Douglas Rissing

Most news headlines concerning insider trading usually portray the activity in a negative light and ultimately lead to allegations suggesting some sort of fraud or other ill-doing. That being said, with respect to this article, the act of insider trading is nothing more than an individual committing to purchasing or selling securities of the company at which they are an insider, and most of the trading done this way is, in itself, perfectly legal.

Who is considered an insider? Federal law defines an insider as a company’s officers, directors, or someone in control of at least 10% of a company’s equity securities. Company employees with significant access to privileged information report their trades to the Securities and Exchange Commission by filing S-4 forms in a timely manner. In fact, we believe that insiders supply the market with high-quality investment information every time they decide to trade their own company’s shares in the open market. An investor that is better informed than their competition can generate higher returns, and in the end, the one who possesses the ultimate level of corporate-specific knowledge is none other than the corporate insider themself.

So the objective shifts towards identifying if investors can use corporate management’s legal insider trading in order to form a profitable investment strategy and attempt to deliver alpha over the overall market. Many books and academic works have been dedicated to this subject. One of the more popular ones being “Investment Intelligence from Insider Trading” by Nejat Seyhun, who is a Professor of Business Administration at the University of Michigan. Another comprehensive guide to the subject is “Profit from Legal Insider Trading” by Jonathan Moreland. There is also a study titled “Estimating the Returns to Insider Trading” published by Leslie A. Jeng and Richard Zeckhauser of Harvard. All of them share the basic idea that the people who have the most knowledge of the inner workings and future prospects of a company know best when and at what price to buy.

What corporate insiders were buying

This is exactly the basis of today’s article. We analyzed thousands of S-4 fillings to find companies that have experienced periods of unusually concentrated purchasing activity by their corporate insiders. We have attempted to place emphasis on companies that enjoyed buying across the board from multiple insiders, in quantities that were not recorded previously, often after a period of selloffs.

Today, we’ll limit our discussion to large-cap stocks only, but you can access our second quarter mid-cap analysis through this link and our second quarter small-call analysis through this one. For the purposes of this analysis, we defined large caps as companies with a market capitalization value of more than $10 billion. This is our short list of research-worthy large-cap companies that in our view enjoyed a period of unusual and atypical interest from corporate insiders during the second quarter:

Hasbro, Inc. (HAS)

-

Active Corporate Insiders: 2

-

YTD Performance: -30.52%

- Total Bought Back: $1,124,303

Hasbro is a U.S.-based play and entertainment company that was founded in 1923 and is currently headquartered in Pawtucket, Rhode Island. While widely recognized as a toys company, Hasbro is not only in the business of selling toys. Instead, they have a broad variety of products through four of its main business segments, Toys & Games, Licensed Products, Digital Gaming, and TV, Film & Digital content. The company relies on its fortress of brands in order to sell its products to retailers, distributors, wholesalers, discount stores, drug stores, mail order houses, catalog stores, department stores, and other traditional retailers, as well as e-commerce retailers.

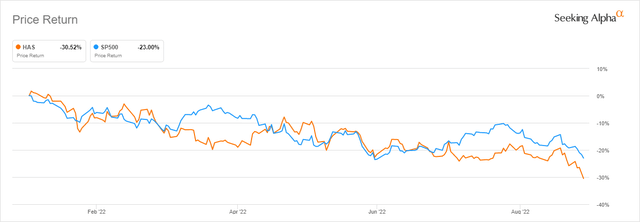

Hasbro slightly underperformed the market, generating a negative 30.52% year-to-date return. The company is trading at a relatively attractive valuation with an FWD EV/EBITDA of 10.12x, FWD P/E of 13.52x and FWD P/FCF of 11.54x. After the recent decline in price, Hasbro’s dividend rose to a very attractive yield of 3.94%. Seeking Alpha Authors have assigned the company a “Hold” rating with an average score of 3.00/5.00. Wall Street Analysts on the other hand remain confident in the future prospects of Hasbro, assigning it a “Buy” rating with an average score of 4.33/5.00 with nine “Strong Buy,” two “Buy,” and four “Hold” ratings. Shares of Hasbro have been bought by the CEO Christian Cocks and Director Michael Burns. Insiders bought back a total of $1.12 million during the second quarter at an average estimated price of $88.64. The company is currently selling at $67.76.

