JHVEPhoto

Dear readers/followers,

It’s time to revisit Assa Abloy (OTCPK:ASAZY) and see why this company could, provided that some of the upside materializes, be a good “BUY” for the long term. Assa Abloy isn’t a high yielder, nor a high dividend grower, but it’s a safe company with a timeless business idea.

Let’s revisit this company and see what’s happened and what the current upside is.

Assa Abloy – Revisiting one of the premier access companies around

The company Assa Abloy AB was formed back in 1994 in a merger between Assa AB, which was split from Securitas (OTCPK:SCTBF) merged with Finnish company Abloy Oy. It was listed on the OMXS that same year, and since that time, the company has performed over 200 M&As, the most prominent of which include Yale Lock, Chubb Locks, Medeco, Mul-T-Lock out of Israel, and Fichet-Bauche in France.

To date, it’s one of the most premier and important companies in the segment – and it owns most of the brands in the segment that you would recognize, including brands such as Assa, Abloy, August Home, Besam, HID, Medeco, VingCard, Yale, HKC Security, Lockwood Locks, and many more.

Assa Abloy has had good sales and earnings performance throughout the pandemic and the latest few quarters. It continues to be heavily M&A-focused – six more acquisitions were signed in the last quarter, with continued cash flow improvements. While the company did record a decline YoY in 2020, it’s back up in 2021 to revenue levels that are above those of 2019. For now, margins are very much intact as well – meaning both the company’s top and bottom line numbers are showing stability.

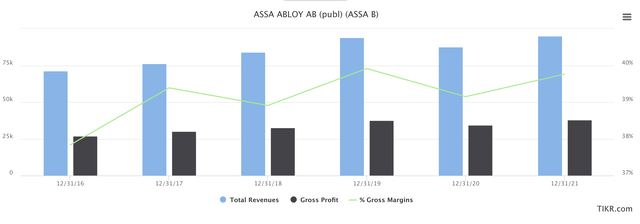

Assa Abloy Revenue/profit (S&P Global/TIKR.com)

These improvements have continued. For 3Q22, the company recorded no less than 33% sales increase YoY, and an EBIT increase of 39% – higher than sales revenue, meaning the company is successfully protecting its bottom line.

The company managed to both win projects and deliver new products to market.

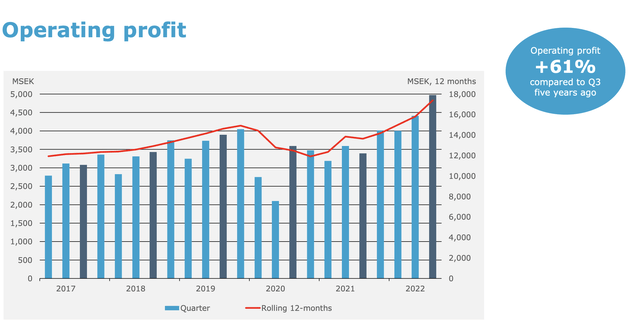

Unlike many other companies in its segment, Assa Abloy has managed to record continued, organic growth for several years, with the exception of COVID-19. Operating profit is a key metric to look at, and things are looking very impressive here.

The company continues to focus on what it views as the key to success in the business – inorganic growth and M&A coupled with low rates of organic growth. Some of the major ones this quarter included DoorBird, a German manufacturer of high-quality IP door intercoms, with 220M SEK in sales in the last years, and an M&A that’s fully accretive to Assa Abloy EPS from the get-go. The same is true for a Brazilian company, Control iD, with sales of 250 MSEK for the past year.

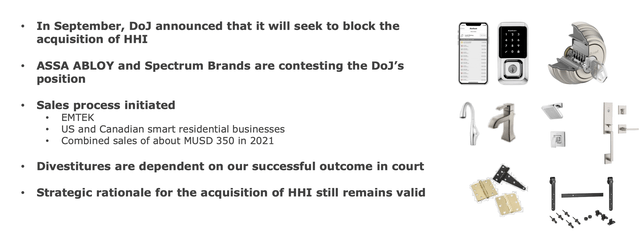

This sort of strategy brings with it some challenges as well – such as when M&As are potentially blocked, as with HHI which is being blocked by the US DoJ as of September.

