monsitj

Introduction

In July 2022, I wrote a bullish article on SA about re-commerce retailer Envela Corporation (NYSE:ELA) in which I said that the company had completed a successful turnaround thanks to its venture into the electronics segment and it looked cheap.

Well, revenues slumped by 10% quarter on quarter in Q2 2022, but the company’s gross margin soared to 26.9% from 20.5%. This allowed Envela to generate a record quarterly net income of $3.85 million but I’m concerned that inventory at its electronics arm was low at the end of June. Considering the market valuation has slumped to $134.1 million as of the time of writing, I think that the company is even more undervalued than in July. Let’s review.

Overview of the Q2 2022 financial results

In case you haven’t read my previous article about Envela, here’s a brief description of the business. The company is among the largest authenticated re-commerce retailers of luxury hard assets in the USA, and it specializes in the sale of precious metals and stones as well as consumer electronics and IT equipment. Cash and inventories typically account for about half of Envela’s asset base and the company has two subsidiaries, namely DGSE and ECHG. The former is involved in purchasing and re-selling or recycling jewelry, diamonds, gemstones, fine watches, rare coins, gold, and silver and has 7 jewelry stores in Texas and South Carolina. ECHG, in turn, specializes in the purchase and recycling or refurbishment of consumer electronics and IT equipment and its main source of inventory is school districts. Also, the latter’s Teladvance arm has a trade-in program to upgrade old phones through its retail clients.

Envela

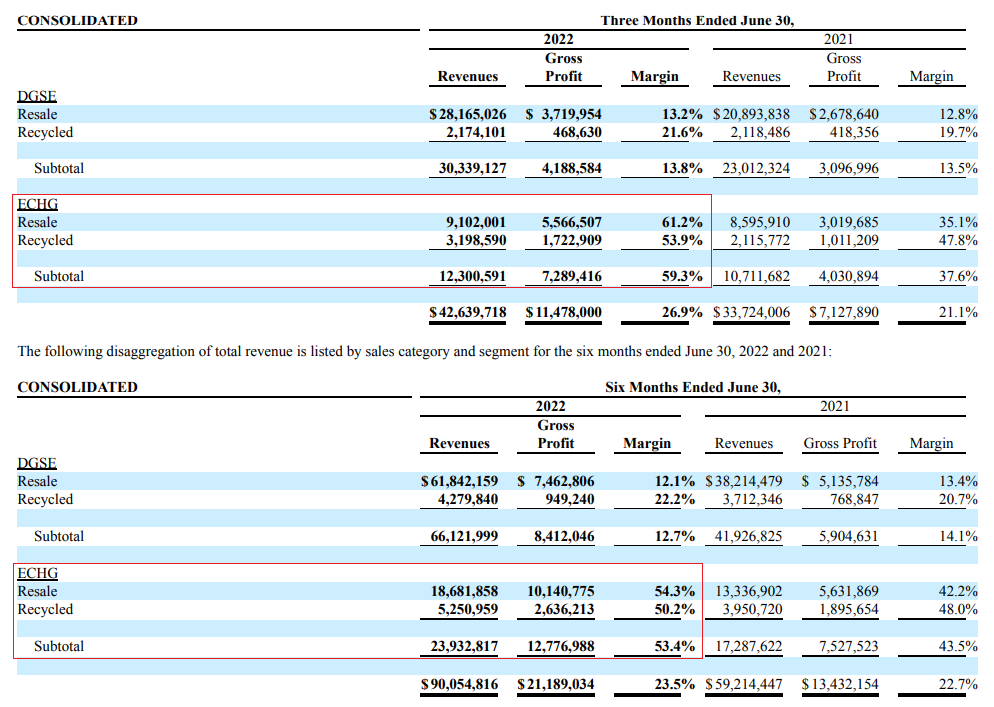

DGSE accounts for the majority of Envela’s revenues. Still, ECHG has much higher margins and this is why the company has been focusing on expanding its presence in the electronics re-commerce market. Looking at the Q2 2022 financial results, revenues declined by 10% quarter on quarter to $42.6 million but net income soared by 45.4%. The main reason behind this was that ECHG’s revenues rose by 5.7% quarter on quarter and its gross margin grew to 59.3% from 47.2%.

Envela

It seems that high inflation and consumer spending pressure are boosting demand for refurbished electronics while negatively affecting Envela’s jewelry business, but I view it as a positive development as ECHG accounts for most of the company’s net income. In addition, both segments continue to show rapid growth compared to 2021 results.

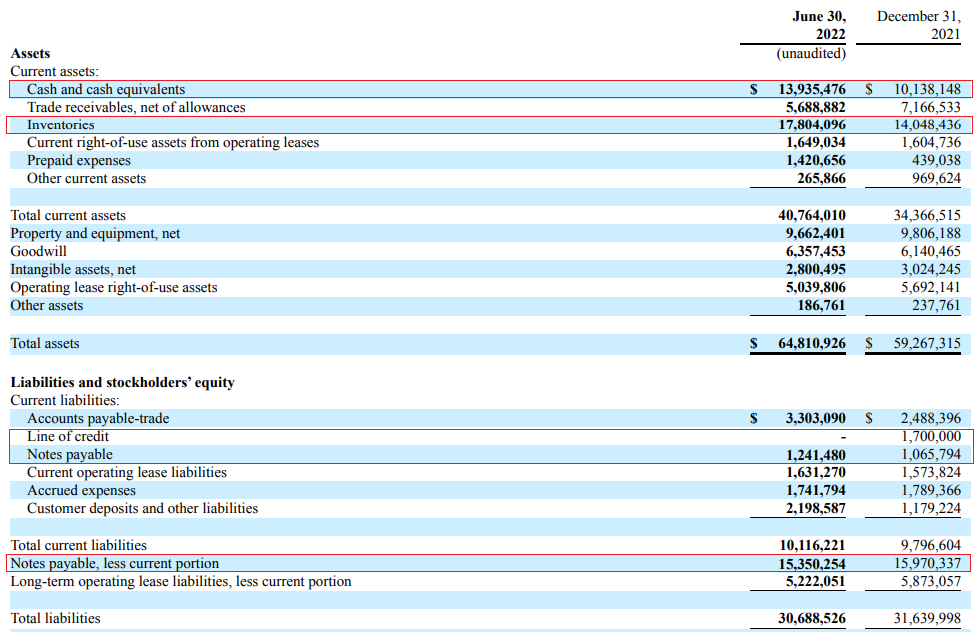

Looking to the future, Envela mentioned in its Q2 2022 financial report that it sees opportunities for further expansion through new openings in the USA (page 25 here) so you can expect the number of stores to increase in the near future. The company revealed in its Q2 2022 financial report that it expects to make capital expenditures of around $1 million over the next 12 months (page 35). In addition, Envela mentioned potential purchases of additional properties by DGSE. ECHG, in turn, has historically relied on pursuing synergistic acquisitions and the latest one included IT asset disposition services provider Avail back in October 2021. I think that Envela could be looking at some small competitors as acquisition candidates at the moment as it had a large amount of cash on its books at the end of June. The company finished Q2 2022 with $13.9 million in cash and cash equivalents, which represents an increase of over $2.4 million quarter on quarter. Net debt, in turn, declined to $2.7 million from $5.3 million in Q1 2022.

Envela

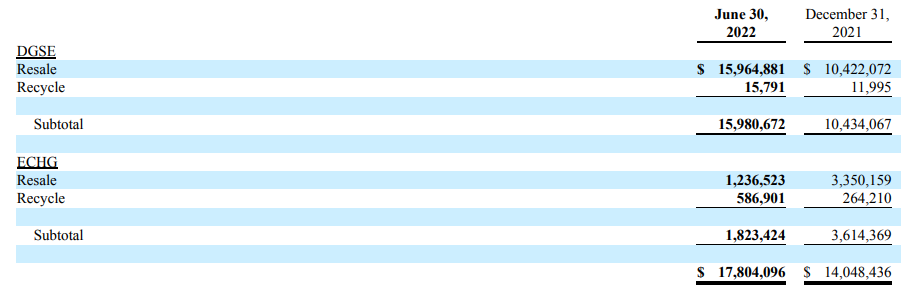

As you can see from the table above, inventories grew to $17.8 million from $14.6 million in Q1 but all of that came from DGSE. The inventories of ECHG decreased to just $1.8 million from $2.3 million three months earlier and this is why I continue to think that the sourcing of inventory at this subsidiary is the most significant risk for the bull case at the moment.

Envela

Sure, Envela is trading at just 7.8x EV/EBITDA based on annualized Q2 2022 results, but inventories at ECHG were so low at the end of June that they covered only 12 days and 16 days of sales for the resale and recycling segments, respectively. I’m concerned that a recession in the USA could lead to spending cuts in the education sector in the near future, which would make ECHG’s sourcing issues even worse as schools hang on to old electronics.

Looking at other risks for the bull case, I think that the other major one is that ECHG is a small company with high margins and no clear moat. In my view, it’s possible that its margins could decrease significantly if a regional competitor emerges. One minor risk to keep in mind is that a significant part of DGSE’s inventory includes gold, which means that a sharp decrease in gold prices will put pressure on the latter’s margins for a brief period of time.

Investor takeaway

Envela booked a record quarterly net income in Q2 2022 thanks to the strong performance of ECHG as it seems the current microeconomic environment is boosting demand for refurbished electronics. In my view, an EV/EBITDA ratio of just below 8x seems low for a profitable and rapidly growing business.

However, the inventory levels of ECHG are at low levels and there is no clear moat, and this is why I rate Envela as a speculative buy. I think that the company should be trading at somewhere above 10x EV/EBITDA thanks to its compelling growth over the past few quarters.

Be the first to comment