Khanchit Khirisutchalual

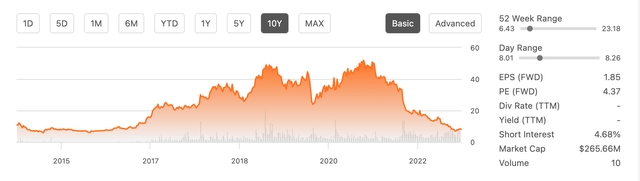

Upland Software (NASDAQ:UPLD) shares have been a terrible performer over the past 3 years with the stock down ~80%. Shares have declined as EBITDA growth has failed to materialize following over $500 million in M&A spend over the past 5 years. Given a low headline valuation (sub 8x adjusted EBITDA), I decided to take a look at the stock following the raise of $115 million via a convertible preferred offering (and addition of private equity executive David Chung to the Board of Directors).

Overview

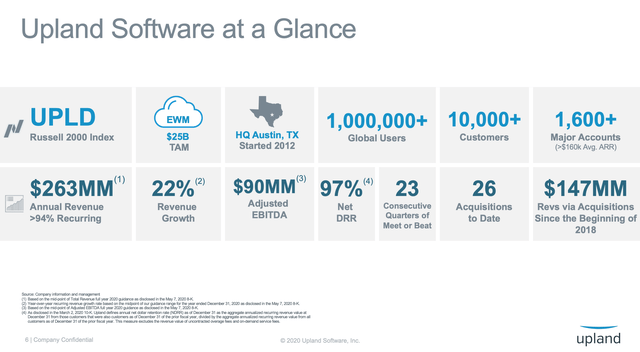

Upland is a roll-up of small Software-as-a-service (“SAAS”) companies led by founder/CEO Jack MacDonald. The premise for the roll-up is that there is a market opportunity to acquire small SAAS companies (sub $25 million in revenue) with attractive economics.

The story, as management tells it, is that while the acquired companies are minimally profitable at the time of acquisition, Upland management would cut sales & marketing and G&A expenses and bring the acquired company’s margins (and Upland as a whole) to 40% EBITDA margins. The all-in multiple for acquisitions on a post-synergy basis would be <9x EBITDA and organic growth would be mid single digits.

Upland Overview (Investor Presentation)

Over the past 5 years the company has spent over $500 million to acquire over a dozen small software companies. Acquisitions span a wide range of applications serving a multitude of industries. However, the financial results have been quite disappointing as I will discuss below.

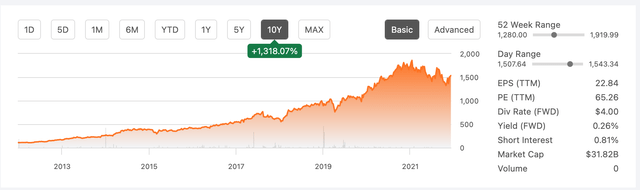

Misplaced Comparison to Constellation Software

Some investors initially compared Upland to the shareholder value creation machine (see 10 year chart below) Constellation Software (OTCPK:CNSWF), which has acquired over 100 small software companies over the past decade. However there are several important distinctions which make this a poor comparison as Constellation was built primarily through the acquisition of core vertical ERP software businesses with very high market shares (within their specified verticals). The acquired companies had attractive economic characteristics including the mission critical nature of ERP software which has high switching costs (very low churn) and tremendous pricing power.

Constellation Software 10 year share price (Seeking Alpha)

By contrast the businesses acquired by Upland appear to have been akin to add-on features (not mission critical). Further these software businesses are subject to greater competitive pressure (market share not firmly defined). Perhaps most importantly, because they lack mission critical status and competitive pressure, these businesses lack pricing power.

Disappointing Long-term Performance

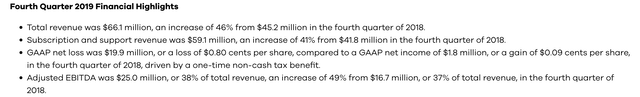

Despite aggressive acquisition spend, run rate adjusted EBITDA has actually declined since 2019:

4Q19 Results (4Q19 Earnings release )

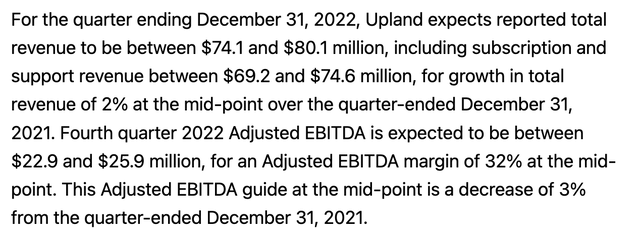

4Q22 EBITDA guidance (3Q22 Earnings release)

At the midpoint of guidance, this is a 2% decline in adjusted EBITDA over a three year period where nearly all software businesses have experienced tremendous growth. Upland has failed to achieve organic growth targets – as you can see, organic revenue is now declining. Further, not only has Upland failed to achieve its targeted 40% EBITDA margin but margins have declined from 35% to 32%.

I believe the poor performance is a function of both the relatively low quality of the businesses acquired (as described above in comparison with Constellation Software) and, to a lesser extent, poor management execution. Upland’s poor operational performance has been reflected in its share price performance:

Upland share performance since IPO (Seeking Alpha)

Is Change coming to Upland?

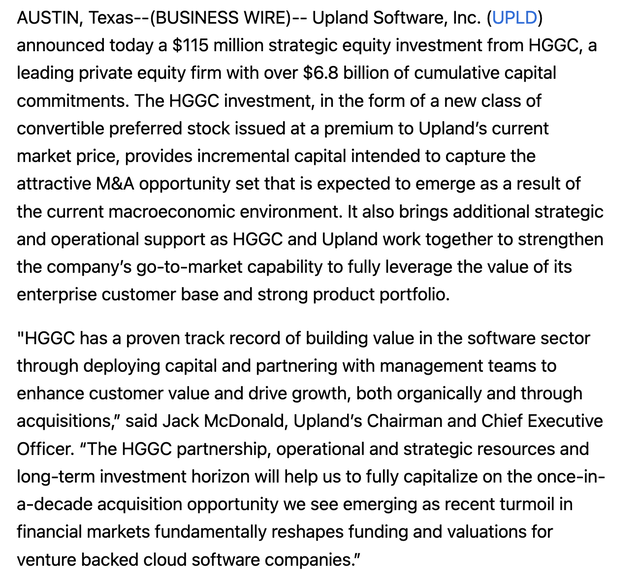

I was encouraged to see that Upland added HGGC private equity executive David Chung to its Board of Directors following HGGC’s purchase of $115 million worth of convertible preference shares. While I thought this might signal big changes at Upland, this seems unlikely at this time given that:

1/ The press release (excerpt below) notes that Upland will continue to forge ahead with its acquisition strategy:

Expect continued M&A (Upland Preferred Investment Press Release)

2/ As you can see in the press release above, Founder Jack MacDonald, who is the architect of Upland’s acquisition strategy, remains Chairman & CEO.

Conclusion

Despite its low valuation, I have no interest in Upland given the lack of leadership change and that it appears the strategy going forward is ‘more of the same’. I may re-visit the story should we see a change in leadership and strategy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment