aislan13

Dear Fellow Investor,

Upslope’s objective is to deliver attractive, equity-like returns with significantly reduced market risk and low correlation versus traditional equity strategies. Volatility from Q1 continued and intensified in Q2, making for another relatively favorable environment for Upslope’s approach.

|

Upslope Exposure & Returns1 |

Benchmark Returns |

|||

|

Average Net Long |

Net Return |

S&P Midcap 400 ETF (MDY) |

HFRX Equity Hedge Index |

|

|

Q2 2022 |

69% |

+0.8% |

-15.4% |

-4.4% |

|

YTD 2022 |

67% |

+0.5% |

-19.7% |

-4.7% |

|

Last 12 Months |

65% |

+3.8% |

-14.8% |

-0.9% |

|

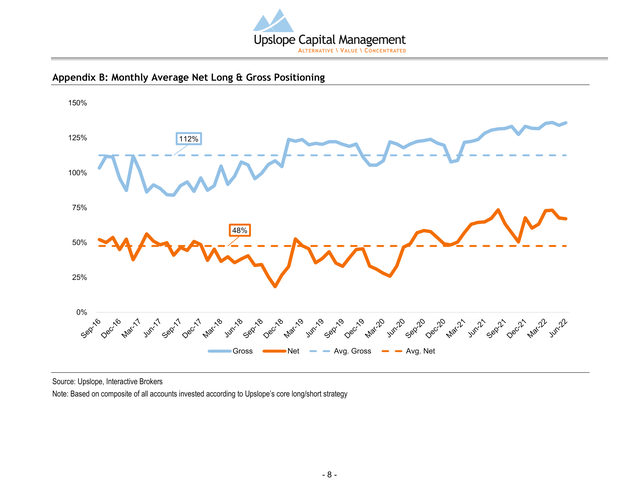

Since Inception* |

48% |

+9.7% |

+7.9% |

+4.0% |

|

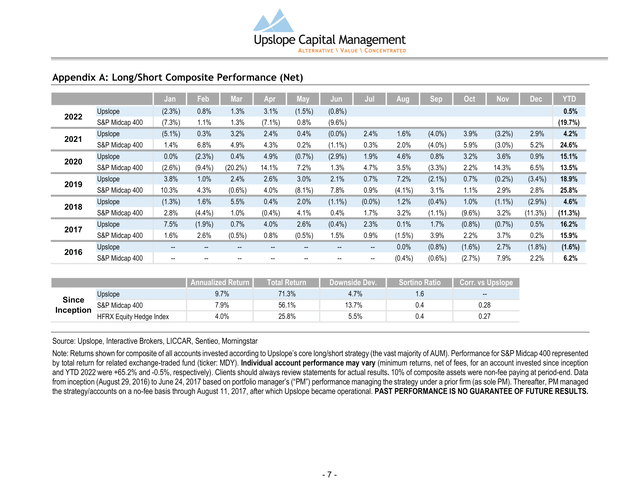

Note: clients should always check individual statements for returns, which may vary due to timing and other factors. *Since Inception returns are annualized. |

||||

MARKET CONDITIONS – ALL SOBERED UP?

Bargains have begun to emerge, but investors need to be pickier than usual – despite a market -20% YTD. Not everything is on sale and the macro environment is packed with landmines. Flawed businesses whose stocks saw bubbly valuations last year will remain challenged, in my view. Just as it was wise to remain humble making predictions about inflation, it’s best to be open-minded about the macro road ahead. A recession is likely. Will it be shallow and somewhat painless – “technical” in the spirit of mis-predicted “transitory” inflation? Or at least V-shaped, like the crises of recent years (2018, 2020) that investors have learned to love? I’m not so sure.

Upslope’s portfolio continues to lean defensive and cheap. Quality is surprisingly high for some of our longs with newfound cheapness. One example (purchased in Q2) is Ball Corp (BALL). In late 2020, Ball traded for over 30x earnings – ridiculous for a humble beverage can producer (albeit an exceptionally well-managed one). It recently traded for half that. Drawdowns are not the same as “value”; but, this seems like an “obviously reasonable” price for the clear leader in a consolidated industry that’s historically shown limited macro sensitivity, a good ability to pass through costs, consistent growth, and disciplined capital allocation.