Hasbro and S&P500 YTD Returns (Seeking Alpha)

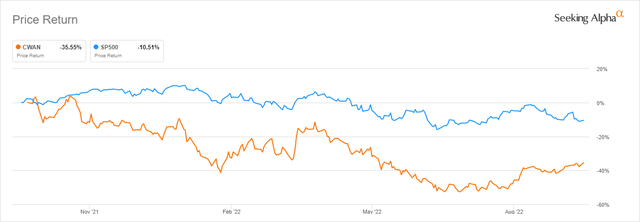

Warner Bros. Discovery, Inc. (WBD)

-

Active Corporate Insiders: 8

-

YTD Performance: -53.45%

- Total Bought Back: $4,644,749

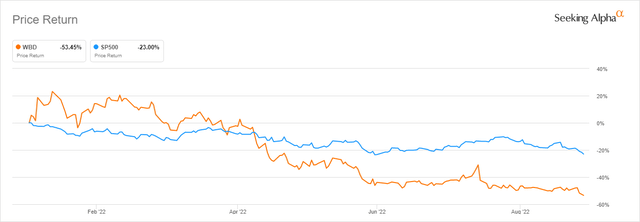

In an effort to place the focus back on its legacy business and attempt to speed up the deleveraging process through divesting unwanted assets, AT&T (T) decided to spin off its WarnerMedia division last year, reaching a deal with Discovery Communications, a media empire led by David Zaslav. The story behind this deal is almost tragic, as AT&T seemingly spun off Warner Media into an offset of a bear market. With the income-oriented AT&T shareholders deciding to treat the spin-off shares as a special dividend, Netflix (NFLX) raising multiple issues with the future sustainability of the streaming model after a disastrous earnings release, and the new Warner Bros. Discovery being forced to downgrade its pro-forma guidance, the newly formed company has generated a negative 53.45% year-to-date return. It was formed as a vertically integrated entertainment company with the aim of taking on behemoths like Disney (DIS) or Netflix.

Even after the downgraded guidance, the company is trading at an attractive 7.89x FWD EV/EBITDA, 7.32x FWD P/E, and a 6.44x FWD P/FCF multiple, while offering a double-digit free cash flow yield. Seeking Alpha Authors still remain largely bullish about the prospects of WBD, with it having an average rating of 4.30/5.00. On the other end, Wall Street Analysts are slightly less enthusiastic but still rate the stock as a “Buy” with an average rating of 3.79/5.00. Shares of WBD have been bought by the CEO David Zaslav, CFO Gunnar Wiedenfels, President Zeiler Gerhard, CCAO Leavy David, and seemingly half of the board of directors. Insiders bought back a total of $4.64 million during the second quarter at an average estimated price of $18.69. The company is currently trading at $11.60 per share.

WBD and S&P500 YTD Returns (Seeking Alpha)

Intel Corporation (INTC)

-

Active Corporate Insiders: 2

-

YTD Performance: -48.28%

- Total Bought Back: $491,198

Intel enjoyed a decade-long period being the almost undisputed chip-making king with little competition to worry about. However, fears seem to have been realized, and with delays in manufacturing and changing leadership, the previously undisputed king has found itself between a rock and a hard place facing intense competition. The chip company is struggling with an aging 10nm process, its desktop CPUs are notorious for their power consumption, its dedicated GPU line failed to impress anyone, and upcoming processor families are behind schedule. All of this led to Intel falling behind competitors such as Nvidia (NVDA), Taiwan Semiconductor (TSM), and Advanced Micro Devices (AMD).

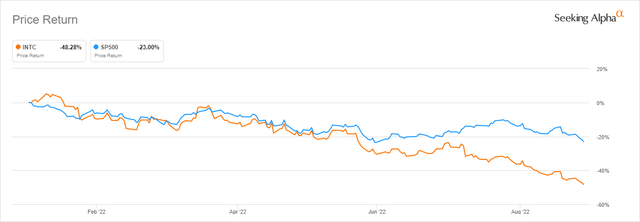

With hopes to turn the ship around, INTC replaced its leadership earlier this year and designed a new roadmap for the future. Still, the chip-maker is struggling to find a bottom as its generated a negative -48.28% return since the beginning of the year, significantly underperforming the S&P500 (SPY). The company is trading at a seemingly attractive 5.42x FWD EV/EBITDA and 12.07x FWD P/E, however, it faces degrading fundamentals and is expecting to end the year with negative free cash flow generation for the first time in more than a decade.

