Guidance

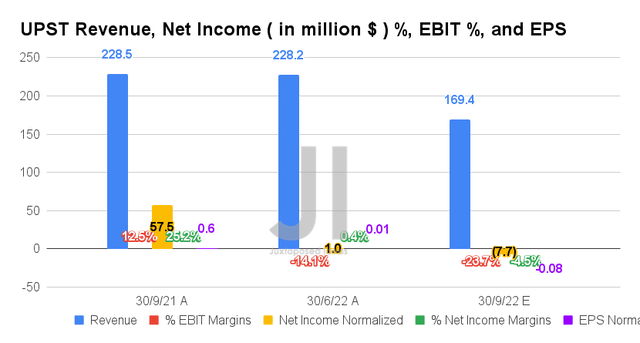

The doomsday fears have had the UPST management issue softer FQ3’22 guidance, with revenues of $169.4M and EBIT margins of -23.7%. These numbers represented a massive decline of -25.76% and -9.6 percentage points QoQ, respectively. Otherwise, a tragic YoY plunge of -36.2 percentage points in its EBIT margins, pointing to the rising inflationary cost pressures and elevated operating expenses thus far. These two combined had already grown by a tremendous 249.13% sequentially for the last twelve months, from $392.87M ending FQ2’21 to $979.87M ending FQ2’22.

Investors must also note that part of these expenses was further attributed to UPST’s large Stock-Based Compensation of $98.76M in the LTM, indicating another massive increase of 264.98% sequentially. It is no wonder then, that the company continues to report a lack of meaningful GAAP net income profitability.

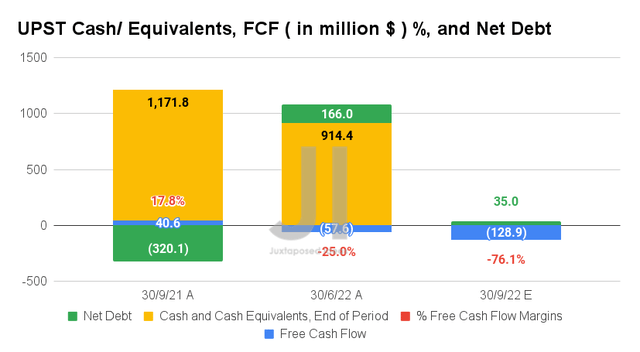

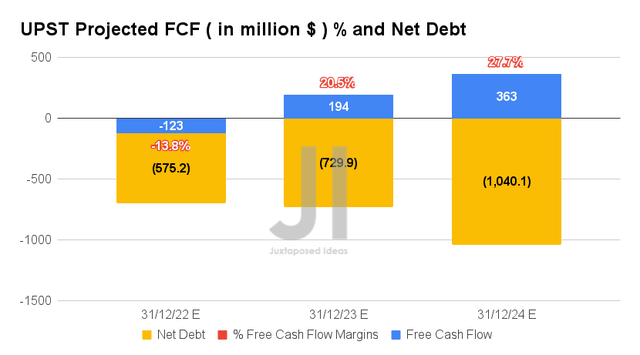

Therefore, it made sense that analysts have lower expectations for UPST’s Free Cash Flow (FCF) generation in FQ3’22, with a projected FCF of -$128.9M and an FCF margin of -76.1%. Thereby, indicating another decline of -223.78% QoQ and -417.48% YoY, attributed to the company’s higher capital expenditure of $12.01M in the LTM, with a sequential 492.21% increase.

Since it has a checkered history of backtracking, we also expect the UPST management to continue leveraging the balance sheet to finance some of its loans ahead, as equity funding dries up during these worsening macroeconomics. Naturally, pointing to its lower net debt situation in the next quarter, while the market’s skepticism continues to grow.

However, we are also somewhat confident that these will be combined with promising funding development, since UPST has continued to add new partners in the past two months. In addition, with the Bank of Canada signaling a pivot through its recent rate hike, many analysts are also optimistic about a similar dovish approach from the Feds by December. That would be a bullish catalyst indeed, since UPST would be able to net an even wider pool of willing funding partners moving forward.

