ANNVIPS/iStock via Getty Images

Sometimes, the best-performing companies can be those you least expect. During these difficult times, it’s hard to imagine a shoe company generating attractive returns for investors. But in Caleres (NYSE:CAL), we are seeing precisely that take place. This upside, it is worth mentioning, has not been without cause. Although the company continues to decrease the size of its retail network, overall revenue and profitability is rising nicely. Long term, I am less bullish about the company. However, I do think that maybe some additional upside might be on the table for investors moving forward. And for that reason, I have decided to retain my ‘buy’ rating on its stock.

Trying Caleres on for size

Back in March of this year, I wrote a bullish article discussing the investment prospects that Caleres offered. In that article, I acknowledged that the company had experienced a great deal of pain as a result of the COVID-19 pandemic. I also pointed out, very clearly, that this is not a high-quality opportunity. The company has been actively working to shrink its store count and to focus more heavily on its e-commerce operations. However, I found myself encouraged by recent financial performance, and I felt shares were cheap enough to offer investors some upside potential. This ultimately led me to rate the business a ‘buy’, which basically means that I feel as though the company will outperform the broader market for the foreseeable future. So far, the business has performed even better than I anticipated. While the S&P 500 is down by 12.3% since the publication of that article, shares of Caleres has generated a return for investors of 31.3%.

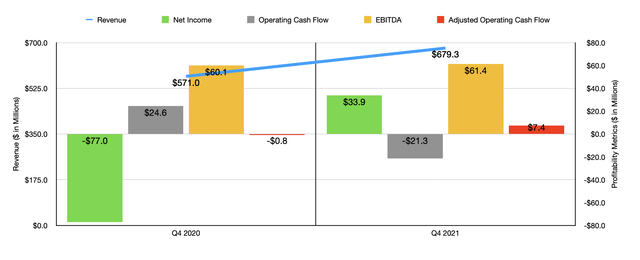

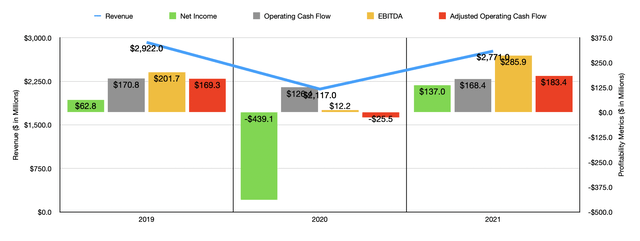

Although the market does send shares of companies up and down irrational at times, I would make the case that the upside in share price Caleres experienced in recent months was not wholly because of that. Overall, financial performance for the company has been looking up. Consider how the business ended its 2021 fiscal year. In the final quarter of the year, the only quarter for which data is now available that was not available when I wrote about it last, sales came in at $679.3 million. That’s 19% higher than the $571 million the company reported the same time one year earlier. Thanks to this, total revenue for the year came in at $2.77 billion. Although that’s still lower than the $2.92 billion reported in 2019, it does represent an increase over the $2.12 billion the company reported in 2020.

Profitability for the company also managed to improve. Net income in the final quarter came in at $33.9 million. That dwarfs the negative $77 million reported just one year earlier. As a result of this, overall profitability for the 2021 fiscal year hit $137 million. That’s higher than the net income reported for at least the five years leading up to that. Operating cash flow managed to drop in the final quarter, dropping from $24.6 million to negative $21.3 million. But if we adjust for changes in working capital, it would have risen from negative $0.8 million to $7.4 million. Over that same time frame, EBITDA ticked up from $60.1 million to $61.4 million. We can see the favorable impact all of these changes had on the company’s final results for its 2021 fiscal year.

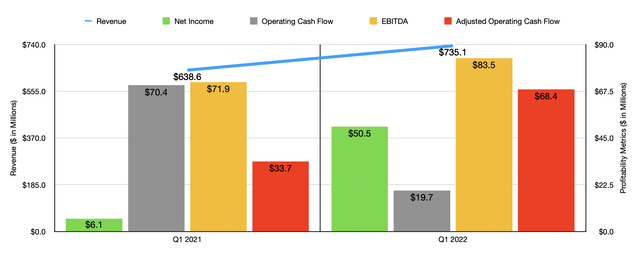

Growth for the business has continued to come in strong. Revenue in the first quarter of 2022, for instance, totaled $735.1 million. That’s 15.1% higher than the $638.6 million reported one year earlier. This rise was driven by strong sales across the company’s key brands. However, it also came at a time when the number of stores the company had in operation dropped. At the end of the latest quarter, the company had only 970 locations in operation. That’s down from the 980 seen one quarter earlier, and it compares to the 1,008 that were in operation the same time last year.

Profitability for the company was also very strong. Net income of $50.5 million significantly surpassed the $6.1 million reported the same quarter one year earlier. Operating cash flow did decline, dropping from $70.4 million to $19.7 million. But if we adjust for changes in working capital, it would have risen from $33.7 million to $68.4 million. Over that same window of time, EBITDA also improved, climbing from $71.9 million to $83.5 million.

When it comes to the 2022 fiscal year as a whole, management is rather bullish on the company. The current expectation is for revenue to climb by between 2% and 5% year over year. Admittedly, that would represent a slowing down for the rest of the year. But any growth should be encouraged. Meanwhile, earnings per share should be between $4.20 and $4.40. At the midpoint, this would translate to net income of roughly $158 million. No guidance was given when it came to other profitability metrics. But if we assume that those will increase at the same rate that net income should, we should anticipate operating cash flow of $211.5 million and EBITDA of somewhere around $329.7 million.

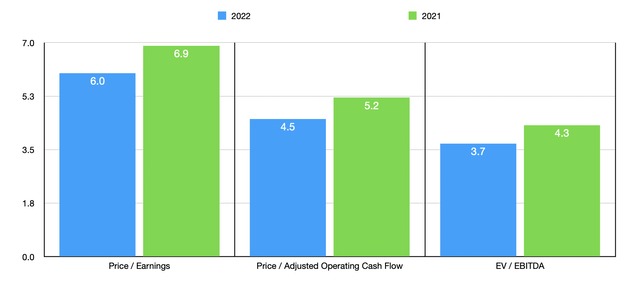

Using this data, we can easily value the company. On a forward basis, the firm is trading at a price-to-earnings multiple of 6. This is down from the 6.9 reading that we get if we use 2021 results. The price to adjusted operating cash flow multiple should come in at 4.5. And the EV to EBITDA multiple should be 3.7. These numbers compared to the 5.2 and 4.3, respectively, that we get if we utilize results from 2021. To put the pricing of the company into perspective, I compared it to five other specialty retailers. On a price-to-earnings basis, these companies ranged from a low of 4 to a high of 10.8. Three of the five companies were cheaper than Caleres. On a price to operating cash flow basis, the range was from 3.7 to 23.5. In this scenario, only one of the companies was cheaper than our prospect. And when it comes to the EV to EBITDA approach, the range was from 1.3 to 7. In this case, four of the five companies were cheaper than our target.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Caleres | 6.9 | 5.2 | 4.3 |

| Destination XL Group (DXLG) | 4.0 | 3.7 | 2.6 |

| Tilly’s (TLYS) | 4.5 | 9.0 | 1.3 |

| Guess? (GES) | 7.0 | 9.2 | 4.1 |

| Boot Barn Holdings (BOOT) | 10.8 | 23.5 | 7.0 |

| Shoe Carnival (SCVL) | 4.4 | 6.8 | 2.4 |

Takeaway

The past couple of months has been really stellar for investors in Caleres. However, that means that the easy money has already been made. Long term, I’m not terribly bullish on the company. In particular, I don’t like to see its physical store count continue to decline quarter after quarter and year after year. But for now, the company is doing a great job. Shares are cheap on an absolute basis and seem to be more or less fairly valued compared to other specialty retailers. Because of this, I do think that maybe some additional upside exists certainly enough to warrant a ‘buy’ designation at this time.

Be the first to comment