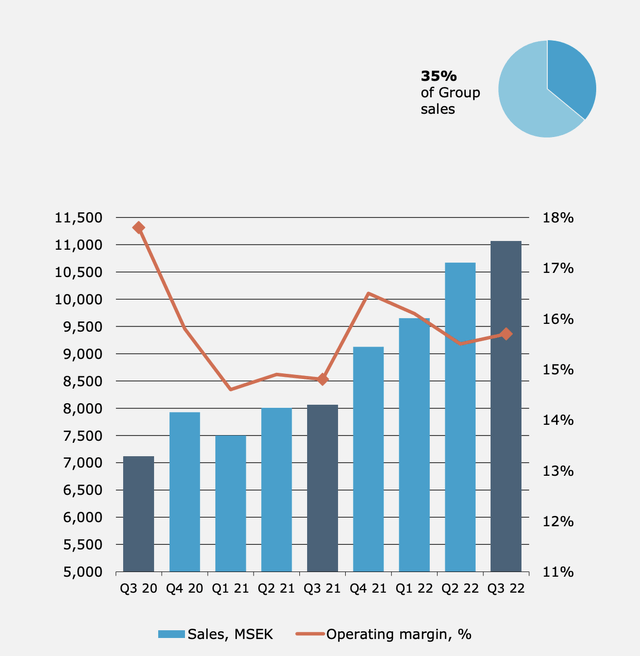

Aside from this, most of the company’s current trends are positive and in-line with expectations and trends. Entrance systems continue to be the company’s major sales sector, with 35% of company annual sales – and trends here continue to be positive, with increased interest in residential and industrial security and safety. The company has a strong pricing position, and while the operating margin isn’t fully recovered yet, the trends are moving in the right direction.

Remember, the company sells its products mostly through distributors. The fragmented end customer market in these products means that Assa sells to many distributors across the world, and works proactively with them in terms of marketing and product development.

The company has achieved what we in the business like to see – a combination of an appealing push and pull effect which serves to not only improve the products but sales, development, and customer relationships as well.

Part of the company’s strength is the number of patents it holds – while continuing to file more. 202 new patents were filed during 2020, and CapEx for R&D was increased as Assa employed almost 400 new people in Research & Development, in line with the company’s long-term goals.

The appeal of Assa Abloy’s business, as I see it, lies in the combined perceived simplicity of the business with the underlying complexity and timelessness of the product. What I mean by that is that:

- Everyone needs locks/access solutions, and it doesn’t matter if we’re in an up- or down-cycle. While building and construction activity does affect sales to some extent, most of the company’s business is aftermarket.

- Products range from a simple mechanical lock, to advanced access solutions for entire buildings. They can be incredibly simple and appeal to the stay-at-home mom who wants a safer doorlock, but they can also be sold to multi-billion dollar companies who want to secure their entire campus.

So if you think this company has a correlation to infrastructure and building – you’d be right, but only to some extent. New technologies and regulations have made certain that the hurdles and complexity of operating an international business in this field are left to the largest players, who in turn buy out the smaller ones – much like Assa Abloy is doing. Even if one field goes down during one quarter – or even a year – another portion of the company’s business is likely to pick up most of the “slack” and deliver at least flat or near-flat results even in a troubled time, as we saw during COVID-19.

There remains little negative to say about Assa Abloy from a financial perspective. The company combines a 10% annual organic and acquired growth in sales with a steady 14-17% operating margin on a long-term run rate. Sales increases are more or less directly found in EPS increases, marking a very efficient operation – and we can see this confirmed in the latest results as well.

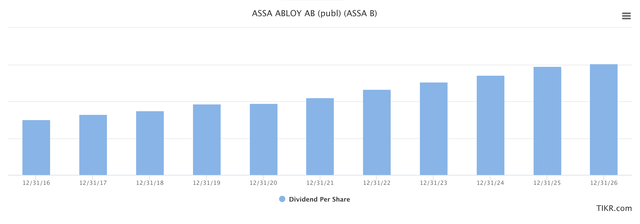

Over the course of ~10 years, the company has increased EPS by over 200% and sales by over 150%. The company is conservatively leveraged and is a conservative dividend payer, and the dividend is expected to rise again and again going forward.

Assa Abloy Dividend (S&P Global/TIKR)

Current estimates are for continual EBIT improvements moving from 2021 and forward, with almost $700M more in EBIT expected for 2026E compared to today, coming to an average growth rate of about 8% on an annual basis- same as with EBITDA, and around the same as revenue growth expectations in the same timeframe.

Based on this trend/trends, let’s look at valuation.

Assa Abloy Valuation

It shouldn’t be a surprise, but it’s nonetheless a sad fact that Assa Abloy, because of all the wonderful qualities it has, rarely if ever is at even a close-to-appealing valuation.

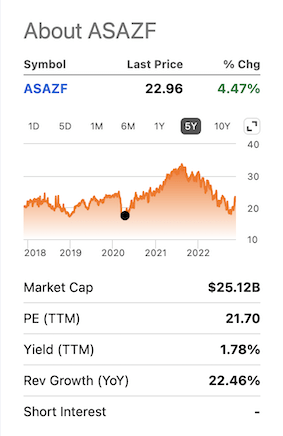

My picking of Assa Abloy last time I wrote about the company was perfect, at least in terms of timing. Take a look right here.