On the short side, our shift away from “SPAC+” shorts continues.2 In their place: increased exposure to select pockets of cyclicals – namely packagers and housing. Some have been indirect beneficiaries of the inflationary environment (fundamentally and as “value stocks”), which seems likely to wane. These stocks have held up surprisingly well, even though historically they have been harmed more than most in a sluggish economy.

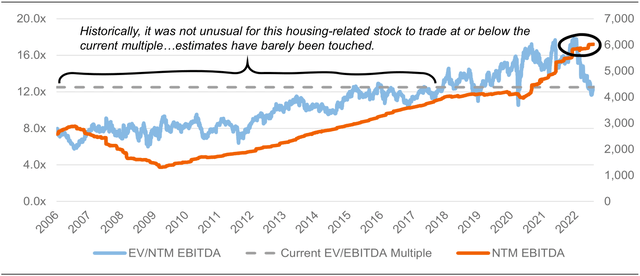

I came about our housing-linked shorts in a roundabout way. After initiating a starter long in a housing stock during the quarter, I concluded (after some restless nights) that in the face of a historic spike in mortgage rates, it was all just a little too cute. While the stock had de-rated, shares have seen lower trough valuations in the past and estimates hadn’t even budged yet. So not only did I hit eject on the starter long, but I sought worse offenders as shorts. “Quality” and “compounders” are words investors use to describe most of them.

These shorts are reasonably cyclical and only cheap relative to the past five boom years. The outlook has changed, and the longer-term floor has historically been lower. While I have no illusions about housing shorts being in the early innings, estimate cuts should still compound potential downside. A clear example of the above phenomenon is shown below.

Exhibit 1: Still Compounding in Housing?

Source: Sentieo, Upslope. Note: as of 7/15/22; EBITDA figures adjusted by multiplier to keep example blind.

Looking ahead, what would it take for me to get more broadly bullish – and what would that look like in terms of Upslope’s portfolio? It’s easiest to answer the second question first: you’d see a reduction in outright short exposure and an increase in the average beta (cyclicality) of our longs.

What would cause this to happen? On the short side, I would need to have a harder time finding interesting ideas. Today, I don’t believe it is that difficult. There are still plenty of SPACs with more downside (approx. 100% in many cases – just on fewer dollars, which means more risk). There are also plenty of cyclicals that seemingly only “work” in a best-case perfect-landing macro scenario, while offering sharp downside if current events continue down the same path.

Finding attractive, higher beta longs is more challenging. Despite the market pullback, there isn’t much that I’m excited about in this category (although we’re getting warmer). I had some fits and starts here in Q1, with a few starter positions that I ultimately ended up cutting entirely. Most of the cyclical areas I’ve studied have priced in a softening economy. But, downside is not yet limited enough. I have a well-worn and growing shopping list that I hope to get another shot at soon. While I’m excited about what may lie ahead, I believe patience is still warranted.

PORTFOLIO POSITIONING

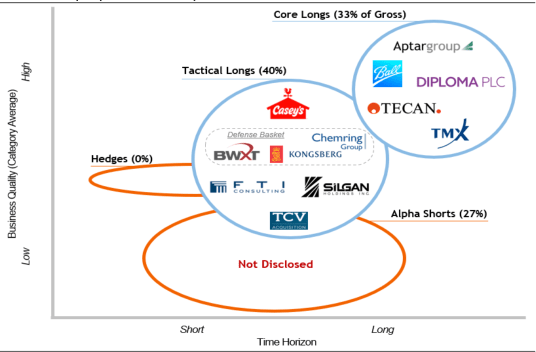

At quarter-end, gross and beta-adjusted net exposures were 135% and 37%, respectively. Positioning continues to reflect a heightened number of perceived opportunities on both the long and short sides of the portfolio – and sharply lower average beta among longs than shorts. Gross exposure is elevated (vs. typical 125% range) owing to a large position in a pre-transaction SPAC (TCVA) trading below NAV.