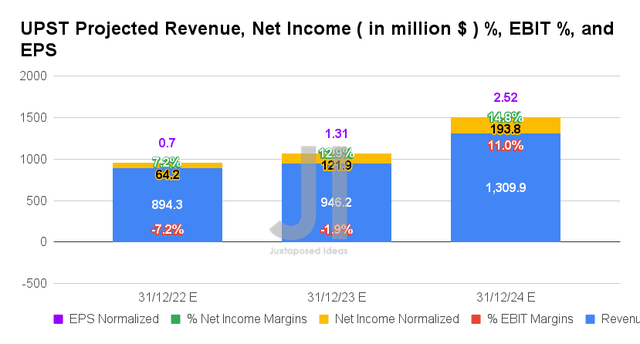

In the meantime, UPST’s top-line growth is mostly intact from previous estimates, though its profitability unfortunately downgraded by -15.03%. Nonetheless, we are still encouraged by the projected EPS of $2.52 by FY2024, since it represents an impressive CAGR of 89.1% over the next two years.

Furthermore, UPST is expected to report FCF profitability of $194M and FCF margins of 20.5% by FY2023, despite the Fed’s rate hikes ahead. Assuming that things play out according to these upbeat estimates, we will see the company report remarkable profitability with EBIT/ net income/ FCF margins of 11%/14.8%/27.7% by FY2024, compared to the current projections of -7.2%/7.2%/-13.8% for FY2022. Thereby, highlighting the stock’s massive potential for vertical recovery ahead once the Feds pivot and macro sentiment improve.

In the meantime, we encourage you to read our previous article on UPST, which would help you better understand its position and market opportunities.

- The Fed Has Upstaged Upstart – Is It A Falling Knife?

- Upstart: The Disruptor Has Been Disrupted – Now Nearing IPO Levels

So, Is UPST Stock A Buy, Sell, Or Hold?

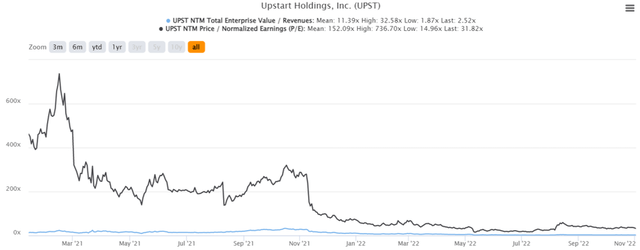

UPST 2Y EV/Revenue and P/E Valuations

UPST is currently trading at an EV/NTM Revenue of 2.52x and NTM P/E of 31.82x, lower than its 2Y mean of 11.39x and 152.09x, respectively. The stock is also trading at $20.43, down -93.9% from its 52 weeks high of $335.42, nearing its 52 weeks low of $20.12. Nonetheless, consensus estimates remain bullish about UPST’s prospects, given their price target of $26.40 and an 11.11% upside from current prices.

Despite the drastic correction thus far, UPST stock continues to trade at a premium, compared to its lending peers such as LendingClub’s (LC) at NTM P/E of 9.84x. With SoFi Technologies (SOFI) similarly trading at an inflated NTM P/E of -59.56x, it is evident that Mr. Market has yet to lose hope and remains cautiously hopeful about these two emerging fintechs’ capabilities in reforming the conventional lending market. However, investors that add at these levels should also note the massive volatility thus far and be prepared for more downsides from current levels. With shorters in no short supply, things will definitely get ugly once the wrong catalysts occur.

In the meantime, we continue to rate the stock as a Hold for now, given our price target of $10s, speculatively by H1’23 when things get really painful. Naturally, the stock is only suitable for those with higher risk tolerance and long-term trajectory, since lead-lined patience is very much needed to ride out the worst of storms.

Be the first to comment