Mike Coppola

Thesis

Warner Bros. Discovery, Inc. (NASDAQ:WBD) has underperformed our expectations, as the market was caught off-guard by a Q3 earnings release that was mixed.

With an advertising landscape that seems to have worsened more than anticipated, the market needed to de-risk WBD’s valuation to reflect the risks from its most critical profitability driver.

However, management has maintained its full-year outlook, behooving WBD to post a robust Q4 to meet its guidance. As such, we believe it has increased the execution risks significantly for WBD, given worsening macro risks that could impede the speedy recovery of the ad market.

With DTC still nursing losses and studios’ profitability still recovering, we postulate that the market has likely reflected an underwhelming Q4. However, we need to caution investors that management’s outlook for FY23 will be critical in helping WBD recover from its well-battered valuation.

A robust Q4 card will also be instrumental in uplifting investors’ sentiments on management’s credibility to execute in a highly challenging environment. Even though we believe the downside risks have likely been baked in, we assess a material re-rating is unlikely in the near term.

Therefore, investors should consider an opportunity in WBD as cautious, implementing appropriate risk management plans to cut exposure with defined price targets or stop loss measures.

Maintain Buy with a medium-term price target (PT) of $13 (implying a potential upside of 15%).

WBD: Q4 Execution Looks Challenging

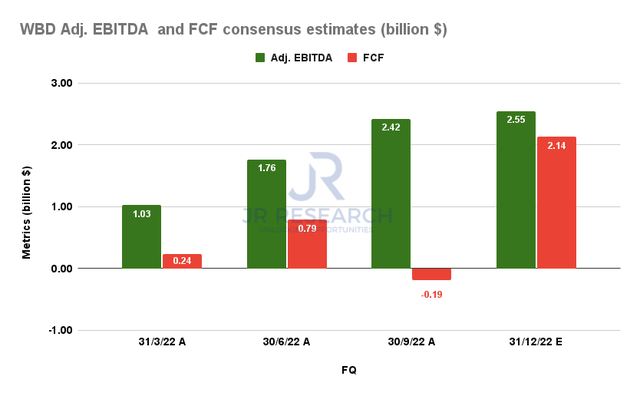

WBD Adj. EBITDA and FCF consensus estimates (S&P Cap IQ)

WBD posted a Q3 release that exceeded the previous estimates for adjusted EBITDA but significantly underperformed on free cash flow (FCF) terms.

Accordingly, WBD posted an FCF of -$192M, well below the previous analysts’ projections of $425M. Given management’s commitment to return the business to sustainable FCF profitability, the company’s full-year target of $3B in FCF (amounting to a full-year adjusted EBITDA conversion of 32.4% at the midpoint) looks increasingly unlikely.

As such, it requires WBD to deliver an FCF in the region of $2.14B-$2.17B to meet its full-year outlook. Hence, we believe the market has de-rated management’s optimism justifiably, given the recent worsening macro conditions. Therefore, even though WBD had not revised its guidance, we believe the market has likely assumed a tepid Q4 execution.

Furthermore, CEO David Zaslav has also not ruled out further disappointment through FY23, as he articulated in a recent conference:

The advertising market right now is very weak. We reiterated our guidance, and we reiterated it today, but the advertising market is weak, and it’s weaker than it was during COVID. And that could change quite quickly. Right now, this is a pretty big miss of the whole Christmas season. And we’re going to make our numbers — if things get a little bit better, we are still trying to do our $12 billion [adjusted EBITDA] for next year. And we’ve said things don’t have to get really good for us to make that number, but it’s going to be hard if it stays this soft for next year. (RBC Capital Markets Technology, Internet, Media and Telecommunications Conference 2022)

WBD: De-rating Is Justified

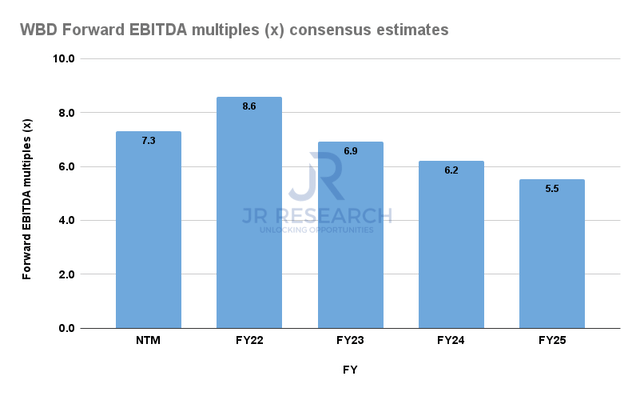

WBD Forward EBITDA multiples valuation trend (S&P Cap IQ)

WBD last traded at an NTM EBITDA multiple of 7.3x, well below its peers’ median of 12.3x (according to S&P Cap IQ data). Therefore, it’s clear that the market deemed it necessary to compress WBD’s valuations further to de-risk its highly challenging execution in Q4 through H1’23, at least.

With WBD still expected to continue improving its profitability robustly through FY25, the potential for a re-rating could be significant if the market anticipates much better execution from the company.

Hence, we postulate that WBD’s valuation remains supportive of a buying opportunity if investors are confident in Zaslav & team.

Is WBD Stock A Buy, Sell, Or Hold?

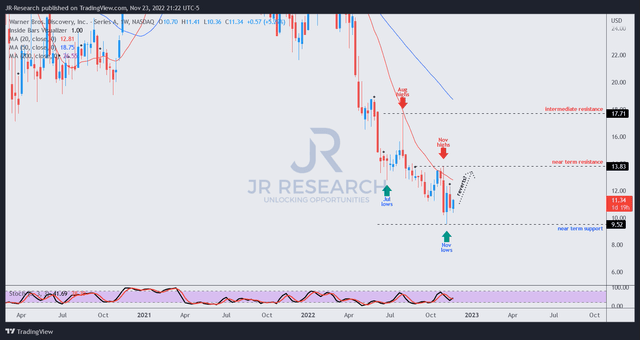

WBD price chart (weekly) (TradingView)

As seen above, WBD bulls managed to stanch further selling downside below its November lows after the initial steep post-earnings selloff. While the bullish reversal has been validated, it’s not considered a bear trap and thus lacks the significant potency we would have preferred.

The critical test for the buyers would be for them to attempt to re-test WBD’s November pre-earnings highs which should attract sellers to cut exposure.

Therefore, we parse it’s appropriate for investors to manage their exposure carefully and avoid adding close to those highs, as WBD remains in a downtrend bias.

Maintain Buy with a PT of $13.

Be the first to comment