Seeking Alpha Authors still remain slightly bullish about the turnaround potential of the company, assigning Intel a “Buy” rating with a score of 3.50/5.00. Wall Street Analysts are much less enthusiastic about such prospects and rate the company as a “Hold” with an average rating of 3.02/5.00. Shares of INTC have been bought by the new CEO Patrick P. Gelsinger and the EVP and CFO Zinsner David. Insiders bought back a total of about half a million during the second quarter at an average estimated price of $44.65. Intel can be purchased currently for $25.04 per share.

Intel and S&P500 YTD Returns (Seeking Alpha)

CDW Corporation (CDW)

-

Active Corporate Insiders: 2

-

YTD Performance: -22.00%

- Total Bought Back: $741,753

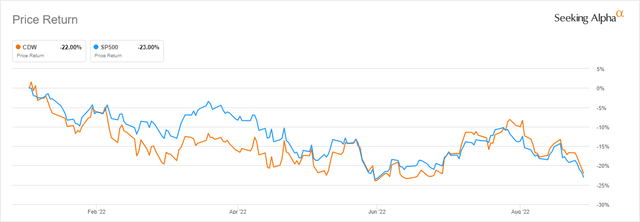

CDW Corporation is an information technology solutions company established all the way back in 1984 and headquartered in Vernon Hills, Illinois. The company offers a broad array of products and services ranging from hardware and software to integrated IT solutions such as security, cloud, hybrid infrastructure, and digital experiences. Its operations are mainly focused on the U.S. market, but the company does business in the United Kingdom as well as Canada. It managed to grow its Net Sales by a CAGR of 8% over the past ten years. Net income has had a CAGR of 18% for the same period. CDW traded mostly sideways with the market since the beginning of the year and has returned negative 22.00% year-to-date. The company is trading at an FWD EV/EBITDA of 12.57x, FWD P/E of 15.90x and 12.07x FWD P/E while offering a token dividend of 1.25%.

Seeking Alpha Authors failed to reach a clear consensus on the company, with ratings ranging mostly from “Hold” to “Buy”. CDW carries an average SA rating of 3.00/5.00. Wall Street Analysts are much more enthusiastic about CDW, assigning it a “Buy” rating with an average score of 4.40/5.00. Shares of CDW have been bought by the President and CEO Leahy Christine and the SVP and CFO Miralles Albert Joseph Jr. Insiders bought back just shy of three quarters of a million during the second quarter at an average estimated price of $169.63. The company is currently selling at $152.60.

CDW Corp and S&P500 YTD Returns (Seeking Alpha)

First Citizens BancShares, Inc. (FCNCA)

-

Active Corporate Insiders: 3

-

YTD Performance: -9.31%

- Total Bought Back: $708,775

First Citizens BancShares is the holding company of First Citizens Bank, a regional bank that operates 640 branches primarily concentrated in South Carolina and North Carolina, but with an impactful presence in states such as Virginia, Florida, and Georgia in addition to some other locations across the United States. At the beginning of the year, it finally closed on a transformative all-stock merger with CIT after a year-long regulatory review and approval process that ultimately formed a top 20 U.S. bank with more than $100 billion in assets and $85 billion in deposits. The stock price initially fell off a cliff as the market struggled to digest the merger, but First Citizens Bancshares has since recovered and is currently outperforming the market, being down only 5.98% year-to-date. The bank is trading at a relatively attractive valuation with an NTM P/E of 9.49x and a book value per share of 1.33x, while offering a small seemingly token dividend yield of 0.23%.

The bank has been held in high regard by both Seeking Alpha Authors and Wall Street. SA Authors have been long bullish on the company assigning it a “Buy” rating with an average score of 4.00/5.00. Wall Street Analysts on the other end have assigned it a “Strong Buy” rating with an average score of 4.50/5.00. FCNCA enjoyed interest during the second quarter from corporate insiders including the CEO Frank Holding Jr, the CFO Craig Nix, and a member of the board of directors. Corporate insiders bought back a total of about $700,000 during the second quarter at an average estimated price of $655.39. The company currently trades at $828.19 per share.

FCNCA and SYP500 YTD Returns (Seeking Alpha)

Final thoughts and conclusions

Many guides for fundamental analysis of companies suggest that reviewing corporate insiders’ sentiment remains an extraordinary resource at the disposal of the individual investor. However, not only can investors rely on insider trading data as a resource to add on top of their due diligence, but they also have the ability to utilize insider data as a starting point for research into investment opportunities through back-testing and other analysis. We stand firm by the belief that investors should utilize insider transactions and other forms of alternative data during their investment process.

Be the first to comment