Exhibit 2: Upslope Portfolio Snapshot3

Source: Upslope. Note: as of 6/30/22 and may change without notice. Logo positioning within categories not reflective of relative time horizon/business quality. See Appendix C for a brief overview of all longs.

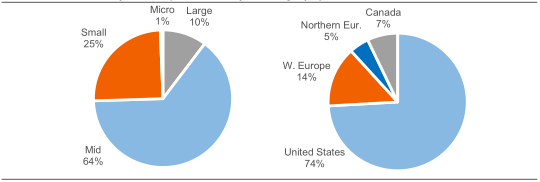

Exhibit 3: Gross Exposure by Market Cap & Geography

Source: Upslope, Interactive Brokers, Sentieo. Note: as of 6/30/22. Market cap ranges: Micro ($13.5bn).

PORTFOLIO UPDATES4

The largest contributors to and detractors from quarterly performance are noted below. Gross contribution to overall portfolio return is noted in parentheses.

Exhibit 4: Top Contributors to Quarterly Performance (Gross)

|

Top Contributors |

Top Detractors |

|

Long: FTI Consulting (+160 bps) |

Long: Diploma (-185 bps) |

|

Short: Tattooed Chef (+125 bps) |

Long: Bright Horizons (-155 bps) |

|

Short: Ranpak (+95 bps) |

Long: Tecan (-145 bps) |

|

Longs – Total Contribution |

Shorts – Total Contribution |

|

-885 bps |

+995 bps |

Source: Upslope, LICCAR, Interactive Brokers

Note: Amounts may not tie with aggregate performance figures due to rounding

Bright Horizons (BFAM) – Exited Long

Bright Horizons is a leading childcare provider with a unique corporate partnership model. Upslope’s thesis was that BFAM was hit hard by COVID-19 but should ultimately emerge competitively stronger. This thesis broke in Q2 (arguably, I confess, much earlier), as the company continued to struggle on most fronts (enrollment + margins) and announced its largest-ever acquisition – in Australia. In addition to poor timing (aggressive deal from a position of weakness), the acquisition also signaled to me a lack of near-term opportunities in BFAM’s core U.S. market.

Envestnet (ENV) – Exited Long

Envestnet is a leading wealth management technology platform. Based on various management initiatives and actions and the fact ENV is a collection of unique assets, Upslope’s thesis was that the odds of a “turnaround or takeout” were quite high. This thesis broke on both fronts during Q2. Fundamentals (tied to broader market performance) deteriorated sharply; and, the odds of a takeout (dependent on financing conditions and general risk appetite) also declined. To put an exclamation point on it, ENV also saw an exodus of various upper-/mid-level executives.

Ball Corp. (BALL) – New Long

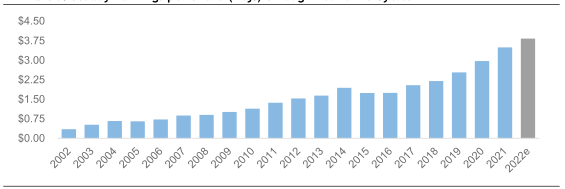

Ball is a simple business, focused primarily on producing beverage cans (90% of segment earnings, with the remainder largely focused on niche aerospace instruments, sensors, and spacecraft). An aggressively un-sexy business, “bevcans” is an attractive niche with historically low sensitivity to macro volatility and solid pricing power (due to tight contractual pass-through of raw material costs and a highly consolidated industry). Barriers to entry aren’t particularly high, but it is challenging for sub-scale entrants to compete and operate efficiently vs. large global players such as Ball.

