Pavel Muravev/iStock via Getty Images

Things are lining up nicely for Universal Display Corp. (NASDAQ:OLED), the largest holder of OLED-related patents and the leading manufacturer of OLED display materials. Alongside its latest quarterly results, Universal Display offered a positive update on the commercialization of its blue phosphorescent emitter technology, highlighting that it is already set to meet preliminary target specifications by end-2022, followed by commercialization in 2024.

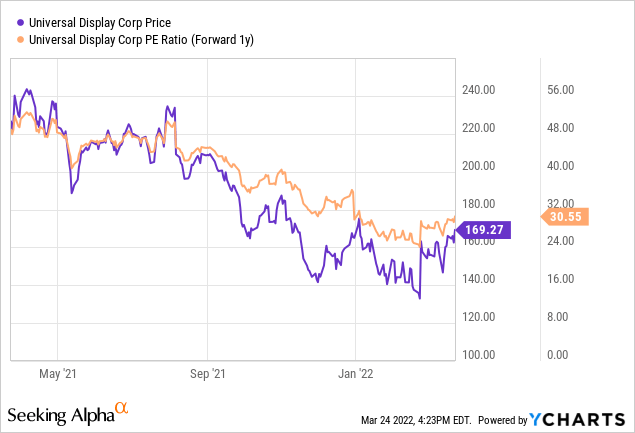

Execution is key here, and assuming these targets are met, Universal Display could be set for a major earnings inflection heading into 2024 given the potential for margin accretion (blue offers higher materials content per device) and increased licensing revenue (blue’s energy efficiency also offers higher customer value). Plus, the recent stock price selloff moves valuations well below historical levels, potentially opening up opportunities for an acquisition by bigger players interested in the company’s best-in-class patent portfolio.

Blue Commercialization on Track; Potential EPS Inflection Ahead

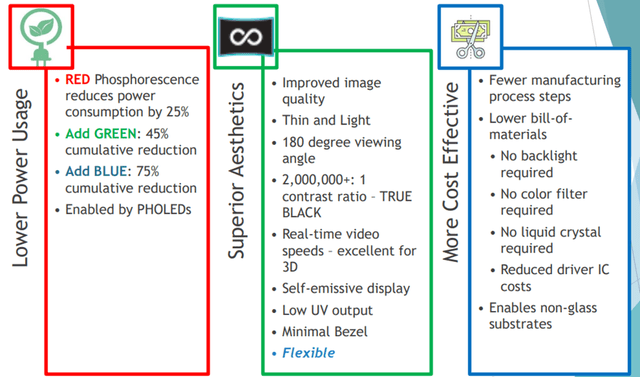

Following several years of development, the commercialization timeline of Blue Phosphorescent OLED (PHOLED) has been set for 2024, extending Universal Display’s OLED capabilities across the full RGB (Red, Green, Blue) spectrum. The key value add for blue is the reduced power usage – adding blue PHOLED not only reduces power consumption by a cumulative 75% but also drives advancements on color point lifetime and efficiency. Execution is still a factor, though – before the full RGB phosphorescent stack will be available to customers in 2024, the company is working toward hitting specifications on its blue phosphorescent emitter. In particular, progress toward material lifetime is the key hurdle in 2022, and from commercialization in 2024, it will likely take 9-12 months before the new material is designed into a product. That said, no further breakthroughs are needed, so I feel comfortable underwriting a 2024/2025 blue timeline.

Universal Display Investor Deck (Q1 2022)

For investors, the financial implications are compelling – per management, a mobile device will sell twice as much blue and green material as red, so once blue is ramped up, we could see a 20/40/40 in volume split. In addition, monetization also hinges on the blue adoption rate by device type and form factor as well as the product subset (e.g., high-end vs. low-end). Given the hundreds of millions of dollars spent on developing blue over the last decade and the clear power consumption benefits for customers, I think blue should command a healthy price point and meaningfully increase the revenue content per OLED device going forward. Financial visibility is limited for now, but I believe there is a strong chance blue adoption could catalyze significant upside to EPS in 2024 and beyond.

Near-Term Upside from the Samsung Licensing Deal

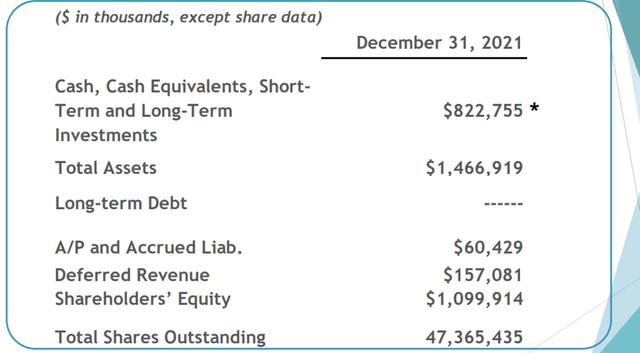

Another potential source of upside to the 2022 numbers could come from Universal Display’s largest customer, Samsung (OTC:SSNLF), which is entering the final year of its current contract (although the company has a two-year option to extend the current agreement terms through 2024). While the current contract terms are undisclosed, an in-line royalty rate would imply Samsung is paying 0.5% to 1% of the average selling price of its display units (a similar agreement with LG Display (LPL)) – a significant amount given its display units are priced at the premium end. More importantly, Universal Display still has >$150m of deferred revenue (mostly from the expiring Samsung contract), and thus, a portion of this balance will need to be recognized as licensing revenue over the course of 2022.

The updated commercialization timeline of the blue emitter also means the new Samsung contract could be repriced upward – under the current licensing agreement, Samsung does not yet have access to blue materials. Plus, Universal Display plans to supply a host material alongside its new blue emitter (a similar strategy to the one used during the commercialization of the phosphorescent green emitter). Given customers will need to buy the entire materials stack (i.e., an emitter and a host) the upcoming renegotiation could result in a big ramp-up in earnings going forward.

Optionality from Massive Addressable Market Opportunities and M&A Potential

As the holder of an extensive OLED patent portfolio, Universal Display has massive addressable market opportunities. This includes widely used electronic devices like smartphones, televisions, tablets, and smartwatches, as well as next-gen devices in the IoT and AR/VR space. As the company generates revenue via royalties based on display area and price (i.e., bigger devices mean higher royalties), increased OLED adoption in bigger form factors like televisions would be enough to drive significantly higher royalty income. Plus, the potential transition of smartphones and tablets to foldable displays represents a huge market opportunity as well, given foldables offer a higher display area than flat-panel OLED screens. Adjacent market opportunities such as global solar panels (a ~$115bn market opportunity) also offer upside optionality in the long run (interestingly enough, the inadvertent discovery of OLED occurred when researching photovoltaic cells), although these remain in the early R&D phase for now.

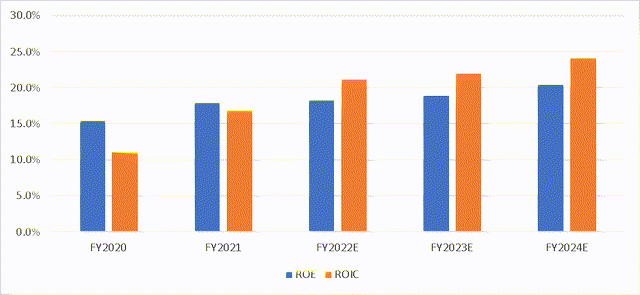

As the company is in a net cash position and generates a predictable (and growing) FCF stream, capital allocation also offers ample upside potential. Of note, its venture arm UDC Ventures is actively investing in complementary next-gen technologies – for instance, it recently acquired a stake in extended reality (i.e., virtual reality/augmented reality/mixed reality) developer DigiLens. Capital return is lower on the priority list for now, with the board opting to return cash via a small $1.20/share dividend (<1% yield at current prices). Given the consistent double-digit ROE/ROICs and the long runway of growth opportunities, though, I think reinvesting in the business is the right way to go. That said, the net cash holding and the patent portfolio make Universal Display an attractive acquisition target for the likes of M&A hungry tech giants like Broadcom (AVGO) or perhaps even a key customer like Samsung, given its strategic position within the electronics value chain.

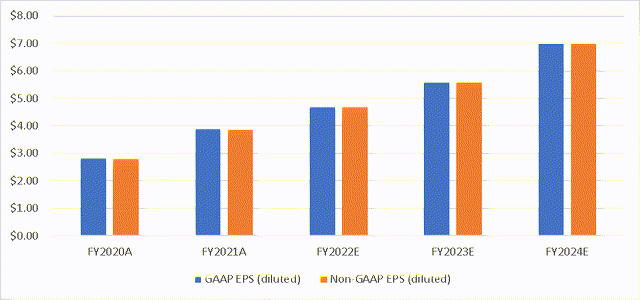

JP Research, Universal Display Disclosures, Author

Industry Leader Poised for an Inflection

Overall, Universal Display remains a safe bet on the penetration of OLED technology in key electronic devices like smartphones, tablets, and televisions over time. As OLED capacity continues to increase, prices should also go down and drive volumes (and the rate of adoption) higher, which should, in turn, translate into higher-margin licensing revenues for Universal Display. Plus, the pending commercialization of blue phosphorescent emitter should catalyze higher utilization rates and an earnings re-acceleration heading into 2024. Based on a relatively conservative ~35x P/E multiple on 2024 EPS of ~$7, I think the stock is worth ~$250, offering investors ample upside from these levels.

Be the first to comment