Assa Abloy Article (Seeking Alpha)

Despite this, the S&P 500 has performed better than this company in the same timeframe – by around 9%. The company has been declining, only to very recently bounce back up.

To reflect the positive expectations and what I consider to be realistic forecasts for the company, I’m increasing my target price to reflect a normalized 20x P/E ratio for the company’s next few years. The current share price of 240SEK for the native reflects around an 18.9x P/E for this – my PT for 20x normalized is at around 255 SEK/share.

Compared to other S&P Global analysts, this is slightly below their own expectations. 23 analysts consider the company’s relevant pricing range between 220-300 SEK/share with an average of 260 SEK/share. Despite this, only 5 out of these 23 analysts are at a “BUY” rating here, which to me makes little sense given where the company might go.

The current dividend yield is around 1.75%, or close to 1.9% going by 2022E – but this company’s argument isn’t the yield or the DGR, it’s the safety, which is above average.

If we assume previous market premiums hold for this company and given their business, I see no reason why, in a post-corona situation, they would not, we can expect share prices of 300 SEK/share within 2 years – and this is not odd, given that the company traded at this share price before.

The richest valuation the company has held for an extended period of time is right around 26-28 times earnings – such a valuation would indicate a potential upside to a share price of 350 SEK/share, or 25%+ from today’s price – and that doesn’t include potential dividend growth.

Assa Abloy is the perfect example of the adage “You pay for quality“. There are plenty of NA/international examples of this as well, but this is the best example I can think of in Sweden besides some of the better-known investment companies.

While others tend to load up on high-yielders, I and like-minded investors have been sticking for the most part to quality companies, even if some of these companies don’t reward investors with fantastic yields.

However, despite the substandard yields that some of these companies offer – such as Airbus (OTCPK:EADSY), adidas (OTCQX:ADDYY), and others, these companies still have superb upsides and historical results.

While no longer at trough lows, we’re still at attractive levels seen from a historical perspective.

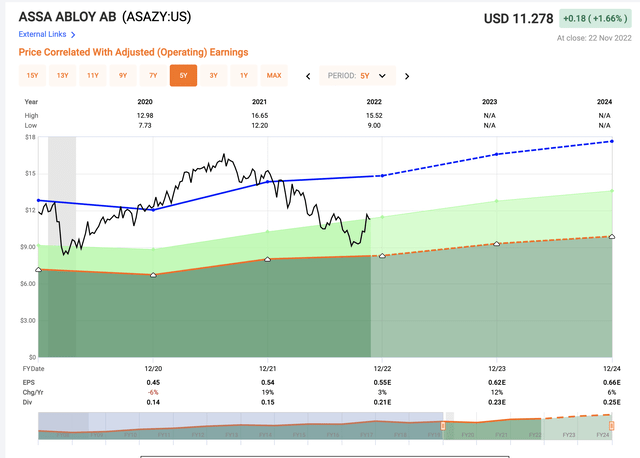

Assa Abloy Valuation (F.A.S.T graphs)

Even considering only a 20-21x forward P/E, the upside here is 11-14% annually, or 28-33% on a 2-3 year basis for this A-rated Swedish stalwart.

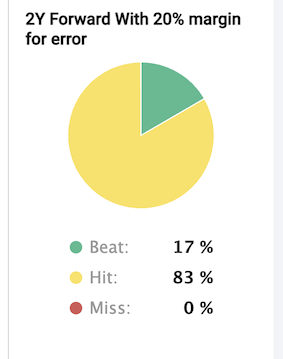

How likely are these results to materialize?

Fairly high, given the analyst forecast accuracy on a historical basis, and the future trends do not represent any massive deviation from historical trends.

FactSet forecast accuracy, Assa Abloy (FactSet/F.A.S.T Graphs)

Based on current trends, valuations and expectations, I would therefore consider this company to be a “BUY” here – and one with a decent sort of stability and upside. Quality can come in many shapes – and some even pay appealing dividends of 5%+ – but I try and lead by clear example, and not ignore the firms like Assa Abloy, just because they pay a 1.5-2% dividend, or even lower.

Here is my thesis for the company.

Thesis

My thesis for Assa Abloy is as follows:

- Assa Abloy is a class-leading access equipment/entrance equipment/security company. It doesn’t have class-leading yield, but it has class-leading safety and offers stability and through-cyclic operating fundamentals that are second to very few businesses in the sector or adjacent sectors.

- The company is a “BUY” to me as long as it trades below its 20x P/E premium – which it is doing at the moment, even if the upside isn’t that high.

- I view Assa Abloy as an attractive investment at a PT of around 255 SEK/share

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company fulfills all but one of my criteria, making it (hopefully) clear why I consider it an attractive “BUY” here.

Be the first to comment