At its foundation, the business is driven by canned beverage (beer, soft/energy drinks, etc.) volumes, with a modest, but persistent uplift owing to a long-term shift from glass and plastic beverage packaging to aluminum (lighter, easier to recycle, and less energy-intensive). No surprise, the core of Upslope’s thesis isn’t about heart-racing upside so much as it is about owning a well-managed, attractive business with limited downside and a history of double-digit free cash flow growth. Ball shares have struggled significantly over the past 18 months. 2021 was the stock’s worst year of relative (vs. S&P 500) underperformance since at least 2000 (a fun fact for those of us that believe we just concluded Tech Bubble 2.0). 2022 kicked off similarly. While the S&P 500 itself saw one of its worst starts to a year ever, Ball shares underperformed even that by an additional 11% (-30% in 1H). Much of this was, in my view, due to a badly needed correction of over-valuation. In recent years Ball became an “ESG” darling, owing to its (logical) messaging around sustainability, as well as its steady performance through COVID-era macro volatility. This exuberance has finally been corrected, in my view.

A big part of my enthusiasm for Ball today is the expected removal of a series of temporary but noisy headwinds. Among them: concern over Russian operations (<5% of sales and expected to exit), weakness in Brazil (historically volatile and nothing new; also consistent with competitor’s experience), and inflationary pressures (headwind to margins that should ultimately be recouped). On top of these concerns, investors (including myself) have eyed significant bevcan industry capacity expansions in recent years with some concern and skepticism. To date, industry expansion has not been speculative and has been tied directly to contracted new volumes. While it remains an issue to watch, I believe:

- it’s very widely known and largely priced in today, and

- we could see some capacity expansion pauses or reversals in the periods ahead (which would be cheered by investors).

Aside from fading headwinds, there are plenty of reasons to like Ball as a business and stock.

- First, as noted, Ball’s business is largely driven by canned beverage volumes, which tend not to be particularly cyclical, and are bolstered by the steady shift towards aluminum beverage packaging.

- Second, Ball has historically been viewed as the best-managed packager with a disciplined, ROIC-focused management team. I have long agreed with this assessment, but believe the stock is no longer priced as such today.

- Third, despite tough sledding for shares of late, I believe Ball is exactly the type of stock that should thrive on at least a relative basis in today’s uncertain macro environment. The core is defensive and the business is better insulated against inflationary and recessionary headwinds than most. The company can also thrive should macro concerns subside.

- Finally, Ball’s niche Aerospace segment remains an obvious source of optionality, given the geopolitical climate and investors’ lack of focus on it.

Exhibit 5: Steady Earnings per Share (Adj.) through Economic Cycles

Source: Canalyst, Sentieo, and Upslope.

Key risks for Ball shares include:

- “Peak cycle” concerns, including: Ball’s purchase of arena naming rights (in Denver), CEO retirement, industry capacity expansion, and previously intense ESG interest. While these are still risks, I believe downside is far more limited today at half of the peak multiple.

- Further valuation compression is also possible. I see this happening largely in a scenario where the broader market completely falls apart – during which Ball would almost certainly outperform.

- Relatively new CEO (was head of bevcans for years and the logical successor to prior CEO).

- Correlation to existing Upslope “packaging” longs. Ball is indeed more correlated to these positions than other Upslope longs; however, each has a different end market focus (Aptar = pharma, Silgan = food, Ball = beverage).

- FX translation headwinds due to the global nature of the business.

Despite near-term uncertainty, I am particularly excited to be a shareholder in Ball, a business I’ve long followed and admired but never owned due to the price tag. While the best opportunities in bear markets tend to be found in beaten up shares of high-risk cyclicals, the unique circumstances Ball has faced in recent years have afforded us an unusual opportunity to own shares of a steady, predictable business at a discount – precisely when such predictability should be uniquely valuable.

CLOSING THOUGHTS

The environment continues to be favorable for Upslope’s strategy. I am pleased to have protected capital YTD but not satisfied with muted absolute returns. While capital preservation remains a priority, I am more actively on the hunt for investments that are less defensive in nature but still have limited downside. For now, I will echo what I said in Q1: valuation discipline, pragmatic risk management, and an ability to be nimble are the key success factors in 2022, and I am more focused on them than ever.

