Praewpailin/iStock via Getty Images

In the third installation of our bank valuations series, we take a look at something in our investment wheelhouse. Post-Great Financial Crisis (“GFC”), Société Générale Société anonyme (OTCPK:SCGLF, OTCPK:SCGLY) (“SocGen”) has been trading at a deep discount to book value. This is a reflection of a bank that has underperformed under the strict regulatory environment imposed subsequently.

In recent years, it has made progress in laying the foundations for better-performing returns. However, with a pandemic-driven business downturn hindering 2020 results, a EUR3.3bn loss from the disposal of Russian assets to do likewise to 2022’s results, and a global recession likely in 2023, the bank has not yet managed to convince the market that its transformation is complete.

We believe that if SocGen can hold firm in the next 12 months, starting from 2024, the stock can embark on a journey from its current lowly levels towards price-book parity.

The Company

SocGen operates a universal banking model, with a domestic retail bank network in France at its core. It also operates a number of international retail banks, concentrated in Eastern Europe and Africa, and a Global Banking franchise which includes its Markets business. These three areas form similar-sized pillars in terms of allocated capital and revenue contribution, although with the majority of its business in retail banking we focused primarily on its vanilla borrowing and lending businesses.

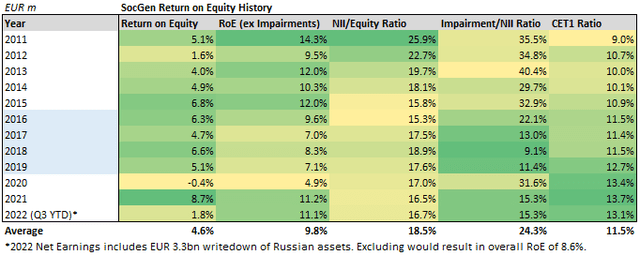

Its Q3 2022 YTD Group Net Income of EUR858m represents an annualized RoE of 1.8% while maintaining a CET1 ratio of 13.1%, although these figures include the write-down impact of Rosbank. Without this expense, RoE improves to 8.6%, and excluding all credit impairments (internally referred to as Cost of Risk), its underlying returns are a respectable 11.1%.

Indeed, this dilemma of delivering strong profitability, both before and after consideration of impairments, has been a recurring narrative over the last 10 years, as we try to demonstrate below.

We see a gradual improvement in the quality of the loan portfolio resulting in a much healthier CET1 ratio over time. However, this has come at the cost of lower returns (RoE ex-impairments) particular during 2016-2019. This has improved in recent years, however, because of idiosyncratic events, the metric that matters most (Return on Equity) has not reflected this stronger standing. (Woodforde Investments)

We observe that up until 2015, SocGen was operating a high-yielding loan portfolio, with Net Interest Income and RoE (ex-impairments) robust. However, large volumes of impairments weighed on overall profitability, with headline RoE in the low single digits, and CET1 never exceeding 11% during that time. Overall, it suggested a loan book of generally poor quality.

Between 2016-2019, while interest net yields stagnated, overall RoE showed signs of stabilizing around 5-7%. We also see a marked improvement in the credit quality of the loan book, as shown by the drop in impairments as well as a rise in the CET1 ratio to just below 13%.

From this stronger capital position, in recent times the bank has been able to improve the underlying yield, as shown by RoE ex-impairments returning to double digits in 2021. However, this healthy standing has not translated to the ultimate bottom line, with 2020 RoE impacted by the pandemic-related loss of volume, and 2022 to be hindered by the Rosbank write-down.

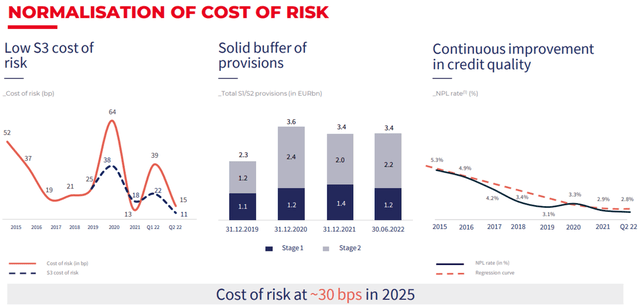

The improved health of the loan portfolio as described by the management. The mention of 2025 target Cost of Risk higher than recent levels is tacit acknowledgement that SocGen will pursue a strategy of adding credit risk. (Financial Results Presentation)

Forecasted Outlook

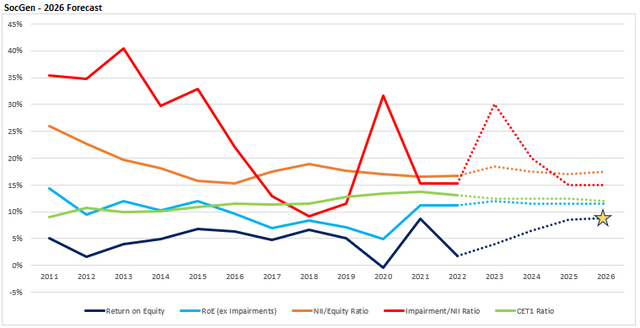

With almost unanimous consensus that a global recession awaits in 2023, we think the next 12 months will continue to prove a difficult environment for SocGen to post headline numbers that reflect its improved positioning. We forecast 2023 full-year RoE to return to low single-digit levels, as again increased credit impairments erode income earning gains from the higher interest rate environment.

What differs this time is that we view the impending earnings deterioration as cyclical and not structural as previously, and, therefore, expect any earnings pain to be short-lived. We foresee clear air awaiting the other side of the recession in early 2024, which will allow SocGen to finally stretch its legs and demonstrate what we believe it’s capable of: sustainable RoE of 8.5%. Our view is congruent to management’s stated ambition of achieving Ro(T)E of 10% and CET1 of 12% by 2025, although perhaps conservative (as management suggests a higher risk tolerance going forwards).

Although we see bumpier times ahead in the next 12 months, we forecast SocGen reaching and sustaining 8.5% RoE by 2026. (Woodforde Investments)

Valuation

We’ve asserted previously that a bank earning 10% RoE is fair-valued at 1.0 P/B. Following on that, we suggest a track record of 8.5% RoE should be accompanied with a fair value equivalent to P/B of 0.85.

In our eyes, although clearly undervalued, we think it is understandable that SocGen’s stock price is trading at P/B of 0.3, a reflection that the bank has not been able to persuade the market it is capable of sustainable, consistent, quality earnings.

With 2023 also not looking like an environment conducive to stellar results, we think that an appreciable uplift in the share price will likely start in 2024 at the earliest. We see price appreciation occurring once SocGen has demonstrated consecutive quarters of near 8.5% RoE, and the stock can be fully rewarded with a 0.85 P/B once it has strung 2 years of performance at these levels together.

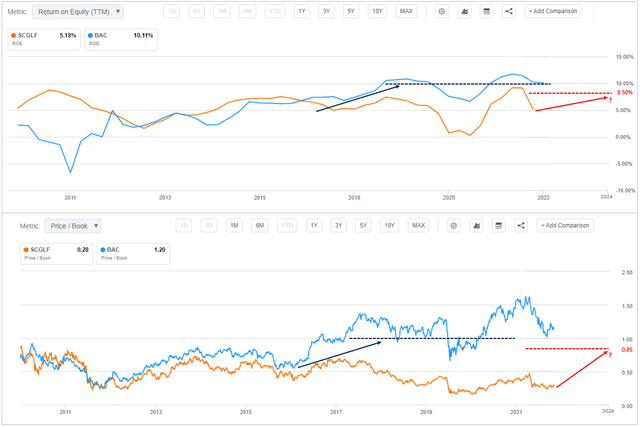

We cite Bank of America (BAC) as a pertinent example of a successful turnaround story, where for the first half of the last decade it traded below book value, eventually reaching parity in 2016 once it had telegraphed to the market’s sufficient durability in its earnings. We see SocGen being able to replicate this price action in the next 2-3 years.

We believe there is a correlation between a bank’s RoE (above) and the P/B (below) the stock trades at. We think SocGen investors can look to BofA (in blue) as an example of where the stock could move to once it starts delivering durable returns. (Seeking Alpha)

In adding a margin of safety to our calculation, we conservatively modelled the stock reaching our target P/B by the end of 2026, which equates to a stock price of EUR85, with another EUR7 returned as dividends. With the stock currently trading around EUR25, we’re looking at total returns almost triple the initial capital outlay within four years.

Risks and Measuring Progress

We find ourselves putting a lot of faith into a bank with a hit-and-miss record, to prove itself over a substantial duration in an uncertain environment. The hit from disposing of Russian assets was a reminder of the untimely setbacks that banks too often encounter, and to certain skeptical shareholders seemingly these unfortunate events happen to some banks more often than others. We could make an argument that SocGen’s lowly stock price contains a discount for perceived operational risk, some of which may be unfairly earned merely by being a European bank. Broadly, we fear that there will not be much residual goodwill from investors should there be a discovery of another “skeleton-in-the-closet” which puts in question the bank’s reputation, culture, or profitability, and in such a scenario our thesis may not hold water.

Also, we have based our assumption of a recovery starting in 2024 based on market consensus that a 2023 recession will be “short-and-shallow.” There is risk that a more severe and prolonged downturn may occur, which may delay the recovery. However, if SocGen has genuinely become resilient as we believe, we should not be anticipating sizable erosion of fundamentals.

Ultimately, for our investment thesis to succeed, the most important aspect is for SocGen to prove its credibility to the market. We look for it to show this through resilient quarterly and annual reported numbers, in particular healthy RoE, CET1 and credit provisions.

We are also keen for a more aggressive change in tone towards SocGen’s share buyback program. With the stock trading deeply below par, we are hopeful for significant reloads over time, as acknowledgement of how undervalued the bank is, as a reflection of how much capital the bank can spare, and regarding how much confidence management has in the firm’s positioning.

Conclusion

On the surface, it is easy to state that a bank trading at 0.3x of the book is undervalued, but the path SocGen has trodden post-financial crisis has made it challenging to earn a more appropriate valuation. With a recession looming, we don’t see a strong pull closer to book value imminent. However, much has been achieved during the last decade to shore up SpcGen’s capital position and to clean up its loan portfolio, and we look for the rewards of that hard work to start bearing fruit from 2024 onwards.

We feel that with current valuations so cheap, it makes little sense anticipating further falls in SocGen’s stock price or predicting sideway movements in the next 12 months. Thus, we advocate a “buy now, buy more later” approach. We’re confident an investment in Société Générale now can grow close to 300% by 2026.

(EURUSD=1 assumed in analysis)

Be the first to comment