As always, I sincerely appreciate the trust you’ve placed in me to manage a portion of your hard-earned money. If you have any questions at all, would like to add to your account, or know someone who may be a good fit for Upslope’s atypical approach, please call or email anytime.

Sincerely,

George K. Livadas | 1-720-465-7033 | george@upslopecapital.com

Appendix

Appendix C: Portfolio Company ((Long)) Descriptions

AptarGroup (ATR): Specialty packaging business focused on pumps and sprayers, with a highly profitable, defensive, and growing Pharma unit. Misclassified and undervalued due to legacy/traditional packaging businesses (Food + Beverage, Beauty + Home), which contribute 60% of sales but just 15% of EBIT.

Ball Corp. (BALL): Leading global producer of beverage cans run by best-in-class management team. Resilient business model with a history of attractive, double-digit earnings growth over the long-term and through economic cycles. Also operates a niche aerospace business.

BWX Technologies (BWXT): Leading producer of nuclear reactors, components, and fuel, primarily for the power and propulsion of U.S. Navy subs and carriers. In addition to rising geopolitical tensions, the nearing end of a major capex cycle and optionality in non-Naval units should provide tailwinds ahead.

Casey’s General Stores (CASY): 3rd largest independent convenience store operator in the U.S. and 5th largest pizza chain; unique footprint exclusively focused on the Midwest/South. Growing business with highly defensible model offers good value and significant optionality from organic initiatives and M&A.

Chemring (CHG.LN): Niche defense contractor focused on Countermeasures & Energetics (defensive flares, specialty explosives) and Sensors & Info (cyber warfare, explosive/chem/bio detection). End markets should outgrow defense market for years; also has elevated “conflict-driven” demand exposure.

Diploma (DPLM.LN): U.K.-based specialty distributor focused on essential consumable products across life sciences, seals (machinery), and controls (aerospace wiring/harnesses). Unique model and conservative M&A strategy have historically enabled attractive free cash flow growth through the cycle.

FTI Consulting (FCN): Boutique consulting and advisory firm, with leading expertise in restructuring, dispute advisory, and other practices. Should ultimately benefit from elevated deal flow in wake of longer- term pandemic effects, reopening, rising rates and long-term effects of SPAC boom/bust.

Kongsberg Gruppen (KOG.NO): 200+ year old defense (missile/defense, remote weapons systems) and maritime (offshore, commercial) business, majority owned by Norwegian government. Dominant positions in niche products with cyclically attractive end markets, strong management team and solid balance sheet.

Silgan (SLGN): Food can, dispensing system, and plastic packaging producer managed with a private equity mindset. Defensive end markets, attractive valuation and disciplined model make for attractive baseline investment with balance sheet optionality (M&A or capital return).

Tecan Group (TECN.SW): Switzerland-based lab automation and consumables business, with leading market position in automated liquid handling. Attractive and defensible base business greatly enhanced by exceptional execution throughout the COVID-19 pandemic.

TMX Group (X.TO): Largest exchange operator in Canada with exposure to equities, fixed income, and derivatives, as well as European power/energy trading/data. Anticipate steady, defensive growth with potential outperformance in the event of rising inflation and/or elevated volatility.

Footnotes

1 Unless otherwise noted, returns shown for a composite of all accounts invested according to Upslope’s core long/short strategy. Please see important performance-related details and disclosures in Appendix A.

2 Of course, I retain the right to about-face on this.

3 Not disclosing shorts publicly due to current market conditions. As always, clients should feel free to contact me regarding any/all positions, including shorts. “Starter” longs (based on Upslope’s judgement) are not shown.

4 Upslope’s general policy regarding disclosure of new positions is to discuss significant longs considered to have been fully established. For shorts, Upslope aims to discuss an illustrative sample of positions (generally desiring added confidentiality). long-term shift from glass and plastic beverage packaging to aluminum (lighter, easier to recycle, and less energy-intensive).

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment